Florida: IRONY ALERT!! *Approved* 2016 rate hikes HIGHER than requested...but lower than I estimated!

When I crunched the numbers for Florida's individual market back at the beginning of August, I had to make certain assumptions based on missing data. Even though I had hard numbers for many of the missing market share/enrollment fields, there were still major gaps, especially on the "companies requesting increases of under 10%" side.

I ended up with three potential scenarios for the requested weighted average increase in the Sunshine State: A best-case scenario of 8.6%, a "most likely" scenario of 10.3% and a worst-case scenario of 12.0%. In the interest of caution, I plugged the "most likely" number (10.3%) into my national average spreadsheet, and assumed it'd be somewhere between that and 12% publicly.

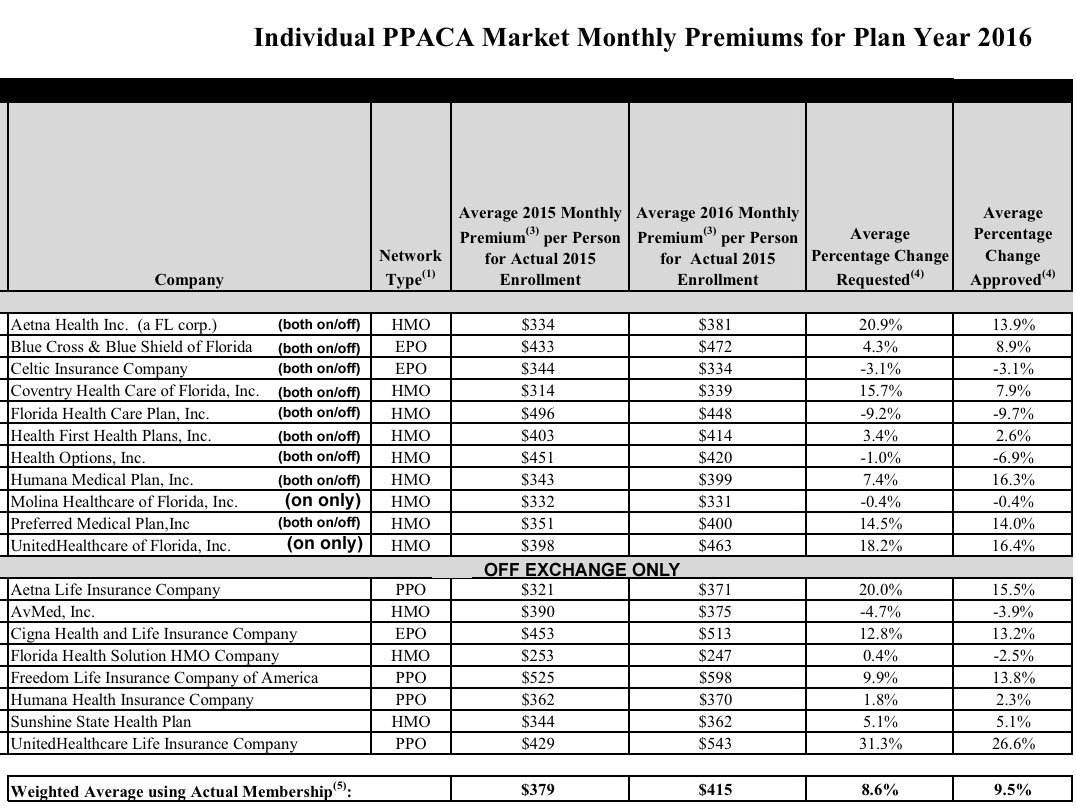

Yesterday, the Florida Office of Insurance Regulation released the approved rate hikes for 2016...and the irony is that the average requested rate hike ended up being lower than what I expected (it was around 8.6%, my best-case scenario)...yet in the end, the FL regulators actually increased the average hikes more than requested, to around 9.5%:

Office Announces 2016 PPACA Individual Market Health Insurance Plan Rates to Increase 9.5% on Average

TALLAHASSEE, Fla. – The Florida Office of Insurance Regulation announced today that premiums for Florida individual major medical plans in compliance with the federal Patient Protection & Affordable Care Act (PPACA) will increase an average of 9.5% beginning January 1, 2016. Per federal guidelines, a total of 19 health insurance companies submitted rate filings for the Office’s review in May with final rate determinations due by August 25, 2015. These rate filings consisted of individual major medical plans to be sold both on and off the Exchange. Following the Office’s rate filing review, the average approved rate changes on the Exchange range from a low of -9.7% to a high of 16.4%. This information can be located in the “Individual PPACA Market Monthly Premiums for Plan Year 2016” document.

Here's the actual table from the FLOIR website (I've reformatted it a bit below to make it more readable on this site):

There's three main takeaways here: First, as noted, the approved weighted average increase is 9.5% across all of the companies, both on and off the exchange. Whether this is good or bad depends on your perspective, of course; to me it's "good" because it's less than what I had been assuming.

The second, and most controversial point, is that the state regulators actually increased rates more than requested by some of the companies. The only other state where I've seen this happen this year is Oregon. The reasoning given by the insurance regulators in Oregon for this is that while preventing price gouging by the insurance companies is certainly part of their job, they also have an obligation to make sure that the market itself remains viable long-term:

“While we’re seeing a vigorously competitive market, we’re seeing a line of business priced below the cost of providing health care to the population, and that’s a long-term problem we need to fix,” saidPatrick Allen, director of the Department of Consumer and Business Services, which oversees the state's Insurance Division.

Basically, the regulators appear to be trying to save the insurance companies from going under due to under-pricing their offerings and going belly up or having to drop out of the market completely.

Zachery Tracer of Bloomberg News has a writeup on this unexpected phenomenon in Florida today:

Humana Inc. and Blue Cross & Blue Shield of Florida were among those whose final rates were higher than they’d first sought. Alex Kepnes, a Humana spokesman, said the approved increase incorporated updated information from the U.S. government on ACA programs designed to spread cost, known as reinsurance and risk adjustments.

...Regulators can push insurers to raise rates if they think companies aren’t charging enough to cover costs, which could raise the prospect of a company failing. They also have the power in some states to force insurers to lower rates.

“In most cases, when a state changes a rate in the rate review process, it’s to lower it, not to increase it,” said Cynthia Cox, who studies private health plans at the Kaiser Family Foundation.

It's important to note that while the overall approved average increase was higher than requested, many of the requests were cut, as shown in the table above; out of 19 total, 10 were reduced, 3 were approved as is and the other 6 were increased. It's just that the amount of the increase, combined with the relative market shares of the companies receiving them, outweighted those with reductions in their rate requests.

Florida also held down rate requests for some insurers. Aetna’s premium increase was limited to 13.9 percent, down from a requested 21 percent.

The third noteworthy point, also shown in the table above, is that starting next year there won't be any PPO plans available via Healthcare.Gov in Florida; only HMO and EPO plans are available via the ACA exchange. Anyone wanting a PPO will have to buy from one of the off-exchange companies, and will therefore have to pay full price since federal tax credits won't be available. This trend isn't unique to Florida, however; Blue Cross Blue Shield of Texas recently announced that they're dropping PPOs altogether as well.

It appears that "narrow networks" are the wave of the future, for good or for bad.