New York: APPROVED avg. 2021 #ACA premiums: +1.8% indy market, +4.2% sm. group

Hmmm...back in June, the New York Dept. of Financial Services published the preliminary 2021 rate filing requests for the individual & small group markets. As I noted at the time:

Hmmmm....some of these seem suspiciously high, at least as compared to the handful of other states which have released their preliminary requests so far, but we'll have to see...

Well, today the NY DFS issued the approved 2021 rates for both markets, and sure enough, they've been reduced pretty significantly:

DFS ANNOUNCES 2021 HEALTH INSURANCE PREMIUM RATES, PROTECTING CONSUMERS DURING COVID-19 PANDEMIC

- Rate Increase for Individual New Yorkers Held to 1.8%, Lowest Ever Approved

- Overall Requested Rate Increase for Individual Coverage Reduced by 85%, Saving Consumers Over $221 Million

- Rate Increase for Small Groups Held to 4.2%, Second Lowest Ever Approved

- Overall Requested Rate Increase for Small Group Coverage Reduced by 63%, Saving Small Businesses Over $565 Million

Superintendent of Financial Services Linda A. Lacewell announced today that the New York State Department of Financial Services (DFS) is steadfastly protecting consumers by reducing health insurers’ 2021 requested rates. Rates in the individual market will increase by only 1.8%, the lowest increase for individuals since DFS regained prior approval authority of premium rates a decade ago. Similarly, the 4.2% rate increase for small group plans is the second lowest ever approved by DFS during that period.

DFS reduced 2021 requested rates in New York’s individual market by 85% overall, saving consumers over $221 million. DFS also reduced 2021 requested rates for small group plans by 63%, saving small businesses more than $565 million. Over 1.2 million New Yorkers are enrolled in individual and small group plans.

“New York stepped up and flattened the curve, but consumers are still feeling the economic effects of the pandemic. Our number one job is consumer protection and ensuring that quality, affordable health care is available to everyone in the state,” said Superintendent Lacewell. “This year marks the tenth anniversary of the Affordable Care Act’s passage and, even as the federal government is trying to repeal the ACA – in the middle of the worst pandemic in a century – New York is fighting to ensure consumers’ access to affordable health insurance coverage and help maintain a robust, competitive marketplace.”

Some health insurers are reporting record profits for the first half of 2020 due to the postponement of elective and non-emergency services, resulting in lower claim pay outs than expected. Any excess premiums that insurers collected must be returned to policyholders under the ACA. Later in 2021, CMS will determine any rebates that may be owed to consumers based on a review of all 2020 claims. DFS notes that there is uncertainty as to future claims and that profits reported so far this year could be offset by higher than expected claim pay outs in the second half of 2020 and in 2021 as elective and non-emergency services resume.

Yep, that's the ACA's Medical Loss Ratio rule.

Additionally, the continued rise of health care costs is the main driver of premium rates, as in prior years. For the 2021 individual rates announced today, drug costs account for the largest share of medical expenses (37.7%), followed by inpatient hospital costs (17.3%), outpatient hospital costs (8.7%), primary care (7.7%), and radiology (6.4%).

Although the 2021 rate increases are historically low, federal tax subsidies under the ACA will help mitigate the impact of the increases even further for some individuals purchasing coverage through the New York State of Health marketplace. Approximately 60% of marketplace enrollees receive the federal Advance Premium Tax Credit (APTC). The APTC amount is on a sliding scale for enrollees with incomes up to 400% of the Federal Poverty Level (FPL), which represents approximately $51,040 for individuals and $104,800 for a family of four. The amount of the APTC is set by the second lowest cost silver plan in each county. Premiums in the individual and small group markets will also be lower in 2021 due to the repeal of the ACA health insurance tax.

Under the leadership of Governor Andrew M. Cuomo, New York has been a national leader in helping consumers through the pandemic, ensuring that New Yorkers have access to critical COVID-19 testing and essential health care services, by taking the following actions, among others:

- Creating a special enrollment period, which enabled almost 8,000 uninsured New Yorkers to apply for health insurance coverage,

Ah, there you have it: I finally have the QHP enrollment for New York's COVID-19 SEP. 8,000 people may seem low (for comparison, California has enrolled 230,000 people this way; when adjusted for population, that would translate into perhaps 115,000 in New York). HOWEVER, New York is one of only two states utilizing the ACA's "Basic Health Program" which covers roughly 800,000 residents who would otherwise be eligible for heavily-subsidized ACA exchange plans instead...and since enrollment in NY's BHP program (the Essential Plan) is year-round, the COVID SEP is irrelevant for that population anyway.

- Waiving all cost-sharing for COVID-19 testing and all telehealth services (whether related to COVID-19 or not),

- Allowing COVID-19 and antibody testing to be conducted at pharmacies,

- Waiving all cost-sharing for mental health services for essential workers,

- Suspending certain utilization review so hospitals could treat patients without undue administrative burdens,

- Requiring health insurers to defer over $53 million in premium collections for more than 16,000 small group and individual policyholders experiencing financial hardship due to COVID-19 without imposing late fees or penalties,

- Collaborating with dental insurers to provide millions of dollars in premium credits to policyholders as dental offices were closed during the pandemic,

- Requiring that all insurers regulated by DFS have preparedness plans to address the operational risk, and identify, monitor, and manage the financial risk posed by COVID-19, and

- Requiring insurers to make sure that participating providers do not charge extra fees to policyholders for Personal Protection Equipment (PPE).

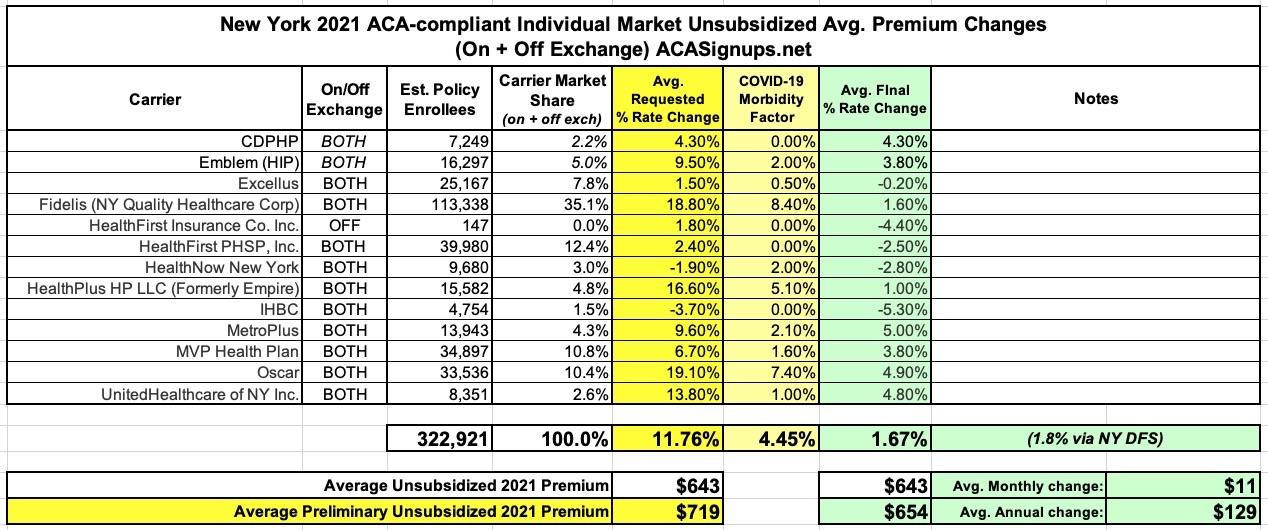

Individual Market

Rates for individuals are more than 55% lower than prior to the establishment of the New York State of Health in 2014, adjusting for inflation but not counting federal financial assistance that the ACA makes available to many consumers purchasing insurance. Approximately 323,000 New Yorkers are currently enrolled in individual commercial plans.

"More than 55% lower than prior to the establishment of the exchange in 2014"? Hmmm...that sounds vaguely familiar...

DFS reduced insurers’ total weighted average increase requested for individuals by 85%, from 11.7% to 1.8%, the lowest ever approved.

These rates will be further reduced for many consumers who are eligible for federal tax credits. Under the ACA, households between 200% and 400% of the federal poverty level ($51,040 for individuals and $104,800 for a family of four in 2020) qualify for federal tax credits, which will reduce premium costs. Households below 200% of the federal poverty level can qualify for the Essential Plan. In 2020, approximately 60% of individuals who enrolled in a Qualified Health Plan on the Marketplace received financial assistance, which effectively held those consumers harmless from the impact of premium increases.

