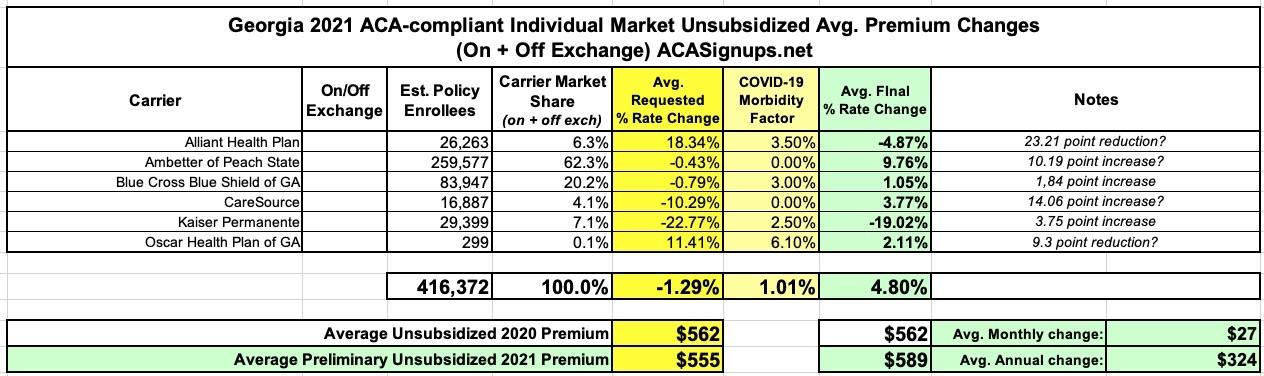

Georgia: Approved avg. 2021 #ACA premiums: +4.8% (was -1.3%)

Exactly one month ago, I posted an analysis of the preliminary 2021 premium rate filings for Georgia's individual and small group market carriers. At the time, the requests from the individual market carriers ranged from a 22.8% reduction to as much as an 18.3% increase.

I've also repeatedly noted that estimates by the carriers of the impact of the COVID-19 pandemic is pretty much all over the place. While a few carriers have indeed baked in significant rate hikes in response to COVID, most either don't mention it at all in their preliminary filings or, if they do, state that they expect the net impact to be negligible. However, they also make sure to hedge their bets by reserving the right to re-file their 2021 requests with adjusted COVID impact.

Overall, as I noted way back in May, the consensus on COVID-19 impact seems to be a big old ¯\_(ツ)_/¯.

Georgia's insurance regulators recently posted the state's final 2021 rate filings, and the results are a perfect example of the massive uncertainty I keep talking about. Check it out:

Alliant Health Plan originally incorporated a 3.5 percentage point increase to account for their expected COVID-19 expenses in 2021, stating:

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID-19 pandemic on claim costs and required premium rates in 2021, but we have made a preliminary adjustment to reflect the increased risk and uncertainty associated with the pandemic and its secondary effects. We incorporated an overall premium adjustment to account for the combined impact of several key COVID-19-related cost drivers.

In their revised filing, however, they state:

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID-19 pandemic on claim costs and required premium rates in 2021. Based on the most recent known information, this filing does not include any adjustments to the 2021 premium rates due to COVID-19.

Not only did Alliant Health Plan knock off the 3.5 point COVID factor, they actually ended up reducing their 2021 premiums by 4.9%..a net 23.2 point swing.

However, take a look at the next carrier, Ambetter of Peach State. Earlier this summer, they said:

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID-19 pandemic on setting premium rates, including whether the pandemic will increase or decrease costs in 2021. Because the range of possible outcomes remains so wide and uncertain, we have chosen to not make an adjustment to the 2021 premium rates at this time.

...but in their revised filing:

At the time of this rate filing submission, we acknowledge there remains substantial uncertainty regarding the impact of the COVID-19 pandemic on claim costs and required premium rates in 2021, but have made an adjustment to reflect the increased risk and uncertainty associated with the pandemic and its secondary effects. We have incorporated an overall premium adjustment to account for the combined impact of several key COVID-19-related cost drivers.

COVID-19 Impact (0.8% of premium impact versus 2020 filed rates)

Premium rates have been adjusted to reflect the estimated impact of the COVID-19 pandemic and associated secondary effects on the cost to provide healthcare coverage in 2021.

In addition to tacking on an extra 0.8 points, Ambetter went from reducing rates 0.4% to increasing them by 9.8%. And so on.

Overall, the difference between the preliminary and final 2021 rates on Georgia's individual market range from a modest 1.8 point increase to a whopping 23.2 point reduction...and while COVID-19 plays a role in some of this, it doesn't account for all of the differences.

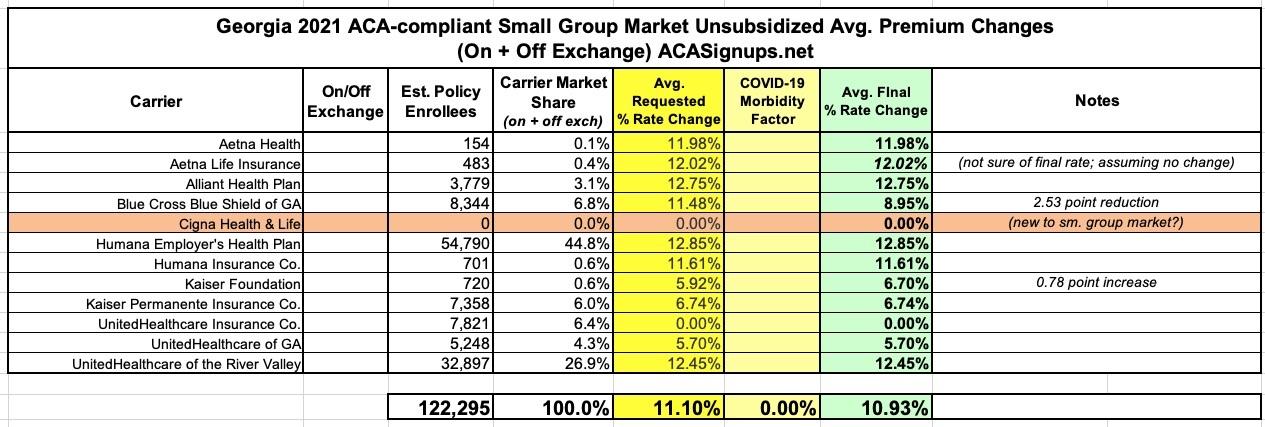

Interestingly, in the small group market, there was hardly any changes made at all...BCBS was dropped 2.5 points, Kaiser was bumped up slightly, and I couldn't find the final rate for Aetna Life Insurance, but otherwise all the requests were left as is:

UPDATE: I've been informed that Aetna's small group rate change wasn't modified at all.