Montana: APPROVED 2020 ACA Exchange Premium Rate Changes: 13.1% *decrease* w/reinsurance waiver

via the Montana Insurance Commissioner's office:

REINSURANCE LOWERS HEALTH INSURANCE RATES FOR 2020

- New Program Championed by Rosendale Leads to Double-Digit Rate Decreases in the Individual Market

HELENA, Mont. – State Auditor Matt Rosendale announced today that every health insurance plan sold on the individual market in Montana will have lower rates next year, largely due a new program that he’s championed for the past two years.

Rosendale was busted being a jackass a couple of years back, and he, like almost every other Republican candidate, was gaslighting like crazy during his failed Senate race last year, but I do give him some credit for pushing for Montana's ACA reinsurance waiver. I don't give him all the credit by any means, of course, since Section 1332 Waivers for reinsurance and other modifications to the law have been a part of the ACA since 2010, but I'll give him a brownie point or two.

The new Montana Reinsurance Program is being credited for at least 65 percent of the average premium reductions that will go into effect in 2020, according to insurance company rate submissions. Rates will go down by double digits on average, and every plan sold on the federal exchange in Montana will see a decrease.

“Premiums will be lower on every single plan that 51,000 Montanans in the individual market depend on,” Rosendale said. “Montanans are sick and tired of insurance getting more and more expensive every year. With reinsurance, we’ve reversed that trend for next year, and that’s exactly why I’ve been fighting so hard for over two years to get this program in place.”

“This is a big step in the right direction, and we’ve got to keep working on the problems that make health care too expensive for hardworking people—high deductibles, outrageous prescription drug prices, hospital costs, and limited options are major issues that we have to address,” Rosendale added.

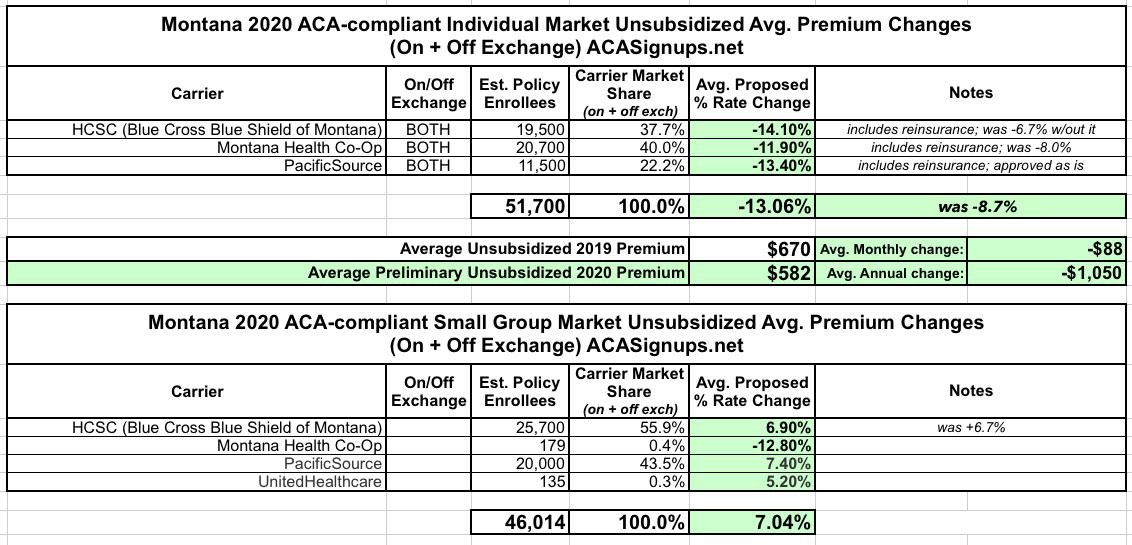

Here's the specifics:

Blue Cross and Blue Shield’s plans will have a decrease of 14.1 percent on average next year. Reinsurance is credited with a 7.9 percent premium reduction on Blue Cross plans. PacificSource will have an average 13.4 percent decrease in 2020, with a 9.1 percent reported reinsurance impact.

The Montana Health CO-OP (MHC) will have an 11.9 percent average decrease in 2020, with an 8.3 percent impact from reinsurance. MHC originally proposed an 8 percent average decrease earlier this year, but that figure was bumped up to 11.9 percent during the insurance commissioner’s rate review process.

When I first did my write-up about Montana's preliminary rate changes, two of the three Individual market carriers had already baked the reinsurance factor into their 2020 requests, but Blue Cross Blue Shield of Montana, which holds around 38% of the market, hadn't done so yet. This resulted in an 8.7% average reduction.

With the reinsurance waiver made official, however, not only does BCBSMT's drop go from 8.7% to 14.1%, one of the other two (Montana Health Co-Op) also gets knocked down a bit more (from 8% to 11.9%). Overall, the average weighted rate reduction statewide will be over 13%:

Across all three companies’ specific plans, rate changes range from about a 2 percent decrease to an over 20 percent decrease, meaning that every plan sold on Montana’s individual market next year will have lower premiums than in 2019. About 51,000 Montanans bought individual market health insurance for 2019.

In the small group market, where reinsurance does not apply, rate changes are more varied. Blue Cross’s small group rates will increase by 6.9 percent on average, PacificSource’s average increase is 7.4 percent, and MHC will have a 12.8 percent average decrease on small group plans. About 46,000 Montanans are covered by small group health insurance in 2019.

As noted in the table above, the small group plans were approved pretty much as is, with a slight change to BCBS there as well.

Reinsurance provides a financial backstop against high-cost insurance claims, allowing insurance companies to mitigate risk and decrease prices while continuing to provide insurance to Montanans with preexisting and expensive medical conditions. Rosendale proposed creating a reinsurance program in 2017. After two vetoes that year, a new bill establishing the Montana Reinsurance Program passed the legislature with strong bipartisan support and was signed into law earlier this year.

Rosendale’s office transferred the health insurance companies’ rate and plan information to CMS yesterday evening to continue the process of preparing for open enrollment, which begins in November. The new plans take effect January 1, 2020.