Wisconsin: APPROVED 2019 #ACA rate changes: 4.2% lower thanks to reinsurance, but WOULD have dropped by around 12.7% w/out #ACASabotage

Wisconsin has an interesting situation. On the one hand, the state has what should be a robust, highly-competitive individual insurance market,with over a dozen carriers offering policies throughout the state. Granted, some of them are likely limited to only a handful of counties, but in theory they should be doing pretty well compared to rural states like Oklahoma or Wyoming, which only have a single carrier on the exchange.

On the other hand, last year Wisconsin ahd among the highest average premium rate increases in the country. Rates were projected to increase by an already-awful 36%, but when the dust settled the average unsubsidized ACA enrollee in Wisconsin was paying a whopping 44% more than they did in 2017 (it was around 45.8% higher as of the end of Open Enrollment but later dropped a bit as the year has passed and net attrition has tweaked the enrollment base).

It's important to keep in mind that nearly half of this year's rate increase--roughly 20 percentage points--was due specifically to last year's sabotage efforts by the Trump Administration...primarily the decision to cut off CSR reimbursement payments, along with other sundry sabotage factors like slashing marketing by 90%, slashing navigators by 40% and so forth. As a result, unsubsidized enrollees in Wisconsin went from paying an average of $518/month in premiums to $744/month this year.

Scott Walker may be a terrible person, but he hasn't managed to survive not one, not two, but four gubernatorial elections in a row (including a recall election in 2012) by being stupid. He's done everything in his power to undermine, weaken and badmouth the ACA like nearly every other Republican for the past eight years...but he apparently put his finger to the wind, recognized that the ACA is suddenly popular these days, and decided to go ahead and jump onboard the bandwagon. From January 22nd:

Scott Walker proposes plan to prop up Obamacare marketplace

After years of fighting Obamacare, Gov. Scott Walker is now seeking to stabilize the state marketplace under the law.

Wisconsin plans to seek federal permission to cover expensive medical claims for health insurers on the marketplace, which should lower premium increases and could bring back companies that dropped out, the governor said in an interview with reporters on Friday ahead of his election-year State of the State address Wednesday.

The state will also ask to permanently continue SeniorCare, a prescription drug program Walker has previously sought to pare down, he said.

Walker also said he’ll ask the state Senate to pass a bill authored by Democratic lawmakers and passed by the Assembly that would enshrine into state law access to private insurance for people with pre-existing conditions.

In the most significant of his health care proposals, Walker will ask the Legislature to join a few other states in adopting a reinsurance program to prop up the individual market, which is used by some 216,000 residents, in a state innovation waiver allowed under the Affordable Care Act, or Obamacare.

"Propping up" is a pretty rude way of wording it, but yes, Wisconsin did indeed eventually implement a fairly robust reinsurance program:

Gov. Scott Walker's administration filed a request with the federal government seeking a waiver that would allow Wisconsin to offer a $200 million reinsurance program designed to lower premiums and attract more providers to the private marketplace.

...Under the reinsurance program, the government would provide money to health insurance providers to pay about 50% of medical claims costing between $50,000 and $200,000 starting in 2019. Deputy Wisconsin insurance commissioner J.P. Wieske said insurance providers will be required to file reports showing what rates would have been without the program so the savings could be calculated.

...Walker, a longtime critic of the national healthcare law known as "Obamacare," has rejected federal money to expand Medicaid and argued for years that the law should be repealed. But this year, as he faces re-election in November, Walker has pushed the reinsurance proposal as a way to stabilize the market and lower premium costs for the state's roughly 200,000 people who purchase insurance under the law.

Cynical as hell? Absolutely. Utter hypocrite? Certainly...and that's compounded by the fact that the reinsurance program is itself allowed for by the ACA, which means that Walker is actually just using Obamacare to improve Obamacare.

Having said all of that, this is still an inherently good thing. When the reinsurance program was officially signed off on, the preliminary projections were that without it, unsubsidized 2019 premiums would likely increase by around 7.5%, but with it, they should drop by around 3.5%

At the time, I also estimated that this year's ACA sabotage by Trump and Congressional Republicans--mostly repeal of the individual mandate, along with expansion of #ShortAssPlans--was causing 2019 rates to increase by around 13 percentage points, which would mean the difference between rates dropping 16.5% vs. only 3.5%.

Today, however, Walker issued a press release which states that final/approved 2019 premiums will actually be around 4.2% lower than this year on average:

MADISON, WI— Governor Scott Walker today announced his Health Care Stability Plan (WHCSP) will lower 2019 premium rates in Wisconsin’s individual health insurance market on a weighted average by 4.2 percent from 2018 rates and by 10 percent as compared to without WHCSP, based on rate filings received by the Wisconsin Office of the Commissioner of Insurance (OCI) and a report completed by Wakely. This is a significant change from the 44 percent rate increase the average Wisconsin consumer saw last year.

In other words, without reinsurance in place, 2019 rates would have increased around 5.8%, which means rates under both scenarios will be slightly lower than expected.

...The Wisconsin Health Care Stability Plan lowers 2019 total individual premium by $992.28 on average compared to without WHCSP.

My own calculations say that the savings thanks to Wisconsin's ACA reinsurance program (that's what it is, after all) will be more like $912 on average ($713/mo on average vs. $789/mo), but there's a lot of little variables here so I'm not gonna quibble about that.

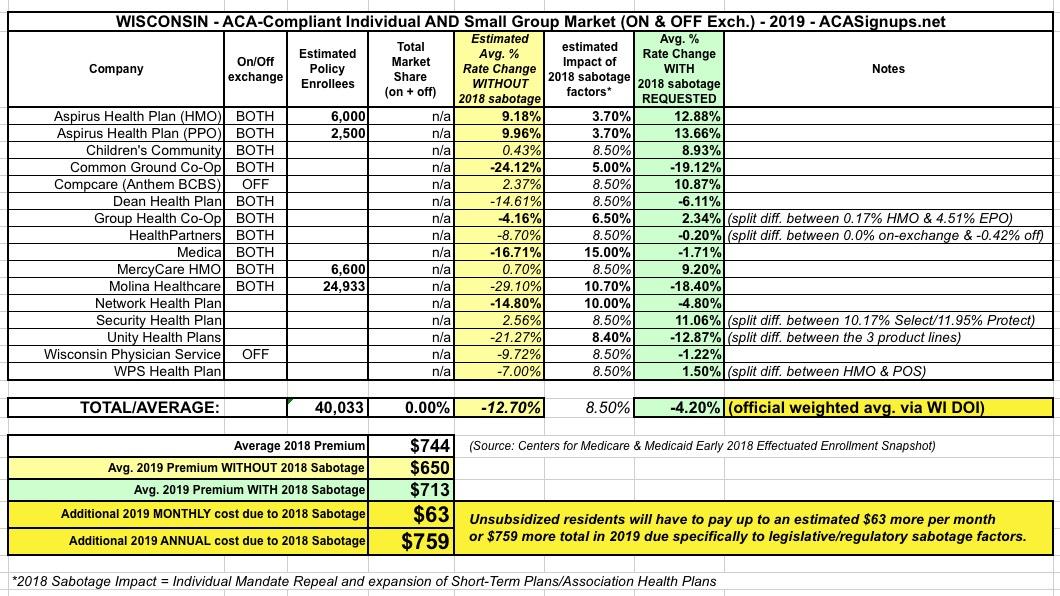

As for my estimate of the #ACASabotage impact, based on my review of the actual rate filings from the carriers, I'm now thinking 13% was overstating it for Wisconsin--of the 16 (!) different carriers participating in WI's individual market next year, 8 of them included solid, precise mandate repeal/#ShortAssPlans rate impact numbers, and they average around 8.5 percentage points.

Unfortunately, I wasn't able to dig up actual enrollment data in order to calculate the relative market share for most of the carriers so I can't run a weighted average, but 8.5% seems more than reasonable to me. With that in mind, here's what Wisconsin's final numbers look like now:

Assuming this is accurate, that means unsubisidized enrollees will still be paying around $63 more per month next year due specifically to #ACASabotage than they'd otherwise be paying, or over $750 more for the year, even with the admittedly impressive reinsurance savings.

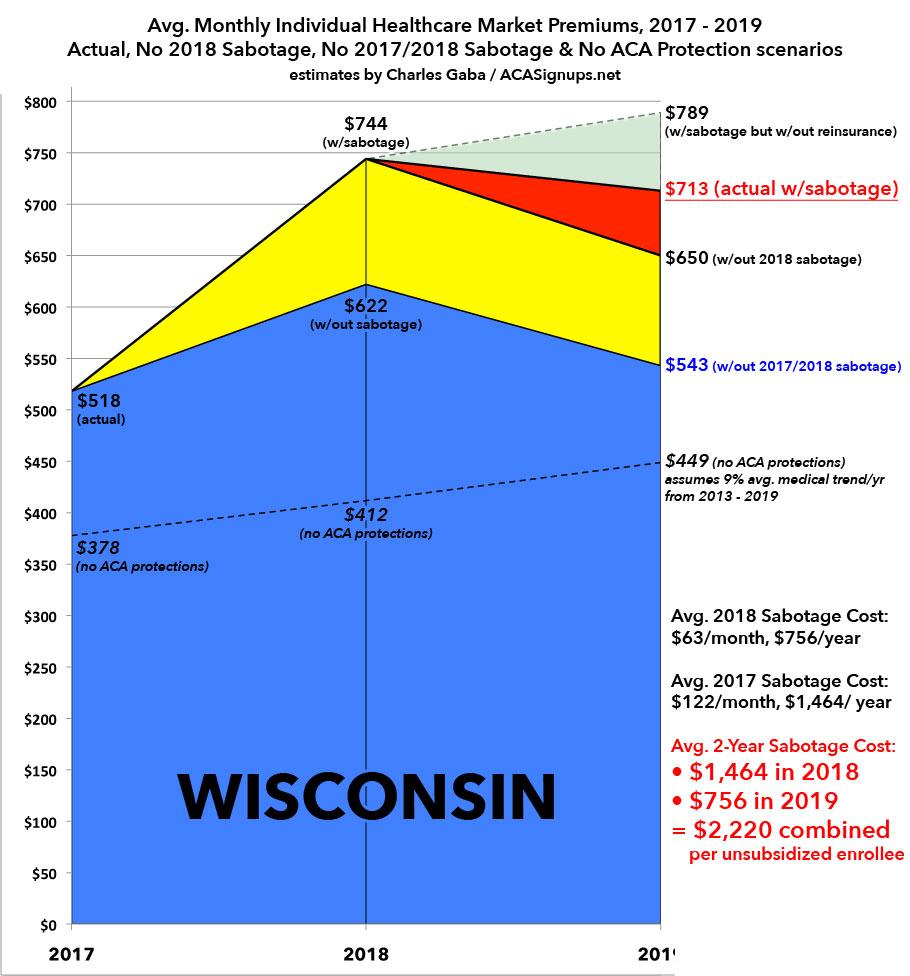

Here's what all three years (2017 - 2019) look like visually, showing five different scenarios:

- actual average 2019 premiums (around $713/mo)

- what they'd look like without the reinsurance program in place ($789)

- what they'd look like without this year's sabotage ($650)

- What they'd look like without this year or last year's sabotage ($543)

- and finally, just for the hell of it, my best estimate of what Wisconsin individual market premiums would look like in 2019 if the ACA had never been passed. While the dollar amount is significantly lower (around $449/month for most enrollees), keep in mind that there'd also be no financial assistance for low-income enrollees, no protections for people with pre-existing conditions, no requirement to cover essential health benefits, no caps on out-of-pocket expenses, and annual or lifetime claim ceilings would still be in place.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.