UPDATE: Anthem loses 8% of ACA exchange enrollees...to competitors

The HHS Dept's official exchange enrollment projection for the end of 2015 has always been that they expect roughly 9.1 million people to still be enrolled as of December (of which perhaps 8 million will renew their coverage for next year). If accurate, this would represent an 8.5% drop from the 9.95 million enrolled at the end of June.

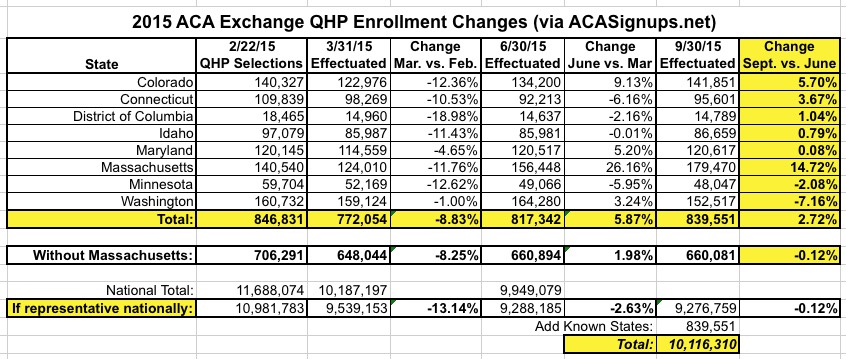

As regular readers know, for the past couple of weeks I've been piecing together a theory, based on limited data, that ACA exchange QHP enrollment may have actually increased since June...or, at worst, only dropped slightly. Hard numbers from 8 states show a net increase of 2.7% from June through September; removing Massachusetts from the mix (special case) brings this down to a nominal 0.1% net drop:

Unfortunately, these states collectively represent only 8.2% of total June effectuated enrollments. There are too many variables state to state to extrapolate this nationally. I'd really need data from two or three larger states--preferably including a southern border state like Florida or Texas--to be certain of my theory; unfortunately, none of them have that data for the third quarter yet (I've asked). Given that the biggest contributor to effectuation loss in Q2 was people being kicked off their policies for legal residency verification issues, Florida, Texas, Arizona and California are very likely to have bigger losses than any of the states above.

However, one interesting tidbit did come out this morning, courtesy of Modern Healthcare reporter Bob Herman:

.@AnthemInc had 824k #ACA exchange members as of Q3. Drop of about 70k from last quarter. Called out "unsustainable pricing" of competitors.

— Bob Herman (@MHbherman) October 28, 2015

At first I was concerned about this, as a 70K enrollment drop from a starting point of 894,000 in Q2 would mean that Anthem had already lost nearly 8% of their exchange membership by the end of September...a faster attrition rate than I was expecting (remember, HHS's 9.1M was for the end of December, not September).

However, I asked and Herman clarified:

@charles_gaba yes, loss was due to people moving to competitors + overall lower expectations.

— Bob Herman (@MHbherman) October 28, 2015

Anthem expects to continue to lose exchange market share in Q4 and 2016. Expects market will "harden" after #ACA 3Rs go away.

— Bob Herman (@MHbherman) October 28, 2015

@charles_gaba Nope, no specifics, just that they lost share and expect that'll continue. Priding themselves on pricing that is "profitable."

— Bob Herman (@MHbherman) October 28, 2015

This is key. Anthem, which encompasses Blue Cross insurers across over a dozen states, is probably about as close to a representative sample from a single company as I'm likely to get data for. That 894,000 June number made up roughly 9% of the total June enrollment figure nationally.

Now, without knowing just where those 70,000 people went, it's still difficult to draw any conclusions; some of them may have moved to ESI. Some may have moved to Medicare or Medicaid. Some may have moved to off-exchange policies (although this number is likely minimal, since about 85% of them would lose their federal tax credits in doing so and would have to start paying full price if they moved off-exchange).

Instead, according to Herman, most of them (I'm assuming at least, say, 50K of the 70K total?) shifted to a competitor on the ACA exchange. If this is the case, and is also representative nationally, then the actual exchange attrition rate in Q3 may be much lower...2-3%, perhaps (20K / 894K). And if that's the case, then there should still be around 9.6-9.7 million people enrolled in exchange policies nationally at the moment, which would be closer to my projection than HHS's. Again, this is still pure speculation; I'll still need more hard data to draw any conclusions.

Here's another interesting thing about this, however: During the off-season, you can't change policies from one carrier to another unless you have a qualifying life event. That is, you can drop your current coverage at any time, but you can't switch to a different carrier unless you have a life event (getting married/divorced, having a child, moving, having a significant income change and so on). If I'm reading this correctly, what Anthem is saying is that about 8% of their enrollees had just such a major life change and took the opportunity to move elsewhere in the process...over just a 3 month period.

That actually bodes well for "Invisible Hand of the Free Market" thinking.

UPDATE: Here's Herman's full story:

Swedish referenced the spate of co-op closures on an earnings call Wednesday. He said Anthem “will not chase price” to boost exchange enrollment and that insurers will establish more “rational” plan prices in the coming years. Anthem had 824,000 exchange members as of Sept. 30, down from 893,000 at the end of the second quarter. Despite the higher medical-loss ratios in that group, Anthem is still turning a small profit on the plans, executives said.

OK, so it's 69K / 893K, slightly lower than I thought (still 7.7% of their total).

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.