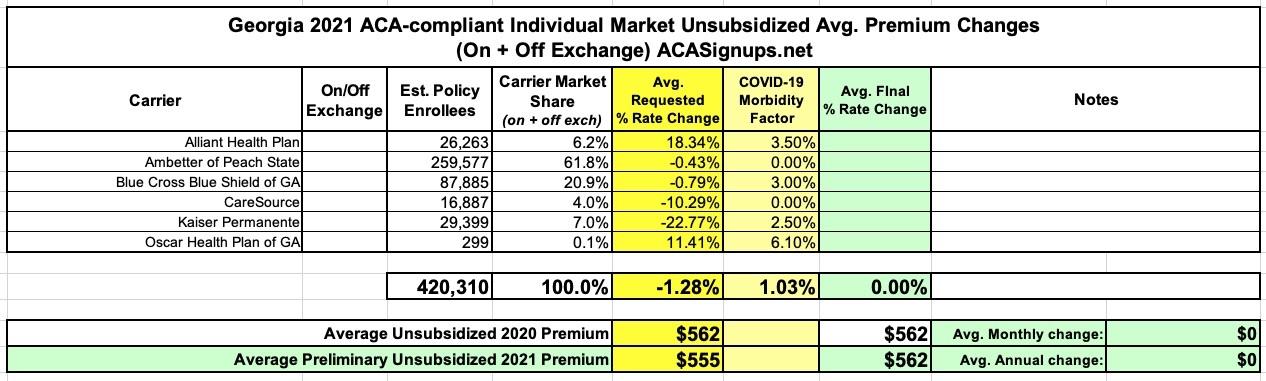

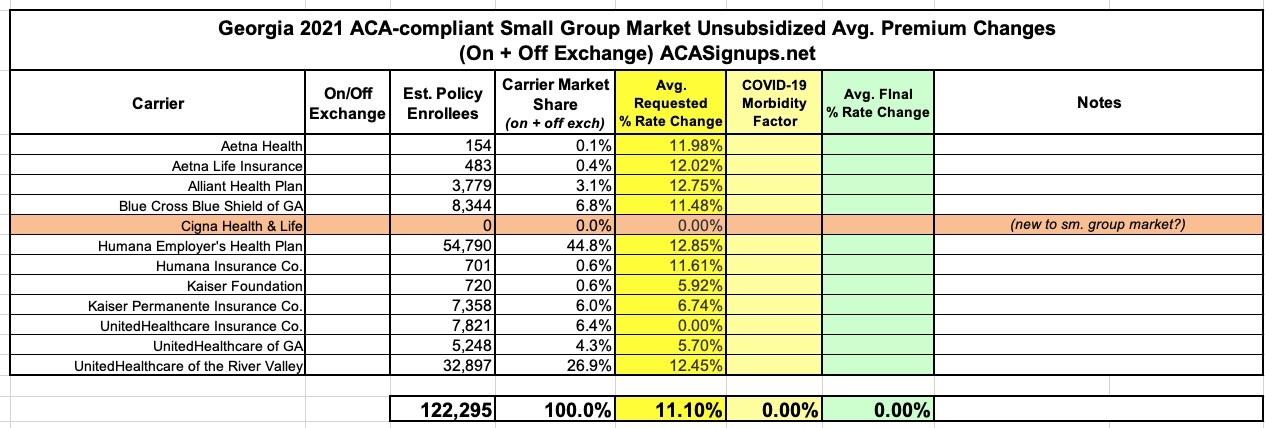

Georgia: Preliminary avg. 2021 #ACA premiums: -1.3% indy market, +11.1% sm. group

I've acquired the preliminary 2021 rate filings for Georgia's individual and small group market carriers. There were two filings submitted for many of the carriers because of a (since delayed) ACA Section 1332 waivier submission; the carriers submitted one in case the waiver was approved and a second if it wasn't. Since the process has been delayed, however, the no-waiver filing is the one which is relevant.

As you can see in the tables at the bottom of this entry, the overall weighted rate change requested by individual market carriers in Georgia is a 1.3% reduction, which would have been more like a 2.3% drop if not for the COVID-19 factor, according to the carriers. The small group market carriers are requesting an 11.1% average increase, which is unusually high these days. I haven't reviewed all the memos for the sm. group market to see what they're pinning on COVID-19, however.

Here's what the indy market carriers have to say about the COVID-19 factor in their 2021 filings:

ALLIANT (indy):

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID-19 pandemic on claim costs and required premium rates in 2021, but we have made a preliminary adjustment to reflect the increased risk and uncertainty associated with the pandemic and its secondary effects. We incorporated an overall premium adjustment to account for the combined impact of several key COVID-19-related cost drivers. These adjustments are derived from a model premised on assumptions of the spread of the disease, including assumptions as to how many people are infected in a population, how that infection rate is different by age / gender, how severe those infections are across the population, as well as assumptions regarding actions taken by governmental authorities, employers, and consumer and healthcare provider behavior in response to the pandemic.

Scientific knowledge of these items is incomplete and new data on the spread of COVID-19 in the United States is still emerging. In addition, actions taken by governmental authorities and the healthcare system related to the COVID-19 pandemic are rapidly changing. Consequently, our results will evolve as new information becomes available and new actions are taken by the authorities and other stakeholders. Due to the limited information available on the pandemic, any analysis is subject to a greater than usual level of uncertainty. If subsequent information becomes available that would materially affect this rate filing submission, we would like to work with the State of Georgia Department of Insurance to update our pricing assumptions regarding the impact of COVID-19 and resubmit this rate filing.

The “Other” projection factor in URRT Worksheet 1, Section II reflects an anticipated combined impact of COVID-19-related cost drivers on healthcare utilization and intensity in 2021, including the following:

- Direct cost of acute COVID-19 treatment, testing, and vaccination

- Pent-up demand as deferred care passes through the healthcare system following social distancing “lockdown” measures

- Morbidity impact of lasting population health changes precipitated by the pandemic, including healthcare complications following recovery from severe cases of COVID-19, and worsened health outcomes, due to deferred or avoided preventive care and maintenance care for chronic conditions during social distancing lockdown periods

AMBETTER (indy):

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID-19 pandemic on setting premium rates, including whether the pandemic will increase or decrease costs in 2021. Because the range of possible outcomes remains so wide and uncertain, we have chosen to not make an adjustment to the 2021 premium rates at this time. However, it is known that the COVID-19 pandemic could have a material impact on morbidity, enrollment, providers, and other factors related to the individual market. If subsequent information becomes available that would materially affect this rate filing submission, we would like to work with the Georgia Department of Insurance to update our pricing assumptions regarding the impact of COVID-19 and resubmit this rate filing.

BCBS GA (indy):

The 12.3% annualized trend includes a 3.0% single year addition to reflect the 2021 rebound of elective procedures deferred in 2020 during the COVID-19 pandemic.

CARESOURCE:

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID-19 pandemic on setting premium rates, including whether the pandemic will increase or decrease costs in 2021. Due to this uncertainty, we have chosen not to make an adjustment to the 2021 premium rates. It is possible that the COVID-19 pandemic could have a material impact on morbidity, enrollment, providers, and other factors related to the Individual market. If subsequent information becomes available that would materially affect this rate filing submission, we would likely pursue opportunities to revise our pricing assumptions and resubmit this rate filing.

KAISER PERMANENTE (indy):

COVID-19 is expected to increase KFHP-GA’s 2021 expense structure by 2.5%

OSCAR (indy):

Impact of the COVID-19 Pandemic

Scenario testing was performed for various macroeconomic forecasts to understand the sensitivity of varying unemployment rates and associated changes in market membership to the individual market in Georgia. In the baseline forecast, Oscar is projecting an unemployment rate that is expected to peak at 15.0% in Q4 2020 and Q1 2021. The resulting impact on anticipated market membership for the 2021 plan year is net growth of 12.6%, which is primarily driven by quarterly SEP activity and membership migration from the employer markets — large group self insured, large group fully insured, and small group fully insured with distributions of 40.0%, 25.0%, and 35.0%, respectively. An adjustment was included to reflect changes in the anticipated market morbidity associated with anticipated membership migration across segments. The estimated impact on an allowed cost basis is -0.5%.

Oscar additionally applied an adjustment for the assumed pent-up demand cost associated with elective, non-emergent procedures that were delayed during the peak of the pandemic. Oscar relied upon the study titled Deferred Procedures to Pressure Near-Term EBITDA and published by J.P.Morgan on March 18, 2020 to help establish baseline parameters of what proportion of health spend is currently elective by service category. A plausible range suggests that 30.0% to 80.0% of elective, non-emergent services will be cancelled, but that the remaining services deferred will eventually take place towards the end of 2020 and throughout 2021. The estimated impact on an allowed cost basis is 1.9%.

Oscar is assuming the pandemic will persist into the 2021 plan year until an effective vaccine becomes available or widespread immunity is established. Treatment for COVID-19 includes, but is not limited to, inpatient care with varying severity, outpatient emergency services, medically necessary diagnostic testing, and primary care consultations. The estimated impact on an allowed cost basis is 2.4%.

An adjustment was included to account for the anticipated costs associated with the introduction of a vaccination in the 2021 plan year. Oscar assumed a 90% adoption rate across the projected membership distribution and a cost of $100 to administer the vaccination. The estimated impact on an allowed cost basis is 1.7%.

Lastly, an adjustment was included to account for the anticipated costs associated with the introduction of antibody testing. Oscar assumed a 60% adoption rate across the projected membership, an average of 1.5 tests per member, and a cost of $150 to administer each individual test. The estimated impact on an allowed cost basis is 2.5%.

If I'm reading this last one correctly, it's roughly 6.1 points of Oscar's 11.4% total increase.