MAJOR UPDATE: Californians: How much will CA's expanded subsidies reduce YOUR ACA premiums?

IMPORTANT: As I've noted before, Covered California has arranged to expand and enhance their ACA premium subsidies beyond the official ACA formula starting with the 2020 Open Enrollment Period. Back in October, I posted a detailed analysis, complete with tables and graphs to explain just how much hundreds of thousands of Californians could save under the new, beefed-up subsidy structure.

However, Anthony Wright of Health Access California just called my attention to the fact that I made a major mistake in my analysis which impacted every one of the examples: I was basing them on the draft enhanced subsidy formula from back in May instead of the final version, which is considerably more generous at the upper end of the sliding scale than the draft version was!

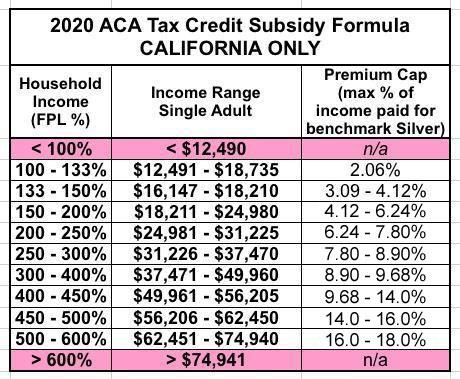

In short:

- The ACA formula caps premiums (for the benchmark Silver plan) at between 2 - 9.8% of household income but only if you earn between 100 - 400% of the Federal Poverty Level.

- The draft California formula is a bit more generous from 100 - 400% FPL and also caps premiums between 9.9 - 25% of income between 400 - 600% FPL.

- The final California formula is more generous yet: It's pretty much the same up to 400% FPL, but caps premiums between 9.8 - 18% of income between 400 - 600% FPL.

I've therefore gone back and re-calculated and re-written the entire blog post below with the updated, corrected subsidy formula. My apologies for the error!

----------

There's two important points for CA residents to keep in mind starting this Open Enrollment Period:

- First: The individual mandate penalty has been reinstated for CA residents. If you don't have qualifying coverage or receive an exemption, you'll have to pay a financial penalty when you file your taxes in 2021, and...

- Second: California has expanded and enhanced financial subsidies for ACA exchange enrollees:

Until now, only CoveredCA enrollees earning 138-400% of the Federal Poverty Line were eligible for ACA financial assistance. Starting in 2020, however, enrollees earning 400-600% FPL may be eligible as well (around $50K - $75K/year if you're single, or $100K - $150K for a family of four). In addition, those earning 200-400% FPL will see their ACA subsidies enhanced a bit.

Here's what the formula looks like for a single adult (the eligibility cap for a family of four is around $150,000/year):

The actual savings compared to the current formula will vary greatly by region, age, plan chosen and household, of course.

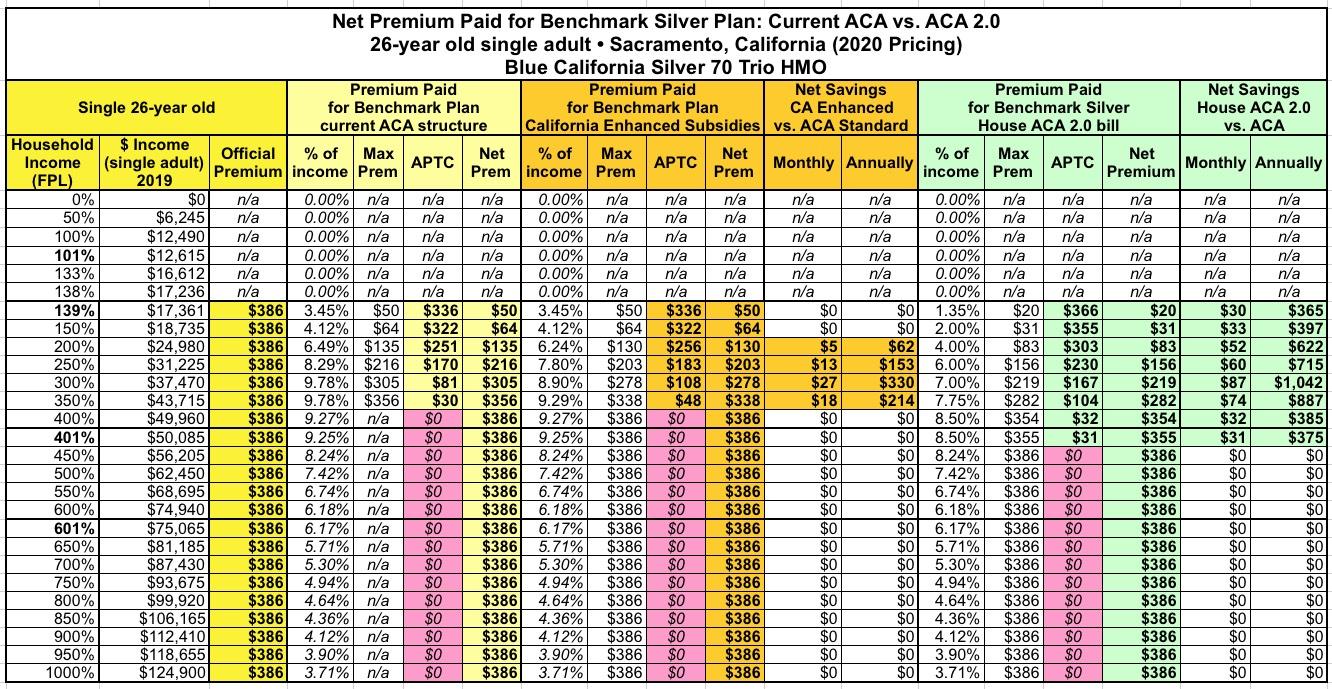

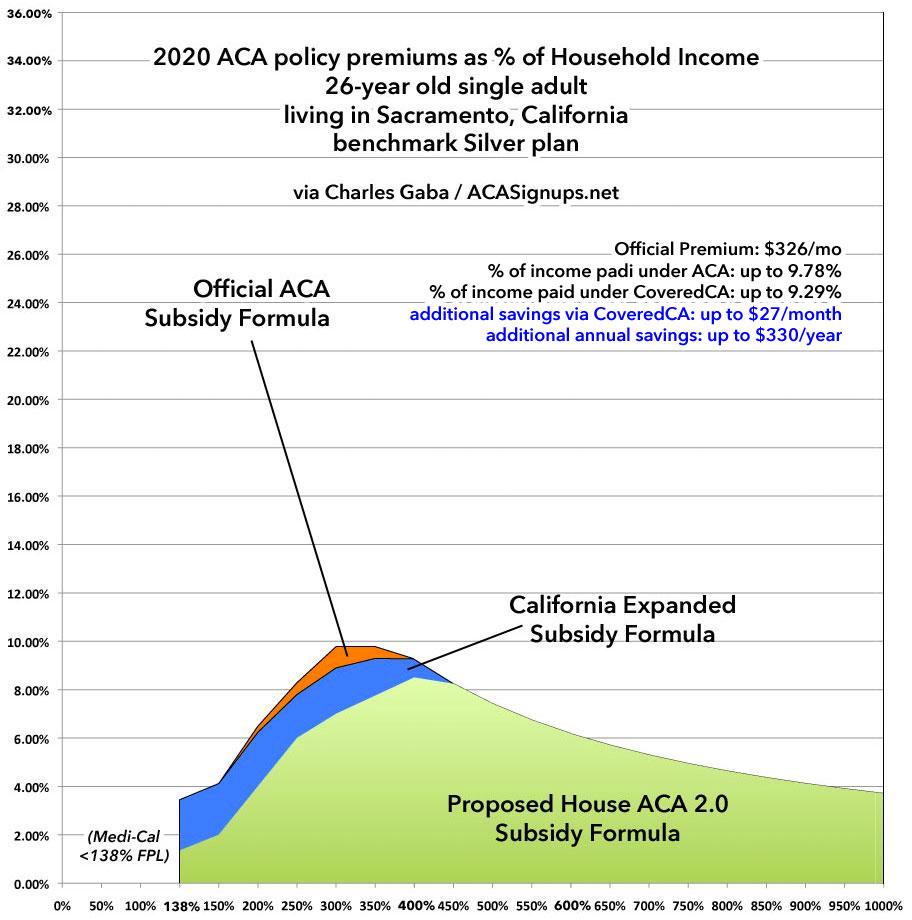

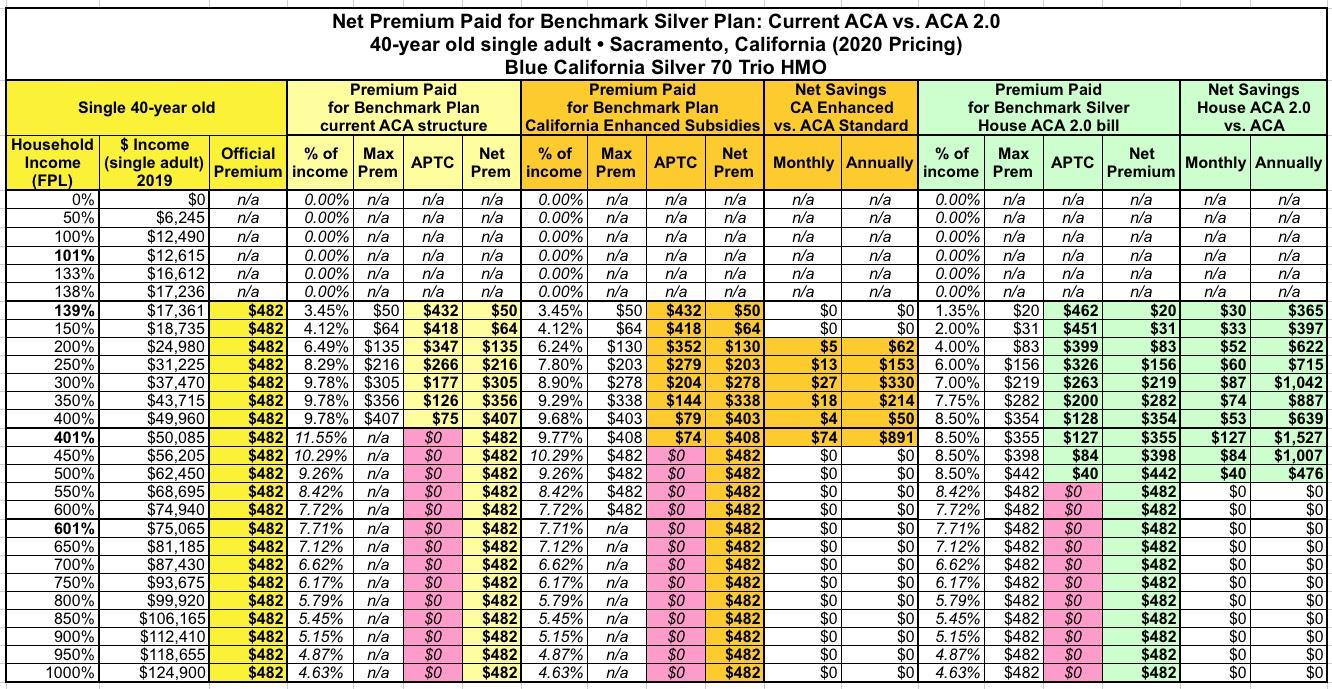

With that in mind, I've whipped up several examples showing how different California households will fare compared to the official ACA subsidy structure for 2020. It's important to keep in mind that all of these assume they're enrolling in the benchmark Silver plan. If they go for a Bronze, Gold, Platinum or different Silver, things will look a bit different as well.

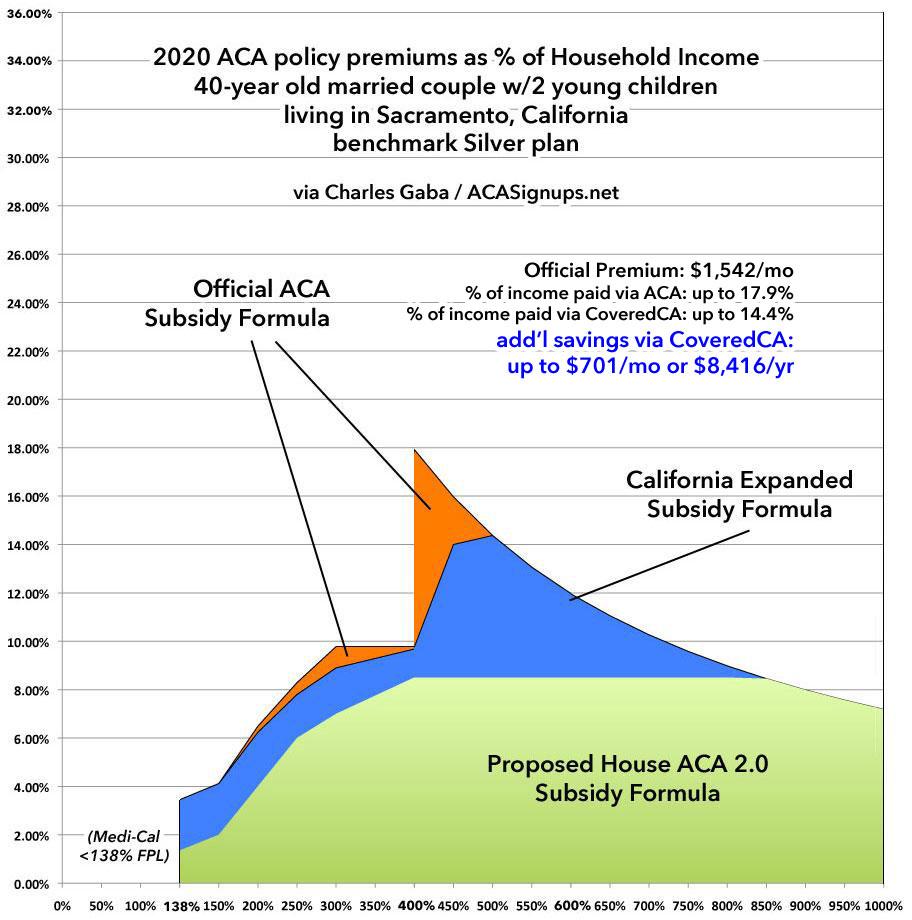

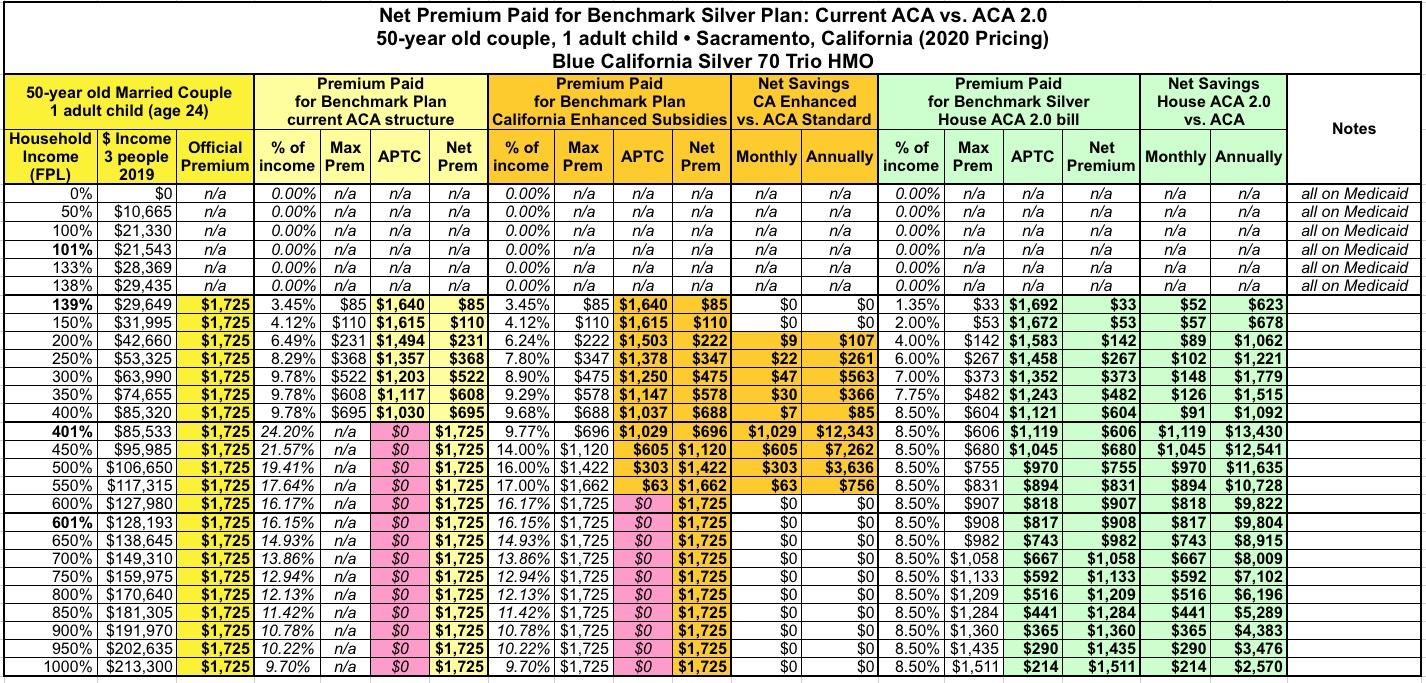

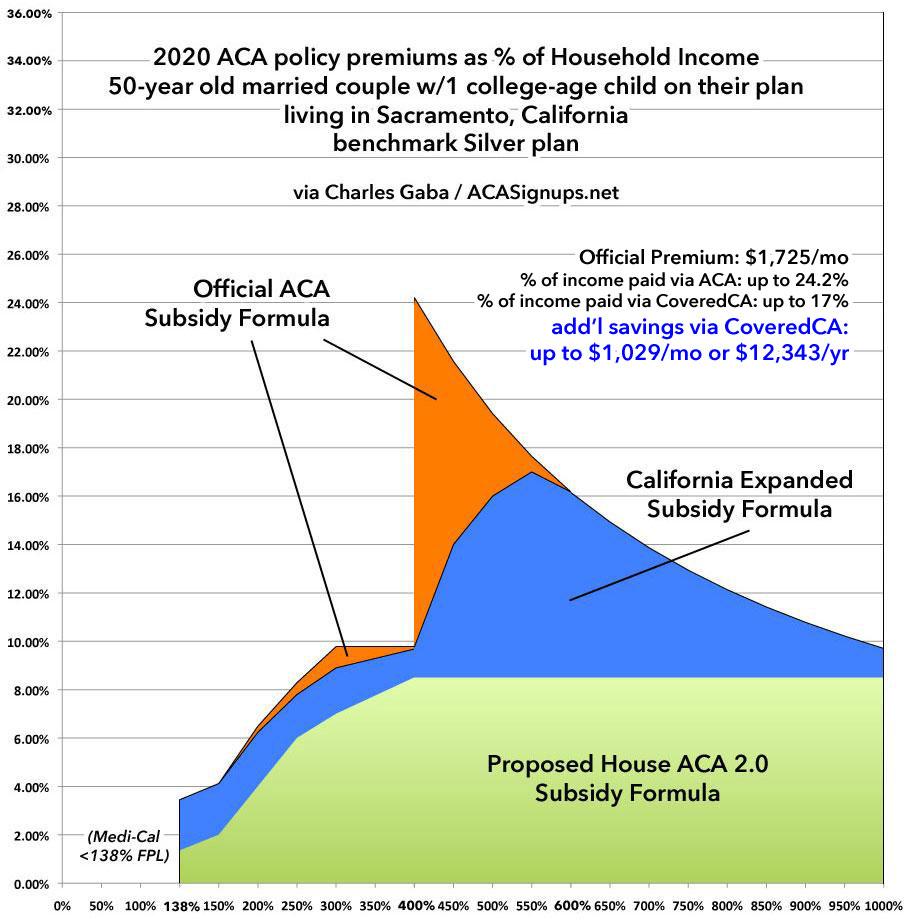

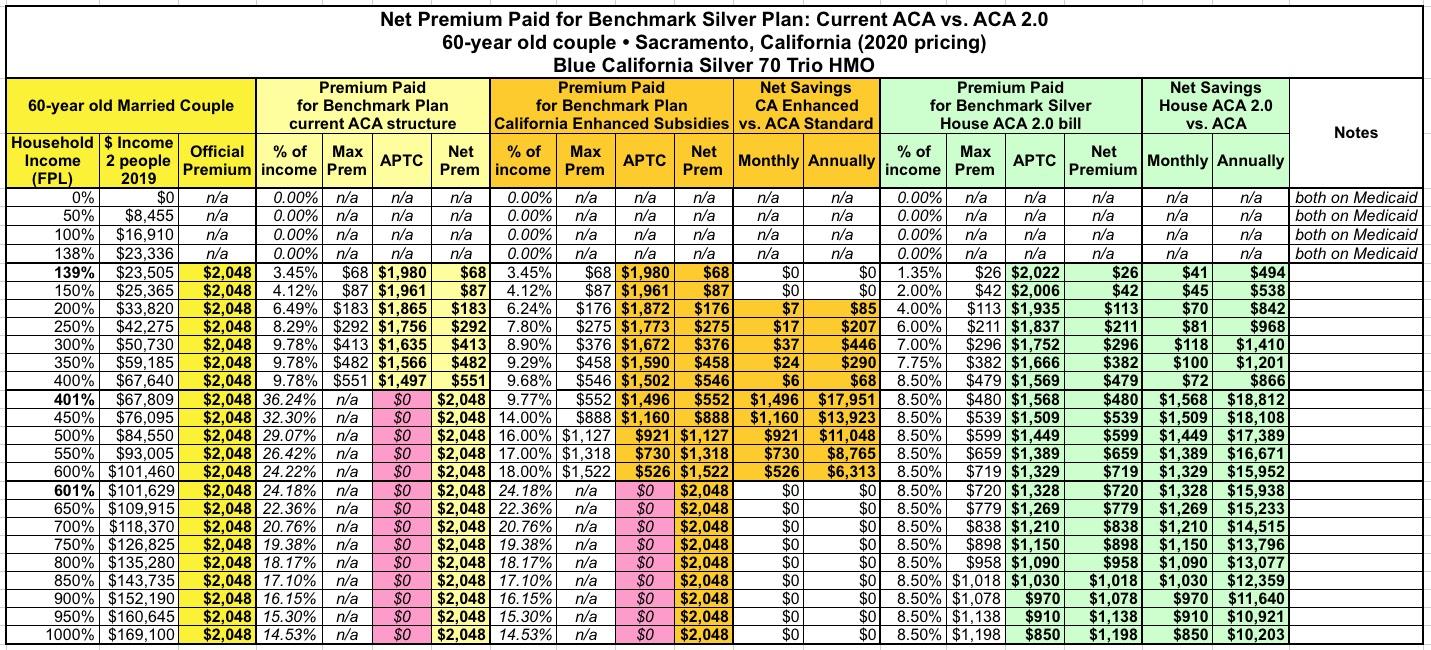

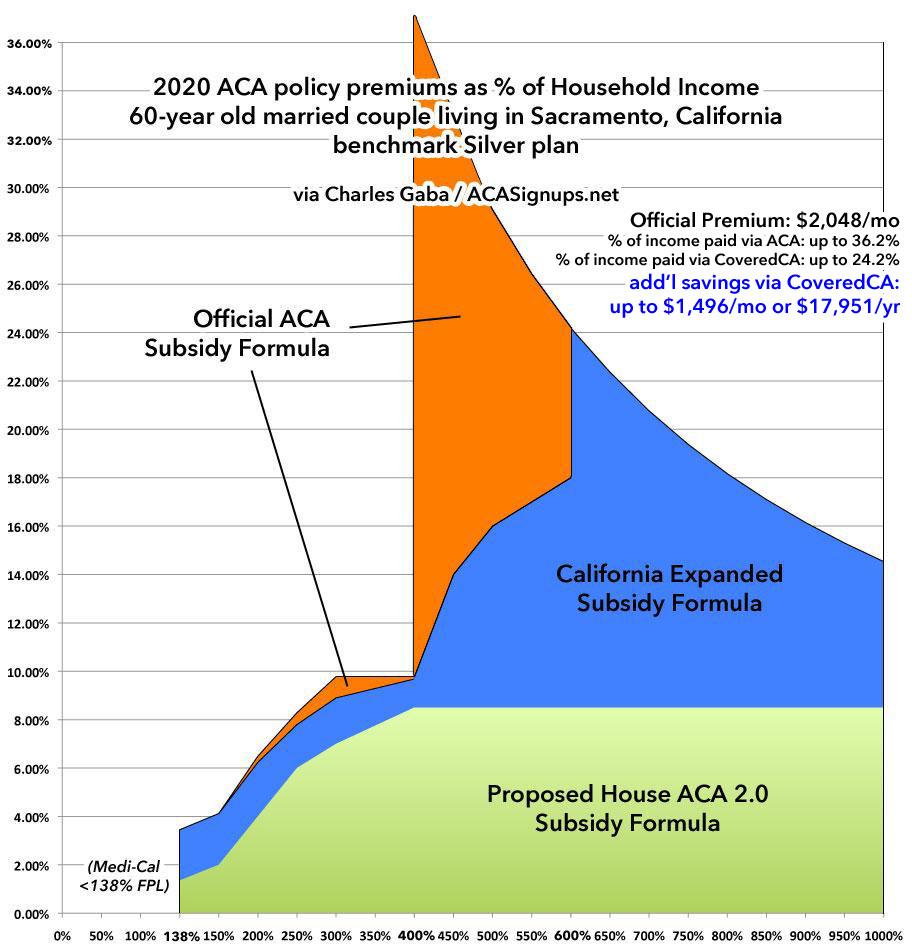

I've also included a third overlay on the tables below: The federal House Democrats ACA 2.0 bill (either H.R. 1868 or H.R. 1884), which would cap premiums at no more than 8.5% of income. The official ACA formula is in Orange; the California subsidy formula is in Blue, and the proposed ACA 2.0 structure is in Green.

Unsubsidized ACA premiums for the same policy can only vary based on three factors: The age of the enrollee(s) (within a 3:1 range); whether they smoke or not (this doesn't apply in California) and what geographic rating area they live in. California is split into 19 Rating Areas.

Since I used Sacramento in my first example, I'll stick with it. Sacramento (both the city and county) is located in CA's 3rd Rating Area, which also includes Placer, El Dorado and Yolo Counties.

First, here's a single 26-year old...let's say, a young adult just moving off of their parents' healthcare coverage. The unsubsidized benchmark silver premium for them is $386/month, or $4,632/year. Under the official ACA subsidy structure, they'd receive as much as $336/month in federal tax credits if their income ranges between 138 - 400% FPL, limiting their premiums to no more than $50 - $386/month. The full price falls below the subsidy threshold at around $47,300.

This means that California's expanded subsidies don't do anything for 26-year olds in the 400-600% range...but from 250-350%, they'd save as much as an additional $330 for the year.

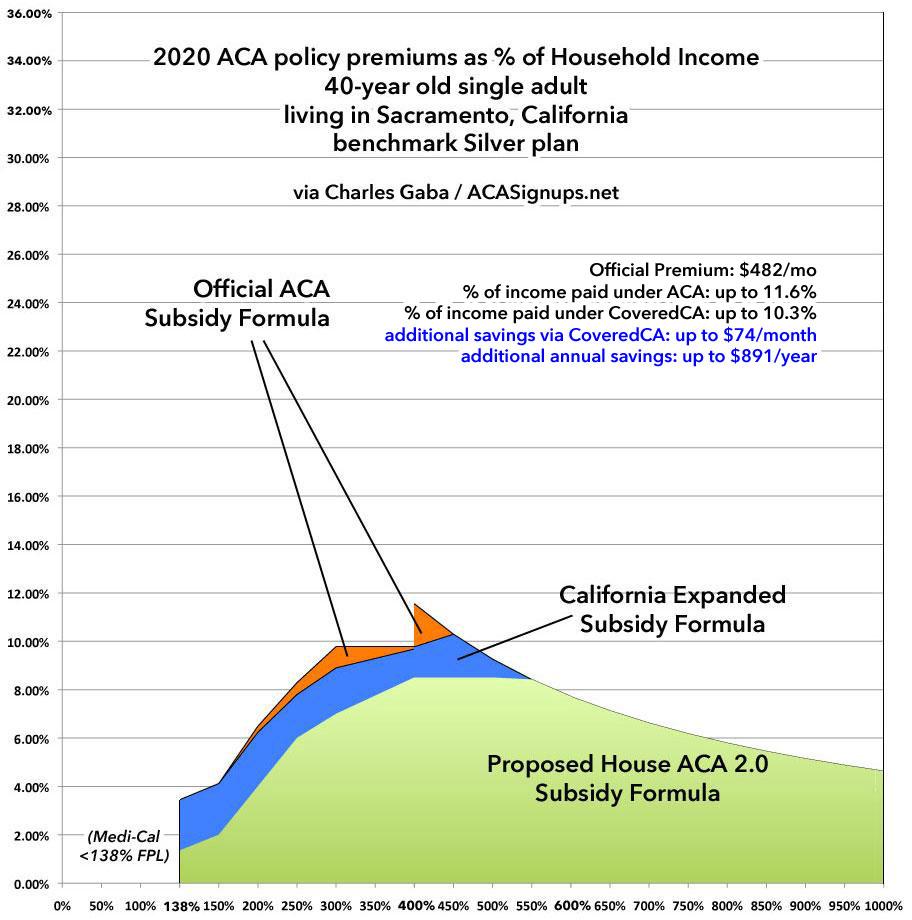

Next, let's look at a single 40-year old. Their unsubsidized premium is $482/month, or $5,784/year.

Under the official ACA subsidy structure, they'd receive as much as $432/month in federal tax credits if their income ranges between 138 - 400% FPL, limiting their premiums to no more than $50 - $407/month. At exactly the 400% threshold, however ($49,960), their subsidies are immediately cut off.

At 40 years old, California's expanded subsidies will save them up to $891 if they earn between 400-600% FPL...and from 250 - 400%, they'd save as much as an additional $330.

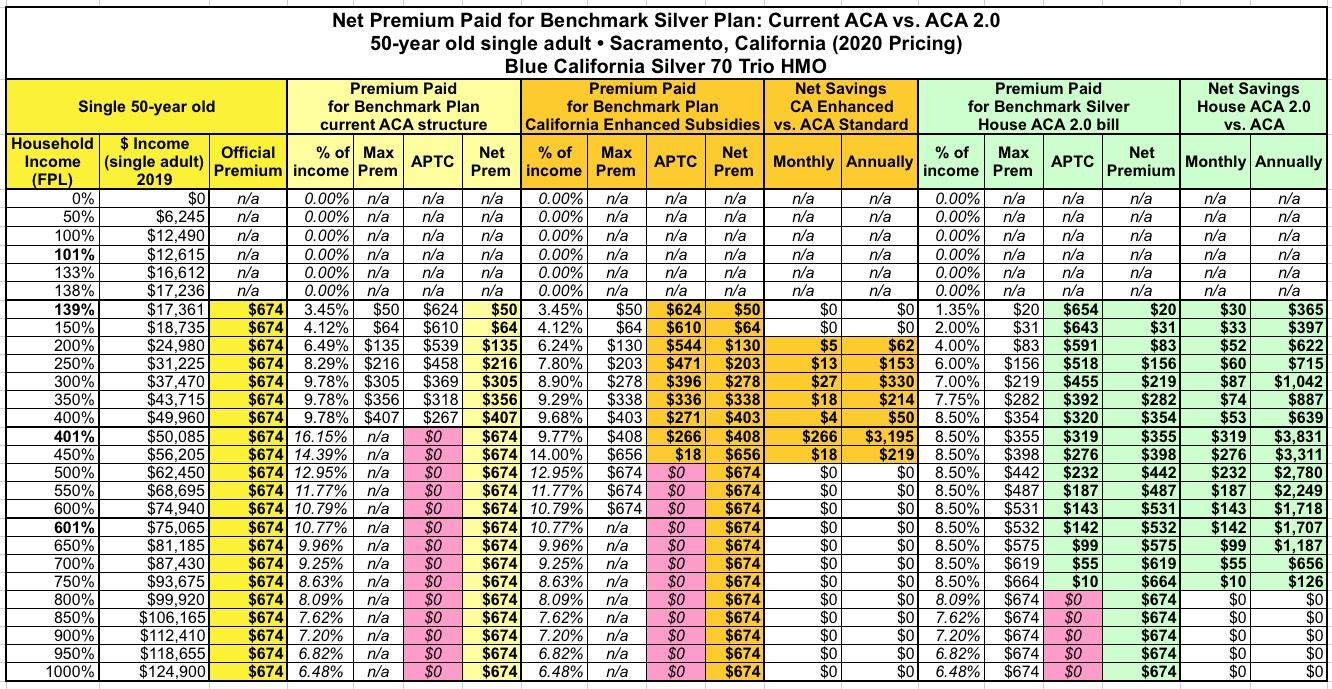

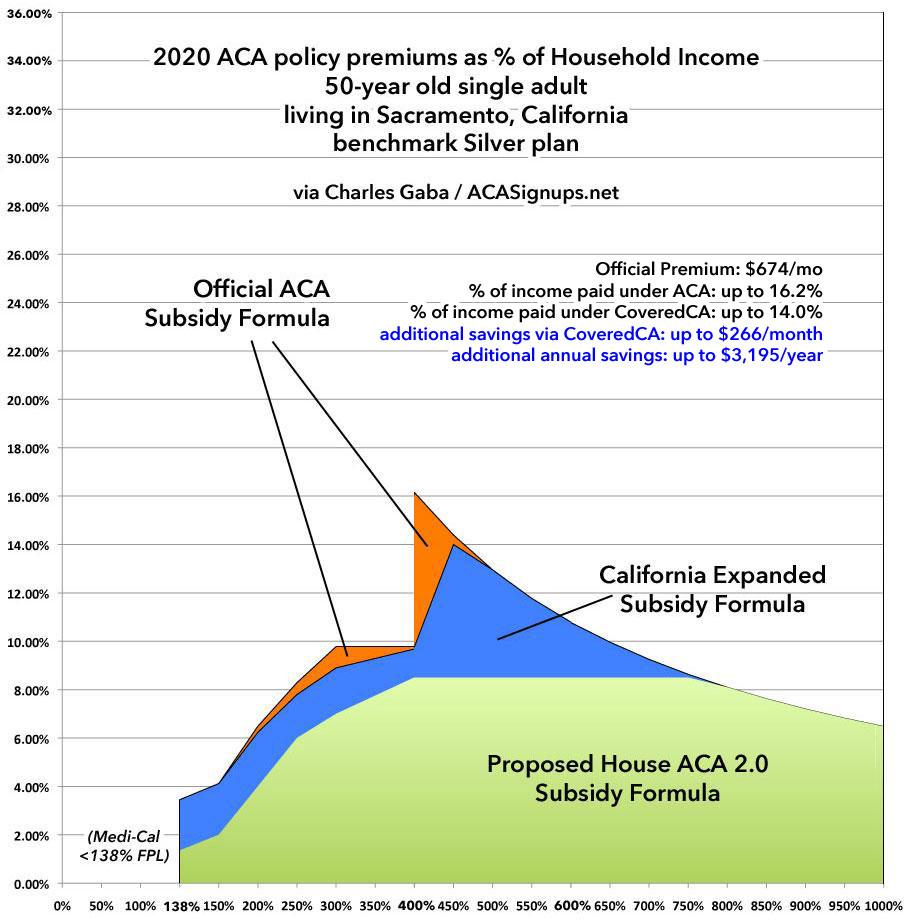

Next up: A single 50-year old. Their unsubsidized premium is $674/month, or $8,088/year.

Under the official ACA subsidy structure, they'd receive as much as $624/month in federal tax credits if their income ranges between 138 - 400% FPL, limiting their premiums to no more than $50 - $407/month. At exactly the 400% threshold, however ($49,960), their subsidies are immediately cut off.

At 50 years old, California's expanded subsidies will save them up to $3,200 if they earn between 400-600% FPL...and from 250 - 400%, they'd save as much as an additional $330.

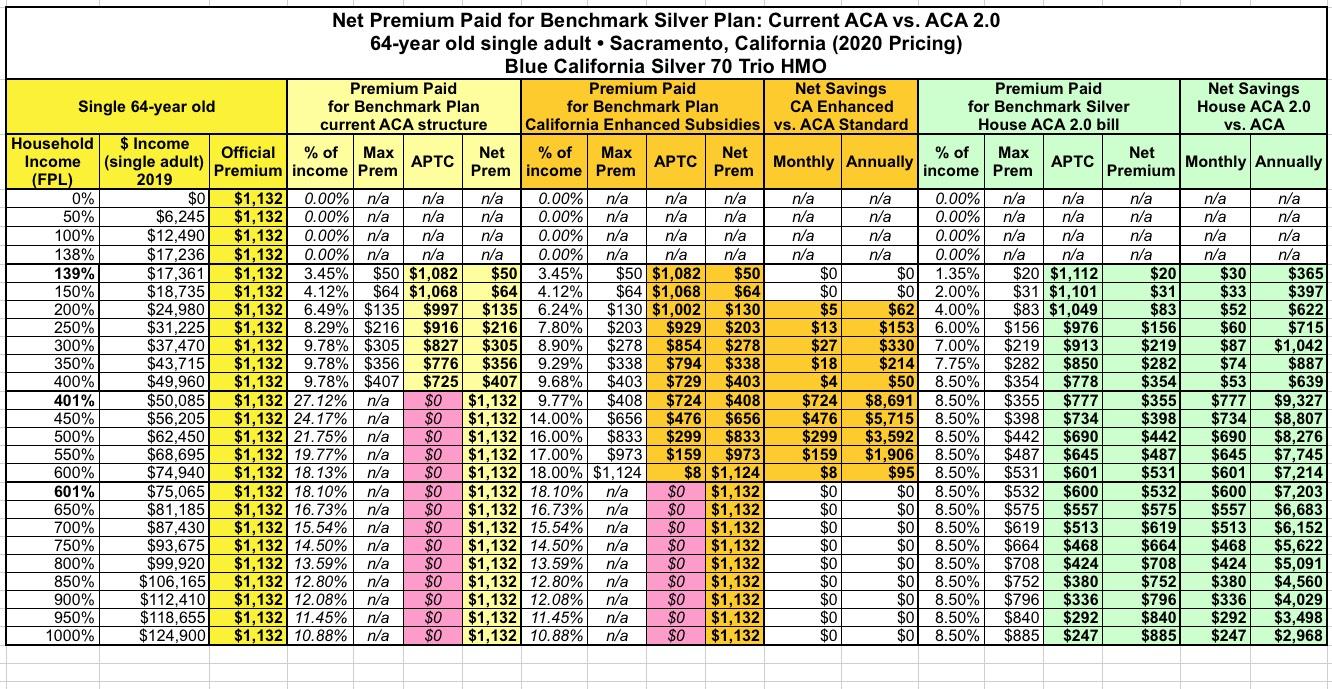

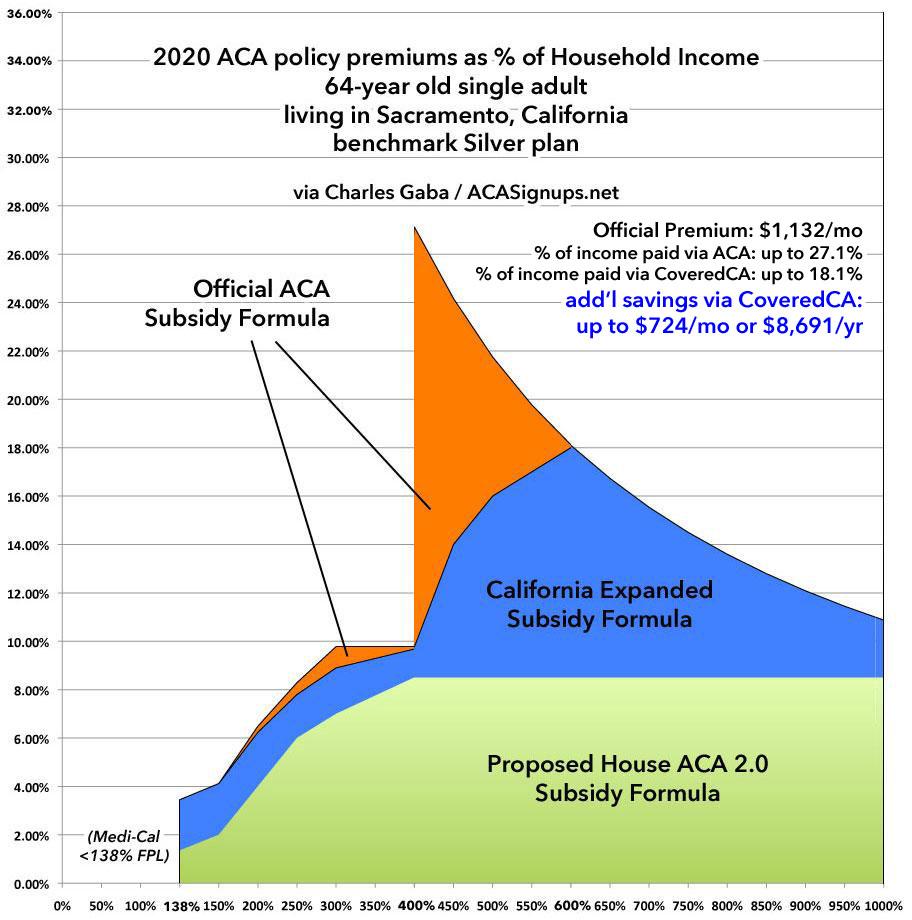

Finally, let's go back to the single 64-year old I wrote about yesterday. Their unsubsidized premium is a whopping $1,132/month, or $13,584/year. That's a ludicrous 27% of their income.

Under the official ACA subsidy structure, they'd receive as much as $1,082/month in federal tax credits if their income ranges between 138 - 400% FPL, limiting their premiums to no more than $50 - $407/month. At exactly the 400% threshold, however ($49,960), their subsidies are immediately cut off.

At 64 years old, California's expanded subsidies will save them up to $8,700 if they earn between 400-600% FPL...and from 250 - 400%, they'd save as much as an additional $330.

All four of these examples are for individuals. What about families? For that, I've put together four additional examples:

- A 30-year old single parent with one child

- A 40-year old married couple with two children

- A 50-year old married couple with one adult child still on their plan

- A 60-year old married couple

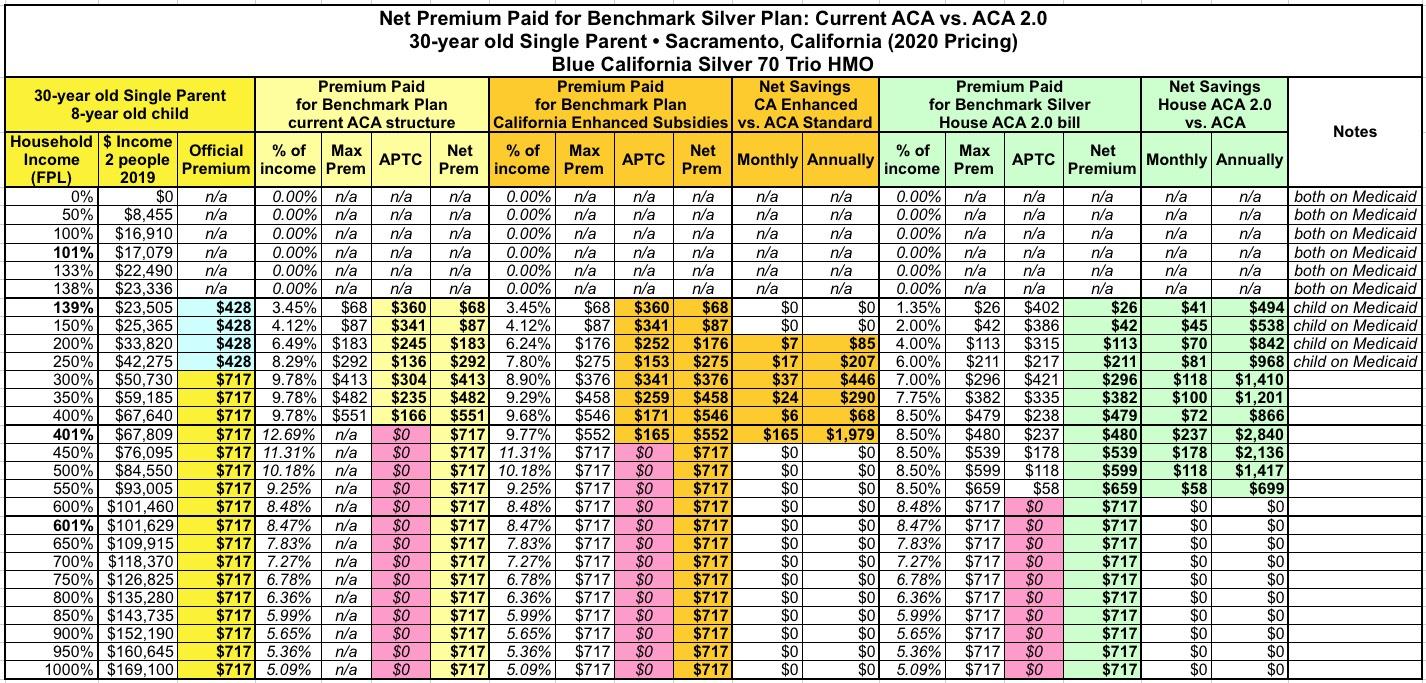

First up: The single parent (30 years old, one 8-year old child):

This actually gets a little trickier than you might think, because in California, children under 18 are eligible for Medi-Cal (Medicaid) if the household income is less than 266% FPL. This means that up to around $45,000, the parent would be eligible for a subsidized ACA exchange plan, while the child wouldn't be enrolled in that plan at all since they'd be enrolled in Medicaid instead. That means the parents' unsubsidized premium for the benchmark plan is $428 for herself only up until 266% FPL...at which point it increases to $717/month for both them and the child.

Under the official ACA structure, the total cost for both would be limited to no more than between $68 and $551/month between 138 - 400% FPL...after which it would immediately jump to the full $717/mo, or over $8,600/year. Under California's expanded subsidies, however, they'd receive additional savings of as much as $446/year between 250 - 400% FPL...and as much as $1,980 between 400-600%.

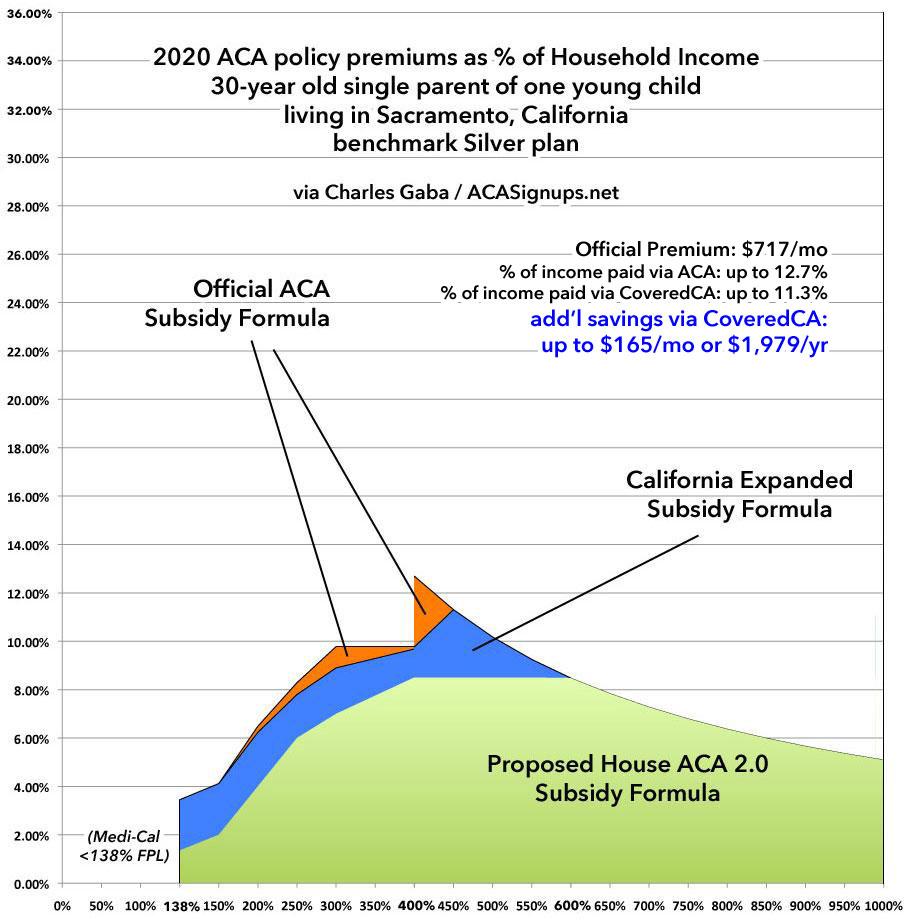

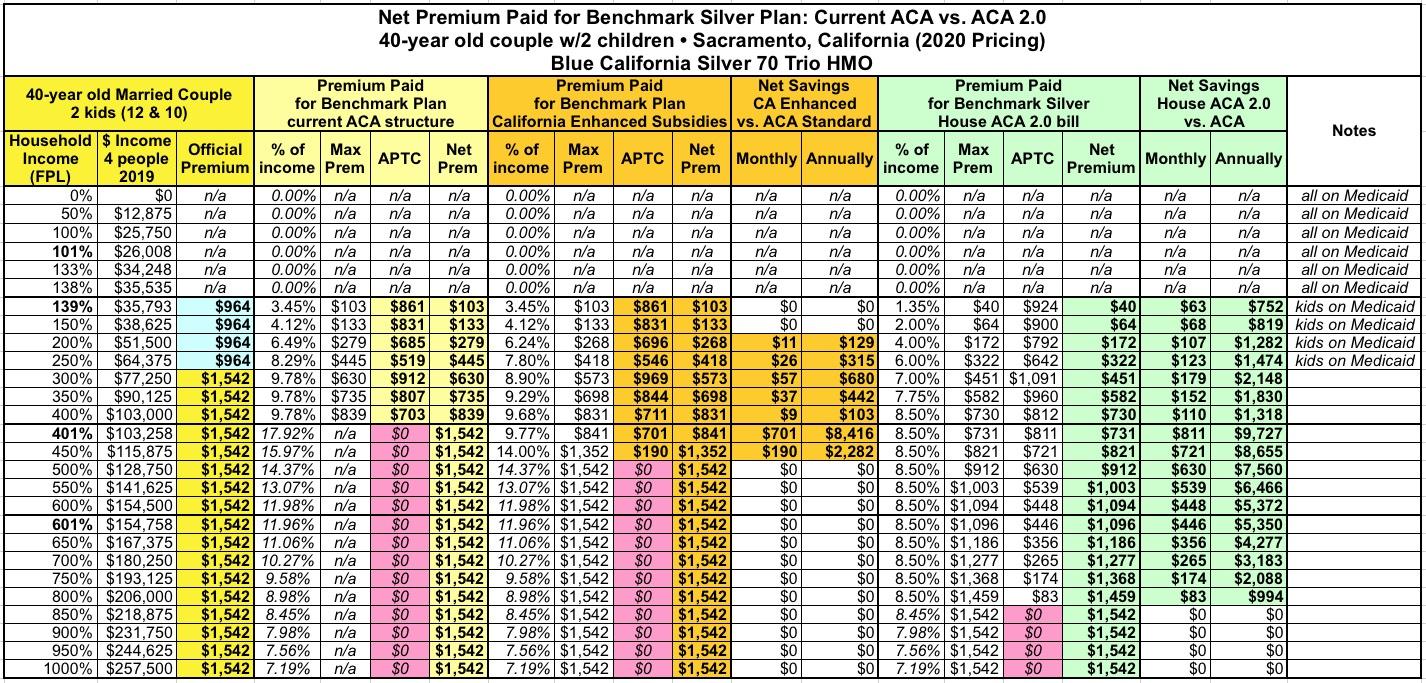

Next: A Nuclear Family...40-year old married couple with 2 children age 12 & 10:

Again, in California, children under 18 are eligible for Medi-Cal (Medicaid) if the household income is less than 266% FPL. This means that up to around $68,000, the parents would be eligible for a subsidized ACA exchange plan, while the children wouldn't be enrolled in that plan at all since they'd be enrolled in Medicaid instead. That means the parents' unsubsidized premium for the benchmark plan is $964 for themselves only up until 266% FPL...at which point it increases to $1,542/month for both them and the two children.

Under the official ACA structure, the total cost for both would be limited to no more than between $103 - $839/month between 138 - 400% FPL...after which it would immediately jump to the full $1,542/mo, or over $18,500/year. Under California's expanded subsidies, however, they'd receive additional savings of as much as $680/year between 250 - 400% FPL...and as much as $8,400 between 400-600%.

Next: Empty-Nesters...a 50-year old married couple with 1 adult child on their plan (age 24).

The Medi-Cal factor is no longer at play here since their kid is over 18, which simplifies things a bit.

Under the official ACA structure, the total cost for all three family members would be limited to no more than between $85 - $695/month between 138 - 400% FPL...after which it would immediately jump to the full $1,725/mo, or a whopping over $20,700/year...fully 24% of their total income.

Under California's expanded subsidies, however, they'd receive additional savings of as much as $563/year between 250 - 400% FPL...and savings of as much as $12,343 between 400-600%.

That's right...the net premiums for this family would drop from $20,700 down to just $8,500 if their household income hovers just over the 400% FPL threshold.

Finally, let's look at a 60-year old married couple:

The unsubsidized premium for this couple would, again, be an absurd $2,048/month. Under the current ACA formula, they're limited to paying between $68 - $551/month if their income ranges from 138 - 400% FPL, but skyrockets right after that; $2,048/month amounts to a jaw-dropping 36% of their total income.

Under the expanded California subsidies, the same couple would see their premiums plummet dramatically if they earn between 400 - 450% FPL...a reduction of nearly $18,000/year, and even at 600% FPL they'd save over $6,300/year.

So there you have it. Here's a summary of the maximum all 8 of these households could potentially save compared to what they'd be paying otherwise for an ACA benchmark Silver plan in 2020:

- Single 26-year old: Up to $330/yr in savings

- Single 40-year old: Up to $900/yr in savings

- SIngle 50-year old: Up to $3,200/yr in savings

- Single 64-year old: Up to $8,700/yr in savings

- 30-year old single parent w/1 child: Up to $2,000/yr in savings

- 40-year old couple w/2 children: Up to $8,400/yr in savings

- 50-year old couple w/1 adult child: Up to $12,300/yr in savings

- 60-year old couple: Up to $18,000/yr in savings

Again, this is for Sacramento County only. All of the amounts above will vary widely depending on the rating area, and of course different ages and household compositions will impact the amounts as well.

California's move here still isn't ideal; it won't be enough to make policies affordable even for many of those who are eligible for the extra subsidies...but for hundreds of thousands of Californians it should still make a big difference.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.