CARES Act unemployment insurance expansion will help many but also creates some misleading ACA enrollment scenarios...

Late last night, the U.S. Senate finally voted to approve a massive $2 TRILLION bailout/recovery bill in response to the Coronavirus pandemic. After a lot of haggling and drama, the final bill ended up passing unanimously, 96 - 0 (four Republican Senators weren't able to vote at all...due to being in self-isolation because of Coronavirus). It's expected to be quickly passed by unanimous consent in the House today and will presumably be signed by Donald Trump before nightfall.

And like that, the largest emergency economic influx bill in history is done.

There's a lot of explainers and thinkpieces being written about the bill as a whole...which elements are good, which are bad, which are flat-out offensive (especially the ~$500 billion in corporate giveaways, which still ended up in the final bill although they supposedly have some sort of oversight over which companies receive them and under what conditions), but my focus is of course on the healthcare aspects, and especially what it means for enrollment in ACA exchange plans and Medicaid via ACA expansion.

I'm off to a late start this morning, meaning that two of my colleagues, Andrew Sprung of Xpostfactoid and David Anderson of Balloon Juice, have already covered the unusual effects the CARES Act's unemployment insurance and one-time cash payouts will have on both existing and new enrollees of both programs.

First, let's look at what the bill actually does in terms of unemployment and other average worker compensation. There's like 2 dozen different provisions in the Unemployment Insurance section, but a lot of them are things like exempting alcohol used to make hand sanitizer from excise taxes and things of that nature. The main sections I'm concerned with here are:

Section 2102. Pandemic Unemployment Assistance

This section creates a temporary Pandemic Unemployment Assistance program through December 31, 2020 to provide payment to those not traditionally eligible for unemployment benefits (self-employed, independent contractors, those with limited work history, and others) who are unable to work as a direct result of the coronavirus public health emergency.

This is a godsend for folks like...well, my wife and I. Both of us are self-employed, so we normally wouldn't qualify for any unemployment insurance.

...Section 2104. Emergency Increase in Unemployment Compensation Benefits

This section provides an additional $600 per week payment to each recipient of unemployment insurance or Pandemic Unemployment Assistance for up to four months.

Every state has a different formula for calculating how much employees receive in unemployment, but they're all based on three main factors: How much you earned during a prior quarter of the year (13 weeks); a multiplier (let's say 50%), and a maximum cap. To use the example at this link, let's say you normally earn $60,000/year ($15K/quarter, or $1,154/week), your state uses a 50% multiplier and has a maximum cap of $450/week. You'd be eligible for $577/week, but since that's more than the $450 cap, you'd be limited to $450/week for up to 26 weeks.

The CARES bill increases this by a flat $600/week more per recipient, for up to 4 months (or up to roughly 17 weeks), so in the above example, the enrollee would presumably receive $1,050/week for up to 17 weeks and then $450/week for up to another 9 weeks.

Section 2105. Temporary Full Federal Funding of the First Week of Compensable Regular Unemployment for States with No Waiting Week

This section provides funding to pay the cost of the first week of unemployment benefits through December 31, 2020 for states that choose to pay recipients as soon as they become unemployed instead of waiting one week before the individual is eligible to receive benefits....Section 2107. Pandemic Emergency Unemployment Compensation

This section provides an additional 13 weeks of unemployment benefits through December 31, 2020 to help those who remain unemployed after weeks of state unemployment benefits are no longer available.

In most states, federal unemployment insurance is normally available for up to 26 weeks, so this would extend that out by up to an additional 13 weeks. Considering that we're already 12 weeks into the year, this means that someone filing for unemployment today would be eligible for it for the rest of this calendar year (especially since Section 2105 would provide compensation immediately instead of having to wait a week or so for it to kick in).

Again, to use the example above: Let's say the $60K/yr individual filed today and was unemployed for the rest of 2020. Their extra $600/week would still run out after 17 weeks (the third week of July), but their regular $450/week unemployment would keep flowing until the third week of September (26 weeks). This extends the regular unemployment benefits up through the end of December.

...Section 2201. 2020 recovery rebates for individuals

All U.S. residents with adjusted gross income up to $75,000 ($150,000 married), who are not a dependent of another taxpayer and have a work eligible social security number, are eligible for the full $1,200 ($2,400 married) rebate. In addition, they are eligible for an additional $500 per child. This is true even for those who have no income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits. For the vast majority of Americans, no action on their part will be required in order to receive a rebate check as IRS will use a taxpayer’s 2019 tax return if filed, or in the alternative their 2018 return. This includes many low-income individuals who file a tax return in order to take advantage of the refundable Earned Income Tax Credit and Child Tax Credit. The rebate amount is reduced by $5 for each $100 that a taxpayer’s income exceeds the phase-out threshold. The amount is completely phased-out for single filers with incomes exceeding $99,000, $146,500 for head of household filers with one child, and $198,000 for joint filers with no children.

OK, so in addition to the beefed-up/expanded unemployment benefits and the extension on the eligibility period, there will also be a one-time $1,200/person payment (+ $500/child).

The $60K/yr example above, if he or she started today and were unemployed all the way through the end of December, would receive a grand total of ($1,050 x 17 weeks) + ($450 x 22 weeks) + $1,200 (let's assume the enrollee is single) = $28,950.

Also keep in mind that this is in addition to whatever the enrollee earned before being laid off, through this past week. That should be roughly $13,800 for the first 12 weeks of 2020, making their grand total income for the year around $42,750....still a 29% pay cut for the year.

OK, so what does any of this have to do with the ACA or Medicaid expansion? Easy: MAGI (Modified Adjusted Gross Income). That's what's used to determine whether you're eligible for subsidies for ACA exchange policies as well as Medicaid expansion eligibility.

Remember, the official eligibility range for ACA exchange subsidies, based on the Federal Poverty Level, is:

In Medicaid Expansion states:

- 0 - 138% FPL = Medicaid; 138 - 400% FPL = ACA subsidies (on a sliding scale); > 400% FPL = neither

In NON-Medicaid Expansion states:

- 0 - 100% FPL = neither; 100 - 400% FPL = ACA subsidies (on a sliding scale); > 400% FPL = neither

For a single adult with no kids, 100% FPL = $12,490/year. 400% FPL = $49,960/year.

The $60K example above (who presumably also just lost their employer-sponsored insurance as well) was earning too much to be eligible for ACA subsidies before, but with their income dropping to $42,750, the enrollee would be eligible for some assistance if the benchmark Silver exchange policy cost more than around 9.8% of their income.

However, there's a twist, noted by the Brookings Institute's Loren Adler last night:

Making the increases to unemployment insurance go farther, the final COVID-19 emergency response bill disregards the new $600/week benefit for purposes of determining Medicaid/CHIP eligibility.

Base UI compensation would still count & both would count for ACA PTC determinations.

— Loren Adler (@LorenAdler) March 26, 2020

What this means is that for purposes of determining Medicaid/CHIP eligibility, the example above would only be counted as earning $32,550 for the year...which is still well above the $17,236/yr (138% FPL) limit for Medicaid anyway. It would still count for ACA subsidies, however.

In this case, the $600/wk disregard doesn't change anything. But what about at the lower end of the subsidy threshold? Crossing below the 138% FPL line in a Medicaid expansion state means the difference between being enrolled in Medicaid proper or a heavily-subsidized exchange plan. Crossing below the 100% FPL line in a Non-expansion state means the difference between a heavily-subsidized exchange plan and nothing whatsoever.

Besides the Medicaid (or Medicaid Gap) / Subsidized ACA line, there's also two other critical income thresholds within the ACA subsidy range: 94% CSR (up to 150% FPL) and 87% CSR (150 - 200% FPL). Crossing over or under any of these lines can mean the difference between thousands of dollars in deductibles and other cost-sharing and only a few hundred dollars. It's really the 100/138%, 200% and 400% lines which are most critical.

Andrew Sprung has done the math on a few case studies which generate some interesting situations and dilemmas:

In the marketplace, Strong Cost Sharing Reduction (CSR) is available up to 200% FPL ($24,980 individual, $51,500 for four). The marketplace value proposition is much weaker for people with incomes over 200% FPL. Silver plan deductibles average over $4,000 for enrollees over this threshold (slightly less at 200-250% FPL, where weak CSR is available). Below 200% FPL, silver plan deductibles range from $0-1000.

...The enhanced unemployment benefit will prevent a lot of marketplace applicants from accessing CSR. Medicaid, for its part, generally has no out-of-pocket costs, or minimal ones.

Let's say a single person has been earning $2,500 per month and has earned $10,000 at the time of layoff. Her ordinary monthly unemployment allowance (which varies by state) is $1,250, qualifying her for Medicaid.

Note: He's assuming the enrollee was employed through the end of April. At $2,500/mo for the full year, they'd earn $30,000, or 240% FPL, qualifying them for decent ACA exchange subsidies. At $1,250/mo for the remaining 8 months of the year, they'd earn $10,000 plus the $10,000 they've already earned...which is below 138% FPL on a per-month basis but over 138% FPL for the full year ($20K = 160% FPL for the year).

For marketplace purposes, however, her monthly income is $3,650, more than she was making before. On a marketplace application, she will have to estimate annual income, and it would be implausible to get it below the $24,980 cutoff for strong CSR. She will probably pay about $200/month for a silver plan with a deductible in the $3-4,000 range. On the monthly basis, however, she is eligible for Medicaid, which costs nothing and has little if any out-of-pocket costs.

$1,250/mo + $2,400/mo (4 weeks x $600) = $3,650/month...or $29,200 for 8 months + $10,000 already earned = $39,200...314% FPL. As Andrew notes, part of the confusion here is the $600/wk counting for one but not the other...but the other part is that Medicaid eligibility is determined based on your monthly income while exchange subsidies are based on your estimated annual income.

...Those whose monthly income qualifies them for Medicaid but whose estimated annual income exceeds 138% FPL should avoid the ACA marketplace -- that is, HealthCare.gov for 38 states, state-based exchanges for 12 others plus D.C. Instead they should apply directly through their state Medicaid department or its website.

He also notes another important point:

Perhaps it's best that those who lose employer-sponsored insurance in a pandemic end up in Medicaid, which will shield them from high in-network out-of-pocket costs and balance billing. In fact it would make best sense either to render the unemployed presumptively eligible for Medicaid or to simply cover all COVID-19 testing and treatment via Medicare. Meanwhile, given our current Rube Goldberg infrastructure, how will people navigate? Millions who go through the marketplace may get the false impression that they're ineligible for Medicaid. Many may reject marketplace coverage offered with weak subsidies or no subsidies. A further fix is needed.

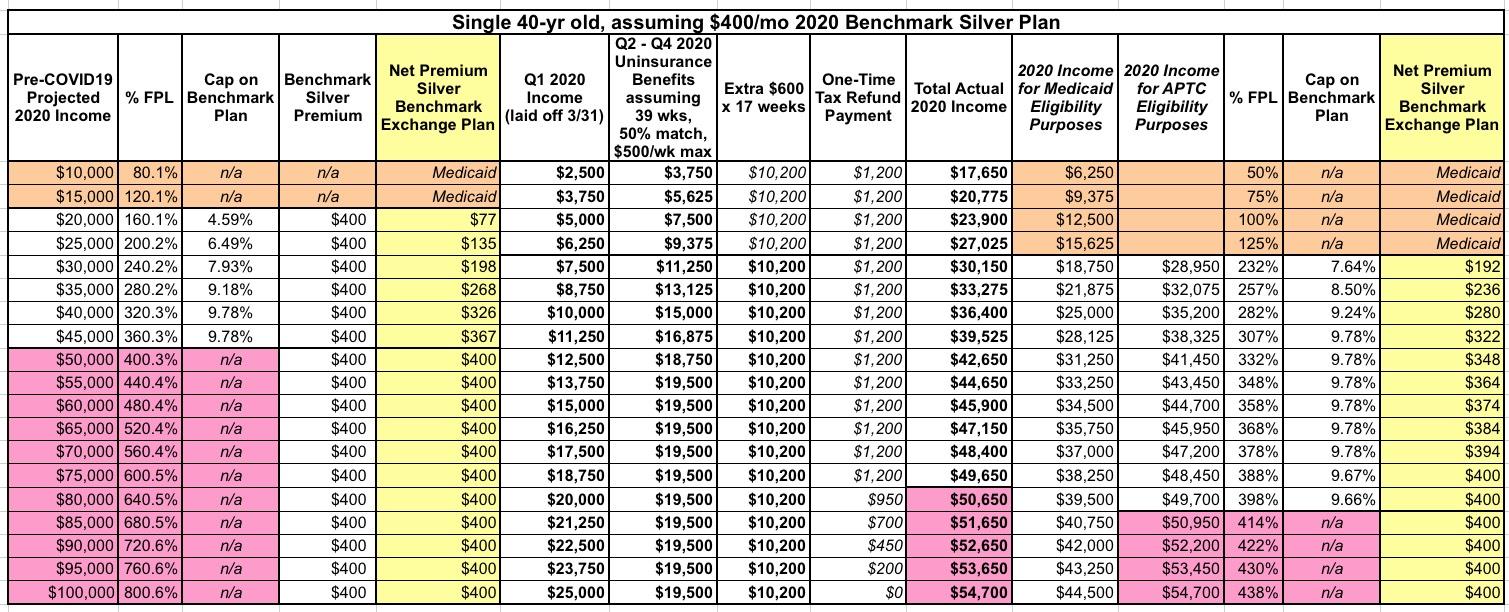

For what it's worth, I've put together the table below which I think explains how a single 40-year old's Medicaid/subsidized ACA exchange situation would look at different income levels. Every example below assumes:

- They were employed at the exact annual income level on the left column in both 2019 and the first quarter of 2020 (spread evenly throughout the full year)

- They were laid off/file for unemployment as of April 1st, 2020 and remain unemployed for the rest of 2020, receiving the maximum expanded unemployment benefits allowed by the new bill

- They live in a Medicaid expansion state, and...

- The benchmark Silver ACA exchange plan for a single 40-year old is $400 at full price.

In addition, according to Adler, that one-time $1,200/person check doesn't count as MAGI income for either Medicaid or APTC eligibililty:

Think of it like a tax refund or refundable tax credit. e.g, PTCs (which are refundable tax credits) don’t circularly then count as MAGI. Or say something like the dependent care credit. I get a $1,000 tax credit because of my childcare expenses, but that doesn’t add to my MAGI.

— Loren Adler (@LorenAdler) March 26, 2020

With all this in mind, as you can see, there are three different "incomes" which people will have in 2020: Their actual total income; their Medicaid eligibilty income and their APTC eligibility income.

That huge leap from 125% FPL to 232% FPL in the 3rd-from-right column is because the $600/wk extra payment doesn't count for Medicaid purposes but does count for ACA subsidy eligibility. The enrollee who earned $25,000 last year would actually bring in $27,025 this year (216% FPL), but for purposes of Medicaid eligibility they'd only count as earning $15,625 (125% FPL).

Andrew's point is that if they were to plug in $27,000 as their expected 2020 income, HealthCare.Gov (or the state-based exchange, depending on where they live) will plug it in at 216% FPL and try to steer them towards a Silver plan with weak CSR assistance for around $105/month when they'd actually be eligible for Medicaid, which would cost them basically nothing (or nominal co-pays at most).

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.