Connecticut: Final avg. 2021 #ACA premiums: FLAT (indy market), +4.1% (sm. group)

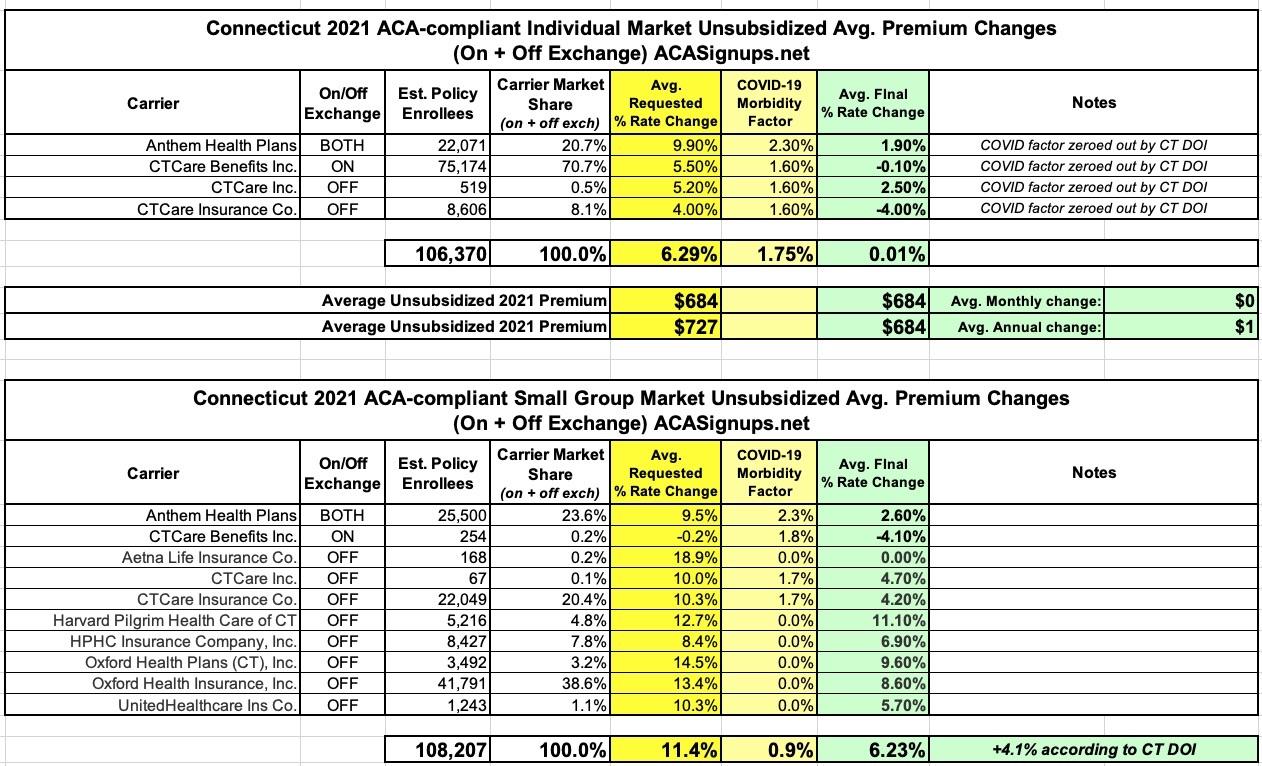

Back in July, the Connecticut Insurance Dept. posted the preliminary 2021 rate filings for the individual and small group market carriers. On average, they were seeking rate increases of 6.3% for the individual market and 11.3% for the small group market.

Today, the CT DOI issued their final rate change rulings, and the difference are pretty dramatic:

Insurance Commissioner Issues Decisions For 2021 Health Insurance Rates

Insurance Commissioner Andrew N. Mais today announced the Department has made final decisions on health insurance rate filings for the 2021 coverage year. As a result of these decisions, approximately 214,600 Connecticut consumers are projected to save $96 million.

The Department approved an average increase for individual plans of 0.01 percent, down from the average request of 6.29 percent. The average increase for small group plans is 4.1 percent, down from the requested average of just over 11.28 percent.

“Working on behalf of consumers, the Department was able to reduce the health insurance rate increase requests thanks to the hard work of our actuaries and professional staff,” Commissioner Mais said. “I will continue to work collaboratively with all stakeholders to find long-term savings while continuing to promote access and eliminate barriers to coverage here in Connecticut.”

Medical trend, a factor that includes rising health care costs such as the costs of prescription drugs and the increased demand for medical services, is rising at approximately 8.8 percent. Other factors contributing to the final decisions include the removal of adjustments attributed to the impact of COVID-19 and the removal of adjustments that reflected morbidity deterioration.

Most insurance carriers have already stated that they think COVID-19 will have a nominal net impact on 2021 premiums (or they simply couldn't decide how much impact it will have, so ignored it completely in their preliminary filings), but this is the first time I've seen a state regulator specifically state that they're requiring the carriers to remove any COVID factor entirely. Huh.

Here's what the preliminary and final rate changes look like in both markets...as you can see, the change by state regulators is pretty dramatic in most cases. I'm not sure where CT DOI gets the 4.1% average for the small group market, however; I get a final average of +6.2%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.