Rhode Island: Preliminary 2019 ACA rate hike request: 9.3%, 1 point due to mandate repeal (updated)

Rhode Island is the 5th state (to my knowledge) to officially post their preliminary 2019 individual market rate change requests.

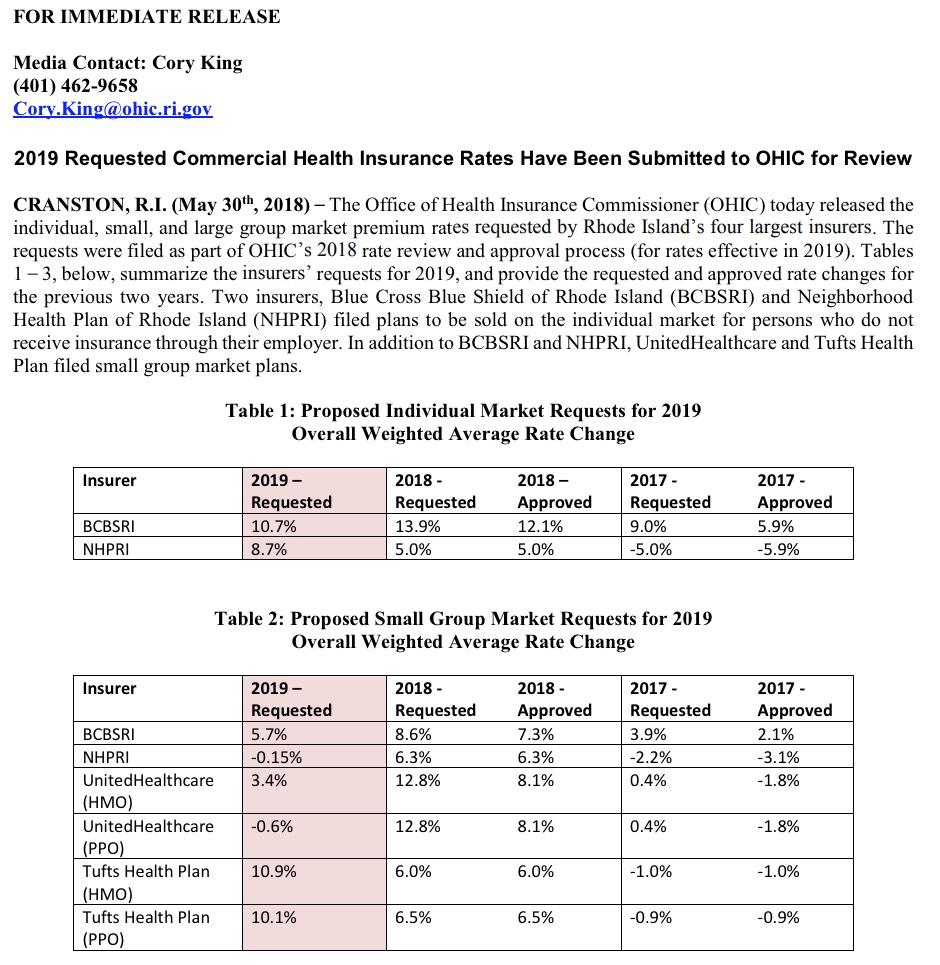

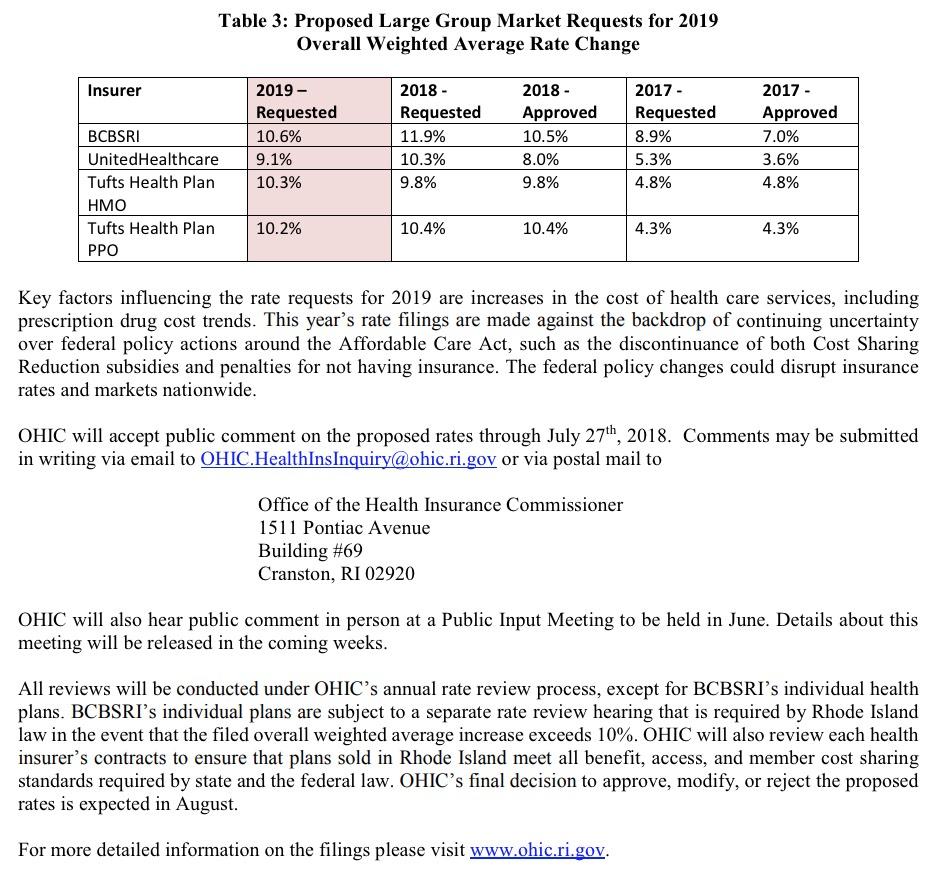

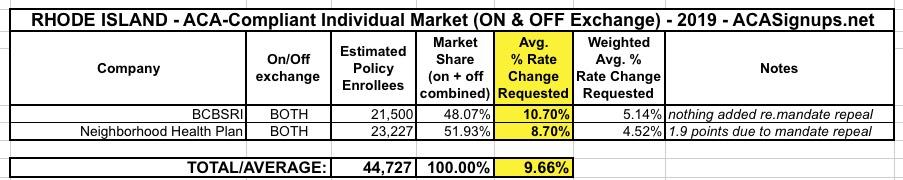

As shown below, things are pretty cut & dry in Rhode Island; they only have 2 carriers participating in the individual market (Blue Cross Blue Shield and Neighborhood Health Plan). BCBSRI is asking for a 10.7% average increase, while Neighborhood is requesting 8.7% overall.

The estimated market share ratios are based on this press release from HealthSourceRI, the state ACA exchange. That doesn't include the final numbers or the off-exchange enrollment, but it should be pretty close, as there are only 2 carriers and their requested increases are so close to begin with it wouldn't make much difference. The weighted average is 9.3%.

Unfortunately I haven't found the actual rate filing forms for BCBS, so I don't have an official estimate of what portion of their 2019 rate increase is being pinned on the ACA's mandate being repealed or the expansion of short-term or association plans by the Trump Administration, but Neighborhood's filing does give a hard number...and it's actually fairly small: Just 1.9 percentage points (that's for mandate repeal...they don't mention #ShortAssPlans at all).

Since Neighborhood also has 70% of the RI individual market this year, that suggests that unless Blue Cross is pinning a lot more of their rate hike on sabotage factors than Neighborhood, it's safe to say that unlike other states, it's only around 2 points in Rhode Island.

It's worth noting that at least in Rhode Island, this estimate is much lower than the Urban Institute's recent analysis of the impact of the mandate being repealed + expansion of short-term plans for Rhode Island (which they pegged at over 20%). On the other hand, seeing how Rhode Island individual premiums average $418/month this year, even a 2% increase will amount to an extra $100 per person next year for absolutely no good reason.

UPDATE: OK, I've cleared up a few things with the Rhode Island Insurance Dept.:

- First, the actual current enrollment in ACA-compliant individual market policies in Rhode Island as of March 31st (including off-exchange enrollees) was actually 21,500 for BCBSRI and 23,227 for Neighborhood Health Care, which means it's actually close to a 50/50 split between the two (Neighborhood holds the bulk of exchange enrollees but BCBS has most of the off-exchange market). I've updated the table below to reflect this; it bumps the statewide average requested increase slightly to 9.7% overall.

- They confirmed that according to BCBS's filings, they aren't including any significant impact due specifically to the ACA mandate being repealed. This makes little sense to me, but if that's what they think, that's what they think. Considering that Neighborhood is only assuming a 1.9 point increase, it sounds like Rhode Island carriers are pretty confident that it won't have much effect in their state for whatever reason. Interesting. Witha a roughly 50/50 split between the two, that effectively means that just 1.0 percentage points of RI's 2019 rate hike can be officially pinned on the mandate being repealed.

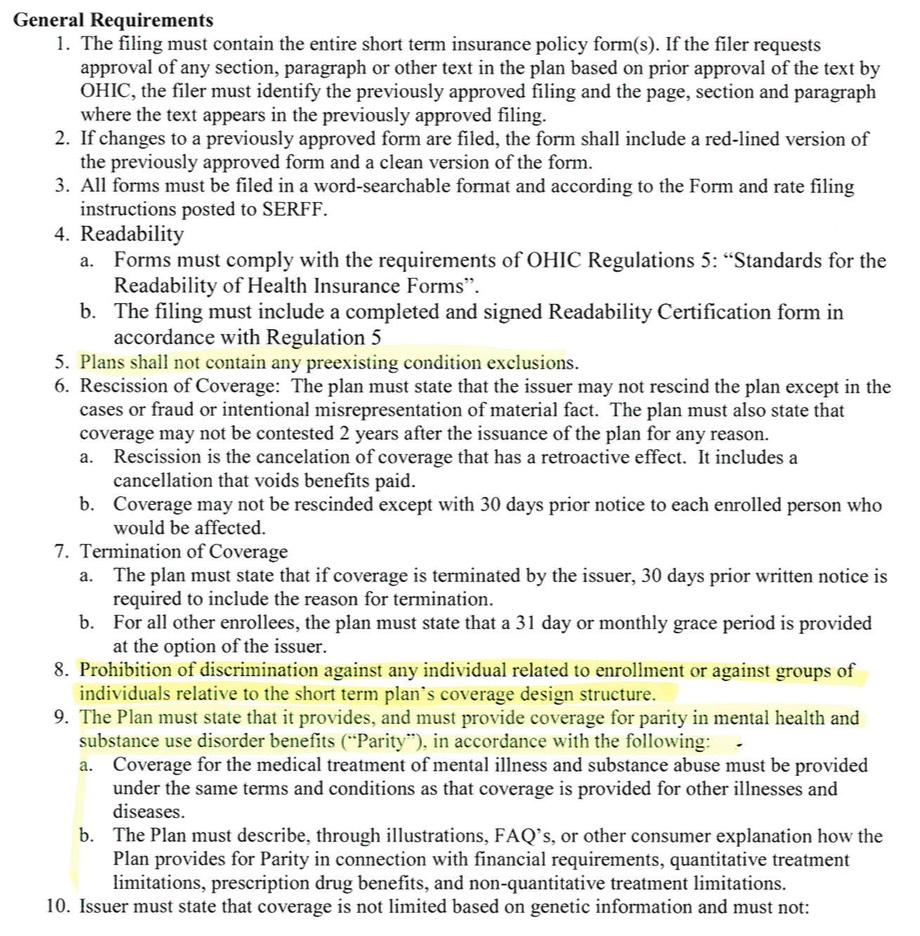

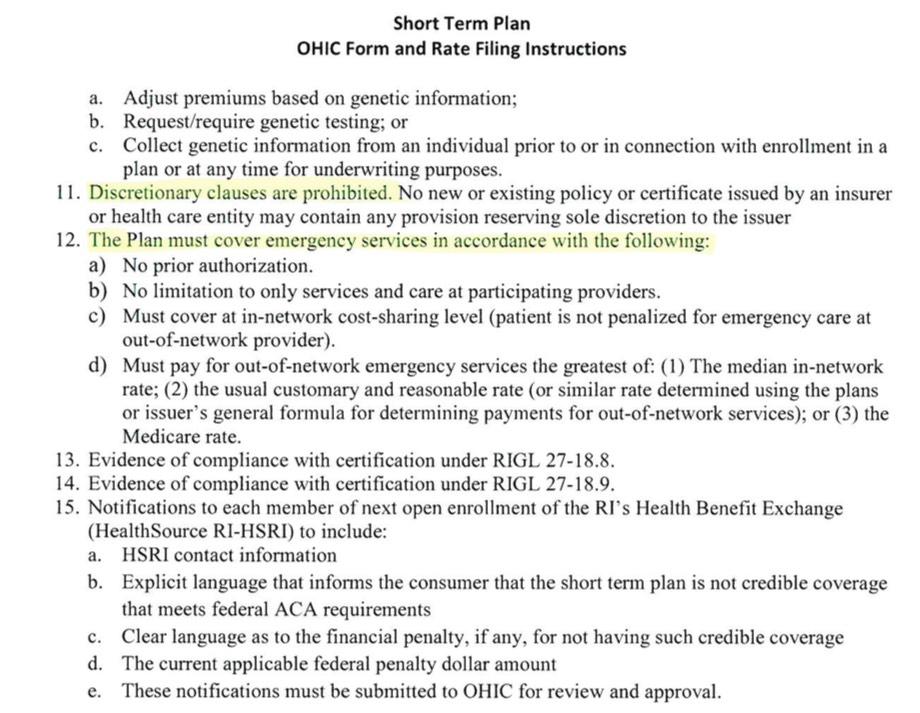

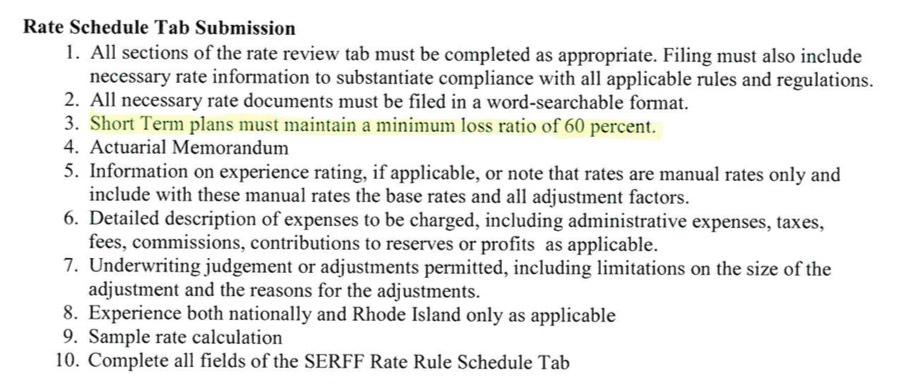

- Finally, and most interestingly: It sounds like the Urban Institute analysts missed something...they have Rhode Island listed among the states which have little or no restrictions on Short-Term, Limited Duration (STLD) Plans, but apparently that's not the case. While there isn't any legislation specifically putting restrictions on STLDs, but there's ample regulation of them by the state insurance department. For instance, in Rhode Island, STLDs are required to include guaranteed issue, appears to require community rating, has to cover mental health and substance abuse treatment at parity with other policies and has to maintain a Medical Loss Ratio of at least 60% (see below for details).

