My Half-Assed Tax Credit Explainer: You may qualify for financial assistance in 2020 even if you didn't in 2019!

With the 2020 Open Enrollment Period rapidly approaching (it actually kicks off on October 15th in California, and on November 1st in every other state + DC), it's important to keep in mind that many people who didn't qualify for financial assistance in 2019 may qualify in 2020...and in some cases that could mean a difference of thousands of dollars due to how the ACA subsidy formula works and other factors.

First, a refresher on how the ACA formula works for Individual Market enrollees (that is, people who are looking to buy health insurance for themselves and/or their family who don't receive it through their employer, Medicare, Medicaid, CHIP or some other source).

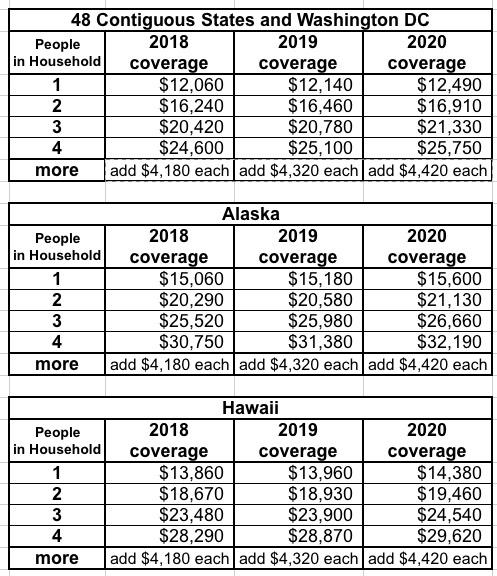

First of all, what is the Federal Poverty Level? Well, that increases a bit every year...and for 2020, it's increasing by around 2.7%:

Alaska gets a 25% bump and Hawaii gets a 15% bump over the rest of the country. I presume this is due to the unusually high cost of living in these two standalone states, although it seems to me that New York and California should qualify as well, but what do I know?

In any event, for most of the country, 100% FPL was exactly $12,140/year for a single person with no children in 2019...but it's increasing by $350 to $12,490/year, or 2.9%, for 2020. FPL for 2 people is going up by 2.7%, to $16,910. For three people it's a 2.6% increase and so on. There's similar increases in Alaska and Hawaii.

IMPORTANT: For most of the rest of this post, I'll be referring to those living in one of the 48 contiguous states or DC. See the above table for Alaska or Hawaii. Also, I'll mostly be referring to single-person households to keep things simple; see the above tables for multi-person households.

OK, so back to the ACA's subsidy formula.

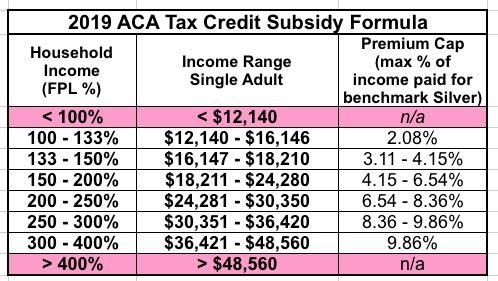

- If you earn between 100-400% of the Federal Poverty Level (see below), you're probably eligible for financial assistance, assuming the benchmark plan available where you live costs more than a certain percentage of your household income. The "benchmark plan" is the second lowest-cost silver plan available in your area:

For instance, let's say you're a 40-year old living by yourself in Oakland County, Michigan, and you earn eactly $18,000 this year, or around 148% FPL. You'd qualify for financial assistance if the unsubsidized premium for the benchmark Silver plan costs more than around 4.1% of your income ($738/year, or $61/month). The actual benchmark for a single 40-year old in Oakland County, MI is $325/month, so you'd qualify for $265/month in financial assistance to knock your premium down to $61/month (you'd also qualify for substanital Cost Sharing Reduction assistance to cover most of your deductibles and other out of pocket costs as well, but that's a different discussion).

If the same 40-year old earns $48,000/year (around 395% FPL), they still might qualify for tax credits...but at that income level, only if the benchmark plan costs more than 9.86% of their income. $325/month = 8.13% of $48,000, so you wouldn't qualify. The cut-off would be around $39,500 in this case...but it will vary greatly depending on what county/state you live in, how old you are, and of course how many people live in your household.

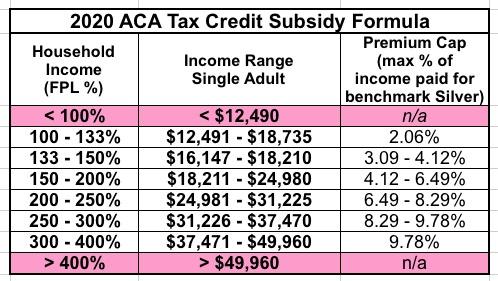

HOWEVER, for 2020, the table above is changing. Most of this is due to that ~2.7% bump in the Federal Poverty Level, but also notice that the Premium Cap percentages are also slightly lower at each level due to a slight tweak in how that formula is calculated as well.

Here's the 2020 table:

IMPORTANT: Everything here applies to people with household incomes over 138% of the Federal Poverty Level (FPL) in Medicaid expansion states or over 100% FPL in non-expansion states. If you're below 138% FPL in an expansion state, you should qualify for Medicaid. If you're below 100% FPL in a non-expansion state...unfortunately, you're likely going to have a lot of trouble finding affordable healthcare. This is a problem which needs to be fixed by either your state government expanding Medicaid or by federal Congressional action...which, unfortunately, is unlikely to happen before January 20, 2021.

