California: Suite of bills would check off a bunch of my wish-list items and more

Over the past few weeks, in the midst of the failed Republican-sponsored "ACA stabilization bill" known as Alexander-Collins (which laughably included "Bipartisan" in the title evne though it had changed dramatically from the actual bipartisan bills which Senators Patty Murray and Bill Nelson had worked with Lamar Alexander and Susan Collins on last fall), Democrats in both the House and Senate introduced real ACA stabilization/improvement bills of their own.

The official names of these bills are the "Undo Sabotage and Expand Affordability of Health Insurance Act of 2018" (USEAHIA) and the "Consumer Health Insurance Protection Act" (CHIPA) respectively, but for pretty obvious reasons I'm shortening each of them to simply "ACA 2.0".

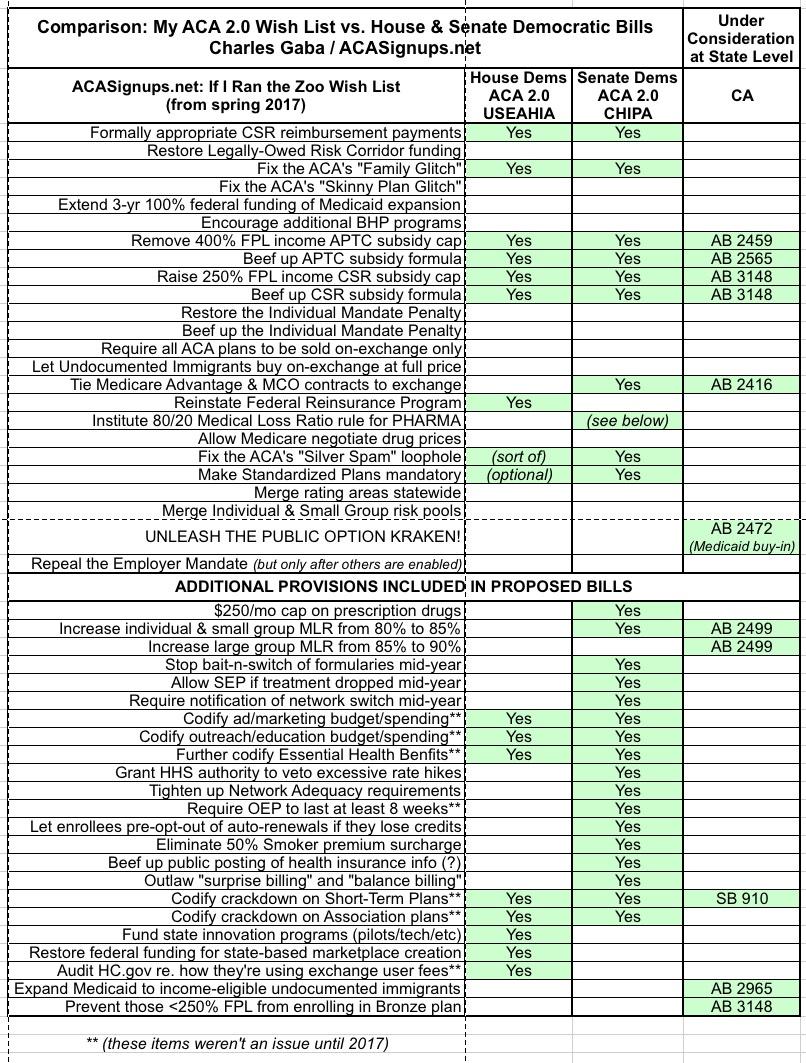

Last week I whipped up a handy chart which pitted each version of ACA 2.0 against each other...and against my own ACA Wish List from a year ago, which I called "If I Ran the Zoo" (I threw in the Alexander-Collins bill as well at the time, but now that it's dead, that's pretty much moot).

Anyway, today, the amazing Louise Norris of healthinsurance.org gave me a heads up about what's going on in California...and the answer is, a lot.

After the proposed state-level Single Payer bill was put on ice last summer for various reasons (primarily serious funding source issues), it looks like the California state Senate and state Assembly have been quite busy, putting together a bevy of standalone ACA improvement bills. To my knowledge none of these have actually passed either chamber yet, but Norris has an excellent roundup of what each would do:

- S.B.910: Would prohibit the sale of short-term health insurance plans as of January 1, 2019.

- A.B.2499: Would increase the medical loss ratio minimum requirements in California by 5 percentage points. So large group plans would have to spend at least 90 percent of premiums on medical claims and quality improvements, while individual and small group plans would have to spend at least 85 percent.

I'll be honest...I'm not sure this is a great idea. Don't get me wrong, I'd love to cut out the profit motive from insurance carriers altogether, but this might be pushing the point. Warren's proposal to set all three markets at 85% makes sense to me now that the carriers seem to have finally figured out how to make a profit on the individual market at all; going to 90% for Large Group might be a bridge too far. Or...perhaps not. I still don't know enough about gross vs. net profits, carrier overhead and so on to be sure about this one way or another. Then again, 85% across the board certainly would make it easier to explain how the MLR rule works to people since it'd be one less caveat to explain.

Of course, the larger problem with setting a minimum percent MLR rule is that it encourages the carriers to collude with providers (doctors/hospitals) to simply jack up the provider rate, so that the carrier receives 15-20% of a larger total dollar figure. This is where actions like the lawsuit just filed by CA Attorney General Xavier Becerra against Sutter Health could become a factor.

- A.B.2459: Would provide a state-based tax credit to offset the cost of individual market coverage that exceeds a certain percentage of the enrollee’s income. As of March 2018, the percentage of income has not yet been determined, but the legislation refers to the difficulties faced by people who have to pay more than 10 percent of their income for a bronze plan.

This basically amounts to removing the 400% FPL income cap, it'd just be funded by the state instead of the federal government.

- A.B.2416: Would require health insurance with Medi-Cal (Medicaid) managed care contracts to negotiate with Covered California regarding offering individual market plans via the exchange, in areas that are in the insurer’s Medi-Cal managed care service area and in which there would otherwise be two or fewer insurers offering plans.

- A.B.2565: Would provide state funding to enhance the premium subsidies that are already available to eligible Covered California enrollees. Enrollees would continue to get federal subsidies, but the state would contribute funds as well, on a sliding scale based on income. Under current federal rules, people with income between 300 and 400 percent of the poverty level have to pay 9.56 percent of their income for a silver plan. Under A.B.2565, the state would contribute enough to reduce this to 8.16 percent. People with lower income would see similar reductions in the percentage of income they have to spend on a silver plan. Like the ACA’s subsidies, the state subsidies could be applied to plans at any metal level.

This basically amounts to beefing up the existing APTC subsidy formula.

- A.B.2965: Would expand Medi-Cal (Medicaid) to all income-eligible California residents, regardless of immigration status. The state would have to seek a waiver from the federal government in order to implement this provision. California considered similar legislation in 2015 (S.B.4), but the bill was amended so that it would only apply to children under the age of 19 (that provision is currently in effect; undocumented immigrant children in California are eligible for Medi-Cal if their household income makes them eligible).

California is likely the only state in which a law like this would have any chance of passing (and as noted, they'd still have to receive a federal waiver approval). I find it hard to believe that federal dollars would ever be approved by the GOP for this, so the state would presumably have to pick up the full tab...and even then, there'd be the obvious concern among many undocumented adults about the Trump Administration having ICE use the enrollment database to hunt down and deport them, which is why the proposal was scrapped last year in the first place.

- A.B.2472: Would allow people who aren’t eligible for Medicaid to buy into the Medicaid program. This would create a public health insurance option in California, operating alongside the private plans that are available for purchase. The state would have to seek a waiver from the federal government in order to implement the Medicaid buy-in program.

It would be awesome if this went through...but again, a federal waiver from Trump's HHS Dept. is required. Not confidence-building.

- A.B.3148: Would prevent anyone with income below 250 percent of the poverty level from enrolling in a bronze plan. The bill would also enhance the ACA’s cost-sharing reductions, to make them more robust in California: People with income between 200 and 299 percent of the poverty level would be eligible for a plan with 87 percent actuarial value, while those with income between 300 and 400 percent of the poverty level would get a plan with 80 percent actuarial value. Under the ACA, cost-sharing reductions end at 250 percent of the poverty level, so A.B.3148 would extend cost-sharing reductions all the way to 400 percent of the poverty level in California.

Now that's something different. The ACA metal level structure is based on the idea that Bronze plans--which only cover 60% of the typical enrollee's medical expenses and therefore have huge deductibles--are supposed to only be encouraged for people in certain situations. Low income enrollees are strongly encouraged to enroll in Silver plans, which include the additional CSR assistance to slash those deductibles down to size, taking them from the normal 70% Actuarial Value level for Silver up to as high as 94% AV. However, the whole premium/deductible/tax credit/CSR system is so confusing to most people that many low-income folks choose to enroll in Bronze plans anyway, being drawn to the dirt-cheap premiums even though Silver plans are a far better value for them overall. AB 3148 solves this problem by...simply denying the Bronze option to lower-income CSR folks altogether.

The higher CSR threshold itself, meanwhile, is similar to both the House and Senate bills.

In any event, I've updated my comparison chart to show how California's state-level bills would line up (if they all became law) against my own list, the House Dem bill and the Senate Dem bill. As you can see, there's quite a bit of overlap on several provisions, most notably on the APTC/CSR subsidy front, where all three would beef things up considerably, and on Trump's Short-Term Plan sabotage: