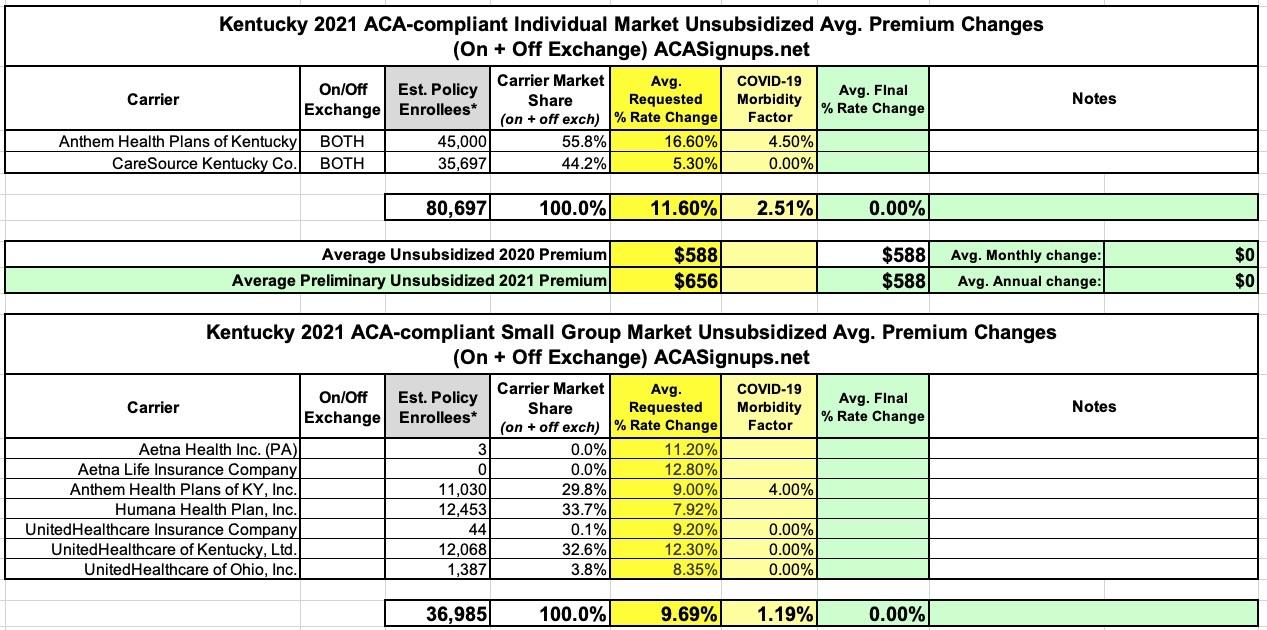

Kentucky: Preliminary avg. 2021 #ACA premiums: +11.6% indy market, +9.7% sm. group market

The Kentucky Insurance Dept. has posted KY's preliminary 2021 rate filings for the individual and small group markets, and the requested average rate increases for both are unusually high compared to the other states which have submitted their filings so far. In another unusual development, most of the carriers on each market are being pretty specific about the impact (or lack thereof) on their 2021 rate filings from the COVID-19 pandemic (I only have UnitedHealthcare posted once but they account for three of the seven small group carriers listed.

Anthem Health Plans of KY (individual market):

The projected population consists of expected retention of existing policies and new sales. The sources of new entrants include the previously uninsured population, grandfathered and transitional policies voluntarily migrating to ACA‐compliant plans, and previously insured populations from other markets or carriers. The morbidity adjustment reflects projected Anthem and market changes in morbidity. Prior experience has exhibited market shrinkage and morbidity increases year over year. With anticipated growing market volatility, the expectation is that selective lapse and market deterioration will continue in 2021 due to increased selective entry and exit as members make health care decisions in the guaranteed issue, community rated ACA marketplace. We assume that this typical market deterioration pattern will be more pronounced in 2021 due to uncertain economic conditions, loss of group coverage and income loss. We assume that this selective shifting into and out of the individual market will lead to a 3.6% increase in morbidity.

The morbidity also includes a 4.5% single year addition to reflect the 2021 rebound of elective procedures deferred in 2020 during the COVID‐19 pandemic. Exhibit E shows the morbidity factor.

CareSource Kentucky:

Due to this uncertainty, we have chosen not to make an adjustment to the 2021 premium rates. It is possible that the COVID-19 pandemic could have a material impact on morbidity, enrollment, providers, and other factors related to the Individual market. If subsequent information becomes available that would materially affect this rate filing submission, we would likely pursue opportunities to revise our pricing assumptions and resubmit this rate filing.

Anthem Health Plans of KY (small group market):

The projected population consists of expected retention of existing policies, transitional policies voluntarily migrating to ACA-compliant plans, and new groups to Anthem. The morbidity impacts of population movement are based on the experience period risk score data and estimated risk scores of the projected population. The morbidity includes a 4.0% single year addition to reflect the 2021 rebound of elective procedures deferred in 2020 during the COVID‐19 pandemic. Exhibit F shows the morbidity factor.

UnitedHealthcare Insurance Co:

At this time due to the significant uncertainty of the impact of the effects of COVID-19 on health care costs we have chosen to not reflect its impact in this proposed rate development. We thank the department for the flexibility that they have given all carriers to adjust rates during the review period and we anticipate revisiting that assumption as more data becomes available.

Overall, here's what it looks like for each market: An average 11.6% increase request for the individual market (with COVID making up 2.5 points of that) and a 9.7% increase for the small group market (COVID = 1.2 points):

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.