UPDATE: ACASignups.net vs. HHS.gov: Let's Get Ready to Rummmmbllllle!!!

UPDATE: 1/13/15: I've modified my final #OE3 projection; I'm now projecting a range of anywhere between 13.8 - 14.2 million (but I'll still be judging myself based on how close I came to the 14.7M figure, however.)

OK, I really didn't plan on going with a "Me vs. HHS" theme here; obviously we're not really "competing" on this issue, and the reality is that both of us could prove to be dead wrong on 2016 exchange enrollments. For all anyone knows, the actual number of people who select Qualified Health Plans (QHPs) during this year's Open Enrollment period (11/1/15 - 1/31/16) could, theoretically, be as few as zero (extremely unlikely) or as high as around 28 million or so (in fact, technically speaking, if every single employer in the country suddenly decided to pay the $2,000/head mandate fee, it could theoretically be upwards of 180 million or so, but somehow I don't see that happening either).

However, thanks to a coincidence of timing, the HHS Dept. just happened to release their official 2016 target just a couple of hours before I posted mine (and yes, I had already locked down my own projection a day earlier--check with the editors of healthinsurance.org if you doubt me). Our numbers ended up being different enough that there'll be some legitimate "drama" in watching the numbers climb (for those nerdy enough to care about such things). At the same time, the fact that they're both in the same general range, even though we used very different reasoning, is somewhat reassuring.

(By the way, in case anyone doubts me on this point, read my post from back on May 5th when I said:

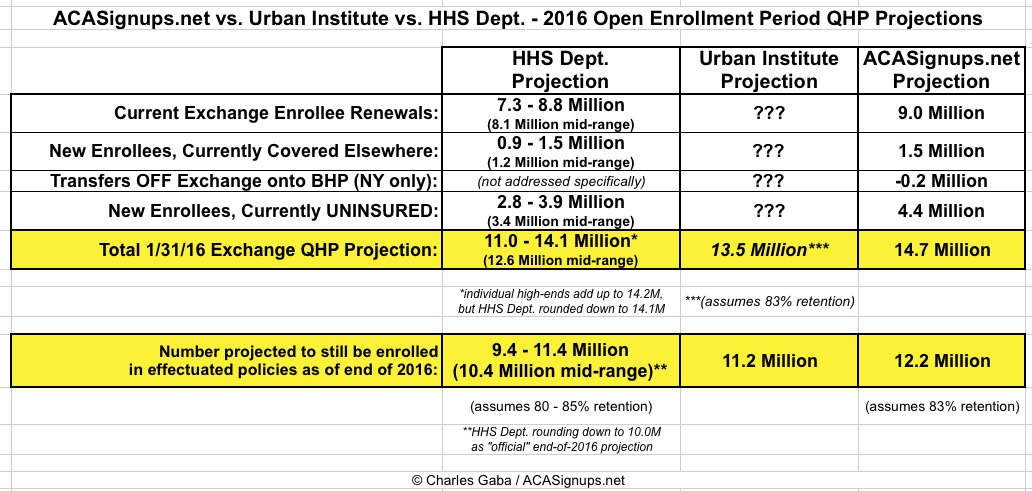

For 2016, the Congressional Budget Office is currently projecting that average monthly full calendar-year ACA exchange enrollments will reach a whopping 21 million.

That's a tall order; based on the first two years the trendline suggests that they're overshooting by around 30%, meaning around 15 million is more likely, but they're obviously counting on the increased "shared responsibility" tax penalty to inspire a lot of folks into action.

Anyway, let's take a look at their projection vs. mine, and see how each of us got there. I gave a basic summary of my methodology in my exclusive piece over at healthinsurance.org; this is a more in-depth look at it.

As I noted yesterday, every 2016 ACA exchange enrollee is going to come from one of three different sources:

- 1. Currently-effectuated exchange enrollees who renew their policies (or switch to a different one); this is further broken into:

- Those who actively renew their current policy

- Those who actively switch to a different policy

- Those who do nothing & allow themselves to be passively (automatically) renewed in their current policy

- 2. NEW enrollees who are already currently insured elsewhere (ie, migrating to the exchange from some other form of coverage):

- Moving from Employer Sponsored Insurance (ESI) to an ACA exchange policy

- Moving from an off-exchange (but still ACA-compliant) individual market policy

- Moving from an off-exchange (Grandfathered or Transitional) individual market policy

- Moving from Medicaid/some other type of coverage to the ACA exchange due to income increase/etc.

