Lemons into Lemonade: Has Patty Murray cracked the CSR code?

Thanks to David Anderson for the heads up on this. According to Caitlin Owens of Axios...

Senate Democrats, led by Sen. Patty Murray, are pushing to increase the Affordable Care Act's subsidies as part of a stabilization bill being renegotiated with Sen. Lamar Alexander. This would mean increasing the amount of financial assistance people receive, as well as making it available to more people.

- ...“We’re interested in both expanding access to subsidies and increasing their value. You’ve got two different sets of populations that will be impacted in different ways depending on how cost sharing” is structured, a Democratic aide told me.

Democrats also want to:

- Restore ACA outreach and enrollment funding.

- Prevent the sale of "junk plans" — a reference to the Trump administration's proposal to expand access to short-term policies that don't comply with ACA regulations.

- Fund a reinsurance program, although the aide says this has become so popular among Republicans that Democrats don't feel like they have to push very hard.

Here's what's going on:

- Originally, it looked like cutting off CSR reimbursement payments to carriers would have little effect (either positive or negative) on subsidized enrollees, but would hurt unsubsidized enrollees greatly, to the tune of a 15-20% rate hike.

- Instead, thanks to the clever Silver Load/Silver Switch workaround whipped up by a combination of analysts, exchanges and carriers, killing the CSR reimbursements actually ended up helping subsidized enrollees. Meanwhile, yes, unsubsidized enrollees did see a substantial rate hike, but this was partly mitigated for many of them thanks to the "Silver Switcharoo" off-exchange option in about half the states.

- As a result, the situation has changed dramatically: Reinstating CSR reimbursement payments now would actually end up hurting more people (~9 million or so subsidized enrollees) than it helps (perhaps ~5 million or so unsubsidized enrollees).

Here's the irony: According to the Congressional Budget Office, stopping CSR payments will save the federal government about $118 billion by 2026...but it would also cost the federal government $365 billion in increased APTC subsidies, meaning a net increased cost of $194 billion after other smaller factors are taken into account:

Effects on the Federal Budget CBO and JCT estimate that, on net, adopting this policy would increase the federal deficit by a total of $194 billion over the 2017–2026 period. That change would result from a $201 billion increase in outlays and a $7 billion increase in revenues (see Table 3, at the end of this document).

The total increase in the deficit that would result under the policy includes the following amounts:

- Costs of $247 billion from net increases in marketplace subsidies (an increase of $365 billion for premium tax credits offset by a reduction in CSR payments of $118 billion) stemming from increases in the average subsidy per person for people receiving the ACA’s tax credits for premium assistance to purchase nongroup health insurance and in the number of people receiving those subsidies in most years and

- A net increase of $7 billion in federal outlays for Medicaid because of higher enrollment resulting from a reduction in the number of employers offering health insurance to their workers in most years.

Those increases in the deficit would be partially offset by:

- Savings of $47 billion, mostly associated with shifts in the mix of taxable and nontaxable compensation— resulting in more taxable income—from a net decrease in most years in the number of people estimated to enroll in employment-based health insurance coverage, and

- A net increase of $11 billion in revenues resulting from an increase in most years in the number of employers subject to penalties for not offering health insurance.

The bottom line is that under the new baseline, restoring CSR funding NOW would effectively give Congress $194 billion more to play with over the next 9 years, or roughly $21 billion per year.

That appears to be the arena Sen. Murray is now playing in.

OK, so what could they do with ~$21B/year, assuming it's specifically limited to staying within the individual market? Plenty.

Silver-loading would disappear but the money that otherwise would have been spent on Silver Loading would instead be used to increase the income cap for premium tax credit eligibility and also increase the size and scope of CSR eligibility.

- If premium tax credits are adjusted so that everyone is guaranteed at to spend no more than 10% of their income on the Benchmark Silver, that is a liberal policy win.

- If premium tax credits are adjusted so the individual contribution grows at a slower rate for people who make more than 200% FPL, that is a liberal policy win.

- If CSR is expanded so everyone who makes between 200% to 300% Federal Poverty Line can buy a CSR Silver with 80% AV, that is a major liberal policy win.

- If the family glitch is debugged, that is a win.

There are a lot of IFs that could produce significant liberal policy wins by making the law work better. And if those are the trade-offs being made, I am all for it as those are liberal policy goals that can be efficienctly and effectively cover people in a far less convoluted and kludgy manner.

My "If I Ran the Zoo" entry is a bit outdated at this point (I originally posted it in April 2017...things change quickly), but Anderson just effectively listed 4 of the 20 recommendations (five, if you include "CSR restoration" in the first place):

- #3: "Fix the Family Glitch"

- #7: "Raise the APTC Cap...

- #7: "...& Beef Them Up Below That"

- #8: "Raise the Cap on CSR Eligibility" (sort of)

Louise Norris describes the Family Glitch here:

Unfortunately, due to a “glitch” in the ACA, they [the families of the employee] are not eligible for premium subsidies in the exchange if the amount the employee has to pay for employee-only coverage on the group plan is deemed “affordable” – defined as less than 9.66 percent of household income in 2016.

...It doesn’t matter how much the employee would have to pay to purchase family coverage. The family members are not eligible for exchange subsidies if the employee could get employer-sponsored coverage just for him or herself, for less than 9.66 percent of the household’s income.

She estimates that 2-4 million more people would become eligible for ACA exchange tax subsidies if this was resolved. Assuming 3 million subsidized enrollees at an average of, say, $400/month in tax credits per enrollee per month, that would add up to roughly $14.4 billion per year...covering ~3 million more people and still leaving around $7 billion per year left on the table!

UPDATE: Thanks to Andrew Sprung for the heads up re. an Urban Institute study from 2016 which pegged the potential cost at anywhere between $3.7 billion - $6.5 billion per year depending on how many people were included...which they figure would range from 1.6 - 3.6 million people depending on how strict/generous the rules for the fix were in terms of who would become eligible for subsidies. That would amount to an average of $1,800 - $2,300 per year in tax credits per enrollee, or $150 - $190/month apiece.

My own $400/mo spitball estimate was based on the average APTC assistance being provided to those currently receiving it, but I'm guessing the Urban Institute figured that the average income level for the "family glitch" population is higher overall (more in the 250 - 400% FPL range than 100-250 FPL?). In addition, I presume the Urban Institute didn't anticipate Silver Loading at the time...

What about the next two (I merged them into a single bullet point in my list; Anderson separates them out)?

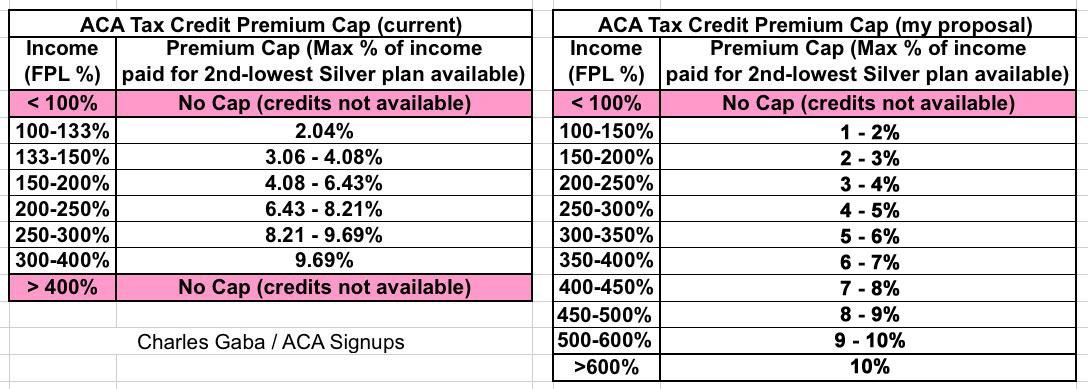

Here's the current APTC formula, with my own proposed formula next to it, which would address both of Anderson's bullets:

- It would remove the 400% APTC cap (while setting a hard limit of 10% MAGI on the Silver benchmark plan for anyone regardless of income, and...

- It would enhance the formula below that threshold: People earning 200-400% FPL would go from having to pay 6.4 - 9.7% of their income to only having to pay 3-7% of their income.

The exact formula could vary, of course; this is just for illustration purposes:

How much would that cost? Well, that's hard to say, but various experts who I've discussed it with seem to think it would add anywhere from 3-6 million more middle class enrollees to the ACA-compliant individual market while only adding perhaps $10-$12 billion to the net cost per year.

In fact, Sen. Diane Feinstein already introduced a bill to do half of the job last summer, as I've written about before (her bill wouldn't change the formula on the left, but it would remove the 400% FPL cap for the 9.69% income threshold).

Finally, there's the "Raising CSR" bullet. In this case, Anderson is proposing something a little different from what I suggested: I was thinking of raising the CSR cap from 250% FPL to 400%, but Anderson is instead suggesting only bumping it up to 300%...but making it stronger within that range.

Right now, there are 3 different tiers of CSR help:

- If you earn 100-150% FPL, CSR help raises your Actuarial Value to 94%

- If you earn 150-200% FPL, CSR help raises your Actuarial Value to 87%

- If you earn 200-250% FPL, CSR help raises your Actuarial Value to 73%

Considering that non-CSR Silver plans have a 70% AV to begin with, many healthcare wonks have never really understood the point of that third tier--it's such a nominal amount. Anderson is suggesting changing the third tier to this:

- If you earn 200-300% FPL, CSR help raises your Actuarial Value to 80%

Again, I don't know how much that would cost...last year, an average of around 5.6 million people received CSR assistance each month,, but I don't know the exact breakout of the three tiers. I know that around 8.1% of exchange enrollees earn between 250-300% FPL, which would amount to perhaps 960,000 people this year, and another 14% earned between 200-250% FPL (~1.65 million this year), so they're already receiving the weak 73% CSR.

If you assume, say, $500 - $1,000 in beefed up CSR assistance per enrollee per year, that would amount to $1.3 - $2.6 billion per year.

These numbers would vary depending on other factors, and of course the addition of 5 - 10 milion more people into the individual market would itself have a significant impact on the risk pool, and therefore on premiums and APTC subsidies themselves. There wouldn't be enough in that $21B/year to do all four of the above, but at least 2 of them could be done without costing a single dime more than the feds are currently projected to do without CSRs being paid back.

Millions more covered at less cost to them without any net increase in cost to the government...which, as the GOP clearly proved last December and again last night, they don't actually care one iota about anyway. Win-Win-Win.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.