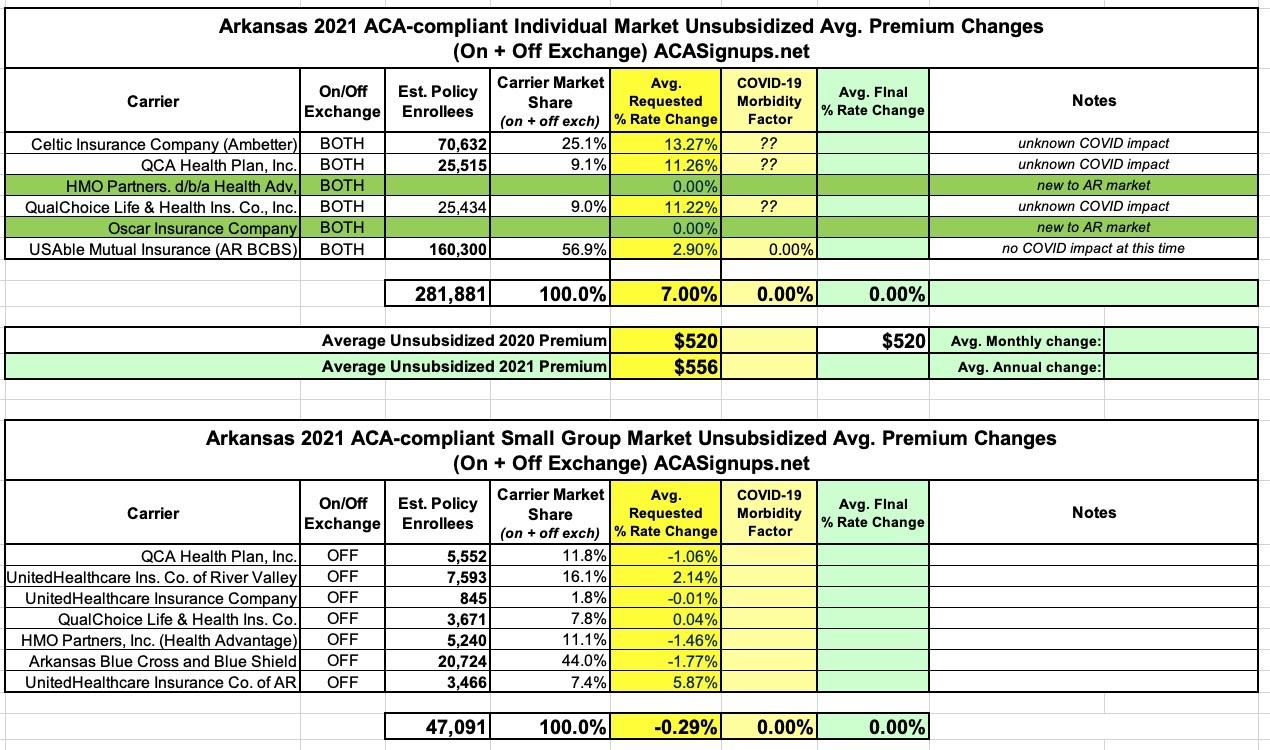

Arkansas: Preliminary avg. 2021 #ACA rate changes: +7.0% indy market, -0.3% sm. group market

via the Arkansas Insurance Dept:

Health Insurance Rate Changes for 2021

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Arkansas Insurance Department for review and approval before plans can be sold to consumers.

The Department reviews rates to ensure that the plans are priced appropriately. Under Arkansas Law (Ark. Code Ann. § 23-79-110), the Commissioner shall disapprove a rate filing if he/she finds that the rate is not actuarially sound, is excessive, is inadequate, or is unfairly discriminatory.

The Department relies on outside actuarial analysis by a member of the American Academy of Actuaries to help determine whether a rate filing is sound.

Below, you can review information on the proposed rate filings for Plan Year 2020 individual and small group products that comply with the reforms of the Affordable Care Act.

Users will only be able to view the public details of the filing, as certain portions are deemed confidential by law (Ark. Code Ann. § 23-61-103).

Arkansas is one of the states which does a fantastic job of doing most of the hard work for me: They post a nice, easy to follow table with the carrier names, on/off exchange status, average rate change requests and, vitally important: They also include the number of enrollees in every carrier's plans impacted by the rate changes. In addition, they provide easy links to PDFs of both the summarized and detailed actuarial memos as well!

UPDATE: (sigh) Unfortunately, those "impacted enrollee" numbers are off on some of the carriers...the actual filing memos include larger numbers for some of them, which are reflected in the tables below.

Thanks to this, calculating the weighted average rate changes for both the individual and small group markets was easy: +7.0% for the individual market, -0.3% for the small group market. Arkansas' small group market looks remarkably small compared to their individual market, but it's important to remember that over 75% of Arkansas' indy market is actually composed of residents enrolled in their unique "Medicaid Private Option" program, in which they're enrolled in private ACA policies which the government pays for using Medicaid-allocated funds. The "actual" individual market in the state is only around 60,000 or so, only a bit larger than their small group market's 47,000.

As for COVID-19, several of the carriers do mention it as being a "significant factor"...in fact, three of the four have almost identical wording:

54.0% of the 11.258% total request is due to Other, defined as: "Morbidity & Risk Adjustment changes, Increase in CSR cost. Note that COVID-19 impacts cost trend, morbidity, and the statewide average premium component of the risk adjustment transfer."

54.0% of the 13.2670% total request is due to Other, defined as: "Morbidity & Risk Adjustment changes, Increase in CSR cost. Note that COVID-19 impacts cost trend, morbidity, and the statewide average premium component of the risk adjustment transfer."

"54.0% of the 11.215% total request is due to Other, defined as: "Morbidity & Risk Adjustment changes, Increase in CSR cost. Note that COVID-19 impacts cost trend, morbidity, and the statewide average premium component of the risk adjustment transfer. ”

For USAble (BCBS of AR), they state:

Given the impact of the COVID-19 pandemic on the healthcare system, UMIC took into consideration whether claim costs for the 2021 projection year should be adjusted to reflect higher claim costs associated with COVID-19. Ultimately, UMIC decided against making any assumptions that would increase the 2021 proposed rate change. By excluding any adverse impact to the projected 2021 claims for COVID-19, UMIC will rely on Capital and Surplus to fund COVID-19 related costs that exceed (are in excess of) the underlying claims cost being projected for the 2021 plan year.

Overall, this makes it sound like COVID-19 is a large part of roughly ~6.4 points of the rate hike for 3 of the 4 carriers (there's also two new carriers entering the Arkansas market: Health Advantage/HMO Partners and Oscar Insurance). However, none of them seem to break it down any more than that, so I don't know what portion of that 54% is specifically COVD-19 related.

Here's what it looks like overall:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.