This means several important things for 2020 healthcare coverage:

At the lower-income end:

- In 2019, in Medicaid expansion states, someone earning up to $16,753/year qualified for Medicaid. In 2020, this is increasing by $483/year ($40/month) to $17,236.

- In 2019, in non-Medicaid expansion states, someone earning as little as $12,140 qualified for major private ACA policy subsidies...but in 2020 they'll actually lose that eligibility, since the 100% lower-bound threshold will increase by $350/year ($29/month).

At the upper end range:

- In 2019, someone earning up to $48,560/year might have been eligible for subsidies...in 2020, the upper-range eligiblity cut-off has increased by $1,400/year ($117/mo) to $49,960.

Using the Oakland County, Michigan example above:

- Michigan premiums are actually dropping 2% on average in 2020. I have no idea what the benchmark Silver plan will cost, but let's assume it's 2% less right off the bat ($319/mo instead of $325/mo for a 40-year old).

- The 40-year old would now be 41, so their unsubsidized premium would go up about 1.8% regardless of any other changes...cancelling out most of that 2% drop and bumping it back up to $324/mo.

If they earn $18,000 in 2020, they'll still be eligible for hefty subsidies...in fact, they'd now only be earning 144% FPL (vs. 148%), so they'd only have to pay $55/month vs. $61. They'd pay $72 less for the year, which might not sound like much, but when you only earn $1,500/month, even a few bucks can make a big difference.

On the other hand, if they earn $48,000 in 2020, they stil won't be eligible for subsidies, since the $324/mo still only adds up to 8.1% of their income.

However, what if the same guy in our example is 60 years old instead of 40? The unsubsidized benchmark Silver premium increases to $691/month. This doesn't change anything at the lower end of the range, but check out what happens at the upper end:

- In 2019, if he earns exactly $48,560 (precisely 400% FPL), he's eligible for $292/month in subsidies to knock his premium down to $399/month ($4,788/yr, or exactly 9.86% of his income)

- In 2019, if he earns $48,561...just one dollar more...he's eligible for NOTHING and has to pay full price for his premiums. This is the dreaded subsidy cliff, and it's one of the biggest and most obvious flaws in how the ACA is structured. He just lost out on over $3,500 in tax credits.

What about in 2020? Well, the subsidy cliff is still there...but it's been bumped up by $1,400/year:

- At $48,561, he's now only earning 388% FPL, so he'd only have to pay $399/month

- If he earns exactly $49,960, he'll only have to pay $407/month ($4,884/year)

- The Full Price Subsidy Cliff now kicks in at $49,961 or above.

I know this can all seem confusing, but the bottom line is that tens of thousands of people who earn just a little too much to qualify for ACA tax credits in 2019 may very well qualify for them in 2020...and this could make a dramatic difference in their cost.

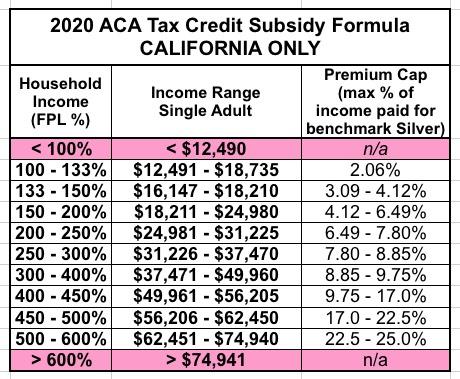

It's also important to keep in mind that California has started offering enhanced subsidies to enrollees earning between 200 - 400% FPL, and is extending subsidies to those earning 400-600% FPL (up to $74,940 if you're single). although the 400-600% extended subsidies are far less generous; they max out at 25% of income at the 600% threshold, like so:

The expanded subsidies in California won't make much difference for most people, but consider a 60-year old single person living in Los Angeles. Their unsubsidized premium is $815/mo.

Here's their situation today:

- At $48,000/yr, the premium costs 20.4% of their income. They'd qualify for $421/mo in subsidies to knock the price down to $394/mo ($9.86% of income).

- At $50,000/yr, the premium costs 19.6% of their income...they qualify for NOTHING and would have to pay FULL PRICE.

- At $55,000/yr, the premium costs 17.8% of their income...they qualify for NOTHING and would have to pay FULL PRICE.

Starting in 2020:

- At $48,000/yr, assuming an identical benchmark, they'd qualify for $431/mo in subsidies, bringing their price down to $384/mo (9.6% of income), saving an extra $10/month

- At $50,000/yr, they'd now qualify for $409/mo in subsidies, bringing their price down to $406/mo (9.75% of income), saving a whopping $4,900/yr.

- At $55,000/yr, they'd now qualify for $234/mo in subsidies, bringing their price down to $581/mo (12.9% of income), saving nearly $2,700/yr.

Massachusetts and Vermont also have their own special, enhanced subsidies available for enrollees earning between 138 - 300% FPL, but those have been in place for years. Washington state is also supposedly expanding subsidies to those earning 400 - 500% FPL, but that isn't set to start until 2021.

BOTTOM LINE: Make sure to visit HealthCare.Gov, CoveredCA.com, or whatever your state's ACA exchange website is and plug in your information to double check to see if you qualify for financial assistance this year! You may be pleasantly surprised.