ACA 2.0: Virginia (VA-07): How much would #HR1868 lower YOUR premiums?

Over a year ago, I wrote an analysis of H.R.1868, the House Democrats bill that comprises the core of the larger H.R.1884 "ACA 2.0" bill. H.R.1884 includes a suite of about a dozen provisions to protect, repair and strengthen the ACA, but the House Dems also broke the larger piece of legislation down into a dozen smaller bills as well.

Some of these "mini-ACA 2.0" bills only make minor improvements to the law, or make improvements in ways which are important but would take a few years to see obvious results. Others, however, make huge improvements and would be immediately obvious, and of those, the single most dramatic and important one is H.R.1868.

The official title is the "Health Care Affordability Act of 2019", but I just call both it and H.R.1884 (the "Protecting Pre-Existing Conditions and Making Health Care More Affordable Act of 2019") by the much simpler and more accurate moniker "ACA 2.0".

The official lead sponsor of H.R.1868 is Rep. Lauren Underwood (IL-14). While it currently only has 39 cosponsors, the larger H.R.1884 bill that includes H.R.1868 has 161 total sponsors to date, so there's strong support within the Democratic caucus.

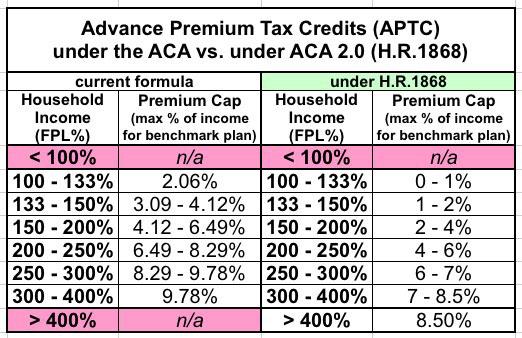

H.R.1868 itself is a very short and simple bill which does just two things, both of which involve changes to the current formula for ACA individual market subsidies:

- First, it removes the current tax credit maximum income eligibility threshold of 400% of the Federal Poverty Line (around $50,000/year if you're single, or $100,000/year for a family of four).

- Second, it makes the underlying formula for the tax credits more generous: Instead of the maximum amount the enrollee has to pay for a benchmark Silver plan ranging from around 2.1% of their income up to around 9.8%, H.R.1868 would drop this down to between 0% - 8.5% of income at the outside.

This may not sound like much, but it would make a huge difference for millions of Americans. The main beneficiaries would be the middle class...people earning too much to qualify for subsidies today, but not enough to easily afford ACA-compliant policies (basically, between 400 - 800% FPL). However, many of those who are already receiving subsidies would also see additional savings.

It's important to keep in mind that there are three main trouble spots when it comes to the individual market under the ACA: Premiums (mostly for the unsubsidized); deductibles/co-pays (for those earning more than 200% FPL); and provider network width. H.R.1868 addresses the first of these three, and it does so very well.

There are other provisions in the larger "omnibus" ACA 2.0 bill (and especially in the Senate version, S.1213) which deal with the other two, but for this project I'm only looking at the first: High premiums.

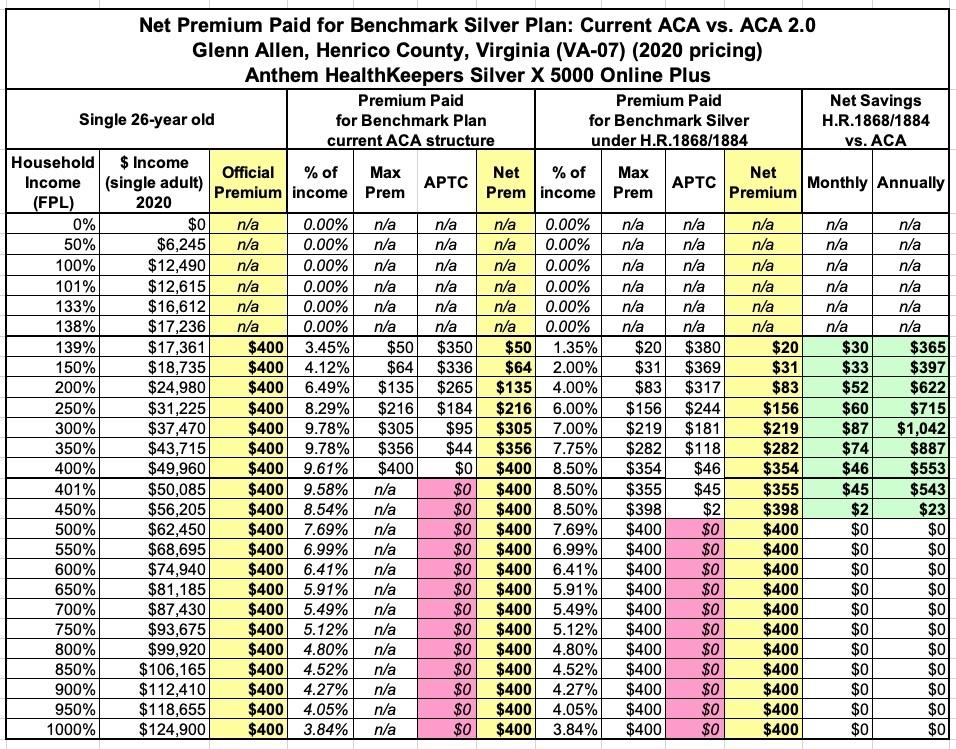

When I ran the numbers for my March analysis of H.R.1868, I used the national average premiums for Silver plans, which cover around 70% of the average person's medical expenses per year. However, that premium can vary greatly from state to state, county to county, carrier to carrier and even by the specific Silver plan you're looking at.

The actual measure is to look at the benchmark plan for the specific geographic area that the enrollee(s) live in. Under the ACA, the benchmark plan is the second lowest-cost Silver plan available on the ACA exchange.

It's important to understand that in addition to where they live, the benchmark plan premium will also vary greatly depending on...

- The number of people living in the household; obviously it will be different for a single adult vs. a family of four.

- The age of the enrollees: Unless you live in New York or Vermont, a millennial will cost a lot less than a baby boomer.