In other words, in Rhode Island, STLD policies are allowed, but they have to be almost as comprehensive as full ACA-compliant policies anyway, which means that they likely don't cost that much less than ACA policies anyway...which, in turn, means that there's very little incentive for any insurance carrier to bother offering them at all.

UPDATE x2: Wow...I never expected tiny Rhode Island to have so much confusion surrounding it! I was just informed by Maanasa Kona of the Center o nHealth Insurance Reforms at Georgetown that...

RI has no durational limits on STPs and that's what Urban's analysis focused on. Our research revealed that Chapter 18 (prohibition against pre-ex exclusion, MLR) of RI code applies to STPs, 18.5 does not (includes guaranteed issue etc) https://t.co/1ArEVlInlL

— Maanasa Kona (@MaanasaKona) May 31, 2018

On a related note, there's a new bill out in RI that would apply chapter 18.5, which regulates individual health insurance and requires guaranteed issue and guaranteed renewability, to STPs https://t.co/CzdFk3crTp

— Maanasa Kona (@MaanasaKona) May 31, 2018

OK, so some of these requirements already apply, some...don't? In any event, the fact remains that STLD plans are allowed in Rhode Island but there doesn't appear to be much point in anyone buying them (which is fine with me). The main point is that neither BCBS nor Neighborhood seem to think they'll have more than a nominal impact next year even with Trump's executive order.