District of Columbia: REVISED avg. 2020 ACA rate hikes: 9%. Or 11.2%. Or 8.8%. Or 5.1%. Or...

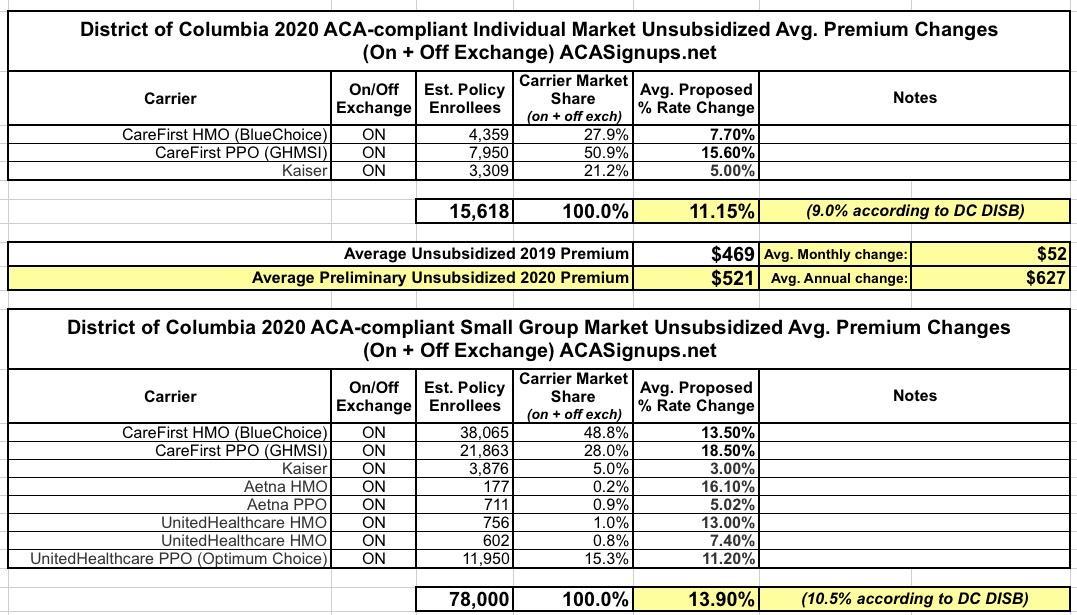

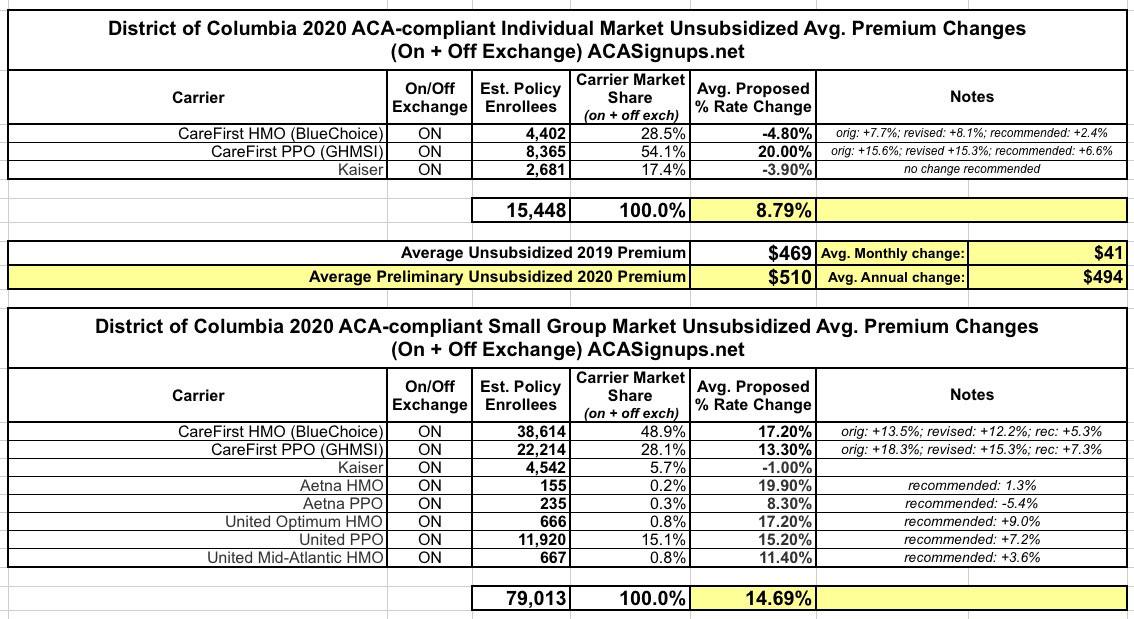

Back in mid-June, the DC Health Benefit Exchange Authority posted the preliminary, requested average unsubsidized 2020 premium changes for the Individual and Small Group markets:

Overall individual rates increased an average of 9.0 percent and small group rates increased an average of 10.5 percent. In the individual market, CareFirst proposed an average increase of 7.7 percent for HMO plans, and 15.6 percent for PPO plans. Kaiser proposed an average increase of 5.0 percent. For small group plans, CareFirst filed average rate increases of 13.5 percent for HMO plans and 18.5 percent for the PPO plans. Kaiser small group rates proposed an average increase of 3.0 percent. Aetna filed for an average increase of 16.1 percent for HMO plans and 5.0 percent for PPO plans. Finally, United proposed an average increase of 13.0 percent and 7.4 percent for its two HMOs and 11.2 percent for its PPO plans.

This is what it looked like at the time:

While the press release put the weighted average increase on the indy market at 9.0%, when I plugged the actual numbers into the spreadsheet, it came in at 11.2%, but...(shrug).

Well, these are just the requested changes, and there's always some back & forth between the carriers and the regulators, often including revised filings, before the final premium changes are locked in for the following year.

The other evening, there was apparently a public hearing regarding the proposed filings, and the takeaway was...confusing (as well as concerning, especially for those who don't qualify for financial assistance):

Sooooo @bjdickmayhew @charles_gaba @LouiseNorris @wcsanders, I went to DC hearing last night re: #ACA 2020 proposed increases. Ugh & expensive. So many (people & small businesses) gave heartbreaking testimony @ current hardships... few might have to leave city/close biz. pic.twitter.com/j2l1b1axh3

— wendy (@wowindc) August 23, 2019

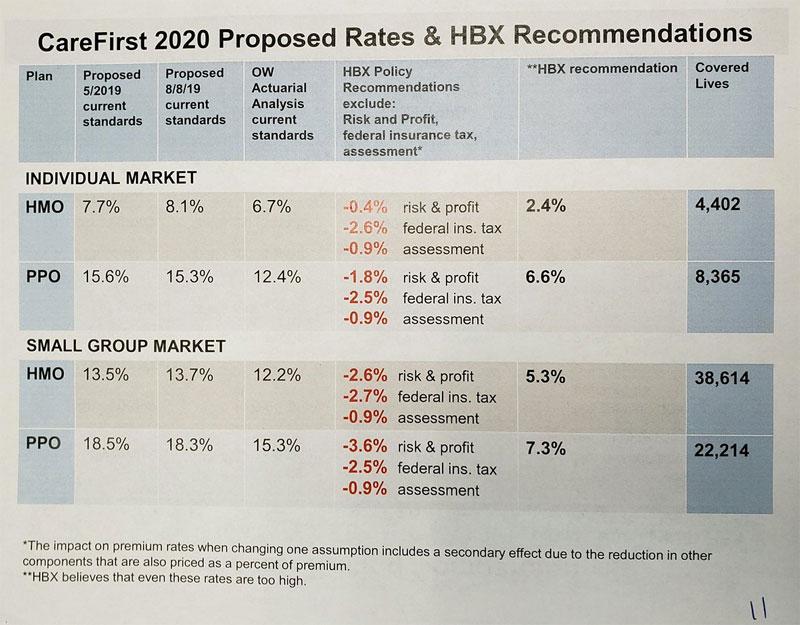

I'm not sure what to make of some of this...it looks like the August 8th percentages are the revised requested changes from the carriers. The HBX recommendation is obvious, although I'm not sure why they need to "recommend" those numbers if they're the ones who vote on the final rate approval (perhaps there's one part of the DC exchange board which makes the recommendations and another part which votes on them?)

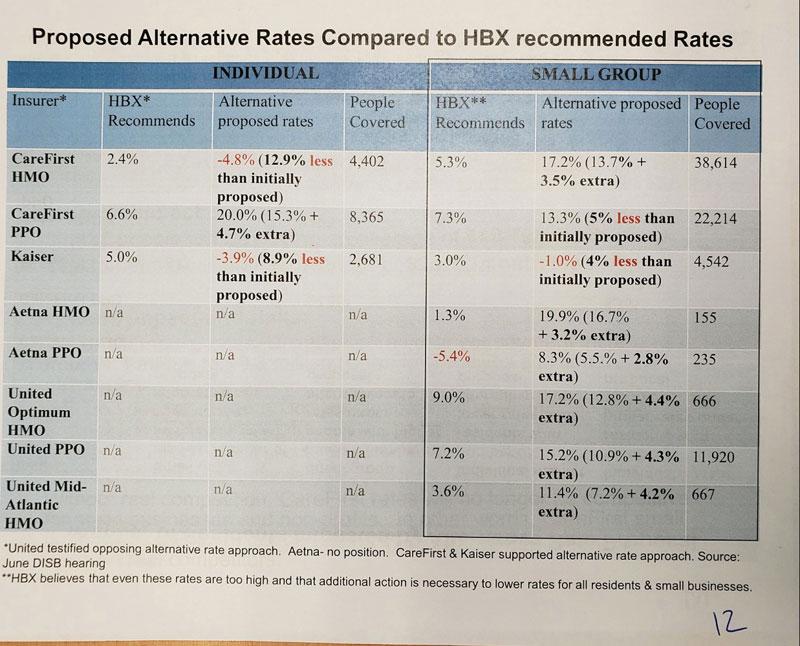

Then there's the second slide, which includes another set of "alternative" proposed rates, some of which are higher, some of which are lower, than any of the other numbers. According to the footnotes, two of the carriers are behind the "alternative" rates, although shouldn't those simply be whatever they proposed in their August 8th filing? Very confusing.

In any event, depending on which set of proposed/recommended rates end up being approved and finalized, DC might be looking at average 2020 increases ranging anywhere from as +5.1% to as high as 11.2% on the individual market, and from as low as 6% to as high as 14.7% on the small group market.

It's possible that the fact that DC has a merged individual & small group risk pool has something to do with the wide range...perhaps they're planning on raising small group rates substantially in order to reduce individual rates, or vice versa? Even so, I'm truly not sure what to do with this.

There's also one other noteworthy item: DC, like New Jersey (and Massachusetts) has reinstituted the ACA individual mandate penalty for 2019 and beyond...but then apparently proceeded to not lift a finger to let anyone in the District know that they had done so:

For nearly six months—including the first month of open enrollment—the District failed to inform visitors to its online insurance exchange about the new coverage requirement. When District officials finally discovered their webpage fail, what did they do to admit their fault, and tell the public? Nothing.

...By stating that the requirement remained in effect for 2017 and 2018, the webpage implied that the mandate will disappear in 2019. But while the federal penalty disappeared on January 1, the District’s own insurance mandate replaced the federal requirement on that date. However, the webpage I saw did not mention the D.C. mandate at all.

It looks like no one updated the page prior to open enrollment to reflect the District’s new coverage requirement.

...In fairness, I, and presumably other prior customers, did receive a mailer from D.C. Health Link discussing the District’s new coverage requirement for 2019. However, the mailer did not mention the mandate until the top of its second page—an area where casual readers could easily miss it.

I don't normally link to The Federalist, but in this case Christopher Jacobs has a valid point. I know it's valid because I wrote an entire blog post complaining about this very point myself last fall (although I was mostly focusing on New Jersey at the time):

The impact of the mandate penalty is completely psychological in nature. It only works (to the extent that it does at all) if people know that they'll be penalized financially for not complying with the mandate.

Remember, the point of the mandate is not to add $700+ to the tax burden of a bunch of people; the point of it is to encourage them (detractors would say "goad") into enrolling in an ACA-compliant policy. The more (presumably relatively healthy) people do so, the healthier the ACA market risk pool is. This expectation is the very thing which caused New Jersey insurance carriers to lower their 2019 premiums by 5.8% in the first place.

HOWEVER...what if no one (or hardly anyone) in New Jersey knows about the penalty still being in place?

More specifically, what if no one who's part of the target population for enrolling in the ACA individual market (either on or off-exchange) knows that the penalty is still around, having simply shifted from the federal treasury to the state?

If someone who would normally be convinced to go ahead and enroll for 2019 with the penalty in place decides not to do so because they think there won't be any penalty for skipping out, guess what? The penalty being there won't make a damned bit of difference, at least in terms of how it impacts the 2019 risk pool.

I followed up on this issue re. DC specifically in February:

...the same principle applies to the District of Columbia as well. DC's local mandate penalty wasn't made official until much later than New Jersey's (it wasn't officially signed by the DC mayor until September), and I had trouble finding any references to it even when I visited the DC Health Link website (there's no notice on the home page; you have to click the FAQ, then "Consumers", and then scroll halfway down the list to find the actual mandate penalty link).

