California: Down the Rabbit Hole of "Short-Term Plans" & Health Care Sharing Ministries

A few weeks ago, I did a write-up about a concerning development at HealthCare.Gov: The growing push under the Trump Administration to not only partner with 3rd-party web brokers (which has been done since the first days of the ACA under the Obama Administration), but to actively promote those third-party brokers over HealthCare.Gov itself.

In and of itself, this wouldn't be too problematic as long as people are still ultimately enrolling in fully ACA-compliant policies and receiving ACA subsidies if they're eligible for them. Hell, one of these 3rd-party authorized web brokers even has a banner ad at the top of my website...which I only allow because this particular one only sells on-exchange ACA-compliant policies.

The bigger problem, aside from the confusion that this no doubt causes some potential enrollees who keep being told to visit HealthCare.Gov (or their state's ACA exchange for the dozen or so which operate their own platforms), is that some of these 3rd-party web brokers also sell non-ACA compliant healthcare plans...particularly so-called "Short-Term, Limited Duration" plans (STLD) or simply "Short-Term Plans".

(Aside: I hashtag these #ShortAssPlans, while other health wonks often call them "Junk Plans", and many of them are, but I prefer #ShortAssPlans since not all of them are junk...just, you know...most of them.)

As noted in the original Washington Post story about this:

The Trump administration is encouraging consumers on the Obamacare individual market to seek help from private brokers, who are permitted to sell short-term health plans that critics deride as “junk” because they don’t protect people with preexisting conditions, or cover costly services such as hospital care, in many cases.

...Critics say that both the sale of short-term plans through private brokers and consumers’ ability to select such plans directly on the marketplace website are the latest examples of Trump administration efforts to weaken the ACA after failing to repeal and replace the law in Congress.

(Again, you can't actually select the plans on HC.gov, but there's definitely a lot of confusion for those who don't pay close attention).

Anyway, I bring this up again because of an interesting twist I stumbled across at the largest state-based ACA exchange, Covered California.

Unlike Trump's HHS Secretary Alex Azar and CMS Administrator Seema Verma, California, and CoveredCA specifically, very much support the Affordable Care Act and strongly oppose attempts to undermine, weaken or repeal the law. In fact, just last year the state legislature passed (and Gov. Jerry Brown signed) a new law, SB 910, which banned short-term, limited duration healthcare policies altogether, effective January 1st of this year.

...All of which makes this particular situation a bit ironic. To be clear, there's nothing illegal here. Whether it's unethical or inappropriate or not depends greatly on your point of view, I suppose...but, well...read on.

Like HealthCare.Gov, Covered California also has authorized agents (aka private brokers) to complement their own ACA navigators to help sell their policies. Again, there's nothing wrong with this at all...private brokers sell lots of ACA-compliant healthcare policies.

Among the certified agents that they work with are a half-dozen agents (brokers) who work for "Health for California Insurance Center" in Santa Rosa, CA. Again, not a problem.

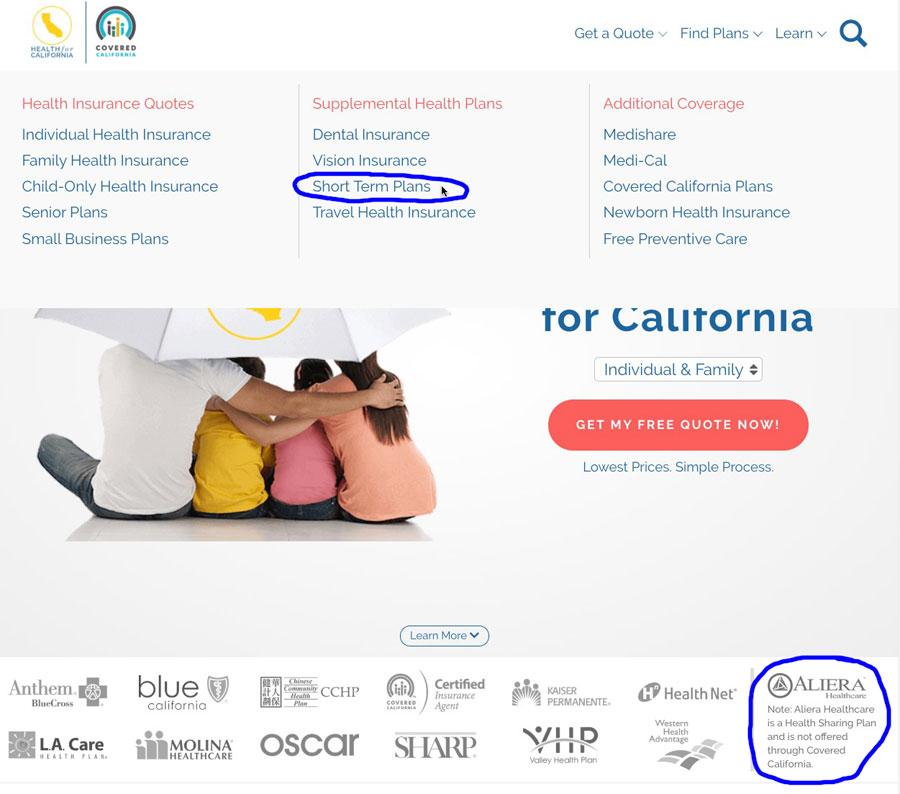

When you visit the Health for California Insurance Center website, however, there's something very interesting:

Whoa. What's going on here?

On the surface, this would appear to be exactly the same as the HealthCare.Gov 3rd-party web brokers who sell both ACA-compliant plans and short-term plans side by side. Bothersome, perhaps, but not illegal, and unlike HC.gov, CoveredCA is not actively pushing people towards the external website.

Except for one thing: As I noted and linked to above, under California SB 910, Short-Term Plans are banned statewide. Yet here's an authorized private California-based insurance carrier, which even has the CoveredCA logo on its website, selling "Short Term Plans".

So...what's going on? Is Health for California Insurance Center blatantly violating the new law?

Well...not quite. Let's take a look. First, the caveat at the lower-right corner says this:

Note: Aliera Healthcare is a Health Sharing Plan and is not offered through Covered California.

A "Health Sharing Plan"? Hmmmm....

Here's what it says at the "Short Term Plan" link:

Short Term Health Care

Need temporary health insurance? Fill in a gap in coverage with a short term health plan.

In California, get Interim coverage for 30-60-90 days, 6 months or up to 12 months.

Ummmmm...yeah, that definitely sounds like the definition of a #ShortAssPlan...but then it gets kind of weird:

Short Term Health Insurance California

If you’re on this page, you are probably looking for short-term health insurance. It could be that you are between jobs, fresh out of school or recently retired. Maybe you didn’t make the Open Enrollment Period and want to have health insurance that will cover you till the next one. The best coverage to get in such circumstances is short-term health insurance.

Short-term insurance, also known as gap health insurance, was a plan that covered you for a short period or covered a gap when you didn’t have health insurance.

What Changed With Short-Term Health Insurance?

Under Obama Care, short-term health insurance plans went away, and Health for California was no longer able to offer these types of coverage. Now, short-term coverage is back again, although it can no longer be called insurance. Instead, short-term coverage is now offered as short-term health plans.

Whoa, whoa, whao...hold the phone a second there, Sparky.

First of all, it's "Obamacare", not "Obama Care", and secondly, "Obamacare" isn't technically a thing anyway...it's the Patient Protection & Affordable Care Act, the Affordable Care Act, the PPACA or the ACA. However, that's a pretty minor quibble.

Secondly, no, the ACA itself didn't "make short-term plans go away" at all...it pretty much ignored them, to be honest. What the ACA did do is say that these plans don't count as qualifying ACA-compliant coverage for purposes of avoiding the ACA's individual mandate penalty.

It wasn't until 2016 that President Obama cracked down on #ShortAssPlans via executive order, restricting them to last no longer than 90 days nationwide (making them "short-term") and not allowing them to be renewed within the same year (i.e., keeping them of "limited duration"). Which...makes sense, really.

In fact, it was because the ACA (wrongly, in my view) treated #ShortAssPlans with kid gloves, necessitating President Obama to restrict them via executive order, that Donald Trump was able to reverse that order a couple of years later...and then some: He's been opening up the floodgates on #ShortAssPlans, the cheaper & crappier the better in his view, like everything else he envisions.

But it's really the third item that's the real cute trick here. Let's read it again:

Now, short-term coverage is back again, although it can no longer be called insurance. Instead, short-term coverage is now offered as short-term health plans.

How can "short-term coverage be back again" in California if a recent law specifically prohibits it? Because these AREN'T "short-term, limited duration plans" in the same sense as the ones which Obama restricted and Trump expanded again.

It's the next paragraph which is the key:

...Health for California offers flexible short-term health plans through Aliera. Aliera Health Care is an HCSM (Health Care Share Ministry) under law, which allows them to offer greater flexibility and lower rates. You can enroll at any time and even enjoy no penalties caused by non-enrollment.

That's right: "Health for California" is not selling "official" Short-Term Plans. They're selling Healthcare Sharing Ministry plans and labelling them as "Short-Term Plans".

What's the difference? Well, official STLDs may not be ACA-compliant, they may have massive gaps in coverage, they may be allowed to discriminate against those with pre-existing conditions, and they may often have lots of hidden charges...but at least they're legally defined as "health insurance" and are thus regulated by the state insurance commissioner.

HCSMs, on the other hand, have many of the same deficiencies as STLDs...but they're also not defined as insurance whatsoever, and thus aren't under the purview of the insurance dept. They are, however, still legal, even in California, as they weren't included in SB 910, which only applies to health insurance products...which HCSMs aren't defined as.

Oh yeah...and you also have to agree to the issuers' "Statement of Beliefs"...which I believe used to generally mean agreeing not to drink, smoke, do drugs, have extramarital sex, gamble and so forth, although I believe most of them have dispensed with a lot of that sort of thing more recently.

In their defense, Health for California is actually pretty up-front about a lot of this:

All short-term health care plans have some limitations:

- They may not protect you from the Obamacare Penalty – Most people tend to think that getting short-term health coverage protects you from the government penalty for not having health insurance. While short-term plans are a good option for medical insurance, it does not shield you from penalties.

On the one hand, this is outdated, since the ACA's coverage mandate penalty was zeroed out by Congressional Republicans...although California recently reinstated the exact same penalty at the state level.

(I should also note thatrevenue from the state-based penalty is part of what's funding California's expanded/enhanced subsidies for those earning 400 - 600% of the Federal Povery Line).

On the other hand, at least they spelled "Obamacare" as a single word this time...

- Most do not cover pre-existing conditions – ACA has set minimum requirements that must be met with major health plans. Short-term health coverage is not required under ACA to meet the essential requirements. As such, most do not cover pre-existing conditions. You could be denied the plan based on your pre-existing condition. If you are still accepted on the plan, they might not cover the said condition. Autism, substance abuse treatment, mental health conditions and other medical conditions may also not be covered.

- They may not cover prescription drugs – Prescriptions you may take or need to take during the course of your short-term health plan duration may not be covered.

- You must agree to a statement of beliefs – Since health plans are not part of government health programs, most plans, including short-term and other health care plans, require you to agree to a statements of beliefs, which may include your commitment to certain lifestyle and healthy practices. Aliera has a very inviting statement of beliefs that’s open to people of many different orientations and faiths.

Sure enough, according to the Aliera Healthcare (aka "Trinity", aka "Unity Healthshare") Terms & Conditions I found, their full "Statement of Beliefs" now boils down to the following:

At the core of what Unity HealthShare does, and how it relates to and engages with one another as a community of people, is a set of common beliefs.

UHS' Statement of Beliefs are as follows:

1. We believe that our personal rights and liberties originate from God and are bestowed on us by God.

2. We believe every individual has a fundamental religious right to worship God in his or her own way.

3. We believe it is our moral and ethical obligation to assist our fellow man when he/she is in need according to our available resources and opportunity.

4. We believe it is our spiritual duty to God and our ethical duty to others to maintain a healthy lifestyle and avoid foods, behaviors or habits that produce sickness or disease to ourselves or others.

5. We believe it is our fundamental right of conscience to direct our own healthcare, in consultation with physicians, family or other valued advisors.

That's pretty watered down, I admit. Unless you're an atheist or agnostic, most of these are no sweat. The only one which really delves into personal behavior is #4, which basically just says, "you shouldn't do unhealthy stuff" and even then it doesn't actually define what that means anyway.

Getting back to Health for California's bullet points:

- There’s a limit on how long you can renew – While it can be renewed several times, a short-term health plan can only be renewed up to 11 months. After that, your insurance company will not renew it further. There is also no guarantee that your insurance company will accept you again when renewing, especially if you had a major illness while on the plan. These plans are intended for short-term solutions, and the idea is that you’ll eventually move on to a more permanent health coverage solution.

And then they close with this:

...Final Word

Short-term plans do not meet government standards, so it’s not advisable to purchase a short-term plan if you have a pre-existing condition. Be on the lookout for the next open enrollment, so you can apply for a major health insurance plan that will save you from government penalties. When purchasing a short-term health plan, you should get one that can be dropped anytime without penalties from the health insurance company.

Of course, most people have no idea they have a pre-existing condition until it's diagnosed anyway, which kind of turns this into circular logic, since oftentimes the only way you'll know about the condition is by going to the doctor and having tests done, which requires having healthcare coverage in the first place.

Overall, they're basically admitting "look, we know these plans suck, but they're dirt cheap and they might come in handy in a pinch".

I actually have a certain level of respect for that level of honesty.

Or rather, I would respect it except for two things:

First, why on earth are they marketing Health Care Sharing Ministry plans (which are legal in California) as "Short-Term Plans" (which aren't)? I could understand trying to market something illegal as something that's legal, but they're effectively doing the exact opposite, which is just...strange.

Secondly, the name "Aliera" rang a bell in my head, and sure enough, I've written about them twice before...this year in fact:

Insurance Commissioner Mike Kreidler today ordered Aliera Healthcare, Inc. (Aliera) and Trinity Healthshare, Inc. (Trinity), both of Delaware, to immediately stop selling health insurance illegally in Washington state and engaging in deceptive business practices.

As a result of a recent Georgia court order, the New Hampshire Insurance Department is advising consumers that Aliera, a company that markets itself as a health care sharing ministry, may be operating illegally in New Hampshire.

This report form the Commonwealth Fund pulls no punches:

Several states have taken legal action against one entity – Aliera Healthcare – which administers, markets, and provides support services for Trinity Healthcare, which represents itself as a HCSM.

Aliera reportedly has 100,000 members nationwide and collected $215 million in revenue in 2018. After receiving numerous consumer complaints regarding these companies, Colorado, Texas, and Washington issued ceased and desist orders to prevent them from operating in the states. In Colorado, the Department of Insurance explained that it was “concerned that they [Aliera and Trinity] may be using misleading marketing practices, blurring the lines between health insurance that complies with the requirements of the ACA and non-compliant insurance . . . the companies may be putting consumers at risk [.]”

In Washington, the Insurance Commissioner found that Trinity did not satisfy the definition of a HCSM and was therefore operating as an unauthorized insurer. Its investigation found that Aliera did not accurately represent Trinity’s beliefs, and that it had provided misleading training to agents and misleading advertisements to the public about HCSM products.

or example, Aliera’s marketing did not describe the faith-based nature of HCSM plans, but rather, marketed the plans as “next generation Healthcare products [.]” The state also found that Aliera’s use of traditional insurance terms, like “Gold,” “Silver,” “Bronze,” and “Catastrophic,” led consumers to mistakenly believe they were purchasing insurance. As a result, the state fined the companies over $1 million.

In Texas, the state filed a lawsuit against Aliera to prevent it from engaging in the business of insurance without a license. In its complaint, it explained that the DOI has “collected evidence of significant customer complaints” against Aliera. When the DOI contacted some of these individuals, they indicated that they believed Aliera had offered them a comprehensive insurance product and “were surprised when their claims were not paid.”

Welp. It sounds like there's more to this than I thought after all.

In short: California, which is devoted to protecting and promoting the ACA, and which disapproves of short-term plans so strongly that they literally banned them, has, as one of their authorized agents of their own ACA exchange (so authorized that they're allowed to include the "CoveredCA" logo and branding on their website) a third-party insurance broker which is also selling health sharing ministry plans from a third company which is, in turn, being investigated an penalized by several other states for operating fraudulently and misleading customers...all while re-branding those ministry plans as "Short-Term Plans", which ironically are illegal in California to begin with.

Does that about sum things up?

To their credit, CoveredCA is well aware of the situation with HCSMs in the state (which have likely become even more of an issue now that "actual" STLDs have been shut down, I'd imagine). It turns out that back in March, they included a whole survey and discussion about the issue:

Covered California received comments from various stakeholders about establishing standards regarding Certified Agents selling ACA non-compliant plans (particularly Sharing Ministries)

Agent Comments

- Comments received from 88 agents as of March 8, 2019

- Comments reflected a wide diversity of opinion, with many respondents supporting Covered California taking action--ranging from banning the sale of Sharing Ministries to requiring disclosure--and many opposing Covered California taking any action.

Among the “buckets” or responses from agents submitting comments were:

- Prohibit certified agents from selling Sharing Ministry plans: 16 support; 14 oppose

- Covered California should establish disclosure policies: 7 support; 5 oppose

- Sharing Ministry plans should be an alternative when no other coverage option fits (e.g., SEP when no QLE exists, subsidy ineligible): 27 support; 18 oppose

- As a result of research to date, more non-Qualified Health Plan products have been identified in addition to Sharing Ministries

- Covered California will be conducting additional research to discover the array of non-QHP products and their implications for consumers and the market

- Some of these products may not be compliant with the Affordable Care Act (ACA)

- Covered California staff expects to bring to the Board a recommendation requiring a disclosure statement with all ACA non-compliant products listed, based on research to be conducted

- This disclosure will be created with input from the Department of Managed Health Care, the California Department of Insurance, the Certified Agent community, consumer advocates and Covered California’s Qualified Health Plans in order to address all ACA non-compliant products

...all of which led to the following policies be implemented at their most recent board meeting in November:

Going forward, authorized agents must...

- Run a consumer’s eligibility for financial assistance or Medi-Cal prior to selling the consumer an HCSM

- Collect a signed Consumer Acknowledgement and Full Disclosure Form from any consumer who purchases an HCSM

- Retain the Consumer Acknowledgement and Full Disclosure Form in hard copy or electronically for 3 years, to be made available to Covered California upon request

- Attest to agreement to abide by Covered California policy regarding HCSMs during annual, web-based Agent recertification training

- Disclose the number of HCSMs sold by the Agent in the prior plan year during annual, web-based Agent recertification training.

So there you have it.

None of these policies does anything to address the problems with Health for California Insurance Center selling Aliera Health's products specifically, given their troubling record of being accused of fraud in multiple states, nor does it answer the question of why those products are being marketed as "Short Term Plans" when they're actually HCSM plans...but at least it's something, I suppose.

As a final note, the sheer breadth of disclaimers at the bottom of the "Short Term Plan" page on Health for California's website would be amusing if the situation wasn't so troubling (and yes, the entire second paragraph is in all-caps and boldface on their website as shown). For a company which prominently displays the Covered CA logo at the top of their website, they sure do go through a lot of trouble to make it clear that they're not Covered CA at the bottom of it:

Health for California Insurance Center is licensed with the Department of Insurance and Covered California. HFCIC is a Covered California Storefront and is one of the largest Covered California enrollment centers in the state.

“COVERED CALIFORNIA,” “CALIFORNIA HEALTH BENEFIT EXCHANGE,” AND THE COVERED CALIFORNIA LOGO ARE REGISTERED TRADEMARKS OR SERVICE MARKS OF COVERED CALIFORNIA, IN THE UNITED STATES. THIS WEB SITE IS OWNED AND OPERATED BY HEALTH FOR CALIFORNIA, WHICH IS SOLELY RESPONSIBLE FOR ITS CONTENT. THIS SITE IS NOT MAINTAINED BY OR AFFILIATED WITH COVERED CALIFORNIA, AND COVERED CALIFORNIA BEARS NO RESPONSIBILITY FOR ITS CONTENT. THE E-MAIL ADDRESSES AND TELEPHONE NUMBERS THAT APPEAR THROUGHOUT THIS SITE BELONG TO HEALTH FOR CALIFORNIA, AND CANNOT BE USED TO CONTACT COVERED CALIFORNIA.

NOTE: I reached out to Covered California prior to publishing this piece for comment (which I admit is unusual for me) and was sent the following response from spokesman James Scullary (emphasis his):

"Health care sharing ministry products are not illegal to sell in California. They are not regulated and it would require action by the state legislature or a regulatory agency to take ban them.

"While Covered California does not regulate these products, we can play a role in protecting consumers and making sure they understand the risks that health care sharing ministries can present. We have been working with stakeholders, agents and others for the better part of a year to better understand how we can make sure consumers know they are not purchasing health insurance if they buy these products. Most of our agents understand this and do not sell health care sharing ministries.

"Last month Covered California’s board approved several measures which will be incorporated into our new agent agreements during January and February, which will require agents to first check if consumers are eligible for financial help through a Covered California plan, or Medi-Cal (California’s version of Medicaid) before selling them a health care sharing ministry product. In addition, agents will be required to get signed form from a consumer acknowledging that they understand that a health care sharing ministry product is not insurance.

"While health care sharing ministries are less expensive and may seem like a good idea, they have left a trail of denied claims, complaints and accusations of false advertising across the country. We want people to know that these products are full of limitations. Most do not cover pre-existing conditions or preventive services and many have caps on the amount they will pay for coverage. If you buy one of these products, nothing is guaranteed.

"California is proud to join states across the nation in making sure consumers are protected and get health care coverage that will be there for them when it counts."

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.