- In some states, children under 18 are eligible for CHIP or Medicaid at lower income levels even if the parents aren't.

- In states which have refused to expand Medicaid, those who earn 100-138% FPL are also eligible for extremely generous private plan subsidies.

- In Alaska and Hawaii, the FPL threshold is higher than in the rest of the country.

I was originally planning on running the numbers for H.R.1868 for all 435 Congressional Districts, but that was never realistic (I ended up completing just 14 of them by January). After that, well, I got sidetracked by other projects, and then of course the COVID-19 pandemic hit...

However, I've decided to go ahead and dust this project off again. I'm never gonna hit all 435 districts, but I should be able to get a couple dozen more completed over the next few months.

Today I've decided to take a look at Virginia's 7th Congressional District, represented by freshman Democratic Representative Abigail Spanberger.

Spanberger lives in Glenn Allen, Virginia, located in Henrico County, so let's see what H.R.1868 would look like for 8 different households:

- A single adult aged 26, 40, 50 or 64

- A single 30-year old parent with one young child

- A "nuclear family" (40-year old couple w/2 children age 12 & 10)

- A 50-year old couple with an adult child still on their policy

- A 60-year old couple

Ready? Here goes...

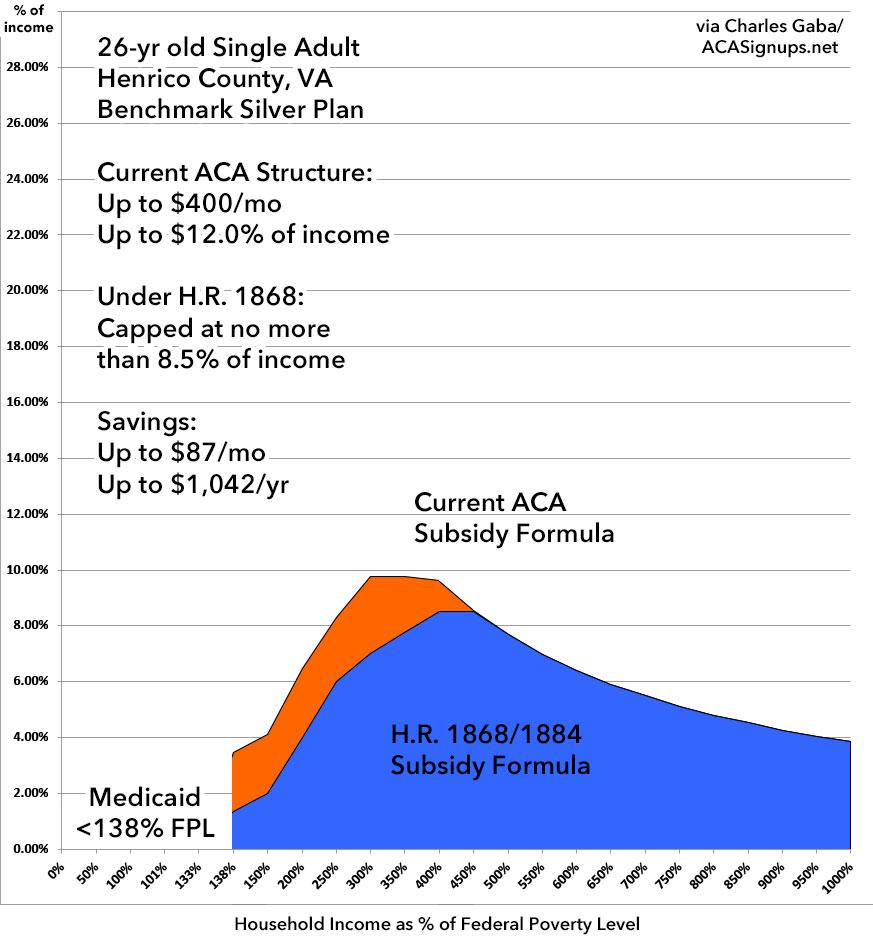

In 2020, for a single 26 year old, the benchmark Silver plan in Henrico County, VA runs exactly $400/month at full price. If they earn less than 138% FPL (around $17,200/year), they're eligible for Medicaid thanks to the ACA expanding the program. Between $17,200 - $50,000/year, they currently pay somewhere between $50/mo and full price. Since $400/mo never quite hits 9.78% of their income anyway, there isn't any "subsidy cliff" to speak of...but H.R. 1884 would still save them up to $87/month or up to $1,000/year:

