California: CoveredCA announces 1.38 million QHPs thru 12/16 & 5-year report on improvements in ACA implementation

This just in from Covered California:

Covered California Releases New Enrollment Data and Issues Reports on Five Years of Improving Affordability, Access and Accountability

- Covered California announced that there are more than 230,000 new plan selections during the current open enrollment period – up approximately 16 percent over this time last year. More than 1.15 million people have also renewed their coverage.

- In addition, more than 540,000 people will receive new state subsidies that will make quality health care coverage more affordable in 2020.

- The agency also released two extensive reports that detail Covered California’s impacts on lowering costs and assuring quality care in its implementation of the Affordable Care Act.

- Since 2013, California has reduced its uninsured rate by more than any other state in the nation has by expanding Medi-Cal, investing in marketing and outreach and keeping costs low for consumers.

- California’s individual market consistently ranks among the healthiest in the nation, helping unsubsidized consumers save about $1,550 annually in 2018 on their premiums compared to consumers in the federal marketplace.

- Covered California’s open-enrollment period runs through Jan. 31. Consumers must sign up before the end of Dec. 20 for their coverage to start on Jan. 1. California is one of 10 state marketplaces that are still open for business, representing 28 percent of Americans.

Following the close of open enrollment in 38 states served by the federally facilitated marketplace, Covered California released new data at the halfway point of its current open-enrollment period and issued two extensive reports that detail the results of its efforts to lower costs, hold health plans accountable and assure consumers receive quality health care.

A total of 230,000 consumers have selected a plan through Dec. 16, which is an increase of approximately 16 percent. In addition, more than 1.15 million existing consumers have renewed their plans for the upcoming year, giving Covered California approximately 1.38 million plan selections for 2020. Covered California is only halfway through its open enrollment period and still processing its renewals. A full accounting and comparison will be available after open enrollment closes.

That's a total of around 1.38 million QHP selections for 2020 as of 12/16; that's around 117,000 more than they had on 12/07.

On the other hand, they're actually 50,000 behind last year according to the 2019 OEP CMS Public Use File, which put it at 1,429,820 as of December 15th (one day less). For the 2019 OEP, they added another 84,000 between 12/16 - 1/31.

They say the 230K new enrollees are up 16% from the same point last year, which means they had roughly 198,000 last year. if they have 32,000 more new enrollees but are 50,000 behind overall, that means roughly 82,000 fewer current enrollees have been renewed so far, though they say that's still ongoing. Plus, it actually says "more than" 1.15 million, which should mean up to 4,000 higher.

Last year Covered California enrolled a total of 1,513,883 people by the January 31st deadline; their all-time record was back in 2016 when they enrolled 1,575,340. They'll need to add another 134,000 between 12/17-1/31 to beat last year's total, or at least 196,000 to beat their all-time high.

"California has acted on its commitment to help people get good coverage that they can afford," said Covered California Executive Director Peter V. Lee. "The new state subsidies build on and go beyond the Affordable Care Act and restore the individual mandate penalty, and we are seeing the positive results of those policies as we approach one of our key deadlines. In the past week, Covered California saw thousands of people come through its doors, with the majority receiving new financial help from the state, from federal tax credits, or from both."

Starting in 2020, California will be providing financial help to eligible consumers. It is the first state to offer subsidies to many middle-income consumers who previously did not receive any financial assistance because they exceeded federal income requirements.

More than 540,000 people have been determined eligible for the new state subsidy, including about 28,000 in the middle-income range of 400 to 600 percent of the federal poverty level, which could extend to an individual making up to $74,940 and a family of four with a household income of up to $154,500. Of those in this income range who have signed up through Covered California, 46 percent have been found eligible for the state subsidies.

That 46% is up a bit from the thru-12/07 numbers (44%). The 28,000 figure is also up 5,000 subsidized 400-600% FPL enrollees in the past 9 days. It's worth noting:

- thru 12/07: 23,000 / 1,263,000 = 1.8%

- 12/08 - 12/16: 5,000 / 117,000 = 4.3%

It sounds like word is starting to get out among those in the 400-600% FPL range, which is a good thing, although their original projections were that perhaps 180,000 people in that range would take advantage of the expanded subsidies.

"In 2019, California led the nation in enacting progressive health care reforms — taking a big step toward universal coverage and passing first-in-the-nation measures to make health care more affordable for families," said Gov. Gavin Newsom. "The contrast with what is happening in Washington couldn’t be clearer. While the federal government is trying to roll back the Affordable Care Act and take away coverage, California is building on the success of the Affordable Care Actand creating a healthier state."

The data release comes on the same day that Covered California issued two new reports that detail how California has used all the tools of the Affordable Care Act to benefit millions of Californians. The first report, "Covered California’s First Five Years: Improving Access, Affordability and Accountability", highlights the key strategies undertaken by the state and Covered California to hold health insurance companies accountable, lower costs and build on the Affordable Care Act. The other report, "Covered California Holding Health Plans Accountable for Quality and Delivery System Reform," summarizes how the 11 health insurance companies Covered California contracts with have met the contractual requirements imposed on them to foster better quality, healthier populations and lower costs, with particular attention to health equity and their efforts to promote changes in how health care is delivered.

In addition to the two reports, Covered California released a chart pack that illustrates many of the improvements made in the past five years.

"These reports are important because implementing the Affordable Care Act effectively is not about just one open-enrollment period or changes of one year to the next," said Lee. "These reports detail the actions taken over five years and the impacts of those actions, demonstrating how California has put consumers first, saving individual Californians thousands of dollars and holding health insurance companies accountable. These results show the Affordable Care Act going strong and working well in California despite concerted national efforts to take us and the rest of the nation backward."

Together the reports show how California implemented the Affordable Care Act — by expanding Medicaid and establishing a state-based marketplace in Covered California — and went beyond the law by providing state-funded subsidies and restoring the individual mandate.

Nation’s Largest Drop in Uninsured

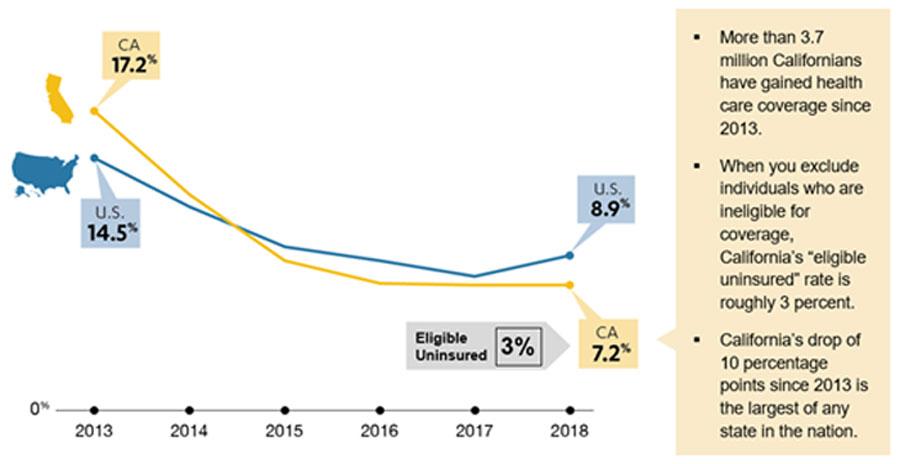

One of the key goals of the Affordable Care Act was to expand coverage. California’s uninsured rate decreased from 17.2 percent in 2013 before the implementation of the Affordable Care Act to 7.2 percent in 2018, representing the largest overall drop in the nation, with 3.7 million people gaining coverage during that time. Taking into consideration the fact that a large portion of the remaining uninsured are undocumented and therefore ineligible for state and federal programs, California’s eligible uninsured rate is approximately 3 percent (see Figure 1: Comparison of California and National Uninsured Rate, 2013-2018).

"California embraced the Affordable Care Act, and it is working well for millions of people," Lee said. "Covered California was built by Californians for Californians, we are a public entity that is holding plans publicly accountable for delivering quality and cost-effective care."

Figure 1: Comparison of California and National Uninsured Rate, 2013-2018

The People Behind the Numbers

One of those consumers who got covered is Sheila, an entrepreneur from Oakland. A free preventive care visit revealed that she was prediabetic, and she immediately began to get the care she needed to get healthy and stay healthy. You can watch and download Sheila’s story here.

The covers of the two reports issued include the images of dozens of consumers helped by Covered California. Their stories and those of others that put faces on the numbers in the reports can be found here.

"We continue to see what is possible when you focus on getting the best value for your consumers, when you hold health plan issuers accountable and work to increase enrollment," Lee said. "While Covered California’s first five years of work have led to significant improvements in quality and savings for consumers, we have just begun to make meaningful change for Californians."

Lower Costs for Consumers and the Federal Government

California’s historic drop in its uninsured rate is due in part to Covered California’s significant investments in marketing and outreach to educate and enroll consumers. By enrolling more people, on average the total group insured is healthier, which means they are lower-cost than if they were a smaller number with a higher concentration of sicker individuals. The most recent data shows California had the third-lowest "average plan liability risk score" in 2018, placing it among the five healthiest state populations for the fifth year in a row.

California’s actions to promote enrollment, encourage retention and foster stability in the marketplace have resulted in a consistently healthier risk mix that has caused California to have 20 percent lower costs on average than if the state had the same risk mix as the rest of the nation. In 2018, this meant unsubsidized consumers saved an average of $1,559 per year on their coverage (see Figure 3: California’s Healthier Risk Mix Leading to Lower Premiums for Unsubsidized Insureds), compared to what they would have spent if California had the same risk mix as the rest of the nation. Overall, California’s healthier risk mix resulted in estimated savings to enrollees and the federal government of $12.5 billion from 2014 to 2018.

Figure 3: California’s Healthier Risk Mix Leading to Lower Premiums for Unsubsidized Insureds

"The reality is that millions of Americans are dealing with the repercussions of federal decisions to cut back on marketing and outreach while promoting cheap, subpar coverage," Lee said. "The result is that many consumers the nation, particularly those in states that rely on the federal marketplace, have been priced out of coverage as the unsubsidized individual markets have become in effect expensive high-risk pools, and some have opted to buy short-term or other non-Affordable Care Act insurance products. These consumers are gambling on what is often junk coverage that excludes those with pre-existing conditions and won’t be there to cover expensive care that some of them will need."

Consumer Choice, Competition and Stability

Since first launching in 2014, Covered California has conducted active and extensive vetting and negotiations with health insurance companies to ensure that consumers have a choice among multiple insurers that are stable and provide value. The result has been continuous participation by 10 health insurance companies, with an additional insurer joining in 2016. The stability and robust competition in the marketplace promote choice, which also helps keep costs low for consumers.

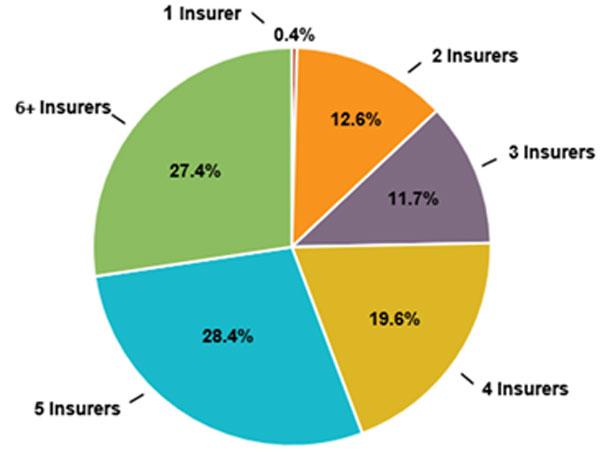

In 2020, not only will nearly all consumers be able to choose from two or more plans, but 75 percent will have four or more choices, and more than half of consumers (56 percent) will be able to choose from five plans or more (see Figure 4: Number of Health Plans Available to Covered California Consumers).

Figure 4: Number of Health Plans Available to Covered California Consumers

"California’s individual insurance market is robust and competitive, with consumers able to vote with their feet," Lee said. "We have nonprofit, for-profit, public and privately-run health plans competing with one another, and Covered California holds them all accountable in delivering quality care."

Meaningful Coverage

The Affordable Care Act established new rules for insurers, such as protections for those with pre-existing conditions, new annual or lifetime limits on benefits and standards for comprehensive coverage. Covered California goes beyond this new floor and also negotiates "patient-centered" benefit designs to promote access, enable comparison shopping and provide "first-dollar" coverage for all outpatient services — meaning care that does not need to meet the deductible — for the majority of its consumers. Currently, more than 70 percent of Covered California enrollees are in plans where most outpatient care, such as primary care visits, outpatient services and lab tests are not subject to a deductible.

The People Behind the Numbers

One consumer who benefited from Covered California’s coverage was Charly from La Mesa. The little girl suffered severe bruising on her arms after playing in the pool. Blood tests showed that Charly had leukemia and she quickly began undergoing chemotherapy and other treatments which totaled $275,000 in the first six months. Watch and download Charly’s story.

The state also took the important step of working to protect the stability of the individual market by banning short-term plans, which are being recommended by Navigators in the federally facilitated marketplace. These plans have coverage caps, provide no mental health coverage, can deny coverage based on applicants’ pre-existing conditions and can expose consumers to risk of rescission.

"Short-term plans can short-change consumers," Lee said. "It’s no mystery: Coverage is cheaper when you strip out all the benefits and protections of the Affordable Care Act."

Covered California also recently announced it would require any insurance agent that is certified to sell its products, and makes available health sharing ministries, be required to alert consumers about the dangers sharing ministries "products" which are not regulated, not considered insurance and could leave people exposed to high medical bills.

Holding Health Plans Accountable

The Affordable Care Act established standards for health plans, including setting limits on what plans can spend on administration, executive compensation and profits, and some reporting requirements related to issuer activities to address quality. Covered California goes beyond these standards to actively foster a market that works for consumers, holding health plans accountable for delivering quality care, addressing health care disparities and promoting changes in the delivery of care that will benefit all Californians.

In "Covered California Holding Health Plans Accountable for Quality and Delivery System Reform", Covered California summarizes the performance of its 11 health insurance companies over their first five years of providing services. The report details plan-specific performance information on clinical measures, patients’ reported experience with care and on how the companies are addressing Covered California’s requirements to reduce health care disparities, change payments and engage in collaborative initiatives to improve care across the entire population.

The report finds that some health insurers’ clinical and patient-reported performance ranks among the very best in the nation — particularly Kaiser Permanente and Sharp Health Plan — while among the other plans there is wide variation depending on the performance measure. Covered California identified areas for improvement and is using this information to inform a major revision to its contracts that are now in development.

The expectations for health insurance companies go beyond just their reporting on standard performance indicators. For example, health insurance companies are required to provide consumers tools to understand the costs of treatments they are considering (with tools available now to virtually all Covered California enrollees). The companies must change their payments to providers over time to move from fee-for-service arrangements to promoting value. Additionally, the companies must promote enrollment in systems of care that foster coordination, such as accountable care organizations.

"Thanks to the continued efforts of Covered California to push its participating health plan issuers to improve quality and promote delivery system reform, California leads the country in terms of participation in integrated delivery systems and accountable care to Covered California.

Covered California also details how it has aligned with other stakeholders to help achieve important gains in hospital patient safety, such as reducing hospital-acquired infections, reducing unnecessary caesarean sections and improving the treatment of opioid use disorders.

Appreciation for Broad Engagement and Dedication to Bernard J. Tyson

In a letter to introduce the report on Covered California’s first five years, Peter Lee acknowledged the fact that California’s progress is the result of engagement by thousands, with particular recognition to Bernard J. Tyson, the recently passed away CEO of Kaiser Permanente:

There have been many individuals and organizations that have contributed to Covered California’s achievements to the benefit of California consumers — policymakers, health insurers, consumer advocates, counties, community-based organizations and agents, to name a few. This said, Covered California specially dedicates this report to Bernard J. Tyson CEO, of Kaiser Permanente, who recently passed away. Bernard embodied unparalleled passion and leadership. His work to transform health care delivery, and his drive for justice in health care and quality have left a lasting imprint on California and the nation.

"Every state and the federal government can do what California has done to maintain the core principles of the Affordable Care Act, which means good benefit designs, no coverage caps and guaranteeing coverage for those with pre-existing conditions," Lee said. "The sad reality is that in the past few years, many federal actions have sought to take the nation back to the pre-Affordable Care Act world of unaccountable health plans and costs for health care that were out of reach for many millions of consumers."

Open Enrollment in California

The reports come out during the middle of Covered California’s open-enrollment period and when nine other states are continuing to enroll consumers. Consumers who need health insurance have through Dec. 20 in order to get coverage that begins on Jan. 1, 2020. Those interested in learning more about their coverage options can:

- Visit www.CoveredCA.com.

- Get free and confidential in-person assistance, in a variety of languages, from a certified enroller.

- Have a certified enroller call them and help them for free.

- Call Covered California at (800) 300-1506.

Open enrollment in California runs through Jan. 31, 2020. In addition, the state of California restored the penalty for consumers who can afford health care coverage but choose to remain uninsured. Those who go without coverage in 2020 could be subject to a penalty when they file their state taxes with the Franchise Tax Board.

Open Enrollment in Other States

Nationally, several states announced open-enrollment extensions this week. California is now one of 10 marketplaces, representing about 28 percent of the nation’s population, that will continue to allow people to sign up for health care coverage to take effect in 2020.

The following state marketplaces remain open for residents to enroll in coverage for 2020 (listed in order of enrollment cutoff):

- Nevada: Nevada Health Link is allowing consumers who have started an application until Dec. 20 to enroll and get Jan. 1 coverage. Contact Janel Davis or call (775) 687-9934 for more information.

- Minnesota: Minnesota’s MNsure will enroll consumers through Dec. 23. Contact Marie Harmon for more information.

- Washington: Washington Healtplanfinder extended its open-enrollment period through Dec. 30. Contact Shawna Bruce for more information.

- Rhode Island: Rhode Island’s HealthSourceRI will be accepting applications through Dec. 31. Contact Robin Dionne or call (401) 383-5542, ext. 5542, for more information.

- Colorado: Connect for Health Colorado extended its deadline for Jan. 1 coverage until tonight. The exchange’s open-enrollment period runs through Jan. 15. Contact Monica Caballeros or call (720) 496-2574.

- Connecticut: Connecticut’s Access Health CT extended its open-enrollment period through Jan. 15. Contact Kathleen Tallarita or call (860) 757-5339 for more information.

- Massachusetts: The Massachusetts Health Connector will be accepting applications through Jan. 23. Contact Jason Lefferts at (617) 933-3141 for more information.

- New York: New York State of Health’s open-enrollment period runs through Jan. 31. The exchange can be contacted at press@health.ny.gov or (518) 474-7354, Ext. 1.

- The District of Columbia: The District of Columbia of Columbia’s DC Health Link extended its deadline for Jan. 1 coverage until tonight. The exchange’s open-enrollment period runs through Jan. 31. Contact Linda Wharton-Boyd or call (202) 741-5201.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the legislature. For more information about Covered California, please visit www.CoveredCA.com.