North Carolina: *Preliminary* 2020 avg. #ACA rate changes: 5.3% *decrease* (UPDATE)

NOTE: This post re. North Carolina's 2020 individual market premium rate change is incomplete because it only includes one of the three carriers participating in NC's market (Blue Cross Blue Shield of NC). The rate change requests for Cigna and Centene haven't been released yet.

Normally I'd wait until I had data for the other two as well, but BCBSNC held around 95% of the state's Individual Market share last year, with Cigna holding the other 5% (Centene was a new entry to the market, so they didn't have any of it). I don't know how much the relative share has changed this year, but I'm assuming that BCBSNC still holds the lion's share of the total.

That being said, BCBSNC just posted their own preliminary rate filing summary on their corporate blog:

Blue Cross NC is decreasing 2020 Affordable Care Act (ACA) rates by an average of 5.2 percent for plans offered to individuals and an average of 3.3 percent for plans offered to small businesses with one to 50 employees. With this reduction, we take 238 million steps towards more affordable care in North Carolina.

This is the second year in a row that Blue Cross NC has filed an average rate decrease for individual ACA members – with the average rate reduction for individual members totaling nearly 10 percent over the last two years. In addition, small businesses have also seen cost reductions in their plans over the last two years.

Blue Cross NC’s focus on better, simpler, more affordable care is working. We strive to be a national model for health care transformation and are always looking for ways to lower costs and achieve better care. This includes our move to a value-based provider reimbursement program, Blue Premier, which supported these decreases. Along with Blue Premier, Blue Cross NC is providing more resources and data to independent primary care practices so they can participate in value-based care models.

Rate decreases are also the result of our commitment to being a good steward of every premium dollar by reducing internal operating expenses. The state legislature and regulators have fostered stability and certainty in the market by not adding additional health insurance mandates and regulatory burdens that typically drive up costs.

As a company, experience is on our side. Over the past six years that Blue Cross NC has participated in the ACA marketplace, we’ve gained substantial customer insight, which has improved our ability to better coordinate care and reduce medical expenses for our ACA customers.

“When the focus is on quality and accountability, costs go down and the customer wins.”

-Dr. Patrick Conway, President and CEO, Blue Cross NC

Blue Cross NC serves more than 435,000 individual ACA members and has more than 8,500 small business ACA customers—representing nearly 70,000 members. Blue Cross NC, once again, expects to be the only ACA insurer serving individual customers in all 100 counties in 2020.

Last year North Carolina's total Individual Market was around 500,000 people. On-exchange enrollment dropped about 3.6% this year, but it's possible that this was cancelled out by a slight bump in off-exchange enrollees thanks to Silver Loading, so that doesn't mean much. Until I hear otherwise, I'll assume it's still around 500K.

If so, that means BCBS of NC's market share has dropped from 95% to around 87%, leaving another 65,000 enrollees between Cigna and Centene/Ambetter. If both of them are also looking at ~5% premium drops, the 5.2% estimate shouldn't change much. Even if they're both flat year over year, that would only nudge the weighted average up to a 4.5% drop. Since these are preliminary requests which will be revised later this summer anyway, I'll stick with -5.2% for the moment.

UPDATE: OK, it's actually somewhat lower than that:

There are about 13k non Blue Cross NC members.

— Blue Cross NC (@BlueCrossNC) August 1, 2019

That means there's only 448,000 statewide this year, which means BCBS NC actually has actually increased their market share to 97%. This in turn means that Cigna and Centene/Ambetter's rate changes would barely move the needle unless they're crazy high or low.

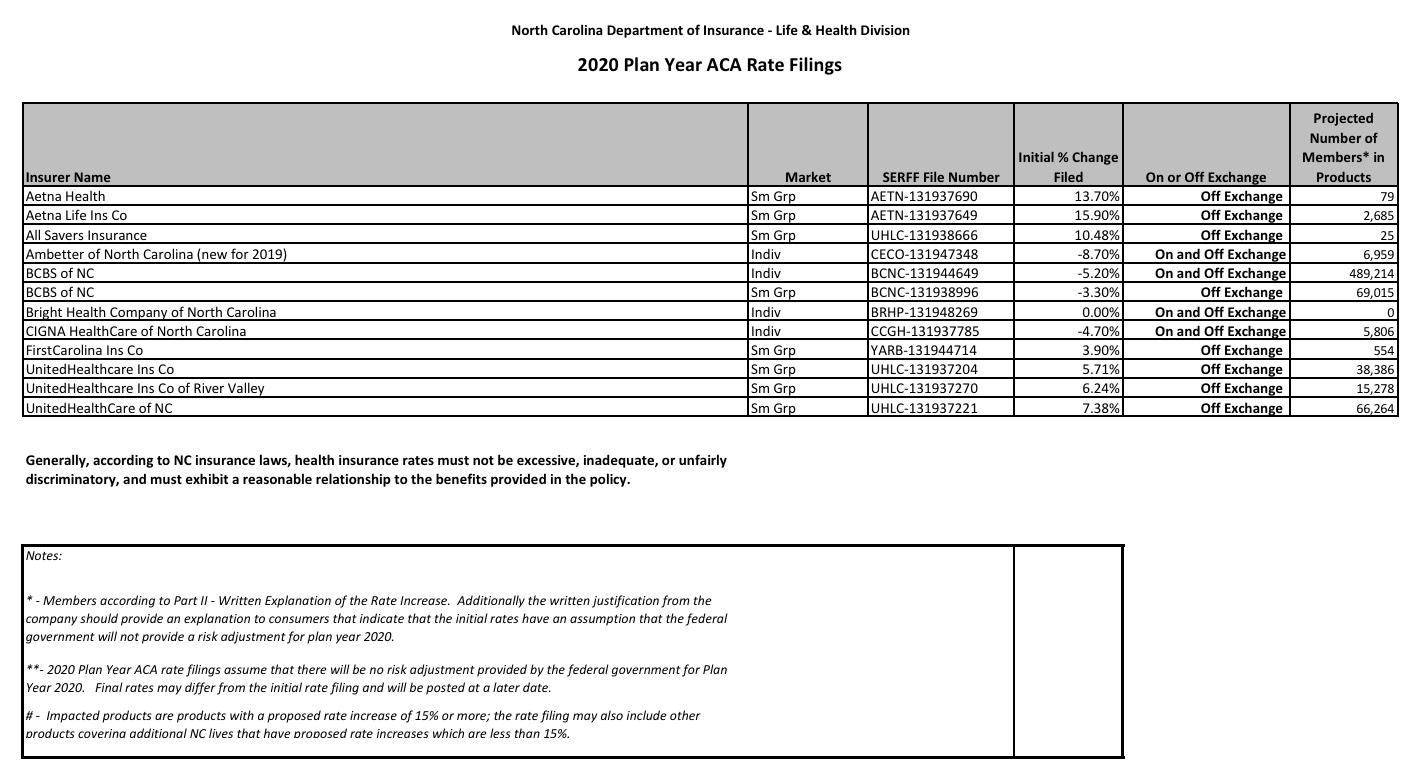

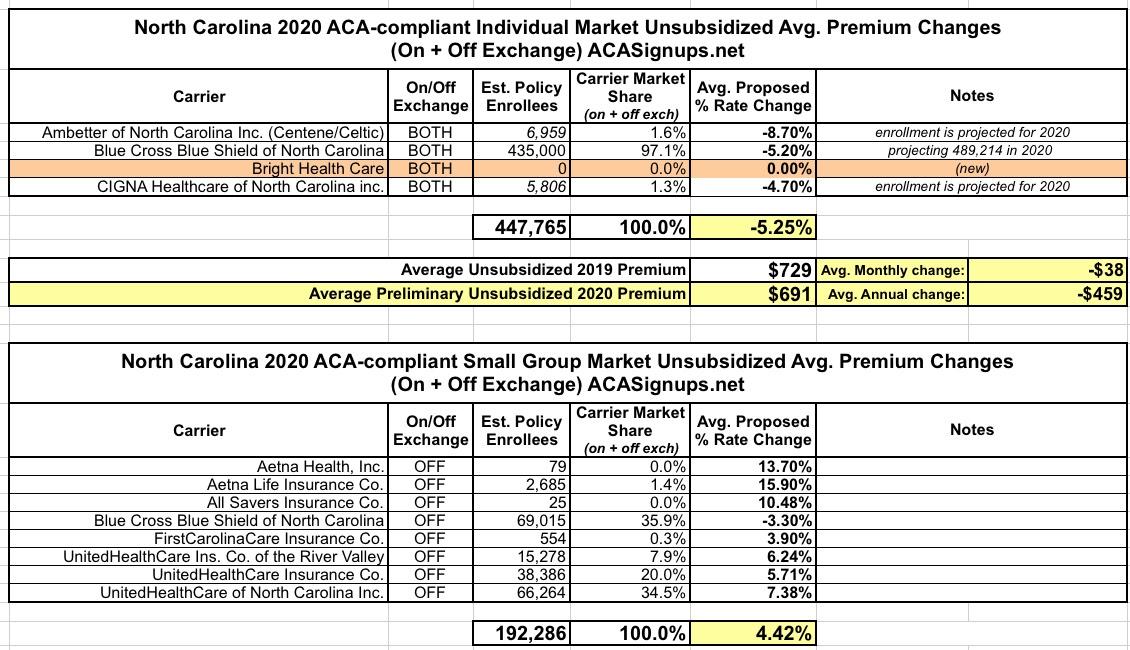

UPDATE: The NC Dept. of Insurance has now posted their preliminary 2020 rate hikes for both the Individual and Small Group markets, and sure enough, BCBSNC holds 97% of the total (interestingly, they're projecting themselves to increase enrollment by around 12.5% next year):

As I noted above, due to BCBS's commanding market share, the 8.7% and 4.7% reductions from Centene & CIGNA barely change anything in terms of the statewide average. There is one noteworthy item, however: Bright Healthcare is joining the NC market in 2020.

This also gives me the rate change and enrollment data I need to calculate the average Small Group Market increase of 4.4%: