Colorado releases revised Public Option proposal w/enhanced subsidies!

Last October I noted that the state of Colorado had released a report on the latest evolution of their impending State-based Public Option addition to their ACA exchange. At the time, the key specs included:

- The "State Option" plans are supposed to be available via Connect for Health Colorado starting in 2022 (i.e., they'd enroll starting in November 2021)

- They expected average premiums are expected to be around 9 - 18% lower than similar policies offered by other carriers

- Hospitals would be reimbursed at rates ranging from 175 - 225% of Medicare rates

Here's where it got more interesting:

- Colorado would also seek an ACA Section 1332 Waiver in addition to their existing reinsurance waiver to bring in $69 - $133 million in additional revenue

- The carrier administering the plans will be require to spend 85% of revenues on healthcare claims...up from the 80% standard MLR required by the ACA.

I promised to read through the lengthy report at the time, but I never got around to it...and now, the state has released an actuarial analysis of the updated plan which includes some more very interesting provisions:

- The issuers will offer the plans on and off the Exchange in the individual market.

- The issuers will offer qualified health plans (QHPs) at Bronze, Silver, and Gold metal tiers.

- The premiums of the plans will reflect facility reimbursement levels that vary by facility. The formula for determining facility-specific reimbursement levels was provided by DOI, utilizing hospital specific financial information provided by HCPF. Maximum reimbursement levels by facility are set between 155% and 218% of Medicare payment rates.

- The plans will be offered beginning in calendar year 2022.

- The state intends to apply for a 1332 waiver and use Federal pass-through savings for additional benefits or expanded coverage. The Baseline scenario presented below reflects the current federal and state regulatory market, including a state-based reinsurance program. The second scenario reflects the results of offering a Colorado Health Insurance Option with additional benefits, a premium wrap and a cost-sharing wrap.

It's important to note, as Louise Norris reminded me, that Colorado's current reinsurance waiver is actually set to expire in 2022 anyway (it's only a 2-year waiver), which means that unless they renew that as well, the new waiver would be replacing the existing one.

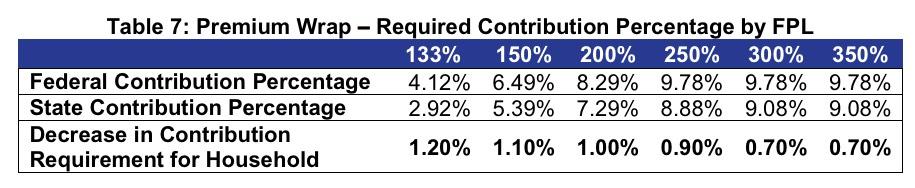

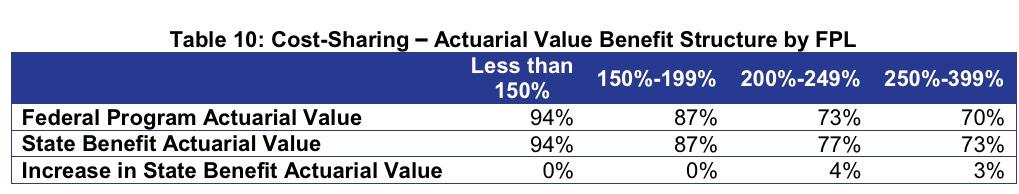

- The premium wrap would decrease the required contribution of income between 0.7 and 1.2 percentage points for enrollees below 400% of the federal poverty level (FPL). The cost-sharing wrap will reduce expenses through lower deductibles, copays, and/or coinsurance rates for on-Exchange Silver plan enrollees between 200% and 400% FPL. This would be achieved through a new CSR plan for enrollees between 200%-249% FPL with a 77% actuarial value (members currently eligible for 73% AV CSR plan) and expanding eligibility for the 73% AV CSR plan to members between 250%-400% FPL (members currently not eligible for CSRs).

If this goes into effect, it will make Colorado the fifth state to offer their own supplemental subsidies beyond the official federal ACA subsidy structure, and the third one to do so since 2020:

- Massachusetts and Vermont have been offering their own supplemental subsidies for enrollees below the 300% FPL threshold (I believe) since 2014

- California expanded premium subsidies to those earning 400 - 600% FPL and enhanced them for those earning 200 - 400% FPL starting this year

- Washington State is supposedly planning on expanding the 10%-of-income premium cap to those earning 400 - 500% FPL starting in 2021

- and now, Colorado plans on shaving 0.7 - 1.2 percentage points off of the % of income cap on benchmark premiums for those earning 138 - 400% FPL, while also boosting CSR subsidies by 3 - 4% AV for those earning 200 - 400% FPL.

Here's the tables showing the enhancements:

As an example: Let's suppose you're a single adult earning $25,000/year (around 200% FPL). Right now, your premiums for a benchmark Silver plan are capped at 8.29% of income, or $173/month. With the enhanced state subsidies, this would drop to $152/month, saving you an additional $21/mo or $252/year. As noted in the analysis:

For CSR enhancements the exact dollar figure is a little trickier to calculate, but let's suppose 100% Actuarial Value was calculated to be exactly $10,000/year (I have no idea what it actually would be for a single adult in Colorado; this is just for illustrative purposes). A 3% AV increase would amount to roughly $300/year shaved off of your deductible. As noted in the actuarial analysis:

Consumer Savings: The estimated annual cost-sharing savings for the targeted population is $376 per eligible member between 200-399% FPL. For members between 200-249% FPL enrolled in a Silver plan, we estimate they will save approximately $32 PMPM in reduced cost sharing. For members between 250-399% FPL enrolled in a Silver plan, we estimate they will save approximately $30 PMPM in reduced cost sharing. Note that the actual impact for consumers will depend on their specific utilization of services and could vary significantly from one member to the next.

As you can see, the combined impact of the enhanced premium subsidies and CSR assistance isn't massive--it looks like it'd average around $600 - $650 in savings per enrollee for those eligible...but that's still a decent chunk of change.

The irony of all of this, of course, is that the funding for the enhanced subsidies would be coming in large part from...the reduction in federal subsidies due to the reduced premiums in the public option plans:

- The Colorado Health Insurance Option with premium and cost-sharing wraps is estimated to reduce average premiums by 12.0% statewide, with reductions varying from 7.1% in Rating Area 2 – Colorado Springs to 19.8% in Rating Area 4 – Fort Collins, compared to the expected rates in 2022 based on current policies and regulations.

- Total enrollment in the Colorado individual market is estimated to increase by approximately 18,100 members. The new members are expected to be individuals who were previously uninsured, and are a combination of unsubsidized and subsidized individuals. This is a significant increase over the assumed take-up in the previous version of the report, and is due to the addition of the premium wrap program. We are estimating a greater take-up among the uninsured as individuals tend to be sensitive to premium changes. An increase in subsidized enrollment due to decreases in net premiums from the premium wrap could lower pass-through savings. Wakely further assumed no change in employer coverage as a result of the Colorado Health Insurance Option for the initial year.

- Our best estimate of the total reduction in Premium Tax Credits in 2022, as a result of the Colorado Health Insurance Option, will be approximately $42.7 million under the assumptions outlined in this report. These amounts reflect the potential Federal passthrough savings and would be used to fund the premium wrap and cost-sharing wrap benefits. This estimate is lower than the previous version due to the increased take-up of subsidized members with the premium wrap program.

In many ways, like the reinsurance program, this is simply taking existing federal subsidy dollars and slicing them up differently. In the case of reinsurance, it's a combination of federal and state dollars; in the case of the enhanced subsidies, it appears to be federal dollars only, unless I'm missing something.

- Comparing the two scenarios shows the differences in enrollment and premiums, as well as the total pass-through amounts available. The comparison further analyzes the cost of the additional premium and cost-sharing subsidies, and how much of the pass-through funding would be used to pay for these additional benefits.

- The estimates presented throughout this report assume both the premium wrap and costsharing wrap are included. However, we did evaluate the impact of offering each of these benefits on their own. The results of those scenarios are shown below in the “PassThrough Savings and New Benefit Program Scenarios” section.

Of course, all of this is dependent on striking a deal with Colorado hospitals and doctor groups agreeing to the 155 - 218% of Medicare rates.

According to this article, Colorado Governor Jared Polis is on the case:

Colorado Gov. Jared Polis’s office released a plan Monday to limit how much the “state option” for insurance would pay hospitals, with a goal of reducing consumers’ monthly costs by up to 20%.

The formula is almost certain to run into stiff opposition from the Colorado Hospital Association. But lawmakers say the rates are better than what some hospitals are currently receiving and the rate-setting will provide more certainty about how much hospitals can expect to be reimbursed for services.

And the plan will benefit rural hospitals, said Rep. Dylan Roberts, a Democrat from Avon who is sponsoring the bill. He said he anticipates the state option bill will receive bipartisan support, despite the vocal opposition. Lawmakers wanted to release the reimbursement formula before the bill was introduced to be transparent and explain the process of developing it, he said.

...Katherine Mulready, senior vice president and chief strategy officer for the Colorado Hospital Association, countered that the information released Monday didn’t alleviate her concerns. It’s difficult to be sure of the impact, since the state didn’t release hospital-by-hospital numbers, but it appears the cuts could average anywhere from 25% to 56% in different parts of the state, she said.

Here's the rub:

The association is still analyzing the proposal, but it seems likely hospitals will have to raise costs for people with insurance plans that aren’t part of the state option, Mulready said.

Yup. Right now around ~71 million Americans are enrolled in Medicaid or CHIP and 60 million are enrolled in Medicare. Around 10 million are enrolled in both, I believe, which means a total of over 120 million people...or over 36% of the population...is enrolled in one or the other. Since Medicare reimburses providers below cost, Medicaid does so even lower than that, and many of the ~9% who are uninsured can't afford to pay anything at all, private insurance reimbursement rates for the other ~55% of the population with private insurance are set at dramatically higher rates to cancel that out and provide hospitals/etc their profit margin.

If another chunk of the population is enrolled in a public option with rates set lower than other private insurance, they'll presumably bump up the rates for others to make up the difference.

...The formula in the proposal would pay hospitals a starting rate of 155% of the rate Medicare pays. In practice, that means that if Medicare would pay a hospital $1,000 to perform a medical procedure, the hospital would get $1,550 to do the same procedure on someone covered by the state option. The percentage of reimbursement would increase depending on different criteria and was partly based on information provided by Colorado hospitals.

By comparison, Colorado hospitals got about 269% of Medicare rates from private insurers in 2017, according to a report from the RAND Corporation. That means they were paid, on average, $2,690 for the hypothetical $1,000 procedure. Some hospitals got twice that rate.

“Certainly rural and smaller hospitals are above 200(%), and I think most are going to be around the 190 to 200 range,” Roberts said.

The proposal estimates hospitals break even at 143% of the Medicare rate, on average ($1,430 for our example procedure). So theoretically, the base rate would build in a small profit. It’s difficult to forecast how much any particular hospital might gain or lose, though, because Medicare pays different rates if a hospital tends to get sicker patients, teaches aspiring doctors or treats lots of low-income patients.

...Hospitals that aren’t part of a larger network would get an extra 20%, as would critical access hospitals — small hospitals that are at least 35 miles from another hospital and generally have short patient stays. A hospital that is both independent and critical access would be paid 40% extra, bringing its total rate under the state option to 195% of what Medicare pays.

As for enrollment in the State Option plan itself...

The state Division of Insurance estimated between 4,600 and 9,200 people would buy the state option plan, but that could change as more details about what it might cost to buy insurance through the plan become available. The governor’s office’s formula anticipates the monthly price of insurance will fall anywhere from 7% to 20%, with bigger decreases in rural areas.

In other words, Connect for Health Colorado is expected to see their enrollment increase by around 18,000 people across all carriers as a result of the State Option, but that doesn't mean that all of them would be the ones enrolling in state option plans...many current enrollees would choose to do so, while some of the new enrollees might go with other carriers instead.