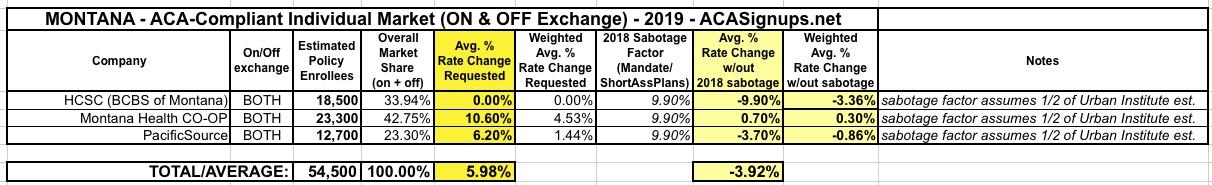

Montana: Preliminary 2019 ACA rate hike request: INCREASING by ~6% instead of likely DECREASING by ~4% w/out sabotage

This article from KTVQ is excellent for my purposes. It clearly and cleanly plugs in just about all of the hard numbers I need to run my rate hike analysis: Which carriers are participating in the 2019 ACA individual market; how many current enrollees each carrier has (both on and off the exchange); and the exact average increase each one is requesting for next year!

Health insurers selling individual policies on the “Obamacare” marketplace in Montana are proposing only modest increases for 2019, on average – or, no increase at all.

State Insurance Commissioner Matt Rosendale released the proposed rates Thursday, with Blue Cross and Blue Shield of Montana proposing an average increase of zero – and a 4.9 percent decline for small-group policies.

The other two companies selling policies on the online marketplace, PacificSource and the Montana Health Co-op, proposed average increases of 6.2 percent and 10.6 percent for individual policies, respectively, and lesser increases for small-group policies.

...About 54,000 Montanans have individual health-insurance policies now, and the vast majority of them are receiving federal subsidies under the Affordable Care Act (“Obamacare”) to offset the cost of the premiums.

...The Montana Health Co-op insures the most individuals, with 23,300 Montana customers, surpassing Blue Cross this year. Blue Cross has about 18,500 customers and PacificSource about 12,700.

The statewide average comes out to around 6.0%. Unfortunately, there's one important bit of information which isn't included in the article: The impact of mandate repeal and/or #ShortAssPlans. There's a vague reference made in a different article, but that's about it:

[Montana CO-OP CEO] Miltenberger and other Montana insurers said the absence of the mandate may have some impact on the market, but he said he expects not many people will drop their coverage, because so many will still get subsidies to offset the cost.

“I would suggest that the majority of consumers value health care, they value health insurance, and they’re going to continue to participate,” he said.

Todd Lovshin of PacificSource said the company will be doing its best to persuade consumers to maintain their coverage, mandate or not.

...Another change in the offing is the availability of short-term individual health-care policies that do not cover the “essential benefits” required by the ACA. A short-term policy is anything less than a year.

The president issued an executive order to allow these policies that cover fewer things, but the federal rules are still being drafted.

Rosendale, who opposes the ACA, said he supports this change, because it will give consumers more affordable options for health coverage.

The three health insurers offering policies on the marketplace in Montana said they haven’t decided whether they will offer these short-term policies with lesser coverage.

Normally, in the absence of hard sabotage data from the carriers themselves or from the state insurance department, I've been using the "2/3 rule of thumb"...taking the Urban Institute projection for each state from March and lopping 1/3 off the total to err on the side of caution. In the case of Montana, however, given the quote from the CEO of the carrier with the largest market share (around 43%), I'm going to assume just half of the Urban Institute number, so I'll go with ~9.9% instead of 19.8%.

If that proves to be fairly accurate, that 6.0% would be more like a 3.9% drop in premiums next year without those factors:

As always, I'll swap out the "percent of Urban" placeholder estimates in the future as I come across hard data from the carriers or state insurance department.