UPDATE: Minnesota: Avg. rate DROP in 2018 thanks to (troubled) reinsurance program

In a year when every state's 2018 Open Enrollment situation is messy to say the least, Minnesota's is far more so:

- Last year they were facing massive rate hikes, especially for unsubsidized enrollees (yeah, I know, I know, don't say it), and came very close to having all of their carriers bail

- In response, they agreed to let most of them put a maximum enrollment cap on a First Come First Serve, with Blue Plus (BCBSMN) agreeing to take the "overflow".

- As a result, Minnesota, which had previously seen relatively sluggish exchange enrollment, took off like a rocket with people scrambling to enroll before the carriers maxed out. They ended the 2017 Open Enrollment Period having seen exchange enrollments increase by a higher percentage than any other state (32%)

- However, the unsubsidized individual market enrollees were royally screwed, so the state legislature and governor slapped together a special, one-time 25% premium rebate specifically for them. The money came directly out of other portions of the state general fund, I believe. MNsure, the state exchange, also added an extra 8-day special enrollment period for these folks to jump in and get in on the rebate.

- This got them over the 2017 hump, but clearly it was a sloppy, stopgap measure only, so earlier this year Minnesota decided to take advantage of the ACA's 1332 Waiver provision, which allows states to make significant changes to how they implement the ACA as long as the changes can be proven to provide at least as many people with similarly comprehensive coverage without increasing the federal deficit in the process...a provision which (former) HHS Secretary Tom Price encouraged states to do.

- Minnesota put together a 1332 Waiver Request for a reinsurance program exactly as they were supposed to:

H.F.5 created the Minnesota Premium Security Plan (MPSP), which is a state-based reinsurance program (similar to the one that Alaska created for 2017, and that the ACA implemented on a temporary basis through 2016) that would take effect in 2018. The reinsurance program would cover a portion of the claims that insurers face, resulting in lower total claims costs for the insurers, and thus lower premiums (indeed, insurers have proposed average rate decreases across the board if the reinsurance program is approved). It would kick in once claims reach $50,000, and would cover them at 80 percent up to $250,000 (this is similar to the coverage under the transitional reinsurance program that the ACA provided from 2014 through 2016).

H.F.5 was contingent upon approval of the 1332 waiver, because it relies partially on federal funding, in addition to state funding. If the 1332 waiver is approved — and it was, on September 22 — the federal government will give Minnesota the money that they save on premium tax credits, and that money will be combined with state funds to implement the reinsurance program (lower premiums — as a result of the reinsurance program — will result in the federal government having to pay a smaller total amount of premium tax credits, since the tax credits are smaller when premiums are smaller).

The good news is that the waiver was indeed eventually approved by CMS, although at an extremely late date. The bad news is that instead of providing additional funding, CMS pulled a fast one on the state:

On September 19, Governor Dayton sent a scathing letter to HHS Secretary Tom Price, calling out CMS for their failure to approve Minnesota’s 1332 waiver in a timely fashion, and for what appear to be last-minute cuts to MinnesotaCare, the state’s Basic Health Program...

Dayton notes in his letter that Minnesota went to great lengths to follow instructions from CMS at every turn, throughout the process of drafting H.F.5 and the 1332 waiver proposal...

...Even more troubling, however, was the fact that Minnesota officials only recently learned that although the waiver approval was likely to be finalized soon, the process was now expected to result in a substantial cut in federal funding for MinnesotaCare. Dayton notes that he’s been told that $208 million in federal funding will be provided for the reinsurance program over two years, but that Minnesota will lose $369 million in federal MinnesotaCare funding over that same two years.

In other words, Minnesota will be worse off under the 1332 waiver than they would be without it. Dayton urged HHS to rapidly approve the 1332 waiver, and to reverse the provision that would otherwise cause a substantial funding cut for MinnesotaCare. However, the approval letter that CMS sent three days later stated that federal savings based on reduced premium tax credits (due to lower overall premiums as a result of the reinsurance program) would be passed on to Minnesota to fund the reinsurance program, but that savings associated with MinnesotaCare would not.

Yes, CMS is effectively stealing $369 million from MinnesotaCare enrollees, giving $208 million of it to unsubsidized MNsure enrollees and...pocketing the $161 million difference? I can't believe that's what it amounts to, and yet that appears to be where we are:

While approving Minnesota’s reinsurance waiver, federal health officials indicated they would cut funding for MinnesotaCare — the state’s subsidized program for the working poor — by an estimated $369 million, despite repeated promises that funding would go untouched.

Department of Health and Human Services Commissioner Emily Piper said and Minnesota’s congressional representatives are still pressing officials at the federal level to relent and restore that critical funding.

Put yet another way, CMS just screwed Minnesota residents earning 138% - 200% of the federal poverty line ($16,000 - $24,000/year) in order to help out those earning over 400% FPL ($48,000/yr +). Certainly that help is needed, but it shouldn't have been done by hurting those lower down the income chain.

In any event, as I understand it, given the time crunch, MN officials had no choice but to grudgingly accept the "approval" and are working to figure out how to refill that $369 million hole in the MinnesotaCare program.

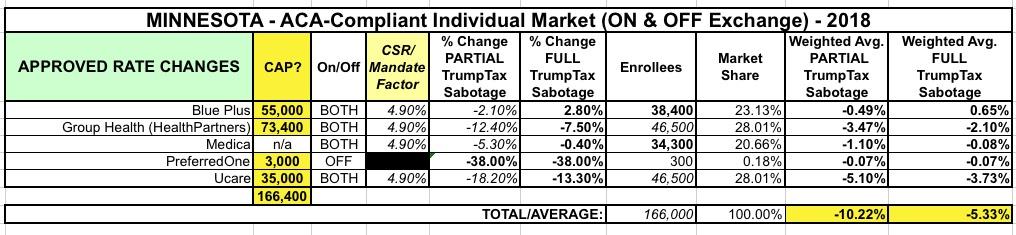

As a result of all this insanity, at least the exchange plan rates are indeed dropping overall...although it doesn't look to me like it'll be anywhere close to the "20% drop" figure I've seen batted about. As far as I can tell, instead of a 12.5% average increase, the average premium rates will drop by around 5.3-10.2% overall depending on whether CSR payments are guaranteed or not.

UPDATE: I've confirmed with the state Dept. of Commerce that all approved rates assume NO CSR payments next year. I've also confirmed that the CSR load is being applied to on-exchange Silver plans only, meaning Minnesota is apparently going the full "Silver Switcharoo" route. I've updated the table below accordingly.

It's also worth noting that 4 of the 5 carriers are once again instituting enrollment caps for 2018, although this year it's Medica which seems to have drawn the "short straw" by agreeing to accept any overflow. I should note, however, that the total "cap" on the other 4 carriers combined adds up to around 166,000 people, which just happens to be exactly what Minnesota's total individual market size is anyway, so unless there's a massive surge in enrollees this shouldn't cause too much of a problem.

One other important thing to note: While the average premiums will be lower for new enrollees (and around the same for current subsidized enrollees), it'll actually still be higher for anyone not receiving APTC assistance this year...because that 25% rebate was a one-time deal. They're paying 25% less this year, but once the rebate runs out will still see their rates jump back up somewhat.

The CSR impact is pretty small in MN anyway because there simply aren't that many people eligible for CSR assistance...because the vast majority of them are enrolled in the BHP (MinnesotaCare) program instead. In fact, only around 11% of MNsure enrollees receive CSR vs. the 60% or so national average. As a result, it only moves the needle around 5 points when spread across all metal levels, according to the Kaiser Family Foundation.