These rate decisions do not include the Essential Plan, available only through the New York State of Health, which will still have premiums of $20 or less for lower-income New Yorkers who qualify. More than 830,000 New Yorkers were enrolled in the Essential Plan as of July 31, 2020.

Interesting...again, NYSoH reported around 800K enrolled in the Essential Plan as of the end of January, so around 30,000 more have enrolled since then. Adding those to the 8,000 QHP enrollees is still just 38,000 New Yorkers, versus ~115,000 if they enrolled at the same rate as Californians. Huh. Obviously there are other demographic/socioeconomic differences between the states, but that still seems a bit low.

Anyway, regarding the dramatic drop between the requested and approved rates: What happened here? Don't get me wrong, a big part of the job of state insurance regulators is indeed to double-check the insurance carriers' math and decide whether or not they feel the requested rates are reasonable or not. If they decide they aren't justified, regulators in most (not all) states have the authority to hack those rate hikes down...or in some cases to actually require a rate decrease. This combined with the ACA's MLR rule (as well as competition, I suppose), is what keeps insurance carriers from price gouging...or at least it keeps the gouging within certain limits.

Having said that, regulators didn't just nip & tuck the 2021 rates in New York--they cut down every carrier's request across both markets with just one exception (CDPHP individual market)...and in many cases they cut them down dramatically. Obviously this is a good thing, but it does make me wonder about the process of the original requests.

To be fair, New York was hit the hardest of any state by COVID-19 back in March/April, and they were one of the first states to post their preliminary rate filings as well, so it might just be a case of backing off of the avg. 4.5% COVID-19 factors they were originally asking for.

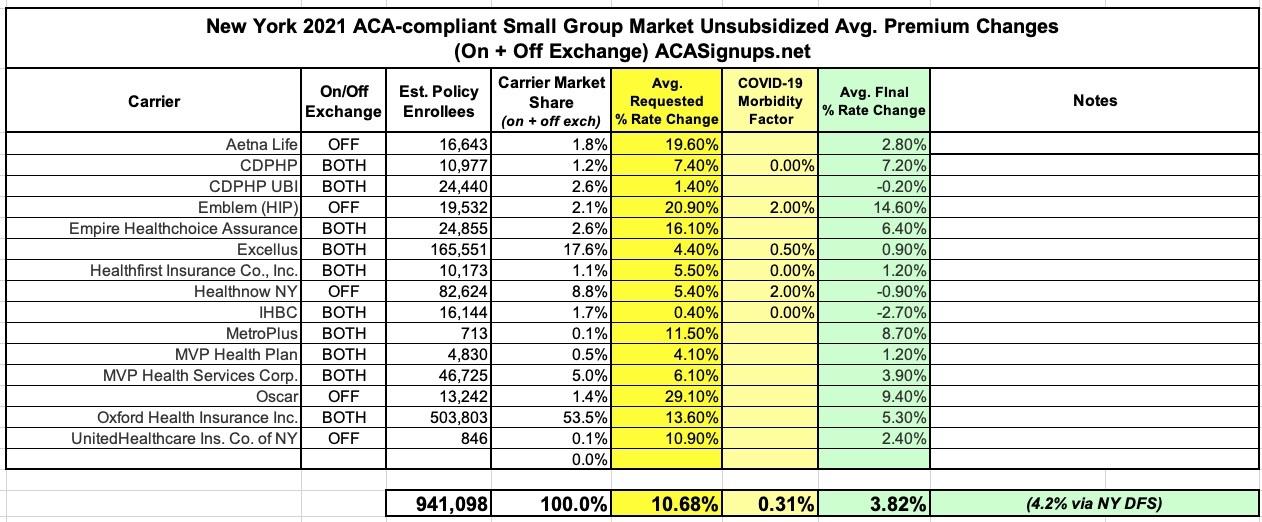

Anyway, here's what both the indy and sm. group markets look like in the end:

Small Group Market

More than 900,000 New Yorkers are enrolled in small group plans, which cover employers with 1 to 100 employees. Insurers requested an average rate increase of 11.4% in the small group market. DFS cut the weighted average requested rate increases by 63%, from 11.4% to 4.2% for 2021, the second lowest increase ever approved, saving small businesses over $565 million. A number of small businesses will also be eligible for tax credits that may lower those premium costs even further.