Michigan: Preliminary avg. 2021 #ACA premiums: up 1.3% indy mkt, 1.5% sm. group

Michigan is the 8th state (by my count) where the insurance carriers have posted their preliminary 2021 premium rate change filings. Every year brings some new twist (in 2018 it was CSR reimbursement payments being cut off; in 2019 it was the zeroing out of the ACA's federal individual mandate penalty; in 2020 it was sort of the repeal of the ACA's health insurer tax (HIT), although that didn't actually happen until after 2020 premiums had already been locked in; and for 2021...it's the COVID-19 pandemic, of course.

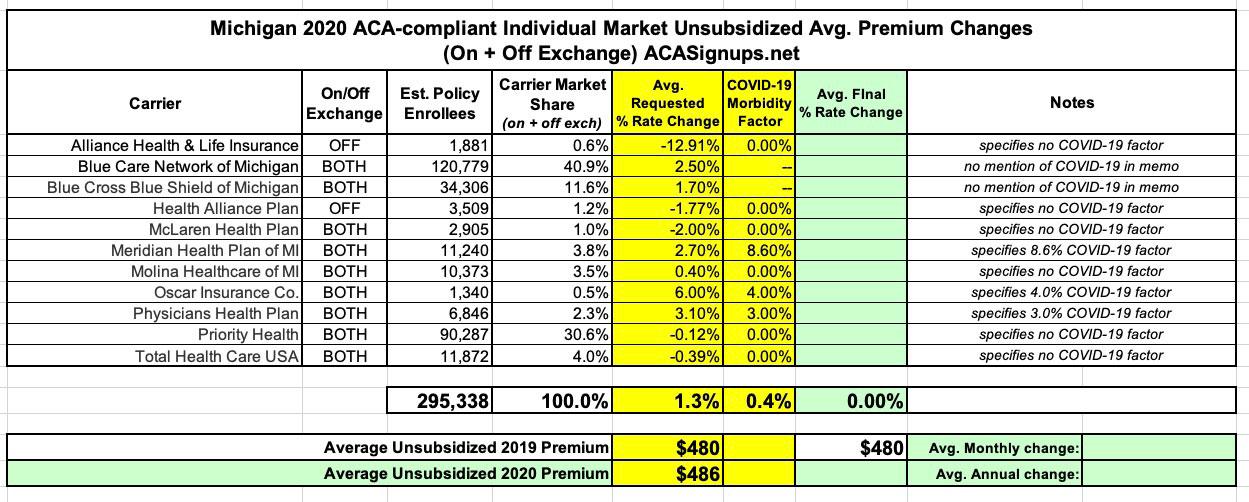

I've therefore added a new column for my weighted average rate change spreadsheets. So far only a handful of carriers have tacked on any substantial rate changes due to expected cost increases from testing & treatment of COVID-19 next year...the general rule of thumb seems to be that the added costs are pretty much gonna be cancelled out by reduced claims from non-COVID healthcare services (delayed/cancelled treatments/procedures, etc).

With that in mind and so many other unknowns, most carriers (so far) seem to be figuring either that these factors will cancel each other out or that there's simply too much uncertainty to even hazard a guess at the impact on their bottom line. As a result, most are settng their COVID morbidity factor at nothing one way or the other. In a few cases (oddly in Michigan this includes Blue Cross Blue Shield/Blue Care Network, which is by far the largest insurance carrier in the state), they don't even mention COVID-19 at all in their actuarial memo, not even to clarify a 0% change from it. Huh.

Of course, these are preliminary filings only--they're based on enrollment and projections made a month or more ago, and with things changing so quickly, pretty much every carrier made sure to note that they reserve the right to file modified rate changes later this summer, so these initial "who the heck knows?" 0% change entries could end up being quite different by this fall.

There are a few exceptions to this, however. Meridian Health Plan in particular is tacking on a whopping 8.6 points to their premiums due to COVID-19 (that is, they would be reducing their 2021 rates by 5.9 points otherwise). Oscar added 4 points, Physicians Health Plan 3 points.

All that being said, as of right now, Michigan's individual market carriers are requesting a weighted statewide average increase of just 1.3% in 2021, with COVID-19 only adding about 0.4% to the average overall:

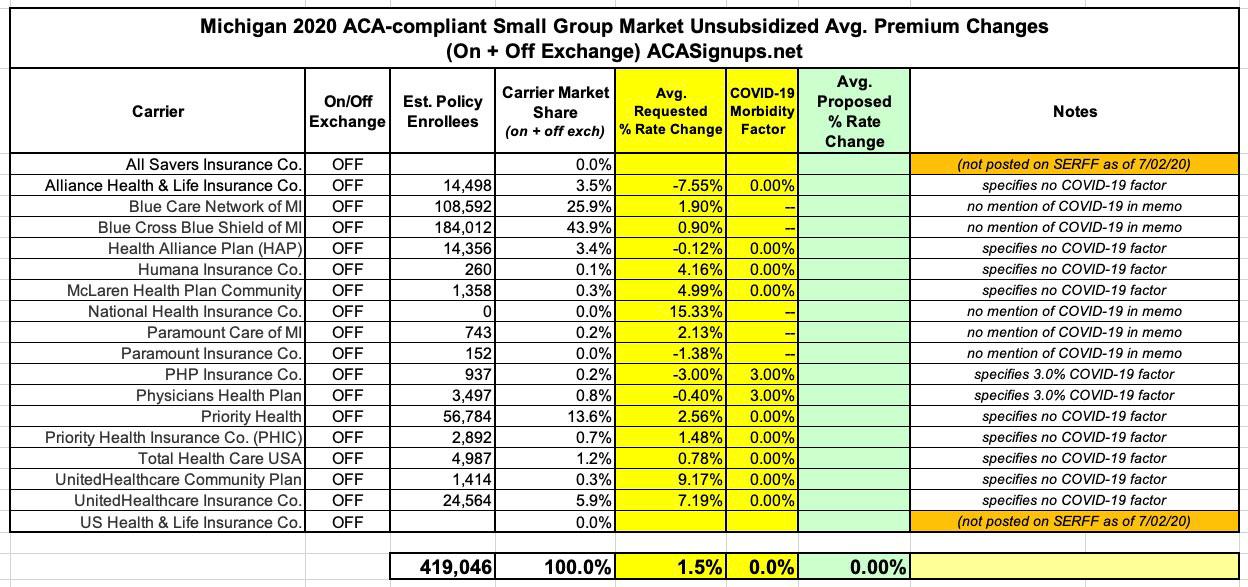

As for hthe small group market, it's pretty much the same story, with carriers making up 70% of the market not even mentioning COVID and only one other (or two) adding anything (PHP/Physicians Health Plan). Statewide, it's a nominal impact to the 1.5% weighted average increase being asked for.

It's also worth noting that neither All Savers nor US Health & Life are listed in the SERFF database as of today, although it's possible that they simply dropped out of Michigan's small group market (last year All Savers only had 14 enrollees, though US Health did have over 2,400):

UPDATE: The Michigan Dept. of Insurance & Financial Services has posted the official preliminary table and it's slightly different from what I have here (mostly re. enrollees) but not by much.