Tennessee: w/RAFreeze resolved, avg. 2019 rates will drop 11%...but WOULD have dropped ~23% w/out #ACASabotage

In my Tennessee 2019 rate filing analysis last month, I noted the good, the bad and the ugly:

- The good news was that average unsubsidized 2019 ACA individual market premiums were expected to drop by about 5.7% after years of double-digit rate hikes.

- The bad news was that due specifically to various types of deliberate sabotage by the Trump Administration and Congressional Republicans (primarily repeal of the individual mandate and expansion of #ShortAssPlans), that 5.7% drop was still a good 12 points or so higher than it otherwise would have been.

- The ugly news was that due specifically to the Trump Administration's utterly unnecessary decision to freeze Risk Adjustment fund transfers in response to a lawsuit out of New Mexico, 2019 premiums would be hundreds of dollars higher still than they should have been for Blue Cross Blue Shield of Tennessee's 113,000 enrollees:

...Administrations don’t typically concede so much, so soon in the face of district court decisions, [U of M law professor Nicholas] Bagley said. “Otherwise, a lone judge could throw an entire agency’s work into disarray,” he added.

He noted that the administration has multiple options at its disposal, like interpreting the court decision narrowly, so that it only affects New Mexico. It could also write a so-called interim rule that would allow payments to proceed.

“They’re asking the court to reconsider, which is something,” Bagley said. “But there are lots of ways to limit the scope in the meantime and they’ve chosen to do none of them. ... Normally, you would work a lot harder, as the federal government, to keep your program going.”

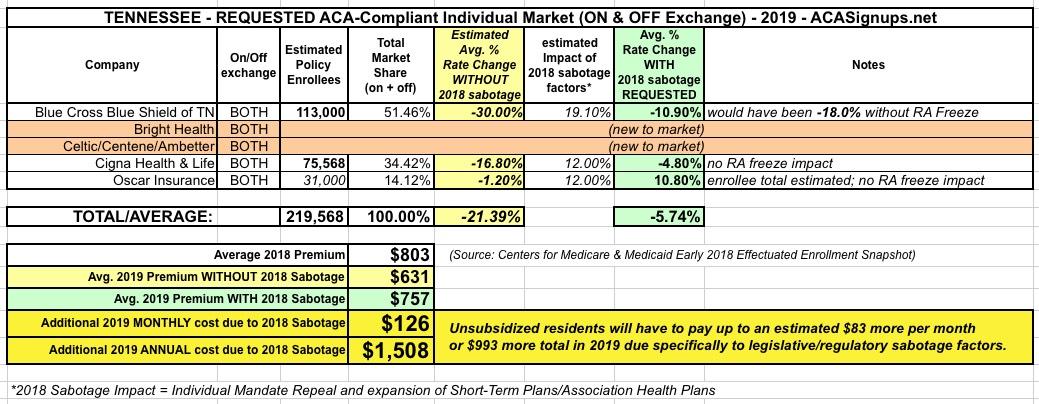

As a result of the above, this is what Tennessee's situation looked like until a couple of weeks ago:

HOWEVER, just a week or so later, CMS resolved the issue after all:

CMS Adopts the Methodology for the Permanent Risk Adjustment Program under the Patient Protection and Affordable Care Act for the 2017 Benefit Year

Final rule addresses the collection of risk adjustment charges and making of payments for the 2017 benefit year

Today, the Centers for Medicare and Medicaid Services (CMS) posted a final rule that reissues, with additional explanation, the risk adjustment methodology that CMS previously established for transfers related to the 2017 benefit year. This important step fills a void created by a federal district court’s vacating of the previously issued methodology, and enables the agency to resume the CMS-operated risk adjustment program in the individual and small group markets.

In short, Trump's CMS basically caused a major panic across the entire industry for no particularly good reason, then patted themselves on the back for resolving a crisis which they had basically instigated. Still, this is a Good Thing, so, y'know, credit where due, I suppose.

In any event, I noted that this should mean that...

Meanwhile, the only material impact I can think of is that Blue Cross Blue Shield of Tennessee will now presumably resubmit a revised filing for next year, removing the extra RA cushion. If so, that should mean that 2019 rates in Tennessee will drop around 9.4% overall instead of 5.7% (and rates would have dropped by as much as 21% without the mandate repeal and #ShortAssPlan expansions).

Rates for individual health insurance plans in Tennessee will drop even more than expected next year, after the Trump Administration reversed plans for cutting payments to insurance companies.

BlueCross BlueShield of Tennessee, for example, will have average rates that are nearly 15 percent less than this year.

Sidenote: It was my understanding that BCBSTN was originally planning on lowering rates 18%, not 15%, but it's possible that some of this was cancelled out by other adjustments.

Cigna had the biggest change, moving from a nearly 5 percent decrease to a nearly 13 percent drop. Oscar was proposing to increase rates by nearly 11 percent and lowered that to roughly 7 percent.

Bright and Celtic are new to Tennessee but lowered their average premiums slightly after the Trump administration reversal.

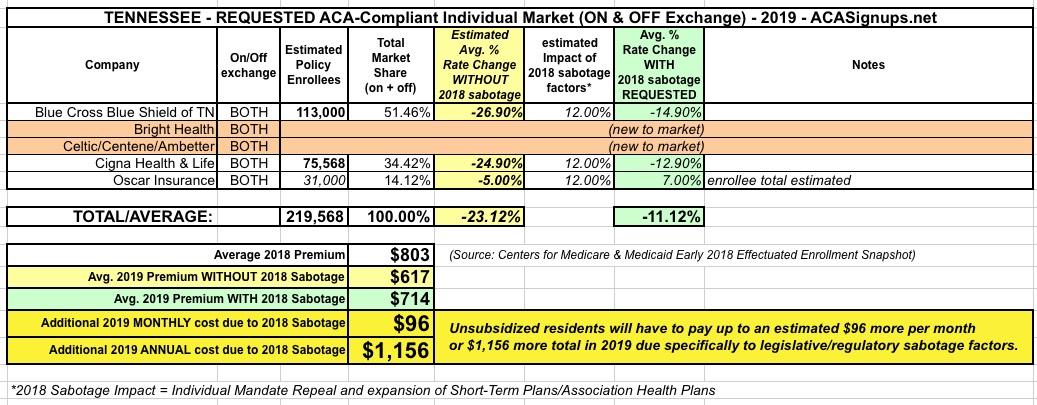

I don't have the revised filings available so I don't know the precise new percentages, but I'm assuming "nearly 15%/13%" mean 14.9% and 12.9%. With that in mind, here's the new Tennessee breakout:

The article is actually a bit misleading--as far as I can tell, BCBSTN was the only one of the three existing carriers which had actually baked in an RAFreeze factor; Cigna and Oscar appear to have made other adjustments to account for their further-reduced rates.

Regardless, the net effect of all this is that Tennessee premiums are now expected to drop by around 11.1% overall instead of 5.7%...but they still would have dropped even further (around 23% by my estimates) if not for ACA sabotage factors.

The average unsubsidized enrollee is paying over $800/month in Tennessee right now. An 11.1% drop should lower this to around $714/month, but without the mandate being repealed & short-term plans being expanded, this likely would have been nearly $100 lower yet. That's still an average annual "sabotage tax" of $1,156 per enrollee.

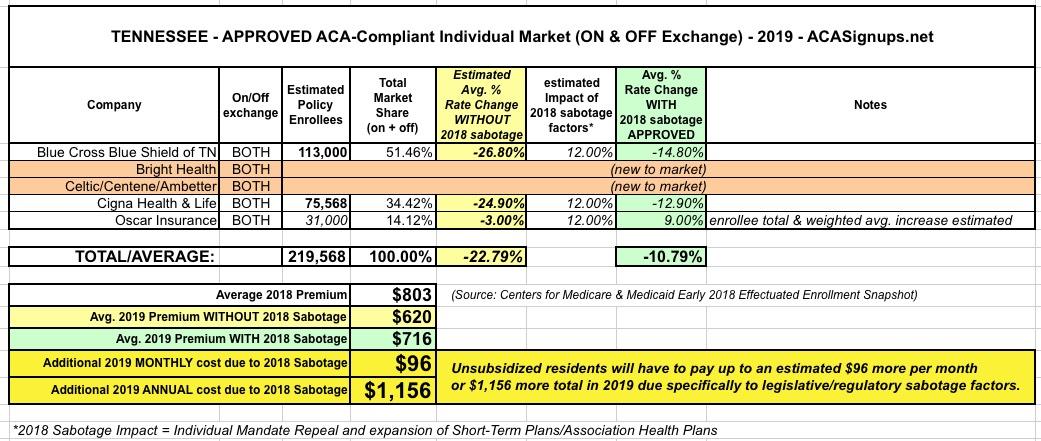

UPDATE 8/22/18: The Tennessee Insurance Dept. has announced their approved 2019 rates for ACA policies, and while the final numbers are slightly different from above, they're pretty close. BCBSTN ended up with a 14.8% drop instead of 14.9%, while Oscar's weighted average increase appears to be around 9.0% instead of 7.0%: