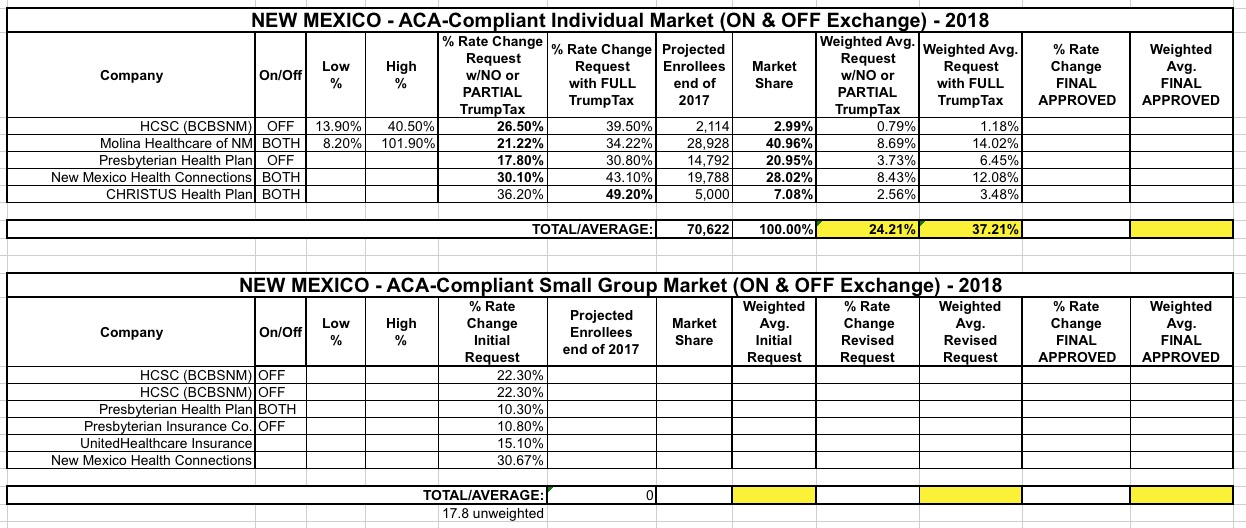

2018 Rate Hikes: New Mexico (early look)

New Mexico's Insurance Superintendent has released their 2018 rate hike request filings.

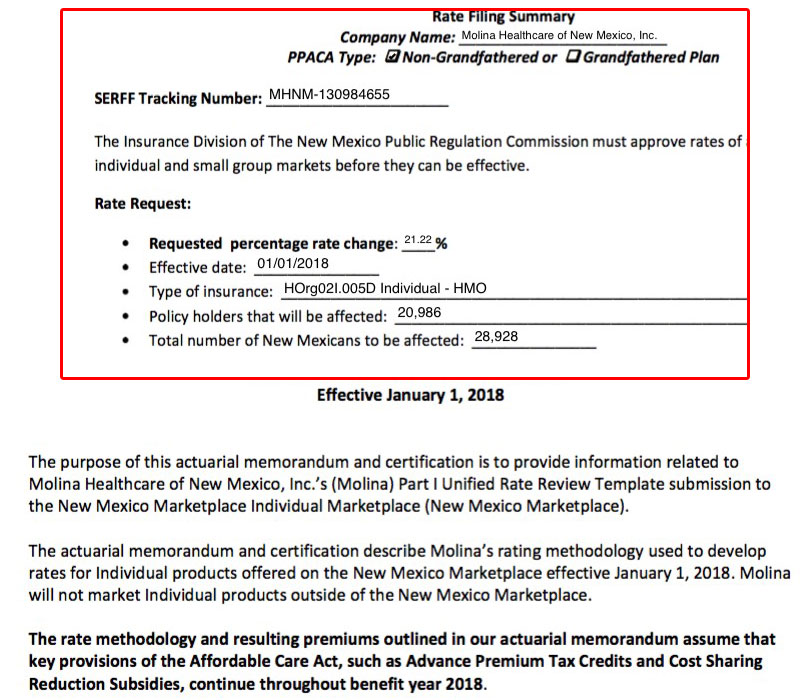

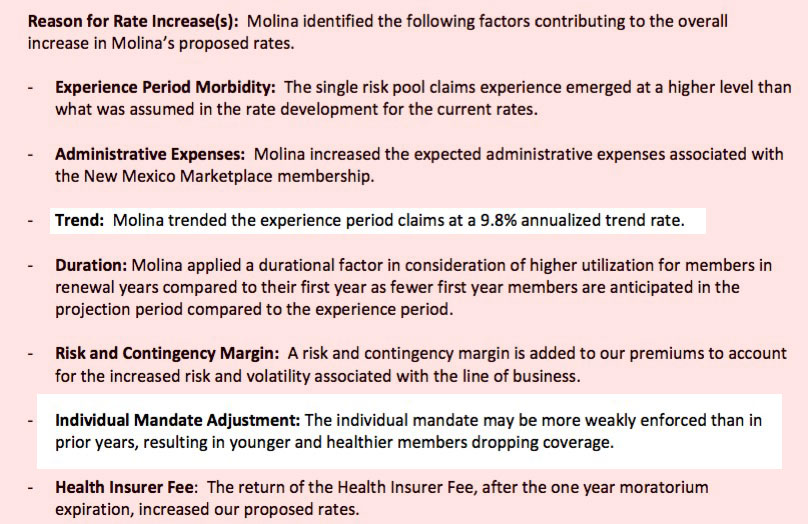

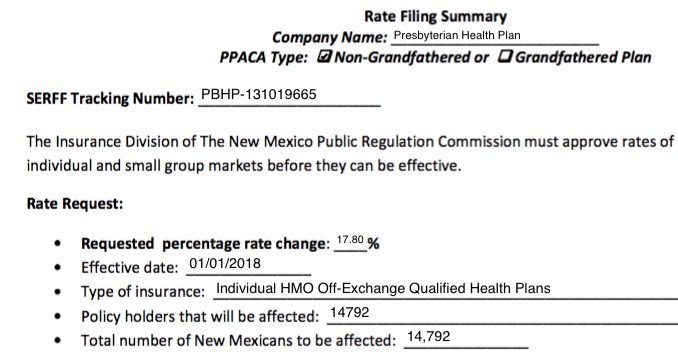

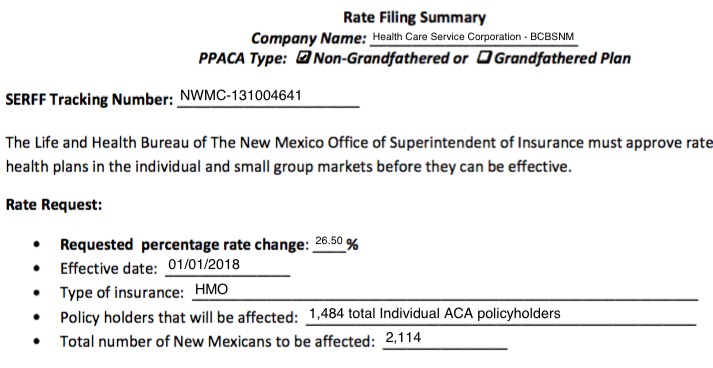

The database at the link above doesn't include the enrollee market share numbers; for that I had to dig up the actual filings at the SERFF database. Blue Cross Blue Shield and Presbyterian seem to be assuming no significant TrumpTax next year (which makes sense, since both will be off-exchange only, thus not subject to CSR payment concerns). Molina's filing is kind of odd--they seem to assume that CSR payments will be made...but that the individual mandate won't be enforced, which seems rather backwards to me (most TrumpTax filings assume neither will be enforced, or that the mandate will but CSR payments won't).

This is doubly confusing since previously Molina was the carrier screaming the loudest about locking in CSR reimbursements, to the point of issuing an ultimatum to the Trump Administration over the issue. Then again, the Molina Board of Directors promptly fired their long-time CEO for doing so less than a week later, so I guess that says it all.

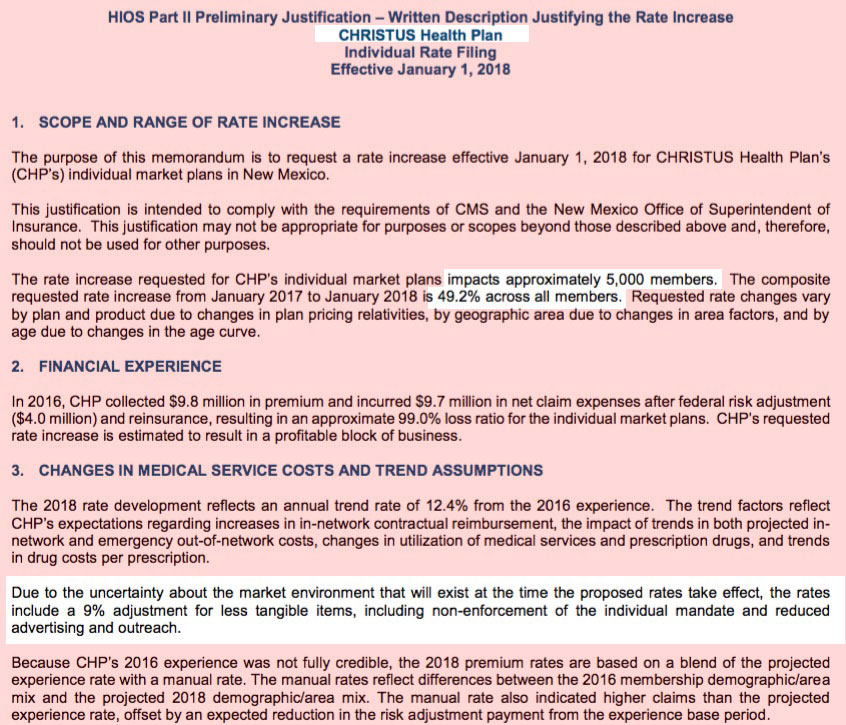

CHRISTUS is asking for an ugly 49.2% increase, but makes it pretty clear that this assumes the worst (full Trump Tax).

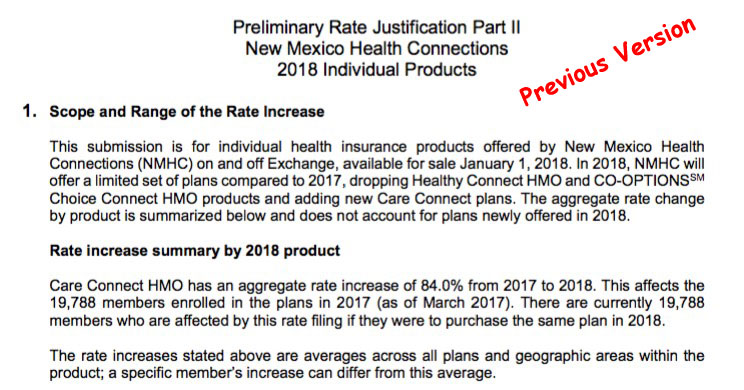

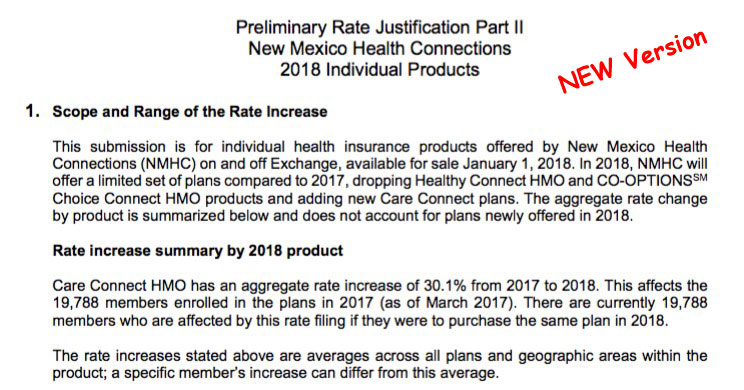

Finally, there's New Mexico Health Connection...which is, by the way, one of the few remaining ACA-created Co-Ops still around. NMHC's filing is confusing: The NM website database lists a jaw-dropping 84.9% average rate hike request...but when I went through the filings, I found a newer version which lists their increase request as "only" 30.1% on average. There's no specific reference to either CSRs or mandate enforcement in either of the filings that I could see, but there's this quote from a Politico article last month:

New Mexico Health Connections is proposing rate hikes of up to 80 percent for next year. That assumes that there will be no cost-sharing subsidies and that the individual mandate won’t be enforced. It also reflects evidence that the plan is already seeing its cohort of younger, healthier customers dropping coverage.

...Without all of these exacerbating factors, Hickey estimates that rate hikes would be much different. His educated guess: increases of 10 to 20 percent.

It sounds like the older filing assumes the full Trump Tax while the newer 30% hike (not 10-20%) assumes that CSRs will be paid and the mandate will be enforced. I might be mistaken about this, but I'm going with it for the moment; I'll revise the table below if necessary.

In any event, once I add in Kaiser Family Foundation's 13% CSR sabotage factor estimate for New Mexico, it looks like NM carriers are seeking a 24.2% rate hike with no/partial Trump Tax or an ugly as hell 48.9% hike with the full Trump Tax effect.

UPDATE: Hmmmm...OK, Louise Norris looked into the NMHC situation and confirmed that both the 30% and 84% filings assume CSRs will be paid, but also assume the mandate won't be enforced. They lowered it from 84% to 30% after confirming that the other carriers are all sticking around next year.

That means the "No/Partial Trump Tax" estimate of 24.2% is the same, but the "FULL Trump Tax" average drops somewhat to 37.2%.

As for the NM small biz plans, I don't have a weighted average, but the unweighted average comes in at around 18%, which is unusually high for the sm. group market.