UPDATE x4: 8 State Exchanges: Enrollment *up* 2.7%! 4 Insurance Companies: Enrollment *down* 8.3%!

As regular readers know, I've been trying to figure out whether effectuated ACA exchange enrollments have dropped noticably since the second quarter or not. Since last November, the HHS Dept. has been projecting that the effectuated number will be down to 9.1 million enrollees by December from 9.95 milliion as of the end of June.

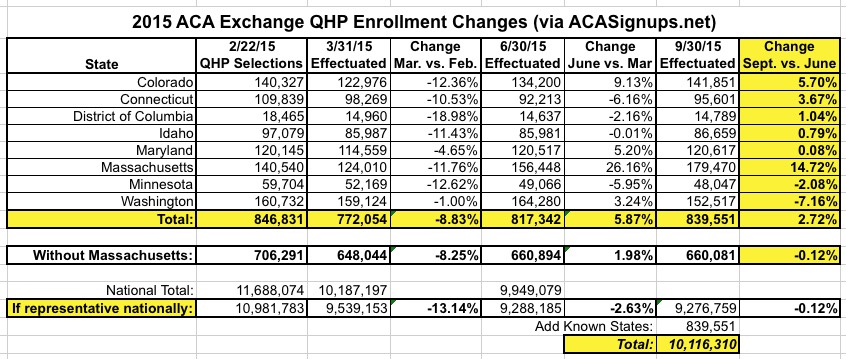

However, over the past couple of weeks, I've compiled Q3 (end of September) data from 8 different state exchanges which collectively suggest that current enrollments are actually up since June...or, at worst, have only dropped slightly:

Then, yesterday, Anthem (which holds roughly 9% of total exchange QHP enrollment) reported that they've lost around 7.7% of those enrollees...except that they seemed to indicate that the bulk of them shifted over to competitors on the exchange, as opposed to dropping off the exchange entirely. This is an important distinction, since anyone who moved to a different exchange policy is still counted in the effectuated exchange QHP tally, of course.

HOWEVER, today came Q3 earnings reports from 2 more large insurers, and the changes are similar:

Membership losses were most evident in Aetna's individual business, which includes policies sold on the Affordable Care Act's public exchanges. Aetna had 1.1 million individual members, down 100,000 from the most recent quarter, Aetna Chief Financial Officer Shawn Guertin said on an earnings call Thursday. A company spokeswoman broke down the 1.1 million individual members into 815,000 on-exchange enrollees and 280,000 off-exchange enrollees.

OK, taken at face value, that would be roughly an 8.3% drop (1.1M vs. 1.2M)...except there's no way of knowing how much of the loss comes from exchange-based vs. off-exchange.

However, according to Bob Herman, who wrote the story above:

@charles_gaba No breakout of lost plans, nor where they went. I do know at end of Q1, Aetna did have ~950k on-exchange. Now it's 815k.

— Bob Herman (@MHbherman) October 29, 2015

OK, so they've lost 14.2% of their exchange enrollment since March. National exchange enrollment dropped 2.3% from March through June (9.95M vs. 10.19M). No way of knowing if Aetna was proportional to that, but assuming it was, roughly 22,000 of that Q2 loss should've been from them, which would mean roughly 113K lost via the exchange since June (remember, it's possible that off-exchange enrollment increased quarter over quarter, even as exchange enrollment dropped).

In other words, it looks like Aetna, which held roughly 9.3% of the exchange market, has also lost a good 9% of their enrollees as well...but again, the wording fo the report makes it sound like a lot of this may have shifted to other carriers:

UPDATE: Well how do you like that! I just received confirmation from Aetna that their June (Q2) exchange enrollment was right around 920K, meaning that they've lost a net of 105K since then.

Competitor Anthem similarly lost scores of people from its individual business, especially the exchanges, as many people have chosen lower-priced alternatives. CEO Joseph Swedish said the individual market had a lot of “unsustainable pricing.”

Bertolini said for the most part, he's seen rational pricing, and some plans with lower premiums may better contain costs. But he viewed the ACA's struggling co-op program as flawed, even though it initially signed up a lot of people.

“What we saw with the co-ops was the immaturity of that model and the anticipation that they could somehow hold the big health plans honest by pricing at a level that captured a lot of membership,” Bertolini said Thursday. “We knew that was going to be troublesome and unsustainable.”

So far it certainly sounds like both of these major insurers are saying that their exchange enrollees have been leaving them to shift to other carriers, especially the CO-OPs (Many of which are going to have to switch right back over to the big guys, I'd imagine, now that 9 of them have gone belly-up in the past few months). However, without hard numbers from the other states (or from the HHS Dept, hint, hint...), there's no way of being sure.

Finally, a third major insurer released their Q3 earnings report...and this one seems to be more cut and dry:

I've been informed that Molina had around 261,000 exchange enrollees total as of Q2 (June), so this would represent an 11.9% drop in just 2 months...which, if it kept dropping at the same rate in September as well, would bring them down to 215K for Q3, or a 17.6% drop in one quarter, which is pretty unpleasant.

HOWEVER, once again, I don't know where any of these folks are going.

As of June, these three corporations held 893K (Anthem) + 261K (Molina) + appx. 920K (?) (Aetna) = around 2,074,000 exchange enrollees, or around 21% of the total as of June 30.

Between the three of them, they appear to be down to 1,869,000...a loss of 205,000 enrollees, or roughly 10%.

IF this is representative of every insurer on the exchanges, that suggests that national exchange enrollment was down to around 9 million even as of the end of September...a faster attritionr rate than either I or the HHS Dept. figured (they assumed 9.1 million as of December; I've been assuming around 9.7 million).

However, if a substantial number of those 205K simply shifted over to other exchange participants (the ones which had a 79% share of the market as of June), this might not be an issue after all.

Again, there's a huge discrepancy between the 8 states I have solid Sept. 30 data for and the 3 major insurers I have data for. If current enrollment is up 2.7% in those 8 states (collectively), but down 10% nationally, that means it would have to be down more than 10% in the remaining 42 states...

Stay tuned...

UPDATE: Well, I've hunted down UnitedHealthcare's Q3 report, which includes the following passage:

The annual care ratio is being modestly affected by the performance of our new public exchange benefit programs, which now serve nearly 550,000 people. Like others, we observed market-wide data this past spring that suggested the risk pool served by public exchanges would require more medical services than original expectations. Rather than wait for our own experience with our new members to fully develop, we increased rates and repositioned certain products market by market for 2016, and we expect improved performance next year. We will expand to 11 new markets in 2016 6 and we continue to expect exchanges to develop and mature over time into a strong, viable growth market for us.

I'm fairly certain that "public exchange benefits programs" refers specifically to "ACA exchange policies", which means that UnitedHealthcare had 550,000 enrollees at the end of September.

Unfortunately, neither their Q1 nor Q2 earnings reports seem to include this number, so I have no way of knowing whether 550K is an increase or decrease from June.

UPDATE x2: OK, I've been informed that UnitedHealthcare's Q1 (March) report had them at around 570,000 exchange enrollees. Assuming they lost members in both quarters, that's a nominal drop (likely 10K in each quarter, or a 1.8% drop from Q2 to Q3). On the other hand, it's also possible that they lost, say, 70K in Q2 but added 50K back in Q3...

UHC's Q2 earnings report does state that:

As expected, attrition in individual exchange products was the primary factor in the overall net reduction of 30,000 people served in the second quarter.

Assuming that I'm reading all of these correctly, it looks like UnitedHealthcare's enrollment went from 570K in March to 540K in June to 550K in September...minor variances, but this would also confirm my theory that many of the enrollees who left the other insurers simply shifted over to competitors like UHC. Again, however, until I confirm this, I have to leave UHC out of the calculation.

I've also been informed that Centene also saw a 7% decline from Q2 to Q3 (from 167,400 down to 155,600).

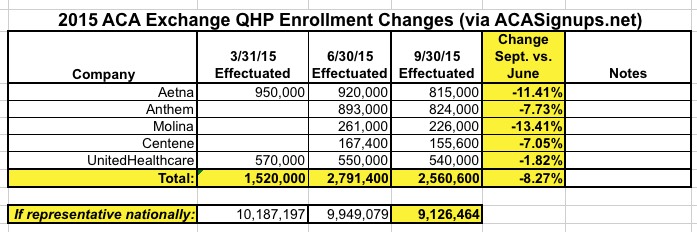

So...adding Centene into the mix, you have around 2,241,400 in June down to 2,024,600 in September...a drop of 9% for those 4 companies (not inlcuding UnitedHealthcare).

UPDATE x3: OK, I've also confirmed that Molina actually dropped another 4,000 to 226,000 as of September.

UPDATE x4: I've confirmed that UnitedHealthcare actually had 550,000 exchange enrollees in June; this is down slightly to 540,000 as of the end of September.

With this, I now have current data (as of 9/30/15) for 5 major insurance companies which collectively made up 28% of total exchange enrollees as of June.

Here's what the data for these 5 companies looks like now:

So...that's quite a discrepancy:

- 8 State-based exchanges suggest that September 30th effectuated enrollment was around 10.0 - 10.1 million (even or slightly up from June 30).

- 4 major insurance company financial reports suggest that September 30th effectuated enrollment was down to around 9.1 million (down 900K from June 30).

Stay tuned...