- 3. Currently Uninsured people:

- Those who qualify for Advance Premium Tax Credits (APTC) (ie, incomes between 100-400% of the Federal Poverty Level (FPL))

- Those who don't qualify for APTC due to their incomes being above 400% FPL

- Those who don't qualify for APTC because they could enroll in their employer-sponsored plan but haven't done so

There's also two other groups within the uninsured, who aren't going to be enrolling on the ACA exchanges at all:

- Uninsured undocumented immigrants: OK, earlier this year up to 423,000 of this population tried to enroll but were kicked off when they weren't able to provide legal residency documentation. Note that many of these people may very well be legal residents, but they couldn't provide proper verification, so they were given the boot.

- People caught in the Medicaid Gap: These are people living in states which haven't expanded Medicaid via the ACA provision, whose income is under 100% of the FPL but over whatever their state's "standard" Medicaid eligibility is (this can vary from state to state...for instance, in Alabama, "parents of minor children" only qualify if their income is up to 13% of the FPL, which is kind of absurd). Technically speaking, there's nothing legally preventing these folks from enrolling in an exchange policy...but if you're making less than $11,770/year, you're not likely to be able to afford any of the exchange policies at full price). Sadly, due to the Supreme Court allowing Republican states not to participate in Medicaid expansion, people in this group make "too much" to enroll in Medicaid but too little to qualify for APTC assistance (which cuts off at 100% FPL).

OK, so after subtracting the last two groups, the question is, how many of the first three will end up enrolling?

1. CURRENT EXCHANGE ENROLLEES:

As of June 30th, there were about 9.95 million people enrolled in effectuated exchange policies. However, there has almost certainly been a bit more attrition since then, which will likely continue right up through the end of the year. How much attrition? Well, the HHS Dept. projected a year ago that 2015 would end with about 9.1 million still enrolled, and they seem to be sticking to their guns on this. It's also important to remember that not everyone currently enrolled will renew their policies; some will let their policies drop off "naturally" as of New Year's Eve while moving to other types of coverage (or even dropping coverage entirely).

