UPDATED: National Q1 Exchange QHP Effectuation Estimate: 11.2 Million

In a classic case of missing the forest for the trees, I posted two very wonky, detailed entries over the past couple of days about Minnesota and Connecticut's latest enrollment numbers...but completely missed one crucially important data point.

Investor's Business Daily's Jed Graham picked up on some of my work for his post today, including the enrollment data for both Minnesota and Connecticut...but in addition to that extra data point (which I'll come back to in a moment), he also nabbed the latest number out of a third state, Oklahoma, from one of Adam Cancryn's updates on what I'm calling the UnitedHealthcare Disenrollment Odometer:

Oklahoma Insurance Department spokeswoman Kelly Dexter said in an email that the company's most recent individual exchange enrollment totaled 5,967 members, but that number could fluctuate as more people pay their premiums. That represents a fraction of the state's overall population of 123,371 exchange enrollees through February. Dexter also said no other health insurers have said they plan to leave the state in 2017.

123,371 people enrolled in Oklahoma ACA exchange policies as of 2/29/16. The problem with this is that Oklahoma's official OE3 QHP selection tally as of 2/01/16 was 145,329 people...which means that the state has seen a drop off of 15.1% in the first month of the off season.

I did note Connecticut's far better retention rate:

This year they're down only 9.2% (from 116,019 to around 105.3K) over 77 days from 2/01/16 - 4/18/16.

However, when it came to Minnesota, I managed to take note of the fact that MNsure increased the effectuated number from February to March by 8%...but completely forgot to note the less positive news: The drop-off from Minnesota's 2/01/16 QHP selection number (85,390) to their 4/17/16 effectuation number (76,505). That's actually a decrease of 10.4%.

To his credit, Graham correctly spotted this nugget and plugged in all 3 states:

But reports from three states — Connecticut, Minnesota and Oklahoma — show that their enrollment has dropped 12%, from a combined 347,000 to about 305,000, since early February.

The 12% loss in those three states is barely better than the 13% decline they saw between the end of the 2015 enrollment period and March 31 of last year. Likewise, national exchange enrollment dropped 13%, or 1.5 million, to 10.2 million over the same period.

The latest three-state snapshot of where paid enrollment stands suggests that national enrollment is likely down at least 1 million, or 8%, from the 12.7 million customers who had selected plans or been automatically re-enrolled as of Feb. 1.

Actually, Graham is being generous here. I've generally maintained that the drop-off rate from the end of open enrollment through the end of March probably would follow the same pattern as last year. However, since CMS had already lopped off around 300,000 people from the "QHP selection" tally during open enrollment, my own 13% attrition estimate is based on 13.0 million, not 12.7 million. If so, that would mean roughly 11.3 million people still effectuated as of 3/31/16...or down around 1.4 million people, not 1 million.

One other item worth noting is the date range for each state:

- Connecticut: 9.2% drop over 77 days

- Minnesota:

10.4%drop over 76 days [8.4%; see update below] - Oklahoma: 15.1% drop over just 28 days

Compare this with the same states last year:

- Connecticut: 109,839 on 2/21/15 >> 98,269 on 3/31/15 = 10.5% drop over 38 days

- Minnesota: 59,704 on 2/21/15 >> 52,169 on 3/31/15 = 12.6% drop over 38 days

- Oklahoma: 126,115 on 2/22/15 >> 106,392 on 3/31/15 = 15.6% drop over 37 days

Connecticut and Minnesota are both doing much better than last year given the timeframe...while Oklahoma is doing much worse.So, is this something specific to Oklahoma itself? Or to all red states? Perhaps the fact that OK is on the federal exchange while the other two run their own? Or is it simply what I suggested above, that the national attrition rate is gonna be roughly the same 13% in Q1 that we saw last year?

Stay tuned...

UPDATE: I also have Massachusetts data through the end of March. However, due to a) MA's unique "ConnectorCare" year-round rule and b) an odd, 17.3K discrepancy between the MA exchange data and the official ASPE report number for the state, I'm not sure how useful that is.

I've also acquired the Washington exchange data through February, although there's also some weirdness there, so proceed with caution.

You can also add Colorado to the mix. This one stings, if accurate.

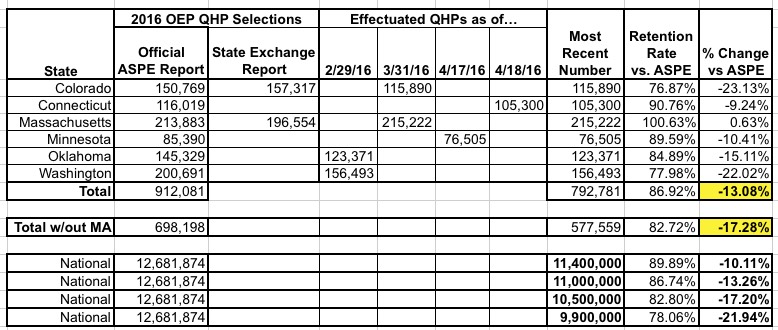

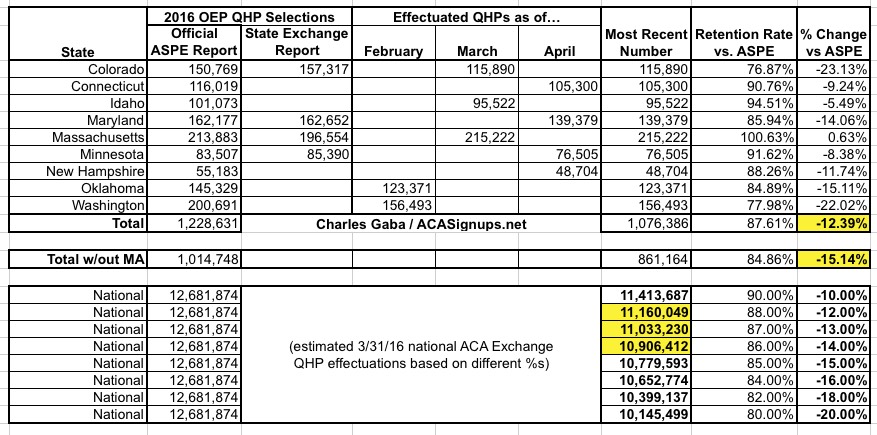

Given all the updates and confusion, here's a table which tallies up all 6 of the states so far. I've plugged in 4 different scenarios depending on how the remaining 45 states have played out:

- Best-Case Scenario (Connecticut & Minnesota): Around 11.4 million still effectuated

- Straight Average (all 6 of the states): Around 11.0 million still effectuated

- Pessimistic (5 of the states w/out Massachusetts): Around 10.5 million still effectuated

- Worst-Case Secnario (Colorado/Washington): Only 9.9 million still effectuated

Again, bear in mind that these 6 states combined only represent 7.2% of total exchange enrollments nationally, so there's no way of knowing how representative they are. Even so, the bottom line is that it's not looking great retention-wise.

Until I have more data, I'm going to go with the midrange and assume somewhere around 11.0 million enrollees as of 3/31/16.

It's important to note, as always, that leaving an exchange policy is not necessarily a bad thing, since in many cases it means that the person has simply shifted over to a different form of coverage such as aging into Medicare, getting a job with employer coverage, falling on hard times and transferring over to Medicaid and so forth.

Consider Connecticut, where, according to Arielle Levin Becker of the CT Mirror:

Of exchange custs who lost coverage, 20% failed to verify info, 53% didn't pay, 10% requested their plans be canceled. 12% moved to Medicaid

Let's assume that my 11.0 million mid-range is accurate. That would mean a reduction of around 1.7 million people from the official 12.7 million QHP selection tally.

Assuming Connecticut's breakout is representative, that would mean:

- 901,000: Didn't pay their first monthly premium at all

- 340,000: Data verification issues

- 170,000: Voluntarily dropped coverage

- 204,000: Shifted over to Medicaid

- 85,000: Other

Nationally, I always assume a 10% non-payment rate (vs. Connecticut's 8.6%). I was never expecting the 3/31 number to be any higher than perhaps 11.3 million at most anyway (87% based on 13 million total QHP selections, of which 300K non-payments had already been accounted for via "pre-purging"), but compiling these numbers has made me more pessimistic.

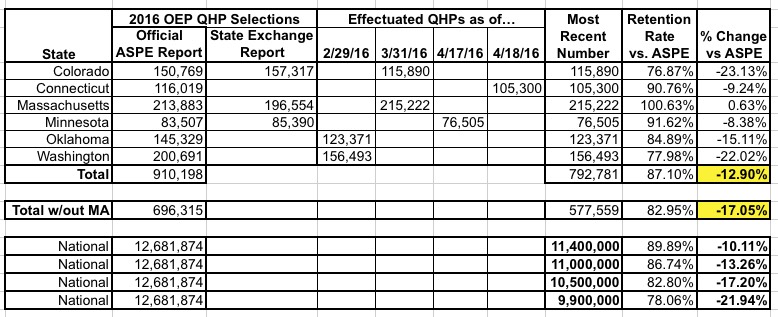

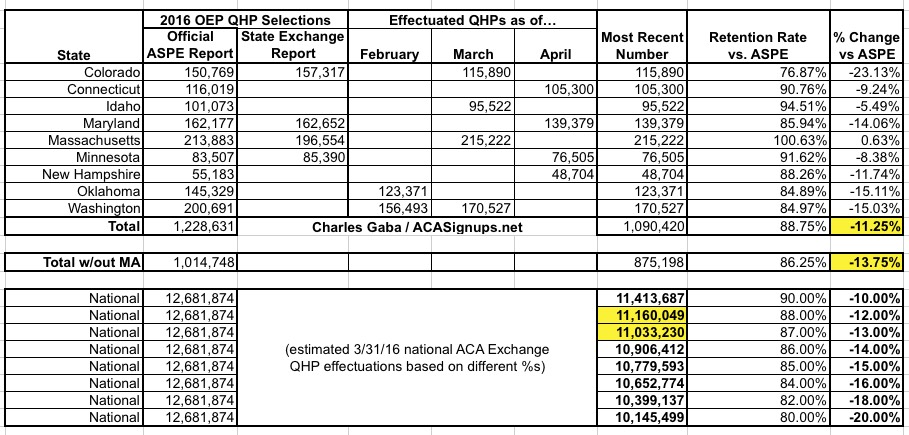

UPDATE 4/25/16: Nice catch by Andrew Sprung (and I'm obviously slipping more than I thought): There's also a small discrepancy between the official ASPE number as of 2/01/16 and the official MNsure enrollment report as of 1/31/16. You'd expect ASPE's number to be slightly higher than MNsure's, since it includes an extra day tacked on, but it's actually a bit lower:

Since the ASPE report is the official final word as far as pretty much everyone outside of the state exchanges is concerned, this means that Minnesota's attrition rate is slightly better than either Jed Graham or I thought (8.4% instead of 10.4%).

Accuracy/consistency is important. If I'm going to use ASPE's starting number for MA (over 17,000 higher than the exchange claims), it's only fair to also use ASPE's starting point for MN (1,883 lower). This doesn't change the larger point, but it does knock the overall average attrition rate down slightly:

It's still looking like exchange QHP effectuations may have fallen to 11.0 million or lower, but again, more data is needed.

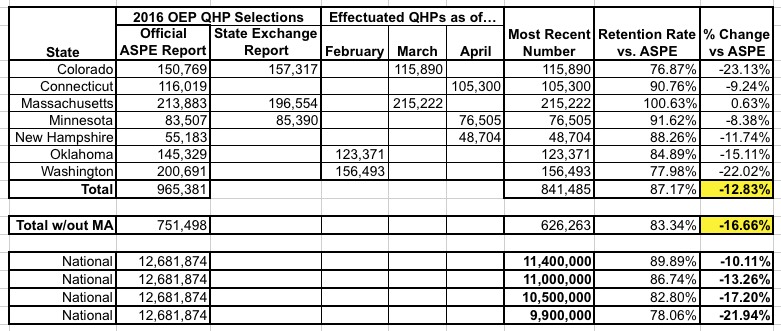

UPDATE 4/26/16: I've added the latest numbers from New Hampshire. They improve things slightly, but NH's enrollment is so small anyway that it doesn't change things much:

UPDATE 4/27/16: Adding Idaho to the mix improves things a bit more:

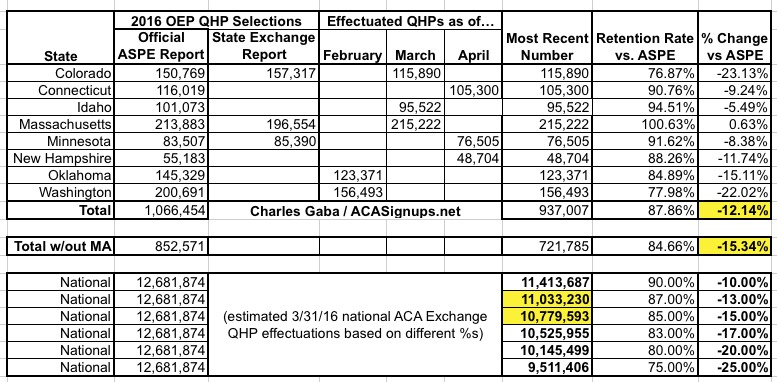

UPDATE 4/28/16: The Maryland exchange just chimed in as well:

Keep in mind that these 9 states still only represented about 9.7% of the 12.7 million exchange enrollees as of the end of January; higher attrition in one or two large states like Texas or Florida could easily skew the average. Still, each state that I add stabilizes the estimate more. It's starting to look more and more like the national exchange enrollment number has dropped somewhere between 12-14%, to right around 11.0 million even.

If so, this would be similar to last year's 13% drop. It's starting to look very much like the "pre-purge" thing I was so fascinated by last winter was actually a non-issue; as Larwit1512 notes in the comments:

As I said repeatedly, I'm not sure the pre-purge in OE3 was any different then the purge on the last two weeks in OE2, they may have done it earlier this year and made more press about it in OE3, but the 300k in OE3 aleays reflected the same number as the 290k in OE2.

OK, fair enough. In any event, half of these numbers are as of April,not March or February, so the 3/31/16 attrition rate might be slightly better than shown above (at the lower edge of the 12-14% range).

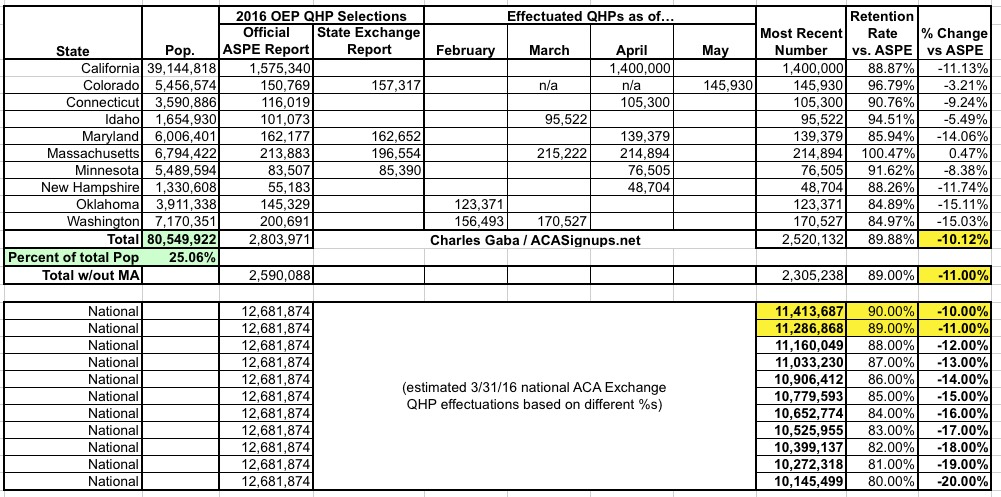

UPDATE 5/05/16: The Washington exchange just released their March data (instead of February), which improves the outlook a bit; it now looks like the national total was at around 11.1 million as of the end of March:

UPDATE 5/17/16: A minor update from Massachusetts...and a major one from Colorado (a data correction on the part of the exchange, actually) have improved the picture substantially:

Assuming I'm highballing a bit, it now looks like national QHP effectuations were somewhere around 11.2 million as of 3/31/16...which is actually right around where I was originally assuming it would be in the first place. Stay tuned...