Maryland: *Final* avg. unsubsidized 2025 #ACA rate changes: +6.2%; Wellpoint joining market (updated)

Originally posted 6/17/24

via the Maryland Insurance Dept:

Health Carriers Propose Affordable Care Act Premium Rates for 2025 New carrier files to enter individual market statewide

BALTIMORE – The Maryland Insurance Administration has received the 2025 proposed premium rates for Affordable Care Act products offered by health and dental carriers in the individual, non-Medigap and small group markets, which impact approximately 496,000 Marylanders. This includes rate submissions from Wellpoint Maryland Inc., an HMO that will begin offering Affordable Care Act products in Maryland for the first time.

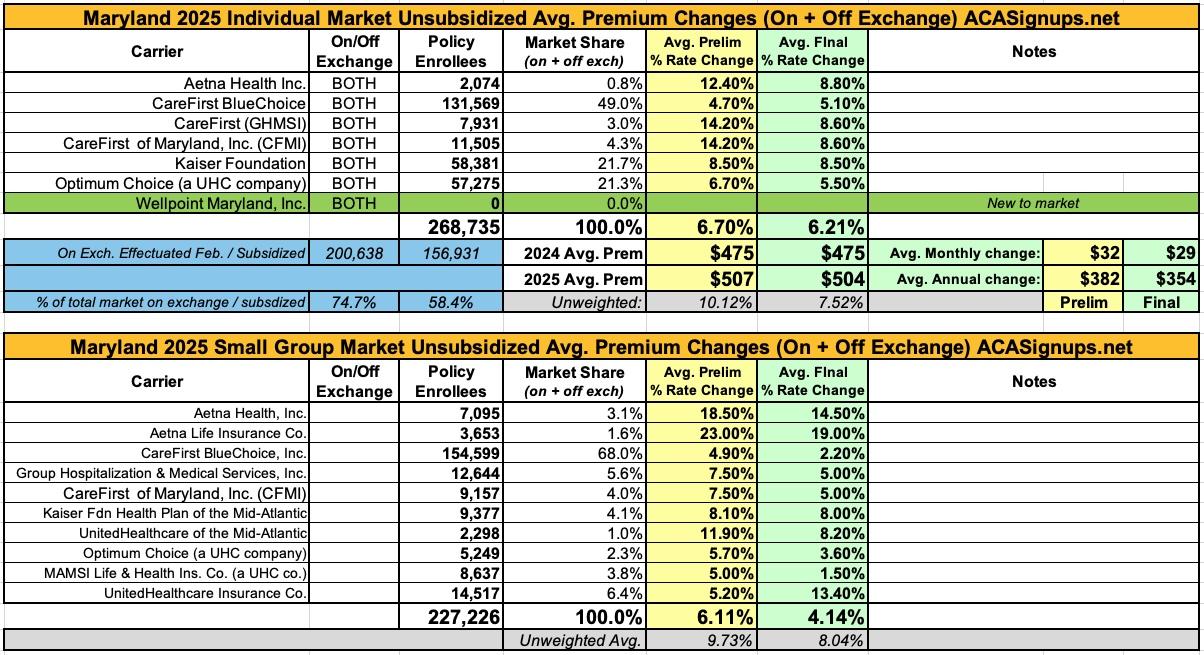

In the individual, non-Medigap market, carriers are requesting an overall average rate change of 6.7%, with the average request by carrier ranging from 4.7% to 14.2%. In the small group market, carriers have requested an overall average rate increase of 6.1%, with the averages by carrier ranging from 4.9% to 23%. In the individual, non-Medigap, stand-alone dental market, carriers have requested an overall average rate increase of 2.4% with averages by carrier ranging from –5% to 18.2%.

The carriers’ requested increases are reviewed by the Maryland Insurance Administration and rates must be approved by the Commissioner before they can go into effect. Before approval, all filings undergo a comprehensive review of the carriers’ analyses and assumptions. By law, the Commissioner must disapprove or modify any proposed premium rates that are unfairly discriminatory or appear to be excessive or inadequate in relationship to the benefits offered. The MIA will hold a public hearing on the ACA proposed rates in July and expects to issue decisions in September 2024.

In both the individual and small group markets, the overall average increase requested for 2025 is consistent with the overall average claims trend. The rates submitted by the carriers for the Individual market include the estimated impacts from the state’s innovative, state-based reinsurance program, which was originally approved for 2019-2023 and has been extended through the end of 2028. The State Reinsurance Program resulted in a 32% reduction in individual market rates in the first three years and has been instrumental in keeping rate increases at or below trend. Even if this year’s requested increases were approved as proposed, the individual, non-Medigap rates would be 16% below the rates being charged in 2018 prior to the start of the State Reinsurance Program.

In addition to rate change filings, the Wellpoint filing identifies new plans that the company will be offering in the Maryland individual market in 2025. Wellpoint is the third carrier to re-enter the individual market since 2021, and its products will be available statewide. This brings the total number of carriers in the market to five and will ensure that Marylanders in all counties will have a choice of at least four carriers.

“We are pleased to have yet another carrier selling in the individual market. The state was down to two carriers before the state reinsurance program was implemented,” noted Insurance Commissioner Kathleen A. Birrane. “The addition of three new carriers demonstrates the continuing success of the program, will provide consumers with an expanded number of choices, and will provide additional competitive pressure to keep rate increases low. Maryland has some of the lowest unsubsidized rates for comprehensive medical coverage in the nation and we want to keep it that way.”

The Insurance Administration will hold a quasi-legislative virtual public hearing on this matter on July 9, 2024 from 1 p.m. to 4 p.m. (See public hearing details below.)

“Feedback from all stakeholders is very important and we urge everyone to participate in the public hearing,” Commissioner Birrane said. “Health insurance costs impact everyone, and we want to give all Marylanders the opportunity to be heard as we consider the proposed rates.”

UPDATE 9/21/24: The Maryland Insurance Dept. has posted their final/approved 2025 rate filings:

Maryland Insurance Administration Approves 2025 Affordable Care Act Premium Rates

Marylanders have more health insurance options as Wellpoint enters individual market

BALTIMORE – Acting Maryland Insurance Commissioner Joy Hatchette today announced the premium rates approved by the Maryland Insurance Administration for individual and small group health insurance plans offered in the state for coverage beginning Jan. 1, 2025.

The approvals include plans offered by Wellpoint Maryland, Inc., which is entering the individual market for the first time in 2025. With this approval, Marylanders will be able to choose from between at least four insurance carriers in the individual market.

The rates for individual health insurance plans under the Affordable Care Act (ACA) will increase by an average of 6.2% this year. This 6.2% was driven by an overall average 6.1% claims costs trend (year-over-year increase in total cost and health care utilization). By major service category, average market trend was 4.3% for hospital costs, 8.5% for professional physician costs, and 10.2% for the costs of prescription drugs.

The approved rates are 0.5% lower on average than insurance carriers originally requested, which represents a total annual premium savings of $6.4 million for Maryland consumers. Marylanders will continue to have some of the most affordable individual market rates in the country largely because of the continued effectiveness of the state’s 1332 waiver in stabilizing the market and – along with federal and state subsidies – helping to bring in younger and healthier consumers.

Maryland’s 1332 State Innovation Waiver was the result of a bipartisan legislative effort in 2018. The waiver was approved by the federal U.S. Centers for Medicare and Medicaid Services (CMS) in August 2018, clearing the way for the implementation of the reinsurance program starting in 2019. The current waiver is approved through 2028.

The approved 2025 rates are 17% lower than the 2018 rates prior to waiver implementation, and the waiver continues to keep rates 30% to 35% lower than they would be without the waiver.

In addition to the rate reductions for unsubsidized consumers, about 80% of people who purchase their individual market policy on Maryland Health Connection, the state’s health insurance exchange, receive some reduction in premium through federal subsidies known as Advanced Premium Tax Credits. The federal Inflation Reduction Act has extended enhanced Advanced Premium Tax Credits through the end of 2025, with no upper income limit on subsidy eligibility. The subsidies are scheduled to expire at the end of 2025, unless the U.S. Congress takes action to extend them. If no action is taken, large premium increases for subsidized consumers and decreases in exchange enrollment are expected in 2026.

People who are between 18 and 37 years old and are under 400% of the federal poverty level remain eligible to receive a state premium subsidy to bring their subsidized premiums even lower.

Wellpoint Maryland, the newest entrant into the individual market, has been approved to sell ten plans both on and off the individual marketplace and these plans will be available in all counties in Maryland. With this approval, all Marylanders will be able to choose from between at least four insurance carriers -- a major improvement from 2018, when the majority of Maryland counties had only a single carrier.

“The success of the Reinsurance program continues to be evident.,” said Acting Commissioner Hatchette. “With five carriers offering a total of 60 plans, consumers have more choices than they have had since 2015. Rates remain 17% below the 2018 level, despite seven years of claim trends. Maryland premiums will continue to be amongst the lowest and most affordable in the nation.”

Individual Non-Medigap Market

About 271,000 Marylanders are affected by the approved rates. The actual percentage by which the rates for a specific plan will change depends on the carrier and plan.

As an example, for a 40-year-old living in the Baltimore metro region, rate changes for the lowest cost off-exchange silver plans range from -11.6% to 10.9%, with average monthly differences ranging from -$40 per month to $42 per month.

Rate changes for the lowest cost gold plan for that same 40-year-old in that same region range from 1.2% to 14.9%, with average monthly differences ranging from $4 per month to $54 per month

Acting Commissioner Hatchette urged Marylanders to work closely with health insurance agents and advisors, and to explore plans available through Maryland Health Connection. Individuals who purchase individual insurance through Maryland Health Connection may be eligible to receive federal premium subsidies or the federal tax credits.

“It is very important for individuals to work with Maryland Health Connection.” Acting Commissioner Hatchette advised. “Even though the enhanced federal subsidies are still in effect, subsidized consumers may see rate changes higher or lower than the unsubsidized rate changes due to a shift in the second lowest cost silver plan upon which subsidies are benchmarked. Consumers should carefully review their renewal notice and work with trusted advisors and the exchange to evaluate whether there is an opportunity to offset any premium changes by selecting a new plan.”

Stand-Alone Dental Market

The Maryland Insurance Administration also approved an average rate increase of 0.3% for dental rates in the individual market, which is lower than the 2.4% originally requested by carriers. Approximately 96,000 Marylanders purchase stand-alone dental plans in the individual market.

Small Group Market

The rates for small group health insurance plans under the Affordable Care Act will increase by an average of 4.5% in 2024. This is a reduction of 1.6% from the originally requested 6.1% average, reducing the market’s total annual premium by more than $24 million.

About 227,000 Marylanders are enrolled in small group market plans in 2024.

As is the case with the individual market plans, the actual percentage by which the rates for a specific plan will change depends on the specific carrier and plan. There are more than 225 plans offered this year in the Maryland small group market and plan sponsors are urged to shop carefully. In addition, Aetna has recently announced that they intend to no longer offer plans in the small group market for initial plans and renewals effective April 1, 2025.

As an example, for a 40-year-old living in the Baltimore metro region, rate changes for the lowest cost off-exchange silver plans range from 0.1% to 14.6% with average monthly differences ranging from $0 per month to $51 per month.

Rate changes for the lowest cost gold plan for that same 40-year-old in that same region range from +2% to +19.7% with average monthly differences ranging from $10 per month to $87 per month.

The attached exhibits provide additional detail and context to the outcome of 2025 ACA premiums. As always, the approved rate increases vary by carrier and plan, with some carriers decreasing rates and other carriers increasing rates more than the average. A member’s annual premium rate will depend on the approved rate increase for their plan, the year-over-year increase in age factor, and, when applicable, the change in subsidy.

Summaries of each premium decision are available on the MIA’s premium review website at HealthRates.mdinsurance.state.md.us. Sample approved 2025 premiums for all companies by geographic region also are available online. The sample premiums do not reflect any employer contribution, any financial assistance a consumer may receive to reduce premiums or cost sharing for plans purchased through the state’s health insurance marketplace, MarylandHealthConnection.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.