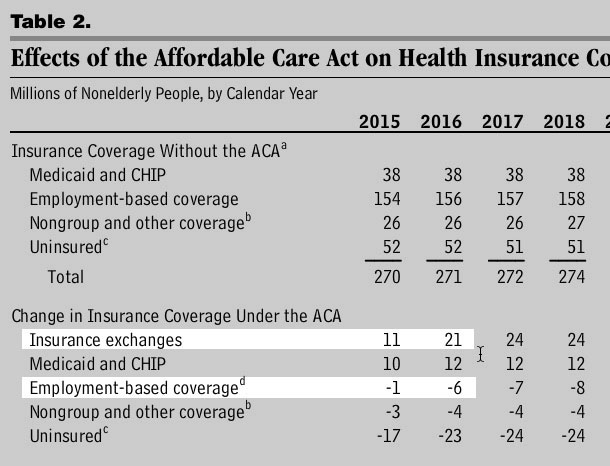

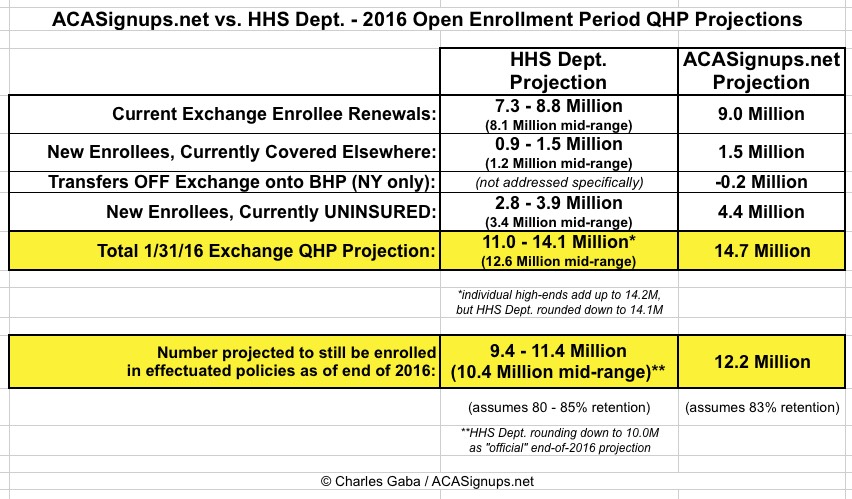

For the first element, continued enrollment by 2015 Marketplace enrollees, ASPE used data from the Centers for Medicare & Medicaid Services (CMS) on individuals currently enrolled in coverage through the Marketplaces and an analysis of re-enrollment rates from OE2 to project a range for OE3. As discussed above, we expect that 9.1 million individuals will be enrolled through Marketplaces for individual coverage at the end of 2015, but we also consider a range of starting points on which to base projections given uncertainty.

They go on to assume that out of 9.1 million end-of-year enrollees, anywhere between 7.3 - 8.8 million of those will renew for 2016, with a mid-range of around 8.0 million.

As for myself, I've been projecting for awhile now that effectuated enrollments should be higher by December (around 9.7 million). As I noted yesterday:

Last year, 6.3 million people renewed their policies vs. 8.0 million who had selected QHPs during 2014 open enrollment (78 percent). A similar ratio this year would be around 9.1 million (vs. 11.7 million). Alternately, I could also assume a 90 percent retention rate of the 9.95 million who were still enrolled as of June 30, which would give me around 8.9 million. Either way, I’m guessing around 9 million 2015 enrollees will renew for 2016.

CURRENT ENROLLEE RENEWAL PROJECTION:

- HHS Dept: 7.3 - 8.8 Million (8.1 Million midrange)

- ACASignups.net: 9.0 Million

2. NEW ENROLLEES WHO ARE CURRENTLY INSURED ELSEWHERE:

The biggest single reason why the Congressional Budget Office, dating all the way back to at least May 2013, has been projecting a huge exchange QHP spike in 2016 is that they've consistently believed that the Employer Mandate being implemented (along with other ACA provisions) would lead to employers kicking huge numbers (5-6 million) of people off of their Employer-Sponsored Insurance (ESI) onto the Exchanges. Even with the 1-year delay of the Employer Mandate and other tweaks to the law (and the economy in general), as of March 2015 they were still expecting a net shift of 5 million people from ESI over to the ACA exchanges:

The fact that the 2015 number is likely to come in at more like 9.7 million vs. 11 million is a separate issue; the point is that the CBO gets full half of the 10 million increase for next year from people leaving ESI coverage.

Here's what the HHS Dept. says about that:

Specifically, we adjust CBO estimates downward based on employer surveys from Mercer and other industry sources, which suggest that shifts from ESI coverage and the off-Marketplace individual market into coverage through the Marketplaces will be smaller than CBO expected and that the remaining uninsured may be harder to reach than in previous years.

I'll be highlighting the other parts of this snippet later, but the point is that the HHS Dept. recognizes, as I did, that:

While the CBO thinks 5 million employees will be shifted from ESI to the exchanges, this doesn’t seem to be happening nearly as much as they figured after all. This alone could account for, say, 4 million fewer being enrolled in exchange QHPs than the CBO’s projected.

In addition to the ESI factor, there's also the couple million people who are still on "transitional" or "grandfathered" policies. While few of these people are required to drop their current policies for another year (or indefinitely), many of them will do so voluntarily, as shown in both Florida and New Jersey.

The HHS Dept. doesn't make any specific mention of people moving off of transitional/grandfathered policies; I've estimated that perhaps half a million of them will make the move to the ACA exchanges. Some people, too, will likely move from their existing off-exchange (ACA-compliant) individual policies onto an exchange policy due to qualifying for APTC assistance, although I suspect that will be a pretty nominal number at this point.

There's also one other item to note, specific to Minnesota and especially New York: Reverse movement...that is, people who are currently enrolled on the exchange who are shifted over to the Basic Health Plan allowed for by the ACA. Here's how the HHS Dept. put it:

...as well as increased access to health coverage as states expand Medicaid and introduce new plan options such as the Basic Health Program in New York and Minnesota.

...and here's how I explained it:

In addition, starting in 2016, New York will become the second state to launch a Basic Health Plan, enabled by the Affordable Care Act. (Minnesota already had a BHP in place pre-ACA.) BHPs are sort of like “Medicaid on steroids” for people under 200 percent of the Federal Poverty Level. Ironically, this ACA provision will likely lead to exchange enrollment being reduced substantially in New York, since about 40 percent of New York’s QHP enrollees fell below 200 percent FPL this year. (73.5 percent were subsidized, of whom 54 percent were below 200 percent FPL.) That could lop up to 200,000 off of the QHP tally.

As a result of all of this, the HHS Dept. sort of lumps all of the subcategories together:

Our analyses suggest that between 0.9 and 1.5 million individuals with non-group coverage outside the Marketplaces and between 2.8 and 3.9 million eligible uninsured individuals will select plans through the Marketplaces.

For my part, I'm assuming 500K coming in from grandfathered/transitional/off-exchange, plus perhaps 1 million coming over from ESI, for a total of 1.5 million...but then subtracting about 200K due to the NY Basic Health Plan factor.

NEW ENROLLEES CURRENTLY COVERED ELSEWHERE:

- HHS Dept: 0.9 - 1.5 Million (1.2 Million midrange)

- ACASignups.net: 1.3 Million

3. CURRENTLY UNINSURED ADDITIONS:

This, as I noted yesterday, is the trickiest part to calculate. As it happens, the Kaiser Family Foundation (considered one of the Gold Standards for this sort of thing) just released a huge study which breaks out their estimate of the total remaining uninsured people in the U.S. by various categories. Here's what they came up with:

- 32.3 Million total uninsured, of which:

- 8.6 Million are eligible for Medicaid coverage (of either the "traditional" or "ACA expansion" categories).

- 3.1 Million are still caught in the "Medicaid Gap" in 19 states.

- 7.1 Million are eligible for Exchange QHPs with APTC assistance.

- 4.9 Million are Undocumented Immigrants (and therefore ineligible for exchange enrollment at all, with or without tax credits).

- 3.7 Million are eligible for Exchange QHPs without APTC assistance due to making more than 400% of the Federal Poverty Line.

- 4.9 Million are eligible for Exchange QHPs without APTC assistance due to having a standing offer of ESI which they've refused to take.

As emphasized above, it's the 3rd, 5th and 6th categories which we're concerned with here. That's a total of 15.7 million people who are currently uninsured but could potentially enroll via the ACA exchanges for 2016.

Here's what the HHS Dept has to say about enrolling the uninsured:

We estimate that there are currently about 19 million people in the addressable market for new enrollment, consisting of 8.5 million people with off-Marketplace non-group coverage and 10.5 million who are uninsured. Based on the 2013 ACS, we calculated the number of QHP-eligible uninsured individuals prior to the first open enrollment period. Adjusting that estimate to reflect the reduction in uninsured rates between 2013 and Q2 2015 according to the Gallup-Healthways Well-Being Index suggests there are currently 10.5 million QHP-eligible uninsured.

Hmmm...only 10.5 million (based primarily on Gallup-Healthways)...vs. the 15.7 million estimate from the Kaiser Family Foundation. That's a pretty wide gap.

...The projection for new enrollment depends on the likelihood that potential consumers from the addressable market will enroll in Marketplace coverage or the “take-up rate.” To predict take-up in the addressable market, ASPE stratified that population by family income into groups that were likely eligible for subsidies (financial assistance in the form of advance premium tax credits and cost sharing reductions) or had incomes too high to be eligible for financial assistance. Statelevel OE3 take-up rates are based on observed rates by these income groups in OE2, adjusted to account for increasing awareness of the Marketplaces, the increase in the individual shared responsibility penalty amount (and increasing awareness of the penalty), and the fact that some states have already achieved such large reductions in the uninsured population that any remaining uninsured people would likely be particularly difficult to reach. We vary these rates to account for uncertainty, which generates a range of estimates for plan selections through the Marketplaces in 2016. Our analyses suggest that between 0.9 and 1.5 million individuals with non-group coverage outside the Marketplaces and between 2.8 and 3.9 million eligible uninsured individuals will select plans through the Marketplaces.

OK, that's quite a mouthful, and they came up with but the last highlighted part is the key one here: They think that between 2.8 - 3.9 million currently uninsured people will sign up this time around.

As for me, I kept it much simpler: I'm projecting the ACA exchanges to sign up 50% of the uninsured eligible for APTC (3.5 million), plus about 10% of the "over 400% FPL" and "Turned Down ESI Offer" crowd (400K + 500K respectively). That adds up to 4.4 million currently uninsured signing up.

CURRENTLY UNINSURED SELECTING EXCHANGE PLANS:

- HHS Dept: 2.8 - 3.9 Million (3.4 Million midrange)

- ACASignups.net: 4.4 Million

Finally, regardless of how many people select a QHP through the exchange during open enrollment, the number who are still enrolled as of the end of 2016 will almost certainly be somewhat lower, due to three factors:

- About 10% of those who select a plan don't actually pay their first monthly premium, and are thus never actually enrolled

- Some people will be kicked off of their policies throughout the year due to failure to verify their legal residency status or for other legal reasons

- Normal net attrition/churn as people add or drop their policies during the off-season

Here's what HHS says about that:

Effectuated (active) enrollment at the end of 2016 is expected to be lower than the number of OE3 plan selections. Based on the Marketplaces’ first two years, we expect a net decrease in Marketplace enrollment relative to the level at the end of open enrollment. The number of individuals joining through Special Enrollment Periods (SEP) throughout the year does not fully offset those who leave for other forms of coverage or due to factors such as non-payment or termination from coverage as a result of a data matching issue. We project that in 2016 the yearend effectuated enrollment will be 9.4 to 11.4 million. ASPE’s analysis implies that most of the new Marketplace enrollment for 2016 is likely to come from the ranks of the uninsured, with more than three previously uninsured new enrollees for each one new enrollee who previously had off-Marketplace individual coverage.

If you compare the two ranges from the HHS Dept, you get:

- Low End: 9.4 Million Retained / 11.0 Million Selections = 85% retention

- High End: 11.4 Million Retained / 14.1 Million Selections = 81% retention

For my own calculations, I looked at 2014 and what I expect for 2015:

- 2014: 6,337,860 effectuated enrollees on 12/31/14 versus 8,019,763 QHP selections as of 4/19/14 = 79.0% retention rate

- 2015: 9.7 Million (???) effectuated enrollees on 12/31/15 versus 11,688,074 QHP selections as of 2/22/15 = 83.0% retention rate

Interestingly, both of us seem to agree that the retention rate should be gradually improving year to year. I used the 83% rate to get a projection of 14.7 Million x 0.83 = 12.2 Million still enrolled at the end of 2016.

So, if you add all of the above up, here's what you get:

WHEW!!

OK, so which one of us will prove correct?

Well, here's the funny thing about all of this.

LAST year, the HHS Dept's official QHP selection projection for 2015 was a range of 10.3 - 11.2 million.

The actual number ended up being 11,688,074...or 4.4% higher than their high-end projection (but 2.6% lower than mine)

THIS year, the HHS Dept's official QHP selection projection for 2016 is a range of 11.0 - 14.1 million.

My projection this year is 14.7 Million...which just happens to be 4.3% higher than the HHS Dept's.

That proves nothing, of course; we could both turn out to be dead wrong...but I find it ironic that I could've saved myself a whole bunch of trouble by just taking whatever number they came up with and tacking on 4%.

UPDATE: Thanks to Jim Drake for catching a slight error on my part; I had the "Offered ESI/Denied" and "Over 400% FPL" numbers swapped by mistake. This has been corrected, although it doesn't change any of my totals (instead of 500K + 400K, it's now 400K + 500K...)

UPDATE: Just to add some more perspective, the Urban Institute has posted their own QHP projection as well, although theirs is based purely on the effectuated number as of the end of 2016; they're projecting around 11.2 million, which should reverse-calculate to roughly 13.5 million QHP selections during open enrollment, right in between the estiamtes by HHS and myself:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.