The February post was about this:

Special Enrollment Opportunity Offered to Uninsured District Residents to Get Covered and Minimize Tax Penalty

Additional 60 days to enroll given to uninsured residents who learn of DC’s individual responsibility requirement when they file their 2018 DC taxes

Washington, DC - This week, the DC Health Benefit Exchange Authority (DCHBX) Executive Board adopted a unanimous recommendation from its Standing Advisory Board to allow a Special Enrollment Period (SEP) for District residents who may be subject to a District tax penalty because they did not have health insurance in 2019. A new District of Columbia law went into effect January 1, 2019 requiring residents to have health insurance, get an exemption or pay a penalty on their DC taxes. Some DC residents are learning about this individual responsibility requirement for the first time as they file their 2018 tax returns.

I mention this today because, while I haven't seen any of the other slides in the presentation at last night's public comment meeting, one thing I don't see any mention of in the slides above is the DC individual mandate penalty.

In any event, the situation in DC isn't looking good for some residents:

#ACA Premiums alone (2019) take me to $7500+ a year, add in HSA Account=$10k+. Of course, I am not including my deductible, dental (crown), vision (contacts) and other out of pocket expenses.... I be looking at $12-15k (not in 401k). Can't afford the 15-20% increase suggested.

— wendy (@wowindc) August 23, 2019

And I am one of the "lucky" ones - I am fairly healthy. (knock on wood). So many last night have had cancer or have other health issues that require medication (that w/o insurance would cost thousannnnnnnds). The #ACA is cracking :(

— wendy (@wowindc) August 23, 2019

I don't know if Wendy is single, or how old she is, but I'm going to assume she is, and that she earns more than 400% FPL and is therefore not eligible for ACA subsidies. If her income is $50,000/year, she'd be just barely over the subsidy-eligibility threshold, which means she has to pay full price. That would explain the $7,500/year in subsidies, which would make up a full 15% of her gross income (20% if you include the HSA contribution).

If she's just barely below the cut-off (at, say, $49,000), she'd be limited to no more than 9.86% of her income for a Silver plan, or $4,831/year, which would knock $2,700 off her total, although that's still only part of the problem of course. I'd have to know more about her situation to tell for sure.

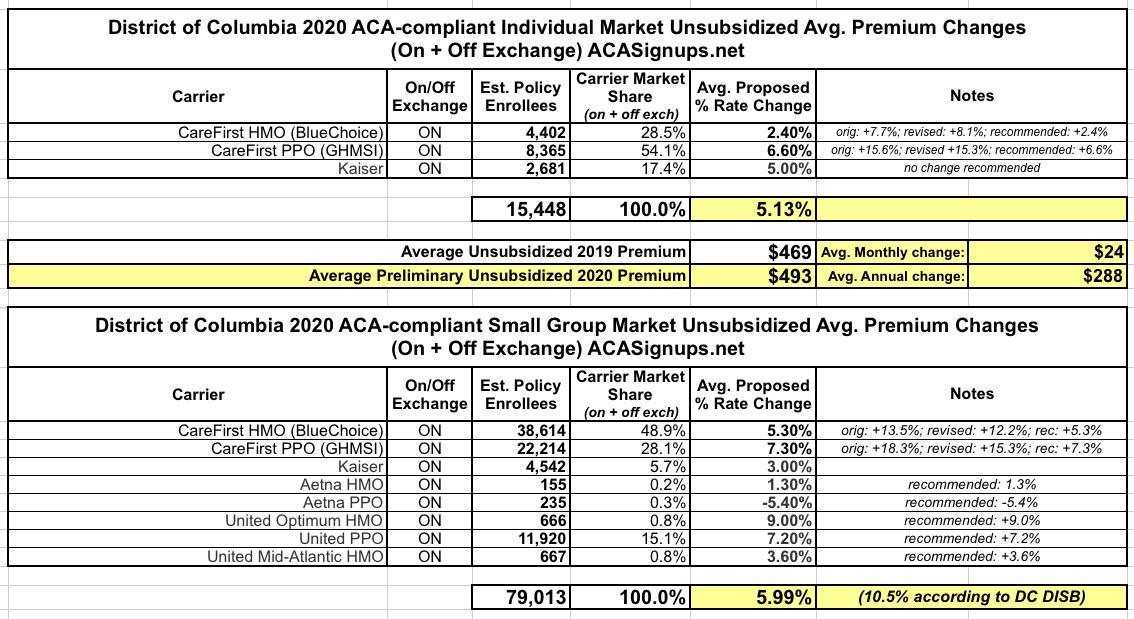

Anyway, here's what the other various rate change scenarios look like in DC: