Connecticut: APPROVED 2019 #ACA rate hikes only 2.7%...because #ACASabotage was ALREADY BAKED INTO 2018 RATES

For months now, I've been trying to get people to understand that when it comes to sabotage of the Affordable Care Act, especially in terms of individual market premium increases, you have to include the impact of actions taken by Donald Trump and Congressional Republicans in BOTH 2017 and 2018, not just 2018 alone.

In 2017, the single largest factor in the ~28% average national unsubsidized premium increase for ACA plans was Donald Trump's cutting off of Cost Sharing Reduction (CSR) reimbursement payments to carriers. This alone accounted for fully half of the 2018 increase. However, there were other, smaller actions taken which added up to another 3% or so: Slashing the Open Enrollment Period in half, CMS slashing the marketing budget for the federal exchange down 90%, slashing the outreach/navigator budget down 40% and so on.

There was also one other factor: Uncertainty about whether or not the IRS would be enforcing the ACA's individual mandate penalty. It's important to understand that there's a fuzzy line between repeal of the penalty, enforcement of the penalty and whether or not the public thinks the penalty is in place and/or being enforced. The impact of the penalty on who and how many people enroll in coverage is completely psychological, after all--in one sense, it almost doesn't matter whether the penalty is repealed--or enforced--or not as long as people think it is (or isn't).

Put another way: If enough (currently) healthy people think the penalty has been repealed (or isn't being enforced) and choose not to enroll in ACA-compliant healthcare coverage as a result...guess what? The risk pool for the following year will be worse off--with correspondingly higher premiums for everyone else--whether the penalty is around/enforced or not.

Conversely, if enough healthy people think the penalty hasn't been repealed and is being enforced, and choose to enroll in ACA coverage as a result, the risk pool will be better off, again, whether or not that's the case.

The reason I'm saying all of this is because of a very interesting twist on the #ACASabotage issue for 2019: Connecticut.

When Connecticut posted their requested 2019 rate filings in July, it appeared to be fairly cut & dried: 12.3% increases, with around 5 points of that being pinned specifically on 2018 sabotage factors...namely the mandate being formally repealed and the expansion of #ShortAssPlans, both of which are expected to have a significant negative impact on the ACA-compliant risk pool.

However, today the Connecticut Insurance Dept. issued the approved 2019 rates for CT individual market policies, with pretty dramatic reductions in the rate increases...with a very interesting reason given for this.

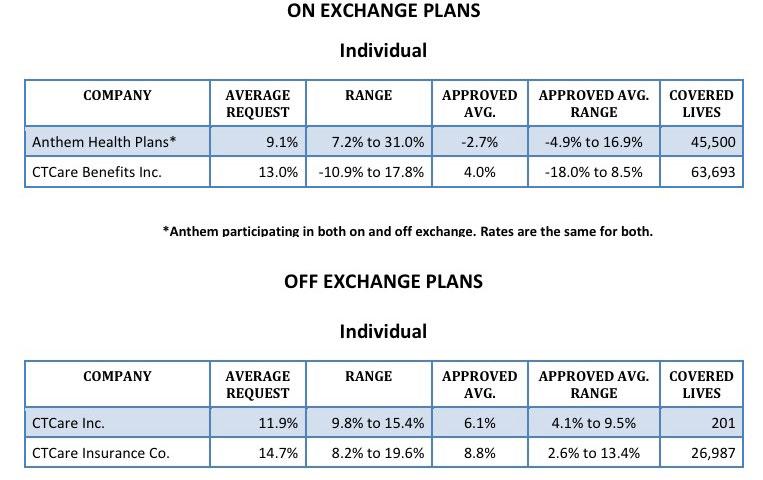

First, here's their decisions, compared to the requested rate changes:

As I said: Pretty dramatic. Anthem is knocked down from a 9.1% increase to a 2.7% decrease. CTCare's three divisions were knocked down from 13%, 12% and nearly 15% down to 4%, 6% and 9% respectively. Overall, the weighted average has been reduced by nearly 10 percentage points, to just 2.7%.

So, why such a dramatic reduction for Connecticut carriers? Well, here's what it says right on the state's insurance department website:

On September 13, 2018, the Connecticut Insurance Department issued its final rulings on 14 health insurance rate filings for the 2019 individual and small group markets. The filings were made by 10 health insurers for plans that currently cover about 293,000 people.

- The average increase for individual plans is 2.72 percent, reduced from average request of 12.3 percent.

- The average increase for small group plans is 3.14 percent, reduced from average request of 10.22 percent.

Pricing Factors for 2019:

- The main driver of the increases is medical ‘trend’ – the cost of medical services and the demand for those services. In addition to medical trend of approximately 8 percent, carriers also accounted for the cost of new state mandates and adding pregnancy as a qualifying event to enroll in health insurance in the individual market.

- The Department determined that there would be limited impact from lack of enforcement of the Affordable Care Act’s individual mandate. While the federal government officially removed the individual mandate penalty for 2019, the Department and carriers accounted for this in the 2018 rates.

And there you have it.

Sure enough, when I look back at last year's Connecticut rate increases for 2018:

In their filings, companies have cited key cost drivers:

Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs, and higher demand for medical services.

Risk Pool Experience: Carriers are seeing deteriorating claims experience continue into the first quarter of 2017.

Health Insurance Tax: The federal Health Insurance Tax is returning for 2018, which accounts for 2-3% of premium. There had been a moratorium on the tax.

Other Factors: Carriers have filed to take into consideration the perceived lack of strong enforcement of the individual mandate, the lack of stability of the risk adjustment mechanism and the evolving participation of carriers in the market.

Then, when the approved rates for 2018 were posted, I noted the following:

I was just watching the Senate HELP hearings when CT Senator Chris Murphy stated that the CSR factor is "around 15%" and the individual mandate enforcement factor is around 6-8% of the total increase.

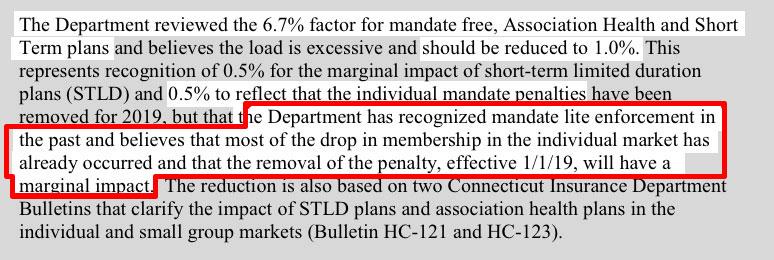

Most carriers only tacked on a point or two to their 2018 rates based on "mandate enforcement" concerns...but Connecticut carriers tacked on a full 6-8 points. The CT Insurance Dept. is basically saying that the carriers tried to double-dip with the "Mandate Penalty" factor, and busted them on it, although it's not quite that simple.

Here's an example of the final decision:

In addition, it sounds like the department doesn't think #ShortAssPlans will be that big of a deal in Connecticut:

- The Department determined there would be marginal impact from the federal government’s new regulations for short-term, limited-duration health plans and association health plans. Carriers filed their rates in July while still awaiting clarification from Washington, which came later in the summer. After a thorough legal review of state laws and regulations and the federal regulations, the Department provided guidance last month in two Bulletins, HC-121 and HC-123

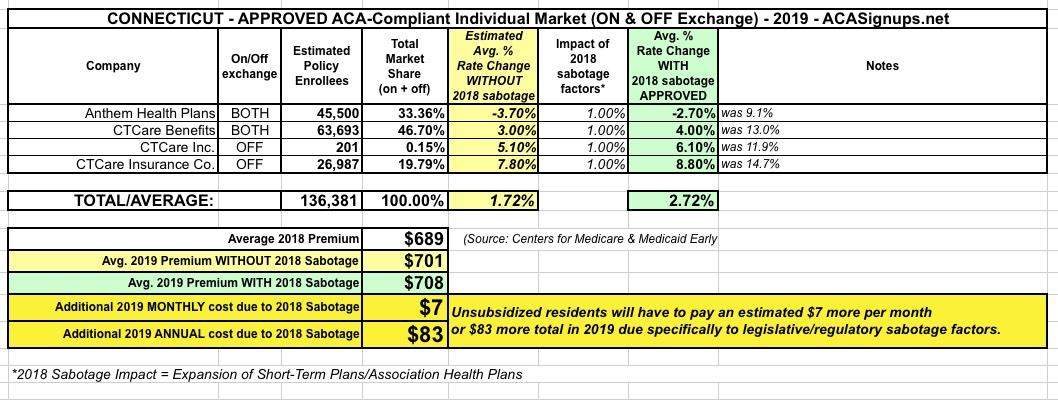

Between the two of these developments, here's what Connecticut enrollees are looking at next year; it assumes just a 1% #ShortAssPlans factor and no mandate repeal factor...but only because unsubsidized enrollees are ALREADY PAYING that extra $38 or so per month THIS year...or around $460 apiece for the year.

Of course, that still doesn't even include last year's CSR cut-off factor, which increased rates around 9.6% by itself, or $52/month, or around $627 this year per enrollee.

That's right: Last year's sabotage of the ACA means that unsubsidized Connecticut enrollees are already paying around $1,087 more apiece this year.

While I'm at it, I should note that the CT insurance dept. also reduced the rate increases for small group plans significantly, from 10.2% to just 3.1% overall: