Tennessee: Here's the OFF-exchange options in those 16 counties

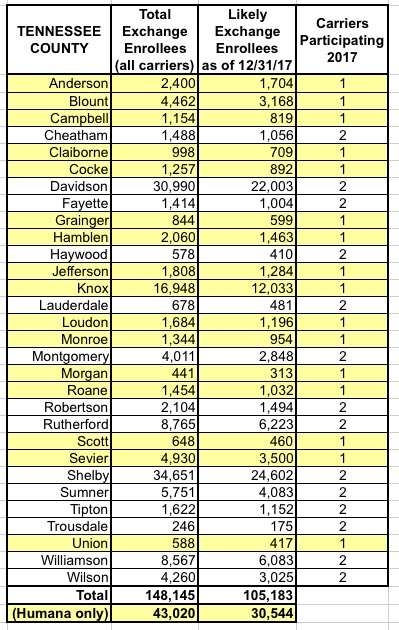

As most people know by now (well, most people in Tennessee, anyway), Humana decided a full two months ago to bail on the entire individual market, across the board--every state, both on and off the exchange, the works. This stung in quite a few counties across 11 different states, but the one which everyone is freaking out about is Tennessee...because there are 16 counties where Humana was the only carrier participating on the ACA exchange. Here's the list of Tennessee counties Humana is available in this year; note that there's an additional 14 counties where there's one other carrier available at the moment.

OK, so assuming Humana doesn't change their mind and assuming no other carriers decide to swoop in and Save the Day® the way BCBSAZ did in Pinal County, Arizona last fall (in dramatic fashion, just 2 months before Open Enrollment started), this would mean that these 16 counties wouldn't have any carriers offering plans on the exchange.

I was inspired by a Twitter exchange to take a look and see just what the off-exchange options are in those counties. I'm not talking about "short term" plans or "mini-meds", which are still available from several sources. I'm also not talking about the "healthcare sharing ministry" plans where people claim* to be devout Christians, not to have extramarital sex, smoke, drink or use drugs. I'm talking about fully ACA-compliant policies available on the off-exchange market which would prevent the enrollee from being charged the individual mandate penalty.

Figuring out which ACA-compliant policies are available OFF-exchange is trickier than you might think. The ON-exchange plans are all listed via Data.HealthCare.Gov, and while all of those are also available off-exchange as well, that doesn't do any good in this situation. HC.gov does have an off-exchange ACA-compliant plan finder as well, but it's incomplete; not every carrier is listed. In fact, I tried plugging in zip codes for all 16 of the TN counties in question and it didn't kick back a single result (whereas plugging in Oakland County, MI brought up 67 plans...and Carter County, Tennessee lists 4 of them, all from BCBS TN).

At first I was afraid that was the answer: NO ACA-compliant plans available OFF-exchange in those counties. However, some further research turned up a total of 10 options.

First of all, according to the Tennessee Insurance Dept. website, there's a total of 6 carriers offering ACA-compliant individual policies in at least parts of the state this year: Aetna, Blue Cross Blue Shield of Tennessee, CIGNA, "Freedom Life", Humana and TRH Health Insurance. We can cross Humana off the list immediately, of course, which leaves the other 5.

According to Cigna's website, they only offer off-exchange plans in 22 counties, which don't include the 16 in question. The same is true of BCBS; they pulled completely out of the Knoxville region (which consists of all 16 counties) this year.

That leaves Aetna, "Freedom Life" and TRH.

I've written about "Freedom Life" before, and while they techically claim to offer a single Bronze plan in Tennessee, everything I read about them screams WARNING! DANGER WILL ROBINSON! I can't really tell whether their Bronze plan is actually available in the counties in question, but even if it is, I'd think very carefully before considering it. Just to give you a hint of what I mean: Their website as listed with the TN DOI as www.freedomlife.net. Check it out.

Aetna, on the other hand, is more straightforward: Plug in a zip code from one of the counties in question and you're taken here, where they list exactly one ACA-compliant Bronze plan, with a $6,550/person deductible. The PDF specifally mentions that yes, it's available in Rating Area 2, which includes the 16 "Empty" counties.

And then there's TRH...which actually takes you to the Tennessee Farm Bureau Health Plan website. They take you through the basics, check to make sure you qualify for an SEP (since we're in the off-season at the moment), and then voila:

In all, the Farm Bureau/TRH offers 9 ACA-compliant policies (3 Bronze, 3 Silver, 2 Gold, 1 Catastrophic)...along with 7 "Traditional" policies. Here's what the info tab for "Traditional" policies says:

Traditional plans require medical underwriting that may affect eligibility and rates. Medical information will be requested for any person over the age of 40 and children 25 months and under; medical records may also be requested if any health condition on the application is marked “yes.” Any fees for obtaining medical information will be at the applicant’s expense.

Underwriting guidelines regarding particular conditions may necessitate a benefit exclusion rider, a member exclusion rider or an adjusted rate for coverage. There will be a 6-month or 12-month waiting period for pre-existing conditions, depending upon the plan chosen.

Yeah, that's right: These are the exact same policies which used to be sold on the individual market before the Affordable Care Act: They ask a bunch of nosey questions about your medical history and health status, they can make you wait up to a year before your policy kicks in, they can charge you a ton extra if they come up with anything they don't like, and yes, you have to do all the legwork and pay for getting all the records they want together.

UPDATE: Thanks to the commentors for catching my mistake--I accidentally entered my birthdate wrong, making the system think I was only one year old! I corrected this and came up with the following (corrected) pricing for a single, non-smoking 46-year old man:

- BRONZE: $317 - $337/mo; $4,500 - $6,500 deductible, child dental

- SILVER: $404 - $433/mo; $2,500 - $3,000 deductible child dental

- GOLD: $510 - $550/mo; $1,000 - $1,500 deductible, child dental

- TRADITIONAL (non-ACA compliant) plans: $100 - $282/mo, $1,500 - $6,000 deductibles; 4 of the 7 include adult & child dental

Of course, there's no way of knowing whether Aetna, TRH or even "Freedom Life" will still be available in the Knoxville area next year, and it's vitally important to remember that unless they offer these policies on the exchange, there won't be any APTC/CSR assistance available to those between 100-400% FPL, but this is still important for people to keep in mind for Knoxville-area residents.

*I, of course, have no evidence that anyone is lying in order to join one of these, of course; I'm sure that every one of the 330,000 of the people who have suddenly found religion since the ACA passed are devoutly following all of the rules required to be a member of one of these...

The organizations require that members follow a code of conduct consistent with biblical values, which often means attending a church regularly and making a profession of faith. It means no sex outside of marriage, no drinking to drunkenness, no drugs and no tobacco outside of a cigar at a wedding or at the birth of a child. If a teenager were to become addicted to drugs, become pregnant or get a sexually transmitted disease, the associated medical costs would not be shared.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.