Sen. Baldwin introduces bill to beef up ACA subsidies for Young Invincibles

Wisconsin Senator Tammy Baldwin has been on a bit of an "Improve the ACA" tear lately. A couple of weeks ago she introduced the "Fair Care Act" to try and nip Donald Trump's #ShortAssPlans proposal in the bud. Now she's introduced another bill which would help shore up the ACA exchanges themselves: The "Advancing Youth Enrollment Act" via Kimberly Leonard of the Washington Examiner):

The Advancing Youth Enrollment Act would give higher federal subsidies to people between the ages of 18-34 so that the cost of private Obamacare plans for them would be lower.

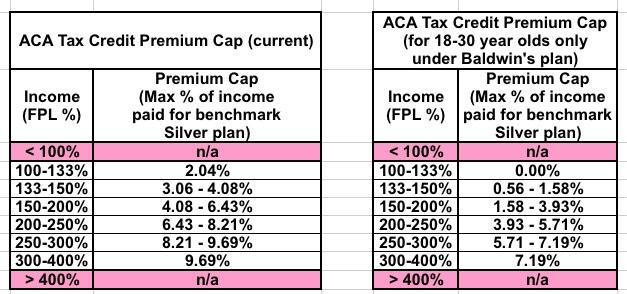

...Under the proposal, young adults would see the maximum percentage of income they must pay toward health insurance under Obamacare decrease by 2.5 percentage points for people between the ages of 18 to 30. Each year after, until the age of 34, they would see a gradual phaseout of 0.5 percentage points a year.

Here's what the ACA's Advance Premium Tax Credit (APTC) formula looks like today for everyone, and how it would look under Baldwin's bill specifically for those aged 18-30 only (you can fill in the blanks for the 31-34 phaseout):

How much would this help shore up and improve the ACA individual market?

An analysis by the pro-Obamacare group Young Invincibles projects that 4 million people between the ages of 19 to 34 would be eligible for higher subsidies if the legislation passed. Nearly half a million could be able to have health insurance that would come with no deductible and with a premium of $23 a month or less, and 300,000 people would have no premium at all.

At this time, a typical young person with coverage from the Obamacare exchange, purchasing a mid-level silver plan, is paying about $150 a month. That same plan would be $95 under the Advancing Youth Enrollment Act.

I'd still prefer that they simply remove the 400% FPL cap altogether, but this is a reasonable idea as well. If it results in several million more Young Invincibles jumping into the ACA market, that would instantly improve the overall risk pool, which should result in lower full-price premiums for everyone regardless of income, so it's a sound idea.

Of course, I'm all for doing both, and neither is likely to happen until at least January 2019 anyway, so there you go...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.