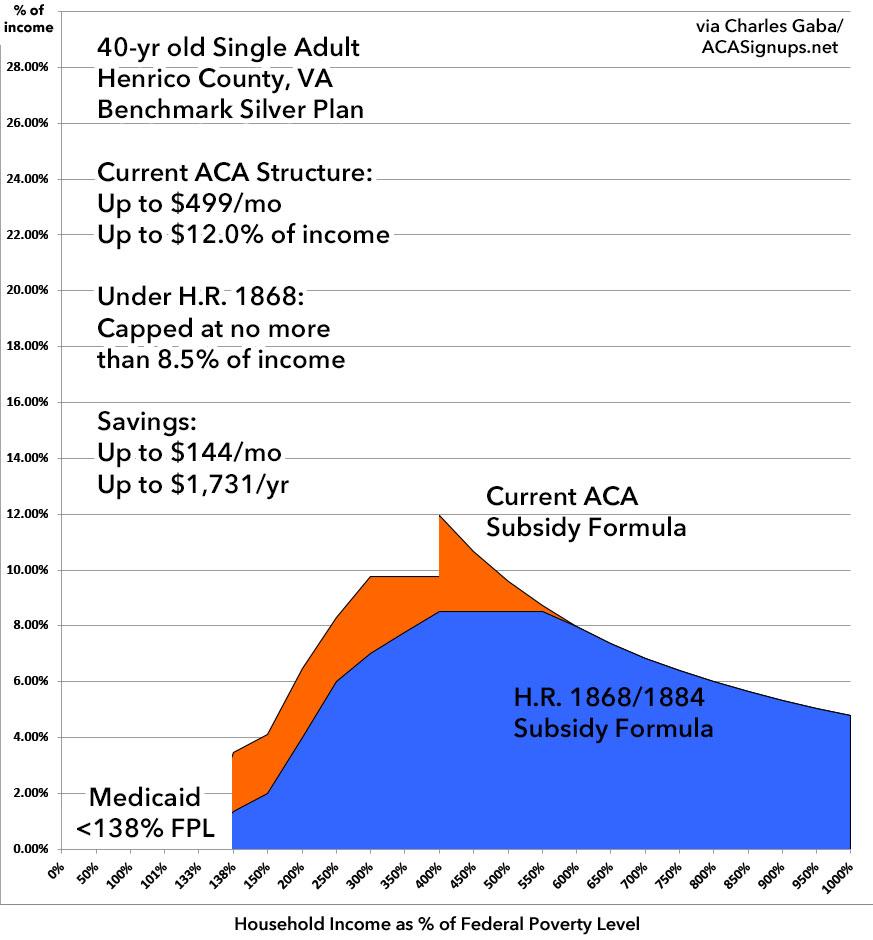

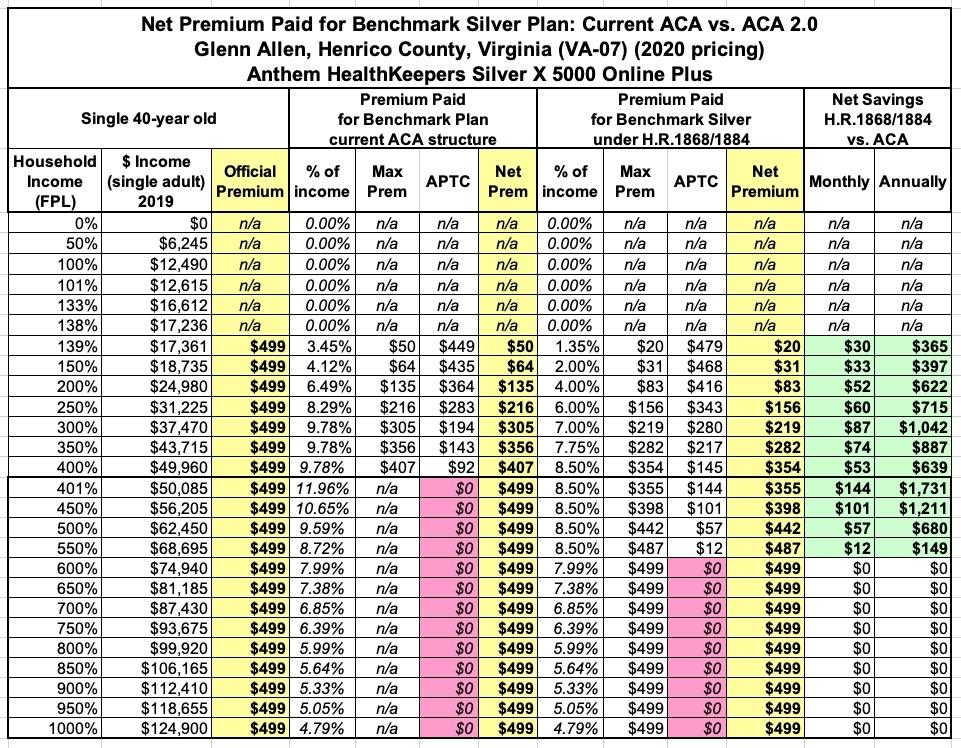

At 40 years old, the Subsidy Cliff starts to show up, but isn't too severe...at full price, the enrollee is paying $499/month, or as much as 12.0% of their income just over the 400% FPL cut-off. Under H.R.1868, this would be reduced to no more than 8.5% of their income, saving them up to $144/month or $1,700/year:

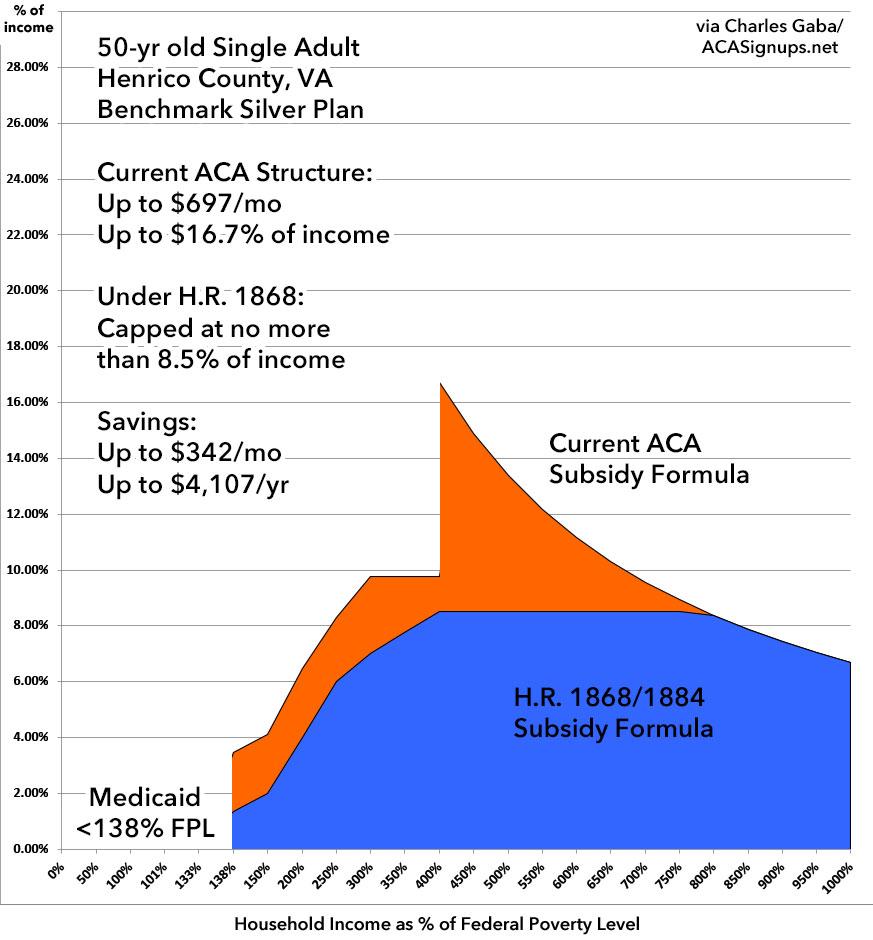

At 50 years old, the Subsidy Cliff starts to earn its name. At full price, our enrollee would be paying nearly $700/month, or as much as 16.7% of their income. Under H.R. 1868/1884, they'd save as much as $342/month or over $4,100/year:

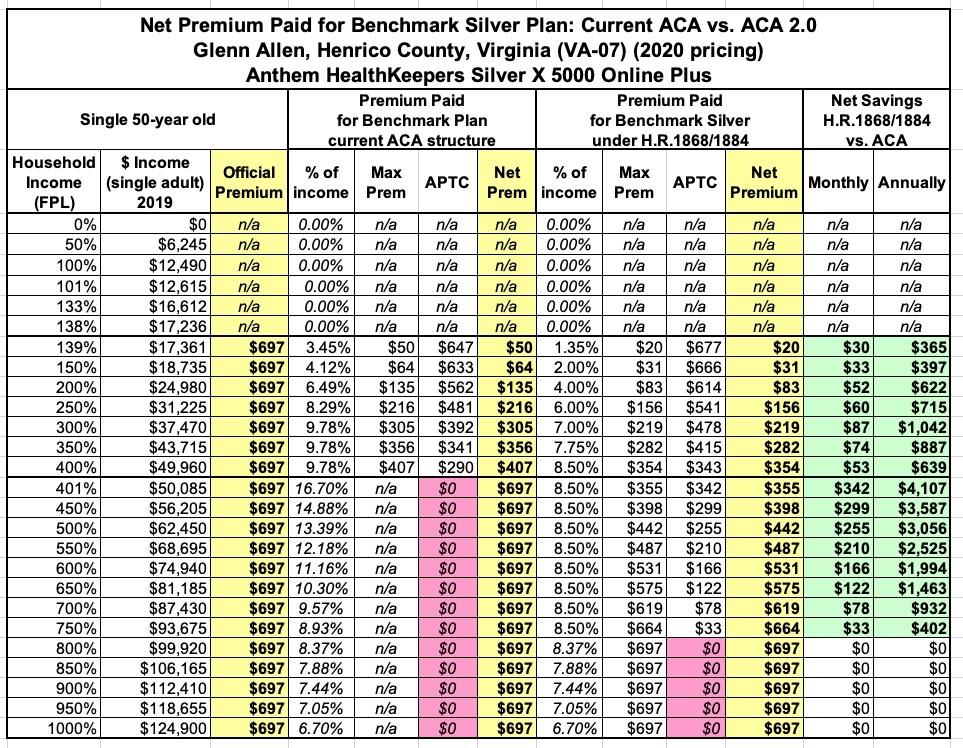

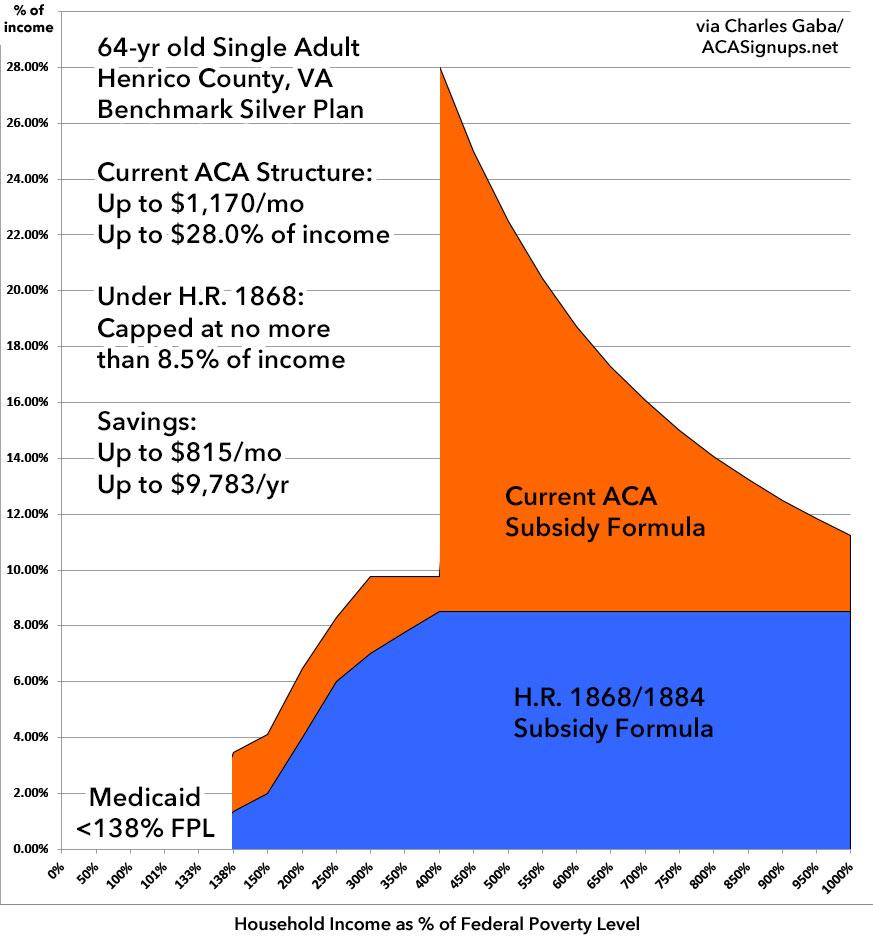

How about a 64-year old adult watching their calendar until they turn 65 and can transfer onto Medicare? Here's where the Subsidy Cliff becomes a Chasm: Under the current structure, the 64-year old would go from being capped at 9.8% of their income just below $50K/year to a whopping 28% of that as soon as their income moves even $1 over the line. Under H.R. 1868/1884, this would be reduced to no more than 8.5% of their income saving them as much as $815/month or a stunning $9,800/year:

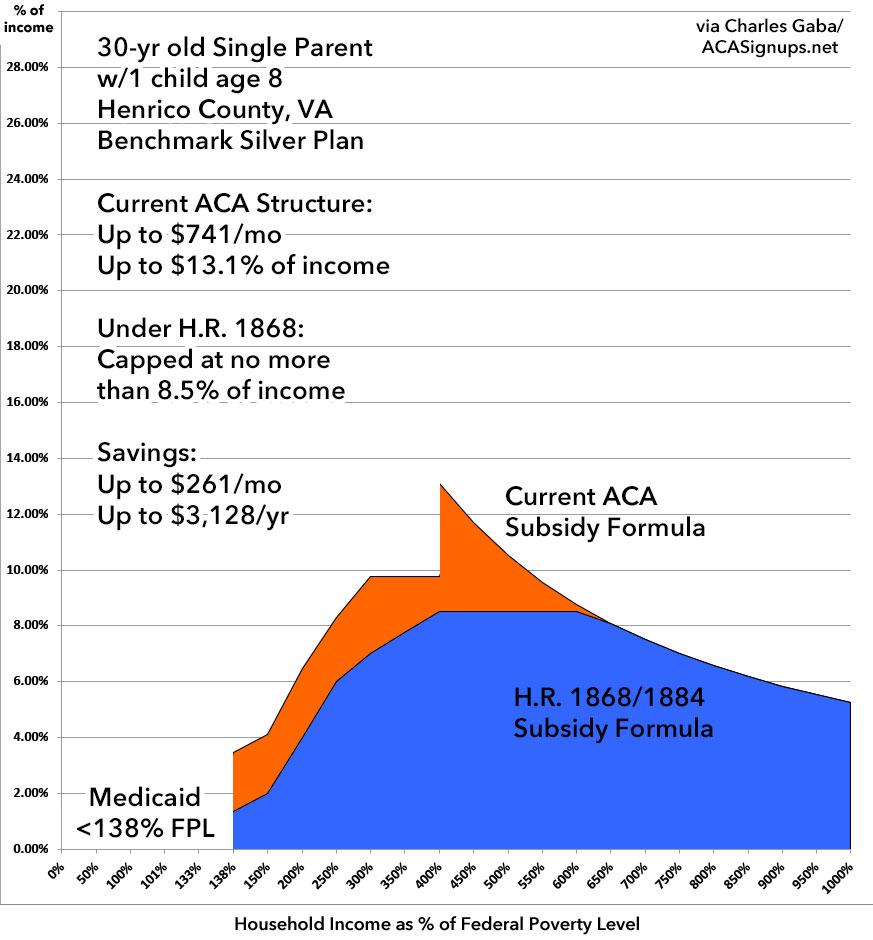

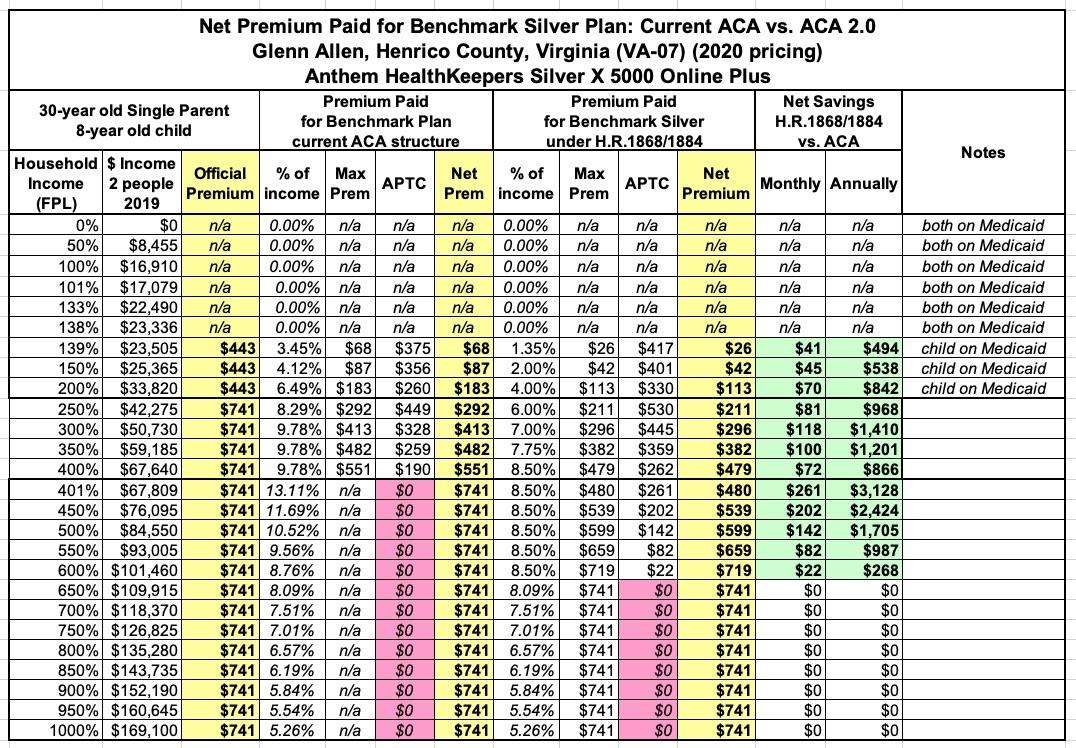

Next, let's move on to the family household scenarios. First, a Single Parent: 30 years old with one child. This gets a bit more complicated, because in Virginia, the child qualifies for the Children's Health Insurance Program (CHIP) up to 200% FPL income, but the parent only qualifies up to 138%. This means that from 138 - 200%, the kids is on CHIP while the parent is on a subsidized ACA plan.

Nevertheless, currently, the parent has to pay between $68/mo - $551/month in the 138 - 400% FPL range...but once they go over 400% FPL (around $68,000/year for a 2-person household), their premium jumps to $741, or over 13% of their income.

Under HR 1868/1884, capped at 8.5% at the outside, they would save as much as $261/month or over $3,100/year:

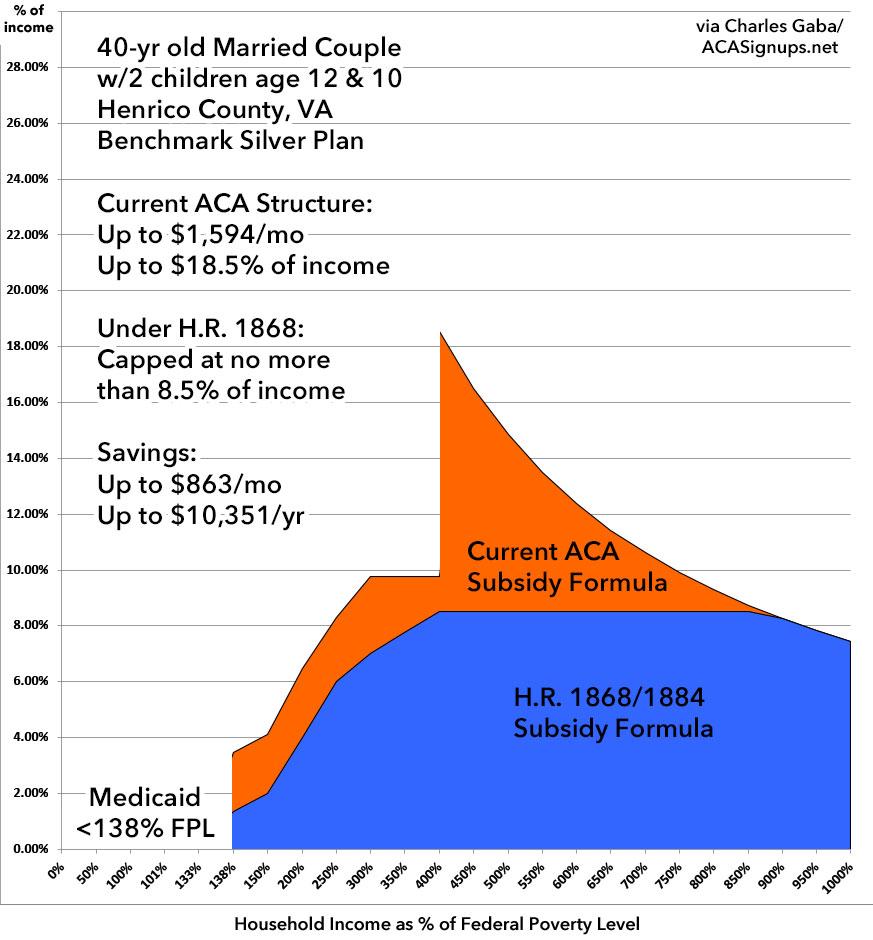

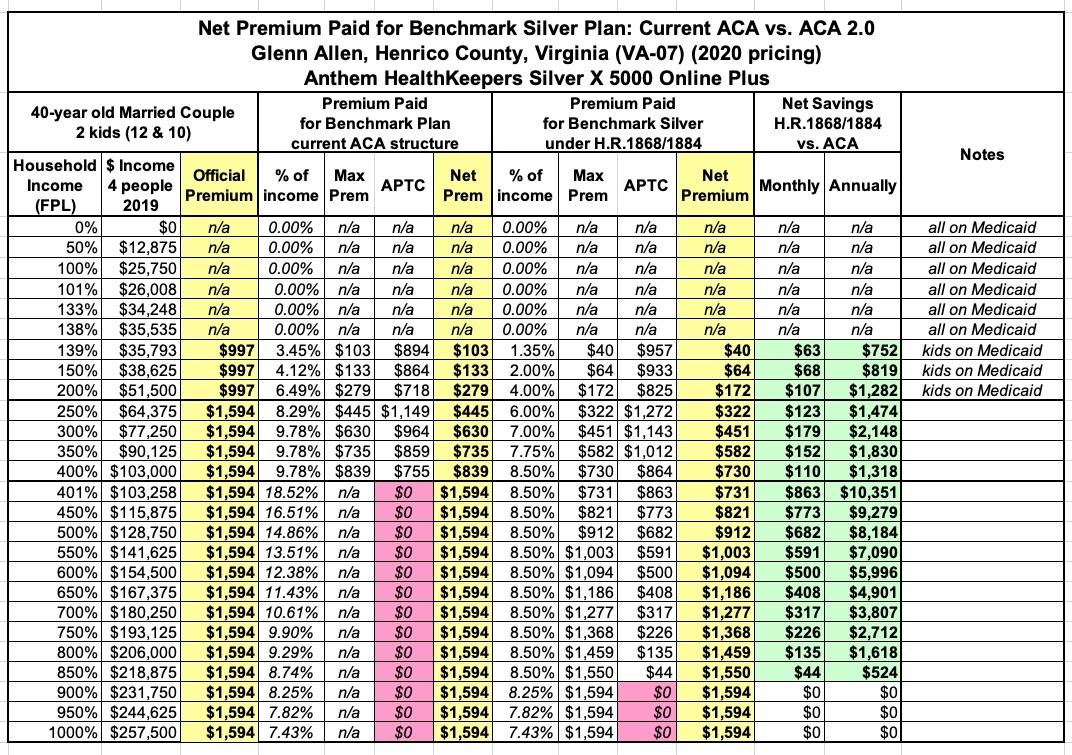

Next: The Nuclear Family...a 40-year old couple with two children. Again, the kids would be eligible for CHIP up to 200% FPL (roughly $50,000/year), while the parents would have to pay between $103 - $839/month if eligible for subsidies...but once they break 400% FPL ($103,000/year), their premiums jump to nearly double that, eating up as much as 18.5% of thier income.

HR 1868/1884 chops this down to no more than 8.5% of their income, saving this family up to a whopping $863/month or over $10,000/year!

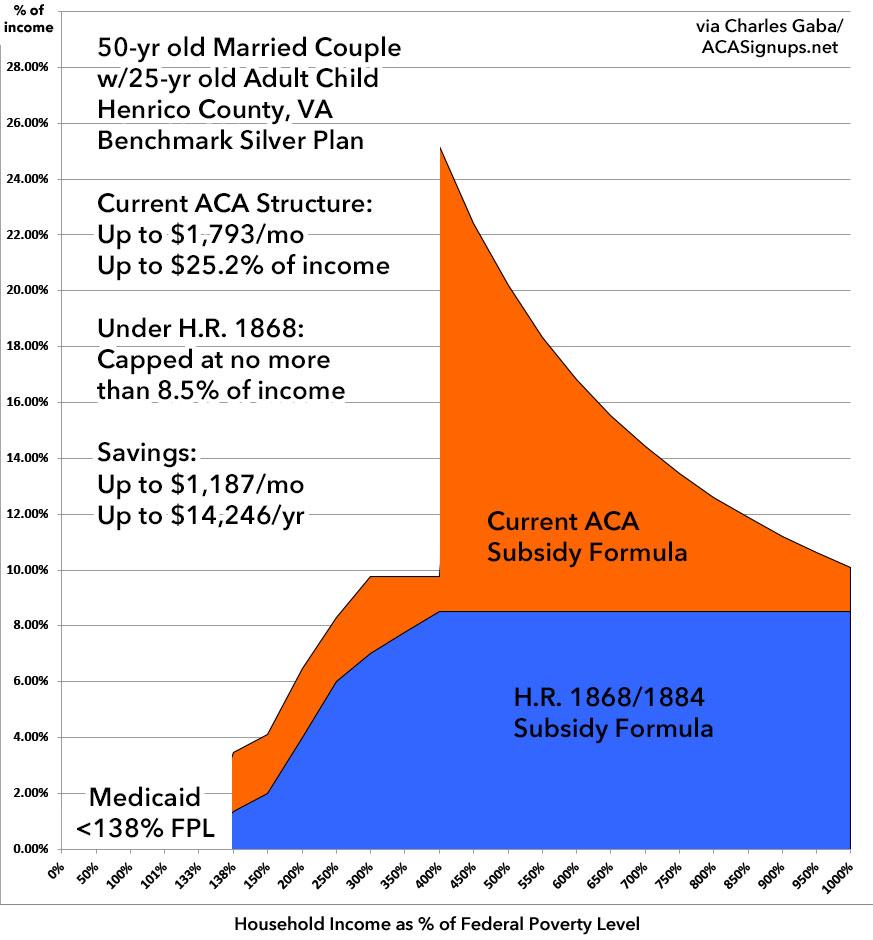

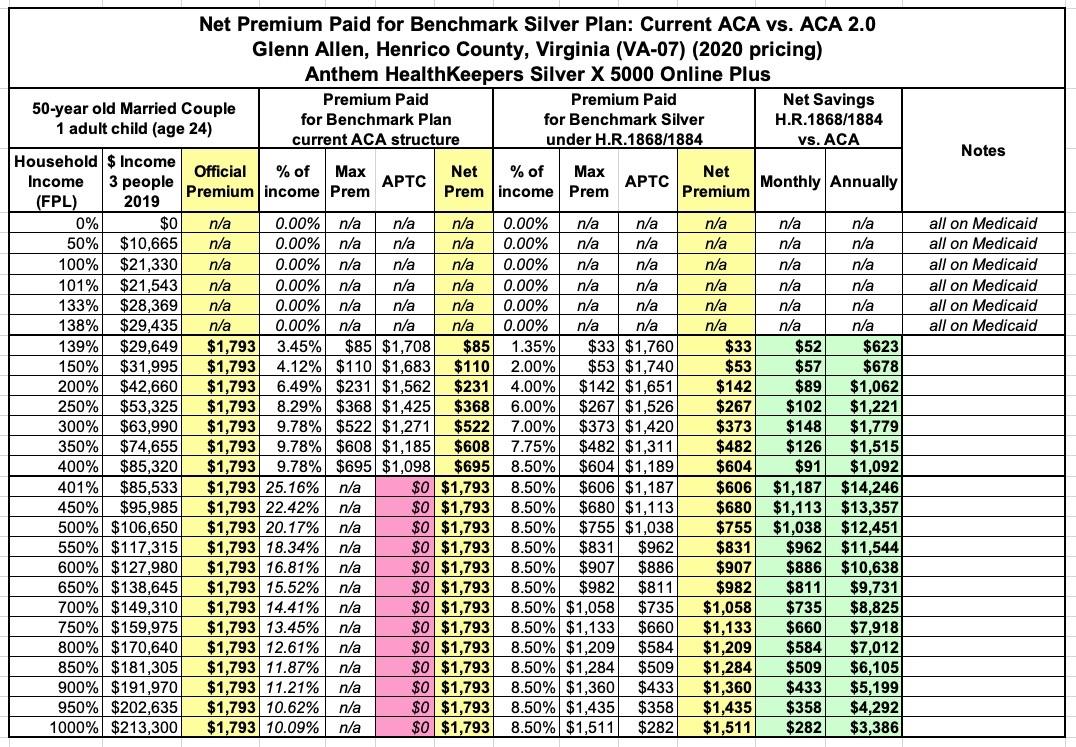

Next, let's look at a 50-year old couple who still has their adult child living with them. Thanks to the ACA, children can stay on their parents healthcare policy until age 26; let's say he's 25 years old.

Again, the subsidy cliff has become a chasm...full price for all three of them spikes from $695/month to nearly $1,800, more than 2.5x as much, or as much as a full quarter of their income. If HR 1868/1884 becomes law, this is hacked down to 8.5%, saving them up to $1,200/month or over $14,000/year:

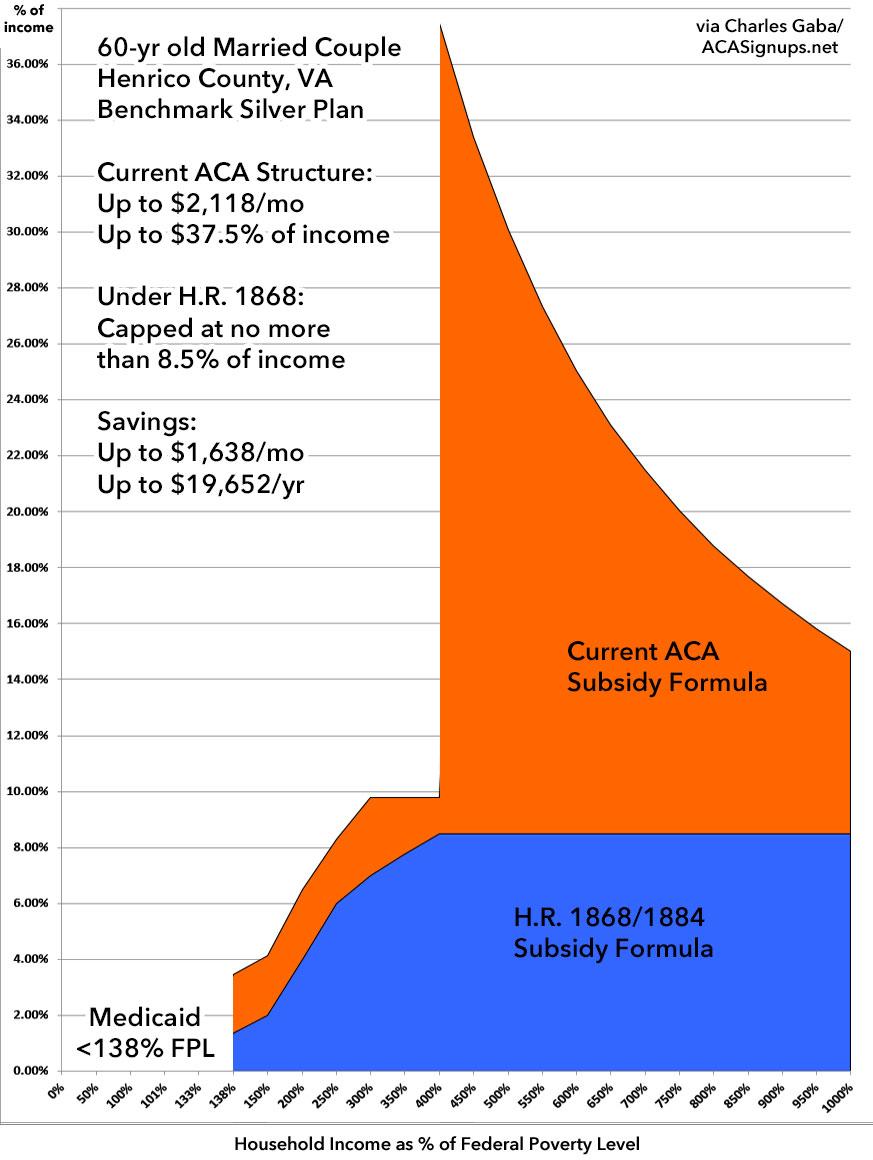

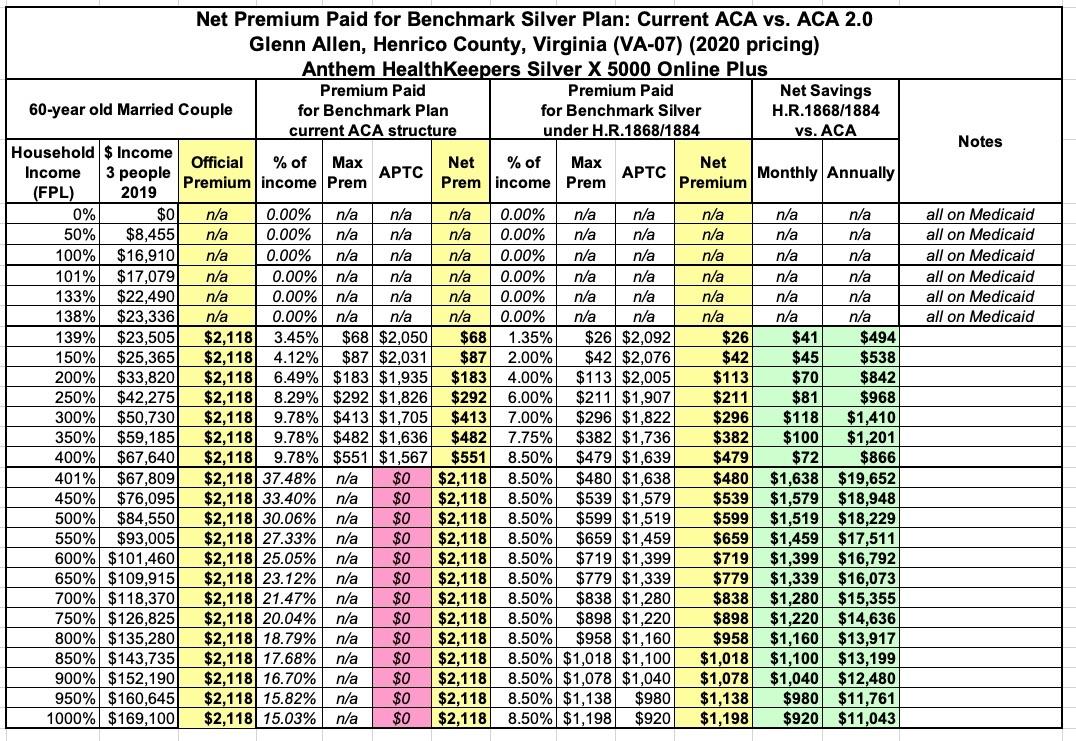

FINALLY, we come to the most obvious and brutal flaw in the ACA's subsidy structure: Older people just a few years away from Medicare. You saw how ugly it was for a single 64-year old, but it's even worse when you have a couple, since the Federal Poverty Line doesn't scale up on a 1:1 basis with the members of the household. Here's what it looks like for a 60-year old couple. Needless to say, no one earning $68,000/year can afford to pay more than 1/3 of that on healthcare premiums. HR 1868/1884 neatly solves this problem and saves this older couple up to a jaw-dropping $1,600/month or, potentially, over $19,600/year: