New York: APPROVED 2020 #ACA premium changes: 6.8% increase

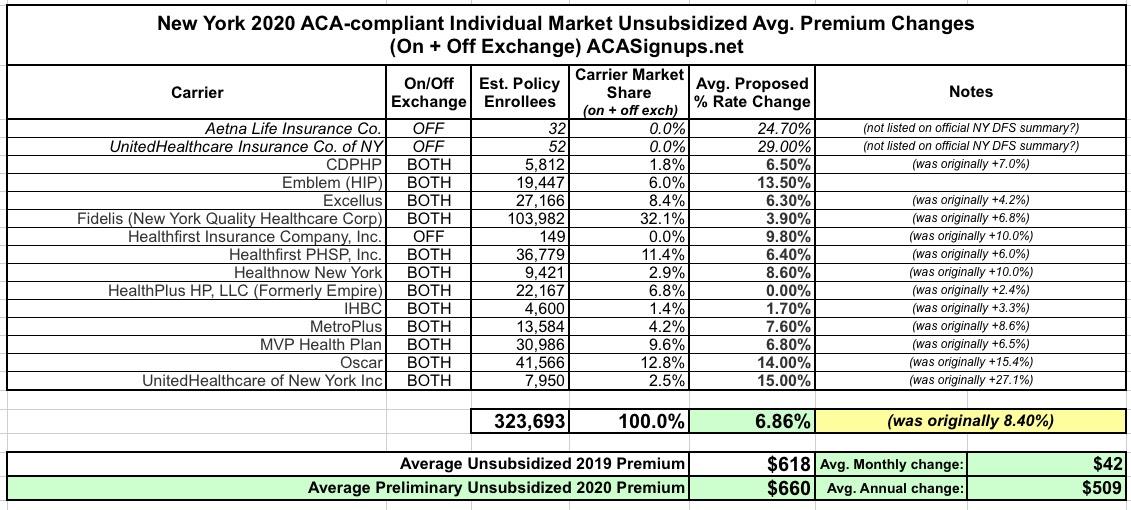

Back on May 31st, I reported that New York's Dept. of Financial Services had released the preliminary, requested premium rate hikes for the 2020 ACA individual and small group markets. At the time, the weighted average increase requested state-wide was around 8.4% (although I got 8.3% when I plugged the hard enrollment numbers into a spreadsheet).

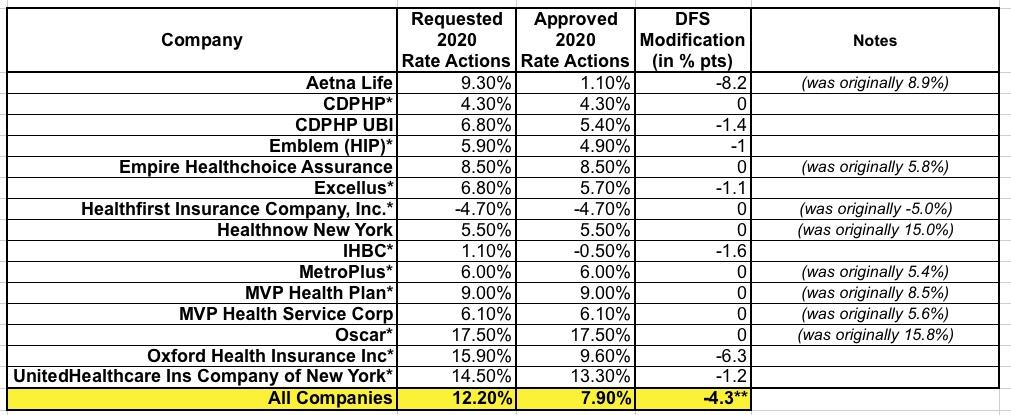

For the small grouip market, NY DFS reported an average requested increase of 12.0%, although again, I only got 11.3% when I plugged in the numbers.

Yesterday, however, NY DFS became the third state (after Oregon and Virginia) to publicly release their approved 2020 premium changes...and like OR & VA, they've shaved a few points off the average rates:

DFS ANNOUNCES 2020 PREMIUM RATES: LOWERS OVERALL REQUESTED RATES FOR INDIVIDUALS AND SMALL BUSINESSES TO PROTECT CONSUMERS AND FUEL A COMPETITIVE HEALTH INSURANCE MARKETPLACE

- New York Rates for Individuals More Than 55% Lower Than Before Implementation of the Affordable Care Act, After Adjusting for Inflation and Before Federal Tax Credits

- DFS Reduced Overall Insurers' Requested Rate for Individual Coverage from 9.2% to 6.8%, a Reduction of 26%, Saving Consumers over $50 Million

- DFS Cuts Overall Insurers' Requested Rate for Small Group Coverage from 12.2% to 7.9%, a Reduction of 35%, Saving Small Businesses over $313 Million

- Overall, Consumers Who Receive Tax Credits for the Most Popular Silver Plan Will See No Increase in Premiums in 2020

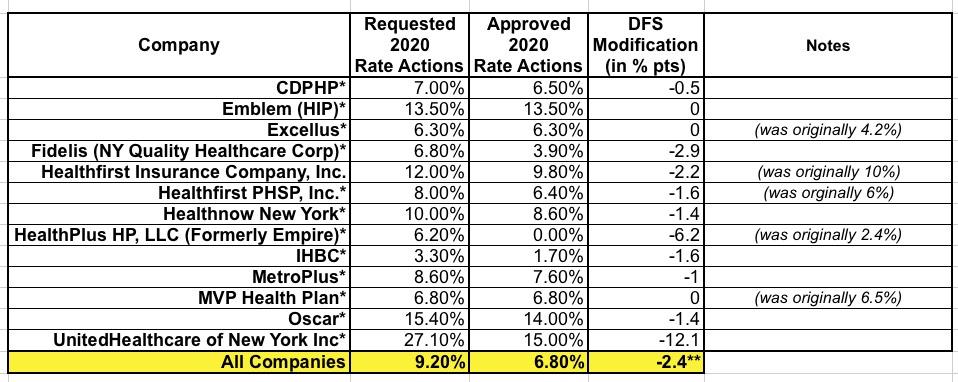

Hmmmm...ok, first of all, I'm not sure where the 9.2% figure comes from; they were pretty clear about the 8.4% back in May, but whatever. As you can see in the table below, several of the carriers appear to have submitted revised filings between 5/31 and now which skewed the "requested" rate changes. Secondly, the "55% lower than before the ACA after adjusting for inflation" caveat is vitally important. Remember, ACA-compliant policies have been mandatory since 2014.

New York - Financial Services Superintendent Linda A. Lacewell announced today that, despite continued federal attacks on the Affordable Care Act (ACA), the Department of Financial Services (DFS) is steadfastly protecting consumers by reducing health insurers’ 2020 requested rates.

Since the ACA was implemented in 2014, New York has cut the uninsured rate in half from 10% to below 5%, and premiums in the individual market have remained more than 55% lower after adjusting for inflation and before the application of federal tax credits. DFS reduced insurers’ total weighted average increase requested for individuals by 26%, from 9.2% to 6.8%, saving consumers over $50 million. DFS also reduced requested rates for 2020 small group plans by 35%, from 12.2% to 7.9% for 2020, saving small businesses over $313 million. Over 1.3 million New Yorkers are enrolled in individual and small group plans.

“Consumer protection is our number one job, and New York has been a national leader in ensuring that quality, affordable health care is available to everyone in the state,” said Financial Services Superintendent Lacewell. “This year marks the ninth anniversary of the Affordable Care Act’s passage and fifth year since implementation, and we continue our strong efforts to support the ACA and combat unjustified federal attacks on the nation’s healthcare system. By reducing insurers’ rate requests, DFS is ensuring access to affordable health care and helping to maintain a robust, competitive marketplace.”

Federal tax subsidies under the ACA will help mitigate the impact of the 2020 rate increases for the majority of individuals purchasing coverage through the NY State of Health marketplace. Costs for the approximately 60% of marketplace enrollees who receive federal Advance Premium Tax Credits (APTC) will be largely unaffected by these rate increases. The APTC amount is on a sliding scale for enrollees with incomes up to 400% of the Federal Poverty Level (FPL), approximately $103,000 for a family of four. The amount of the APTC is set by the second lowest cost silver plan in each county.

The main driver of premium rates, as in prior years, is underlying medical costs. For the 2020 individual rates announced today, drug costs account for the largest share of medical expenses, followed by inpatient hospital costs, and outpatient hospital costs.

Under the leadership of Governor Andrew M. Cuomo, New York has taken aggressive action to protect New Yorkers' access to quality, affordable health care, regardless of federal actions, by codifying the consumer protections of the ACA, including the ban on preexisting condition exclusions, the prohibition on annual and lifetime dollar limits, the guarantee of quality essential health benefits, and the ability to keep children on their parents’ plans through age 26. Indeed, the Governor went beyond the ACA’s protections, ensuring more expansive contraception coverage as well as medically necessary abortion coverage with no cost-sharing. In addition, the Governor expanded coverage for in-vitro fertilization for large groups and fertility preservation services for those with serious health conditions. In addition, the Governor’s budget codified in State law the NY State of Health, the Official Health Insurance Marketplace. And the Governor proposed and passed a state law codifying the protections of the federal Mental Health Parity and Addiction Equity Act (MHPAEA), and strengthened coverage for addiction treatment including limiting copayments to one per day even if the consumer has multiple addiction treatment services that day. Furthermore, the Governor took action to protect access to coverage for the LGBTQ community, including enactment of a state anti-discrimination law in the face of the Trump administration repeal of those protections.

Yep. New York has indeed been one fo the dozen or so states to move aggressively to codify many fo the ACA's protections.

Individual Market

Rates for individuals are more than 55% lower than prior to the establishment of the NY State of Health in 2014, adjusting for inflation but not counting federal financial assistance that the ACA makes available to many consumers purchasing insurance. Approximately 326,000 New Yorkers are currently enrolled in individual commercial plans.

DFS reduced insurers’ total weighted average increase requested for individuals by 2.4 percentage points, or 26%, from 9.2% to 6.8%. Medical costs reflected in health plan rate requests averaged 7.3%, which DFS reduced to 6.9%. However, certain reforms that DFS enacted, including standardizing the difference in pricing between health plan metal levels (platinum, gold, silver and bronze), have helped reduce rate increases by over 2%. In addition, the federal ACA Health Insurance Tax, which was reimposed for 2020, accounts for approximately 2% of the increase. Without this tax, the increase would have been 4.8%. This year’s 2020 rate increases will be the lowest for the individual market since 2015.

Consumers who receive federal ACA tax credits – 47 percent of all individual market enrollees on and off marketplace – will see no change in the cost of coverage compared to 2019. Taking this into account, the estimated overall impact of the 2020 premium increase on consumers on and off marketplace who purchase the most popular silver plan would be a decline of 0.5%. For example, an individual earning $30,000 living in Kings County would pay $199 per month after tax credits for the lowest cost silver plan, $14 less per month than in 2019.

Households with income between 200% and 400% of the federal poverty level (up to $49,960 for individuals and $103,000 for a family of four in 2020) qualify for federal tax credits, which will reduce premium costs. Households below 200% of the federal poverty level can qualify for the Essential Plan. In 2019, approximately 60% of individuals who enrolled in a Qualified Health Plan on the Marketplace received financial assistance – which means these consumers are held harmless from the impact of premium increases.

These rate decisions do not include the Essential Plan, available only through the NY State of Health, which will still have premiums of $20 or less for lower income New Yorkers who qualify. Approximately 790,000 New Yorkers were enrolled in the Essential Plan as of January 31, 2019.

Small Group Market

More than one million New Yorkers are enrolled in small group plans, which cover employers with 1 to 100 employees. Insurers requested an average rate increase of 12.2% in the small group market. DFS cut the weighted average requested rate increases by 4.3 percentage points, or 35%, from 12.2% to 7.9% for 2020, saving small businesses over $313 million. The federal ACA Health Insurance Tax, which was reimposed for 2020, accounts for approximately 3% of these rates. Without this tax, the increase would have been 4.7%. A number of small businesses will also be eligible for tax credits that may lower those premium costs even further.

The same thing happened in the Small Group market, where over half the carriers actually re-filed modified requests at some point in June or July before finally settling in and being approved at 7.9%: