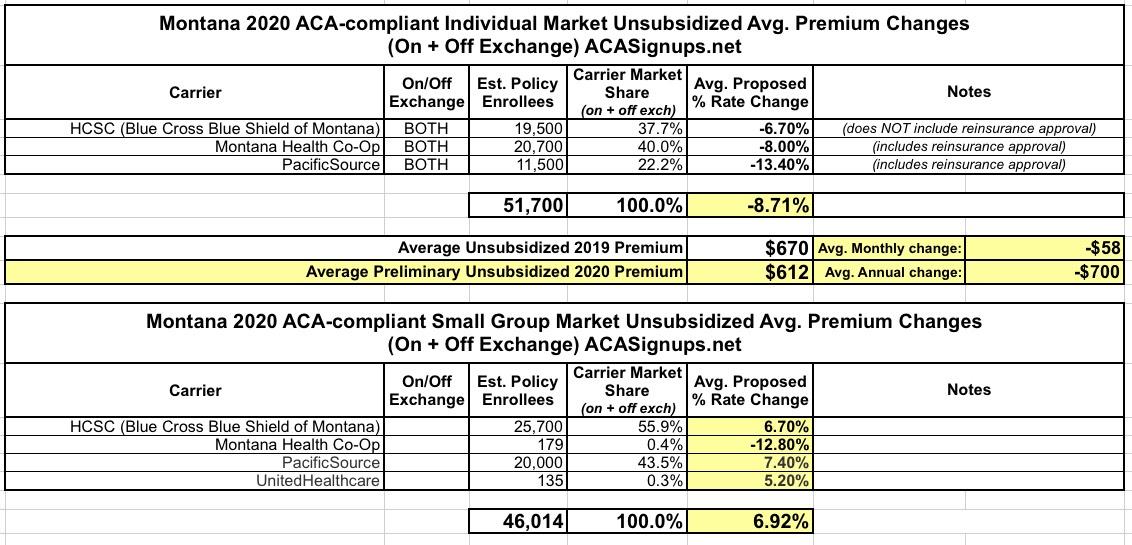

Montana: PRELIMINARY 2020 ACA Exchange Premium Rate Changes: 8.7% *decrease*

This Just In from the Montana Insurance Commissioner's office:

2020 Rate Filings and Rate Review

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Montana State Auditor’s Department of Insurance for review and before plans can be sold to consumers.

What is rate review?

The rate review process, established by the Montana Legislature in 2013, does not give the Commissioner the authority to disapprove rates or prevent them from taking affect. It does give the commissioner the chance to review the factors insurance companies use in setting rates.

If the commissioner finds a rate increase to be excessive or unjustified, the insurer can voluntarily lower the rate increase. If the insurer decides to use the rate anyway, the commissioner will issue a public finding announcing that the rate is unjustified.

What does the department consider?

Rates reflect estimates of future costs, including medical and prescription drug costs and administrative expenses, and are based on historical data and forecasts of trends in the upcoming year. In its review, the Department considers these factors, as well as factors such as the insurer’s revenues, actual and projected profits, past rate changes, and the effect the change will have on Montana consumers.

Below, you can review information on rate filings for individual and small group products that comply with the Affordable Care Act (commonly known as Obamacare). You can access past year filings here.

It's important to keep in mind that two of the three carriers on the Individual Market in Montana are assuming that the state's Reinsurance Waiver request (allowed for by under the Affordable Care Act's Section 1332 provision) will be approved by CMS. The third (Blue Cross Blue Shield) has not included the reinsurance impact yet, though they say they'll do so later on this summer.

Unfortunately, the actual SERFF rate filing forms and actuarial memos aren't available yet, but I've been informed that:

- The reinsurance program, if approved, will be weaker than the 10-20% reduction originally hoped for; instead it'll only reduce unsubsidized premiums by around 7-8% on average than they'd be without it. This suggests that with reinsurance approval, BCBSMT should come in at something like a 14% reduction, which would mean something like an 8.3% statewide reduction compared to 2019 premiums. On the flip side, if the waiver isn't approved for some reason, 2020 premiums will likely be roughly flat year over year.

- Montana has four rate setting regions; the rate changes for each of the three carriers vary widely from one region to another, which means that although there's been some convergence of rates over the years, different carriers will likely have the benchmark rates in different regions.

Assuming the reinsurance waiver is approved (which it likely will be), the current weighted average rate increase is a 5.5% average decrease for the Individual Market, while the Small Group market is looking at a 6.9% average increase regardless of what happens with the reinsurance waiver.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.