UPDATE x2: OE3 WRAP-UP: 8 Major factors for the so-so enrollment number

NOTE: THIS IS AN UPDATED/EXPANDED VERSION OF MY "PRE-MORTEM" FROM 1/28/16.

Also see these three additional entries for more major OE3 analysis:

I noted over a week ago that, after seeing the writing on the wall for several weeks and lowering my final 2016 Open Enrollment Period projection from 14.7 million to around 13.8 million, the time had come to lower it once again, to somewhere between 12.4 - 12.9 million.

As announced yesterday, the official QHP selection number ended up coming in right in the middle of this: 12.7 million nationally (9.6 million via HC.gov).

So...what went wrong? Well, from the HHS Dept's POV, nothing...or at least nothing that they didn't already project last October. They had already openly stated that they didn't expect any dramatic exchange enrollment increases this year, giving a wide open enrollment range of 11.0 - 14.1 million QHP selections...which has a mid-range of 12.6 million.

The better question is how I managed to be off by so much, overestimating (originally) by a whopping 2 million people, Obviously I can't be expected to nail every number, but that would be the least-accurate projection I've had to date (overshooting by 15.7%).

There's still a handful of enrollees left to be added to the state-level numbers (perhaps 60K or so collectively), but it's time to look at the major reasons for the shortfall.

Some of these are well-documented criticisms: Premiums and/or deductibles are simply too damned high for many policies/regions in general. This post is not about price/affordability issues, however; this is about more specific factors.

First, let's take a look at the state-by-state enrollment table, sorted highest to lowest in terms of how well each did vs. my personal projections:

ASIDE from the price factor, here are the major reasons why 2016 ACA exchange enrollment came in short not only of the CBO's absurd 21 million projection from last year, but even of my own 14.7 million original target:

- Cancelled Enrollees were PRE-PURGED this year (HC.gov)

- The BASIC HEALTH PLAN program in New York (& Minnesota)

- MEDICAID EXPANSION transfers in Indiana and Pennsylvania

- Fewer people transferred from EMPLOYER sponsored insurance than CBO expected

- Fewer people transferred from OFF-EXCHANGE policies than CBO expected

- The uninsured population is STILL CLUELESS about the deadline, the financial penalty or both.

1. PRE-PURGING CANCELLED ENROLLEES:

As I've noted many times over the past month or so, one major factor is a very simple one: The gross QHP selection total is actually at least 300,000 people higher than the official reports show.

There's no "fuzzy math" or "cooking the books" involved; in 2014 and 2015, the HHS Dept. didn't have the ability to separate out QHP selections which were cancelled due to non-payment (or other legal/technical reasons) until after the end of the open enrollment period. As a result, the actual enrollment number appeared to drop by a dramatic 13% from 11.7 million on 2/22/15 to 10.2 million on 3/31/15...over 1.5 million people in just 5 weeks.

The reality, of course, is that a major chunk of that 1.5 million had already been cancelled/purged by the insurance carriers weeks or even months earlier; it just took longer for the updated data to get processed into CMS's data reporting system. In fact, my guess is that over half of those policies were people who had been auto-renewed from the previous year but failed to pay their January premium, meaning they were never effectuated for even the first month...but it still took another 2 months for the numbers to catch up.

This year, CMS has confirmed at least 300,000 people whose cancelled/never-effectuated policies have already been culled from the total. As I showed a couple of weeks ago, it's actually even higher than that; CMS has been "pre-purging" some invalid QHPs all along...but I don't know exactly how many; I'm guessing perhaps 100K more, or around 400K total. This means a "cleaner" official number, but is also something I didn't know they were doing this year until recently.

During yesterday's HHS conference call, they specifically mentioned that even their official OE3 projections were based on the old methodology of not subtracting cancelled accounts until after the fact.

Since my 14.7 million projection assumed the same "include them all!" procedure as 2014 and 2015, those ~400K purged QHPs account for about 20% of the "shortage".

2. The BHP Program in NY (& MN):

Note: It's probably not fair to include Minnesota in here, because their Basic Health Plan program (MinnesotaCare) was already being factored in for both 2014 and 2015 (and the program itself was around for years before the ACA was even passed anyway), but I figured their 33,333 BHP enrollees should at least get a quick mention.

For 2016, New York became the 2nd state to launch the ACA-enabled Basic Health Plan program for lower-income residents. BHP is sort of like "Medicaid on steroids"...it has an excellent actuarial rating and enrollees have nominal premiums (just $20 per month with no deductible), while the state only has to pay 5% of the cost, with the feds picking up the other 95%. In fact, as Andrew Sprung has noted, the BHP program, properly expanded and managed, could be turned into the "public option" that so many progressives are clamoring for:

While no state has yet moved to create a public option, two states, Minnesota and New York, have taken what might be understood as a halfway step – or else an alternate route to more affordable care. That is, they have deployed a state-run Basic Health Plan (BHP) that provides comprehensive coverage at very low premiums to state residents with household incomes below 200 percent of the Federal Poverty Level (FPL).

To date, about two-thirds of enrollees in private plans offered in the ACA marketplace are in households with incomes below that threshold. The as-yet unanswered challenge for states committed to making the ACA work for all their citizens is to make coverage more affordable for people with somewhat higher incomes. As we will see, though, Minnesota may be poised to take a large step in that direction.

I'll discuss the future potential of the BHP program in the future; for the moment, the main point is that when NY launched their own BHP, it cannibalized around 300,000 people from private policies on the exchange (QHPs), plus another 100K who would otherwise have been likely to go the QHP route.

Again, during yesterday's conference call (and in the Weekly Snapshot report) these numbers were specifically broken out, even though NY isn't part of the federal exchange.

Now, I had tried to account for the BHP factor in my original projection for New York; I assumed that any QHP gains (perhaps 100K or so) would be cancelled out by people shifting to BHP coverage. However, I vastly underestimated just how popular BHP would be: 300,000 more people signed up for it state-wide than I was anticipating. As a result, instead of NY's number coming in at around 416K QHPs + 100K BHPs (516K total), it now looks like it'll be more like 260K QHPs + 400K BHPs, or 660K between the two.

In short, the NY BHP factor accounts for around ~160K of the difference, or 8%.

3. Medicaid Expansion in Indiana & Pennsylvania:

OK, I completely dropped the ball on this one, even though I've written extensively about exactly this issue: Roughly 1/3 of those who enrolled in ACA exchange policies last year had incomes between 100-138% of the Federal Poverty Line. That means that when any non-expansion state goes ahead and expands Medicaid (as both Indiana and Pennsylvania did after the 2015 Open Enrollment period ended (or at least in the middle of it), up to 1/3 of the exchange population will be automatically shifted from QHP enrollment over to Medicaid, while new potential enrollees in that income range will be redirected towards Medicaid as well.

I don't know exactly how many people in either IN or PA fell into this category, but based on each state's 9/30/15 effectuated enrollment numbers, I'd imagine that perhaps 100K people in Pennsylvania and 50K in Indiana who would otherwise have enrolled in QHPs instead signed up for (or were transferred over to) Medicaid, or about 150K total. This explains why OE3 enrollment for each not only didn't go up this year, but actually dropped compared with 2015 (by over 33K for PA, 23K in IN).

That's around 150K of the difference, or 8%.

4. ESI coverage dropped far less than expected:

This is one which both the HHS Dept. and myself did already account for:

...the CBO gets fully half of the 10 million increase for next year from people leaving ESI coverage.

Here's what the HHS Dept. says about that:

Specifically, we adjust CBO estimates downward based on employer surveys from Mercer and other industry sources, which suggest that shifts from ESI coverage and the off-Marketplace individual market into coverage through the Marketplaces will be smaller than CBO expected and that the remaining uninsured may be harder to reach than in previous years.

I'll be highlighting the other parts of this snippet later, but the point is that the HHS Dept. recognizes, as I did, that:

While the CBO thinks 5 million employees will be shifted from ESI to the exchanges, this doesn’t seem to be happening nearly as much as they figured after all. This alone could account for, say, 4 million fewer being enrolled in exchange QHPs than the CBO’s projected.

Since I had already accounted for the ESI factor in my original 14.7 million projection, I don't get to count it again here (note: Commenter Larwit1512 and I have gone back and forth about the ESI shift issue; I'm not gonna comment further).

5. Far fewer OFF-EXCHANGE enrollees moving ON exchange:

I completely missed this in my writeup about the Congressional Budget Office's latest budget outlook, but Timothy Jost noted it in his own more detailed CBO/ACA exchange writeup.

As Jost notes, this is expressly addressed by the CBO's latest report:

The CBO had estimated in its March 2015 baseline report that 21 million individuals would be covered through the marketplaces by 2016. Enrollment has been much lower than projected, a fact noted frequently by ACA critics. The January 25, 2016 report clarifies that the 21 million number had included 15 million who would be covered through the marketplaces with premium tax credits and an additional 6 million who would purchase unsubsidized coverage through the marketplaces.

The CBO now projects that 13 million will be covered through the marketplaces for 2016, including 11 million with subsidized coverage and 2 million without. Half of the 8 million enrollee discrepancy between the March 2015 and January 2016 enrollment numbers is due to a reduced estimate in the number of individuals projected to enroll in the marketplaces without subsidies.

The CBO expects that most of these individuals will now purchase coverage directly with an insurer. The CBO also dialed back its projections for marketplace enrollment for 2015 from 11 million to 9.5 million, with the difference entirely due to a reduction in the projected number of unsubsidized enrollees.

In other words, the CBO's 21 million projection assumed that an additional 4 million people who were already enrolled in off-exchange policies would drop those and shift to new exchange-based policies (just as my wife and I did ourselves 2 years ago). Instead, the CBO is now saying that most of these folks will stay put...and why wouldn't they?

As I've noted many, many, many times before, dating all the way back to February 2014:

For months I've been trying to hunt down the ever-mysterious "Off-Exchange" private QHP enrollment data...people who have purchased new, ACA-compliant healthcare policies since October 1st, but have done so directly via the various insurance companies. These are, for the most part (at least in the states which haven't granted a 1-year extension of non-compliant policies) the same (or very similar) policies as those sold via the exchanges; the enrollment process simply bypasses the exchange websites, that's all. There are several reasons why people do this; the most obvious is if their taxable income is too high to qualify for an ACA subsidy. Why go through the hassle (on some exchange sites, not others) of jumping through the extra hoops of the Exchange process if you're certain that you aren't going to qualify for a tax credit anyway?

A fairly consistent 85% of exchange enrollees have received federal tax credits for the first 2 years, and this seems to still be the case this year. I'd be willing to bet that most of the other 15% are those who, like my wife and I, have variable incomes which hover around the 400% FPL mark, and therefore are never sure whether they'll qualify for APTC or not from year to year. In fact, only 9% of the enrollees appear to actually be over 400% FPL (a small percentage of those under 400% still don't qualify for APTC for various reasons).

Again, if your income is reliably above 400% FPL, what practical reason would there be to enroll via HC.gov or one of the state exchanges when you can get the same policy (or similar) directly through the insurance carrier?

Now, there are exceptions to this. Vermont and the District of Columbia require all individual policies be sold via their exchanges, and there are probably some cases where a carrier is offering better-value policies (even at full price) on exchange than off...but otherwise, I don't know why the CBO ever assumed that the percent of full-price enrollees would nearly double, from 15% to nearly 30%.

The CBO didn't account for this, but I did in my original projection:

The HHS Dept. doesn't make any specific mention of people moving off of transitional/grandfathered policies; I've estimated that perhaps half a million of them will make the move to the ACA exchanges. Some people, too, will likely move from their existing off-exchange (ACA-compliant) individual policies onto an exchange policy due to qualifying for APTC assistance, although I suspect that will be a pretty nominal number at this point.

Therefore, while this does account for several million of the CBO's overestimate, it doesn't account for any of mine.

6. The remaining uninsured STILL haven't a clue about the deadlines and/or tax penalties:

The final factor is one which I've written about before, and which there seems to be no obvious solution to: In spite of a massive outreach/marketing/eduction effort by HHS, CMS, HC.gov, the state exchanges, the private insurance carriers, Enroll America, Families USA, Planned Parenthood, the United Way and dozens of other organizations, people STILL had no idea about the deadline and/or mandate tax:

Kaiser Health Tracking Poll: January 2016

Knowledge of Enrollment Deadline and Fine For Not Having Insurance

As the Affordable Care Act’s third open enrollment period comes to a close at the end of this month, most of the uninsured are disengaged from the ongoing enrollment process. Just 15 percent of the uninsured can correctly say when the deadline to enroll is. The majority (57 percent) of the uninsured say they don’t know the deadline and small shares incorrectly believe the deadline is some other time in 2016 (16 percent) or that it has already passed (12 percent). Additionally, only 1 percent correctly name the 2016 fine amount of $695 per person or 2.5% of household income.

I can understand being confused about the amount of the penalty, but to not know about the 1/31 deadline at all? That just boggles my mind. Obviously I'm super-aware of this to a degree that the average person isn't, but come on...the various organizations and agencies listed above have been plastering deadline notices all over the place. I realize that a large portion of the uninsured aren't likely to see Twitter feeds and banner ads, but 15% still seems jaw-droppingly low to me.

(sigh) Ah, well...15% is twice as many as the 7% who knew the deadline a month ago, so I guess that's an improvement...

Although they largely do not know the fine amount, nearly half (47 percent) of the uninsured anticipate that they will have to pay a fine for not having health insurance in 2015. An identical share (47 percent) say that they do not think they will have to pay a fine and the remaining 6 percent say they don’t know. Some uninsured may in fact be exempt from the fine because of hardship exemptions available under the law.

In terms of enrollment engagement and efforts to get coverage, most of the uninsured say they have not been contacted about signing up for coverage (67 percent) or that they have not tried to get more information on their own (57 percent). More specifically, most uninsured say they have not taken steps to figure out if they are eligible for the two main coverage expansions under the ACA.

In fairness, it's not quite that bad: Lori Lodes of CMS pointed out during a previous coference call that the KFF survey includes all of the uninsured, not just those eligibile for exchange enrollment. Since only around 50% of the uninsured are realistically eligible to begin with, and since the demographics of the other half are mostly those who wouldn't have any reason to keep track of the deadline anyway, this suggests that the awareness level among those eligible to enroll is probably somewhat higher than 15%. That's still not great, but it's better than nothing.

How much of a factor did this make? That's impossible to say, really.

UPDATE 2/05/16 #7: The Great American Insurance Broker Purge:

Thanks to Allison Bell of LifeHealth Pro for reminding me of this one: As I've written about repeatedly, due to concerns about exchange enrollees being too pricey to treat, several insurance carriers decided, starting almost immediately at the start of the open enrollment season, to start killing off commissions for their insurance brokerage network...especially for ACA exchange policies.

It started with (of course) Unitedhealthcare reducing exchange commissions by 80%, then getting rid of them entirely, then eventually spread to other major (and some minor) carriers like Anthem, Aetna and Cigna, although some of them are only killing commissions during the off-season.

It's impossible to know exactly how many potential additional enrollees would have signed up if so many major carriers hadn't started effectively telling their brokers not to suggest signing up, but even 1-2% more would have meant an additional 125K - 250K people on exchange plans.

UPDATE 2/07/16: #8: The Mystery of IRS Form 8962:

Back in late October, just a few days before Open Enrollment started, I noted that there was a strong possibility of exchange enrollment suffering due to the nearly 1.5 million households which received APTC assistance in 2014, but failed to properly reconcile their financial assistance using IRS Form 8962. In half the cases, they filed their tax returns but forgot to include the reconciliation form 8962. In the other half, however, they didn't file a federal tax return at all.

By the time the dust settled, at first it looked like around 463,000 households would end up losing any 2016 tax credits...but I dismissed the issue as being fairly nominal later when it looked as though only perhaps 60,000 people had actually had their 2016 credits taken away.

Today, however, I learned that the HHS Dept. is going to allow a Special Enrollment Period for anyone who did lose their credits due to not filing a return...and for the life of me, I can't tell whether it's going to apply to 60,000 or 1.2 million people.

If it's the 60K figure, then that's barely a rounding error. If it's 1.2 million, then that could have made up a significant chunk of the difference. Obviously not every one of these people would have re-enrolled for 2016, but assuming 90% of them tried to do so, that could potentially be up to 1 million more people.

So...there you have it. I can quantify around 35% (700,000) of the 2 million difference between the 12.7 million actual and my 14.7 million projection (and potentially up to 1.7 million of it, depending on the 8962 situation). As for the rest, that's where the other issues come into play (unawareness of the deadline/penalty and, of course, the premium/deductible factors).

There will be a lot more to say about all of this, especially once the official ASPE report is released in a few weeks, but that's about it for now.

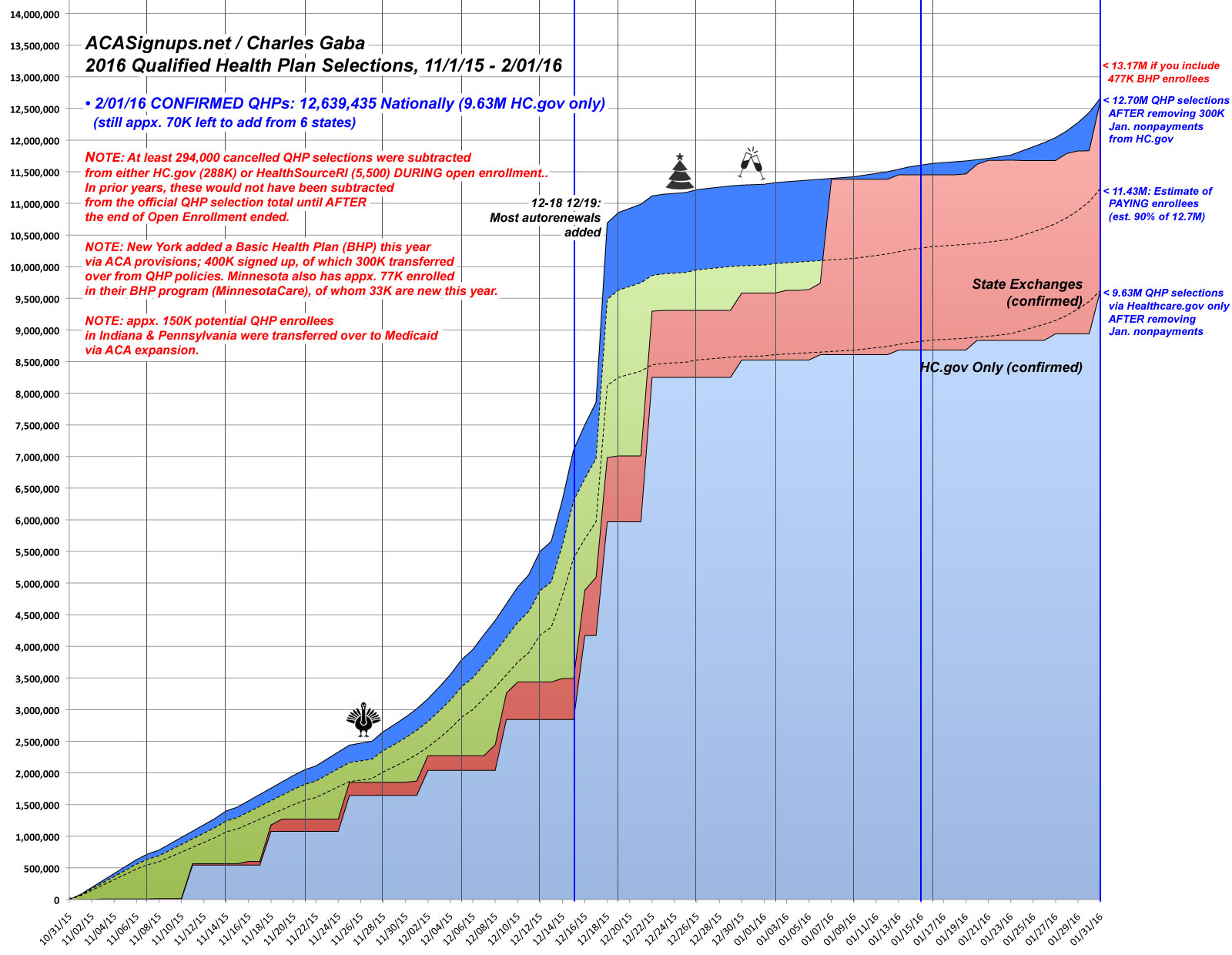

In any event, here's the final version of The Graph for the 2016 Open Enrollment Period. As you can see, I've done my best to take into account both the purge factor as well as the NY/MN BHP factor. For the IN/PA Medicaid transfers, I made note of them but didn't include a marker for them on the right side: