Pennsylvania: *Preliminary* 2020 avg. #ACA exchange rate changes: 4.6% increase

This Just In from the Pennsylvania Insurance Dept:

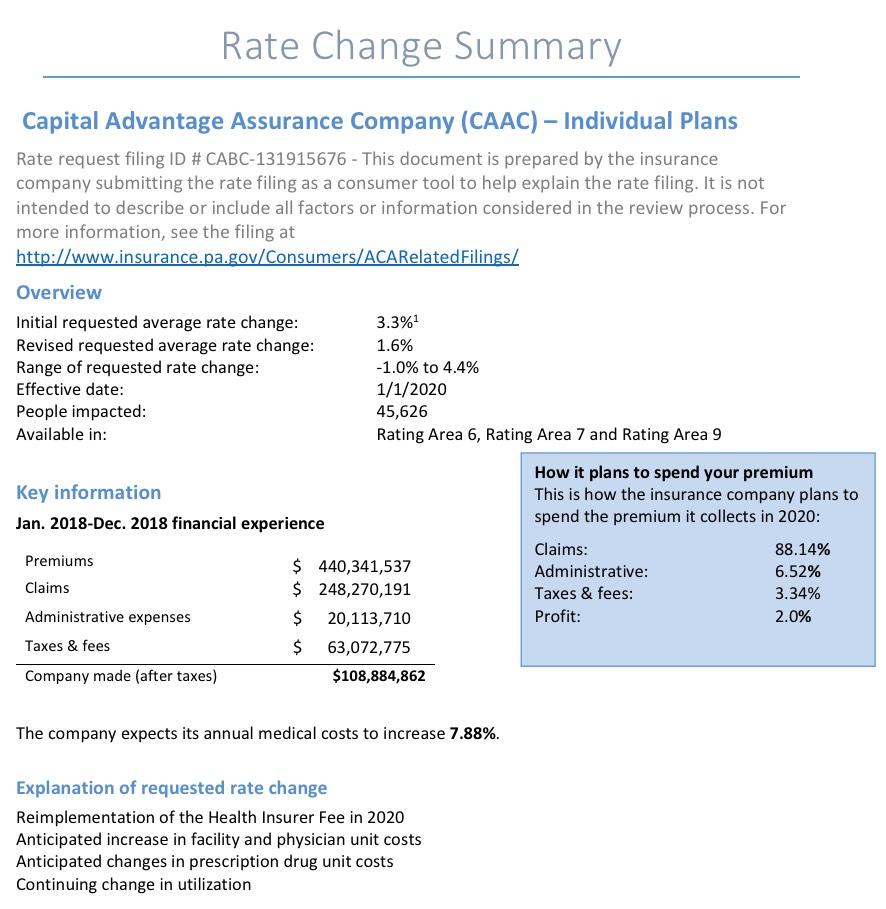

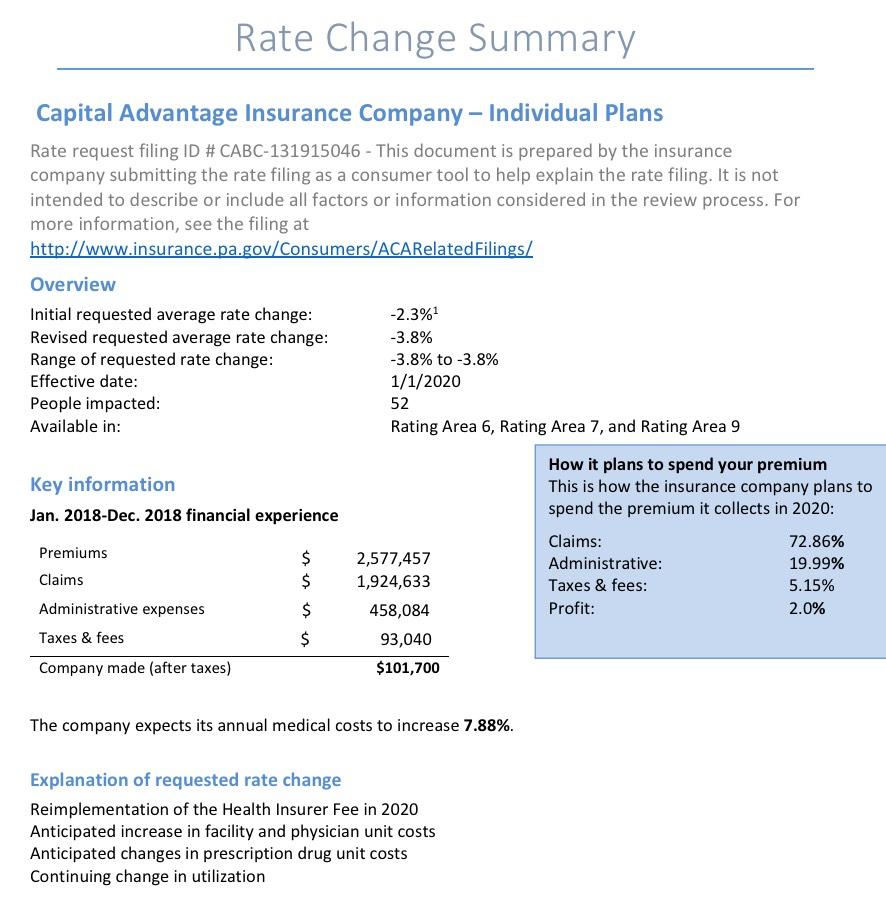

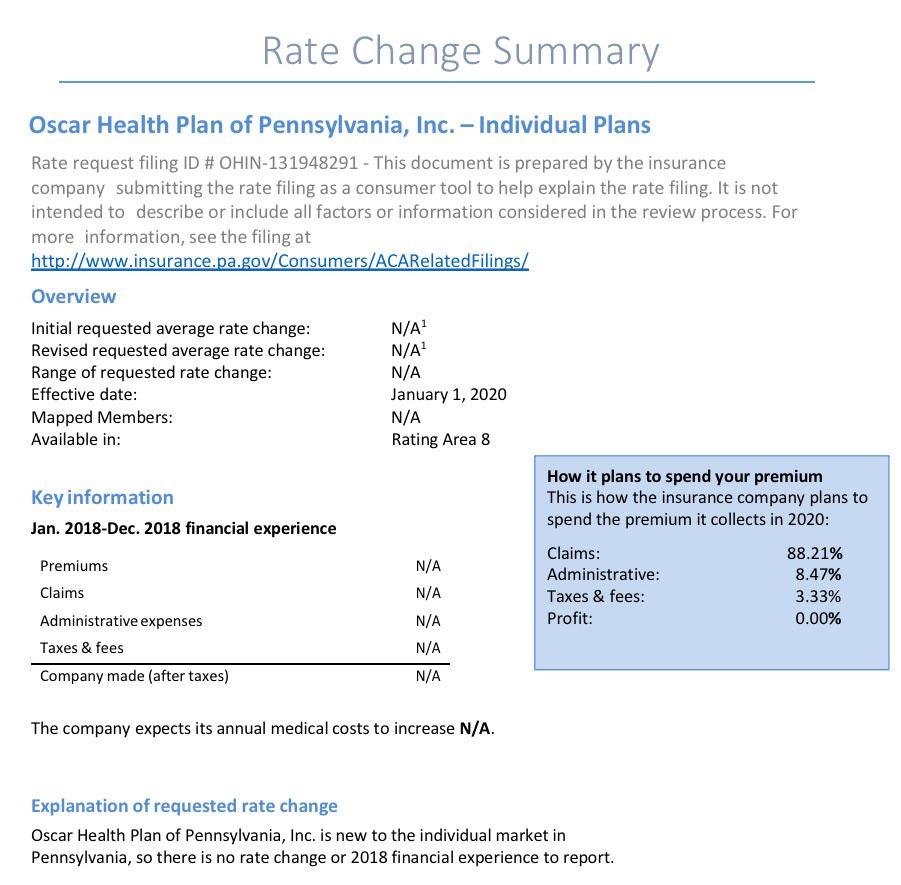

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Pennsylvania Insurance Department for review and approval before plans can be sold to consumers. The Department reviews rates to ensure that the plans are priced appropriately -- that is, they are neither excessive (too high) nor inadequate (too low) -- and are not unfairly discriminatory.

Rates reflect estimates of future costs, including medical and prescription drug costs and administrative expenses, and are based on historical data and forecasts of trends in the upcoming year. In its review, the Department considers these factors, as well as factors such as the insurer's revenues, actual and projected profits, past rate changes, and the effect the change will have on Pennsylvania consumers. For more information on this process, watch our How Are Health Insurance Rates Decided?Opens In A New Window video.

Below you can review information on pending and approved rate filings for individual and small group products that comply with the reforms of the Affordable Care Act. Limited portions of the filings are deemed confidential by law. Consumers are invited to submit comments on any pending filings to ra-rateform@pa.gov. Comments submitted in writing will be posted to our website.

You can find rate filings for products that either predate the Affordable Care Act ("grandfathered" products), or that have been granted a temporary period in which to transition into compliance with Affordable Care Act ("transitional" products), here.

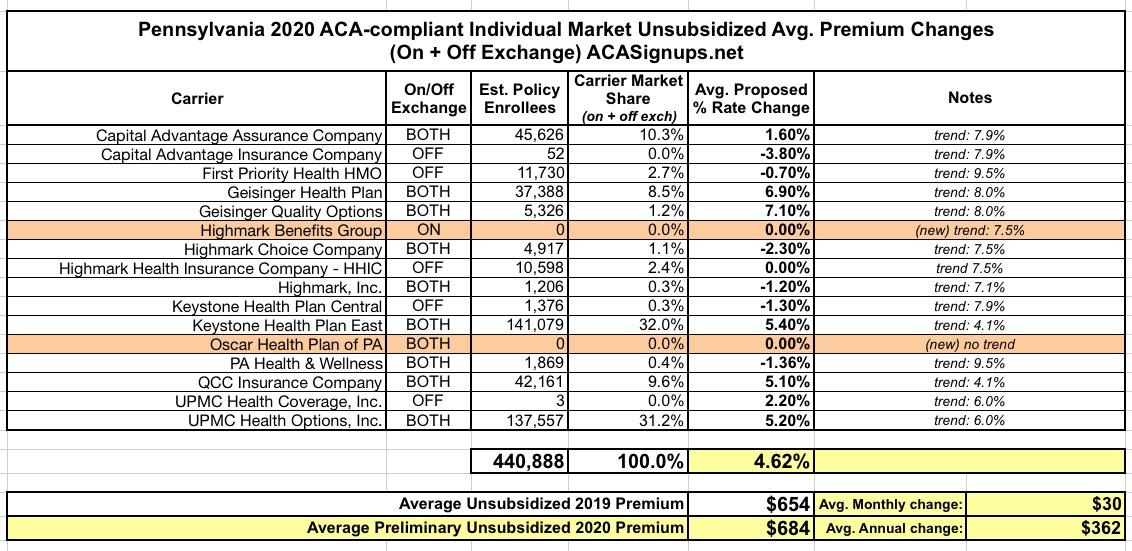

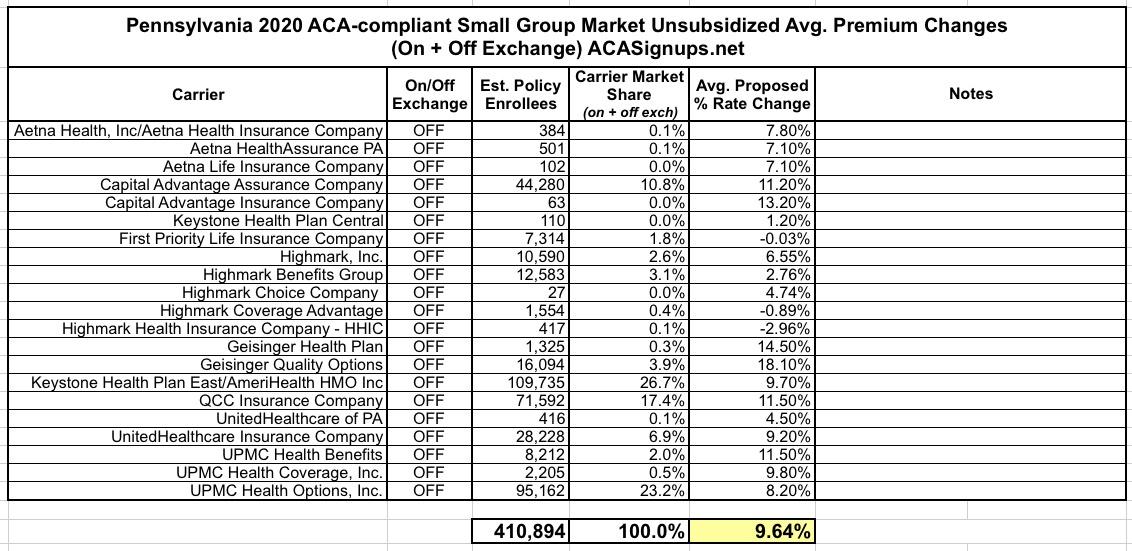

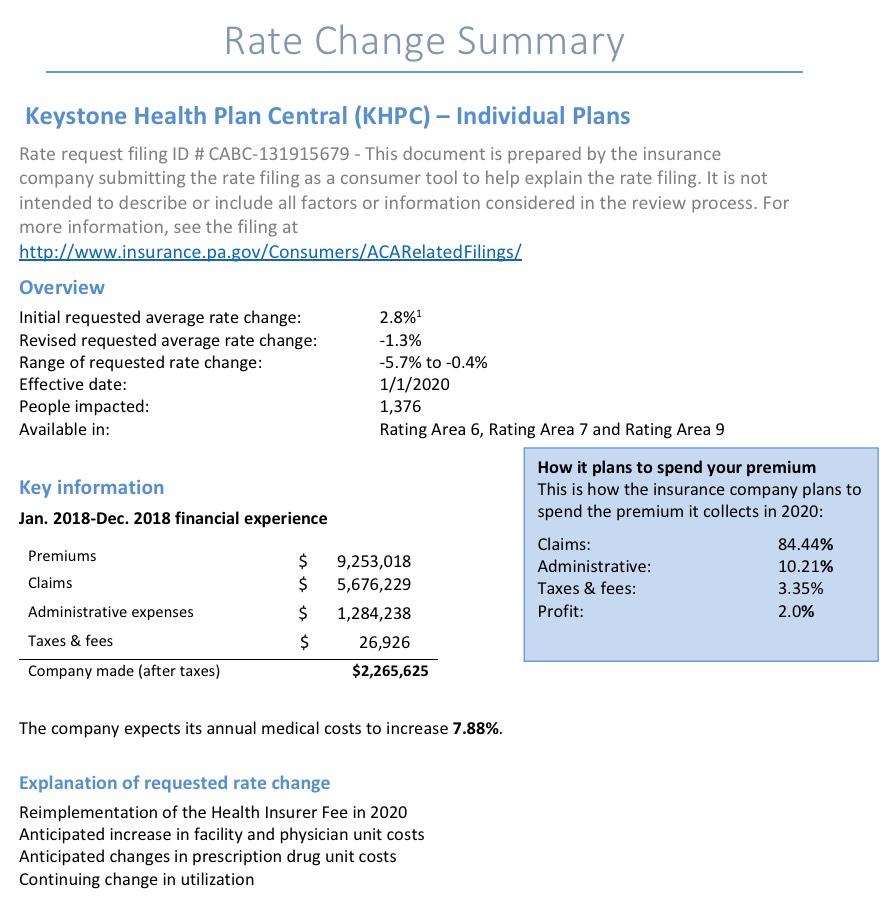

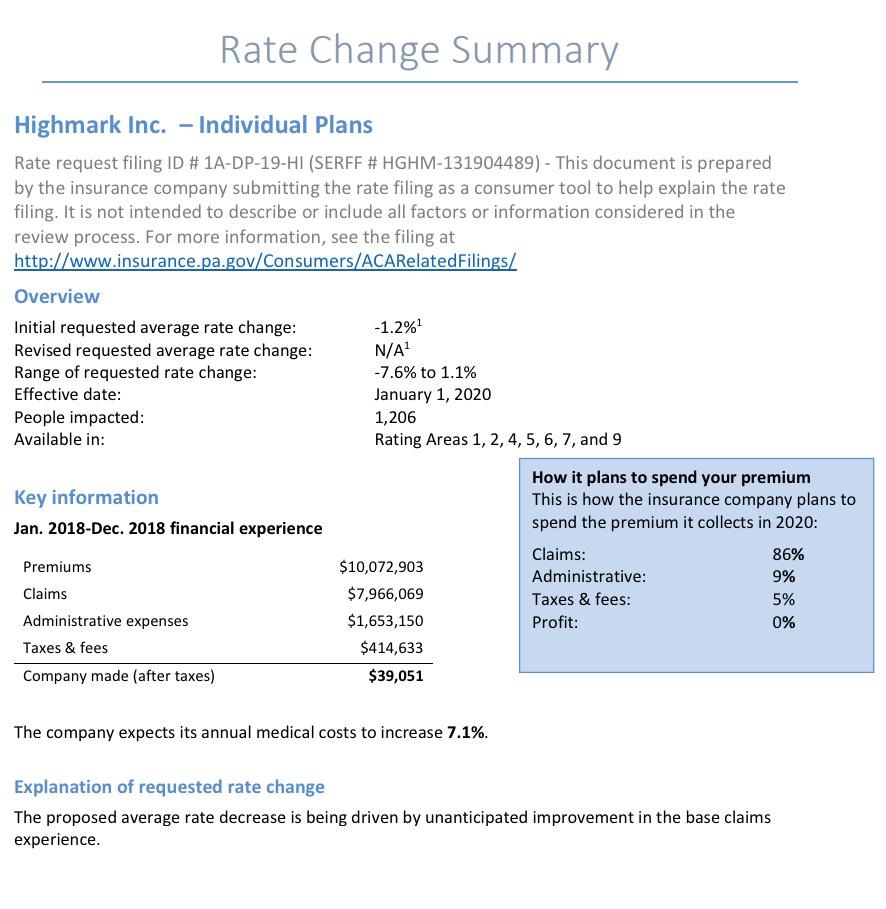

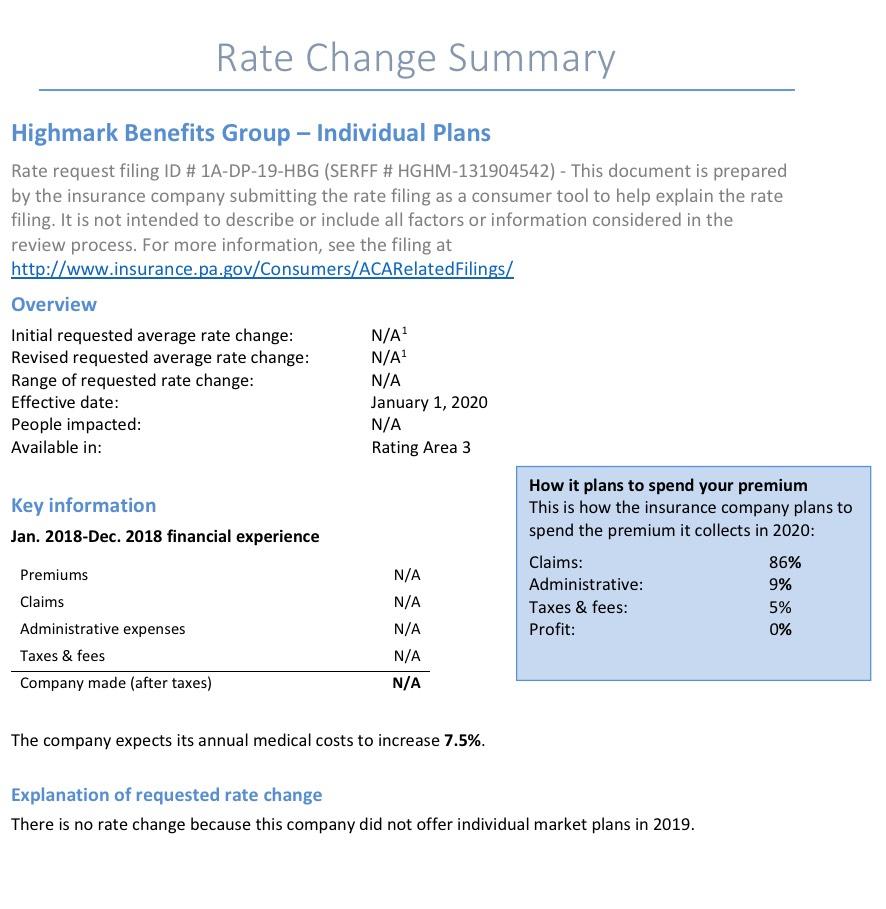

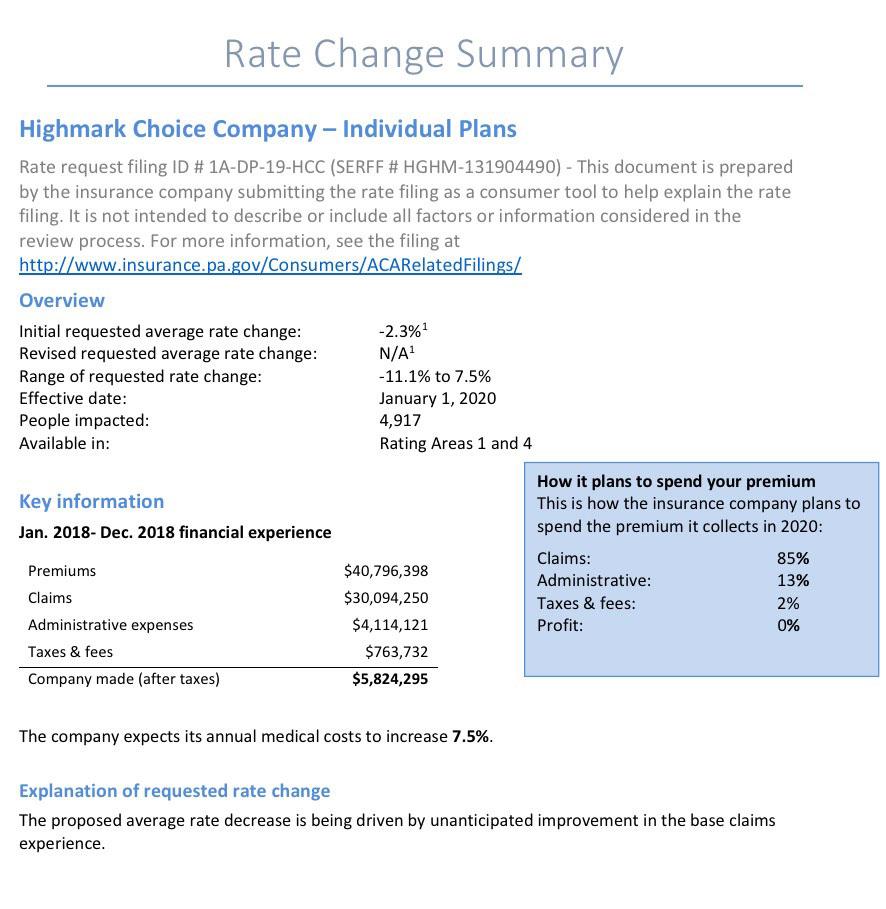

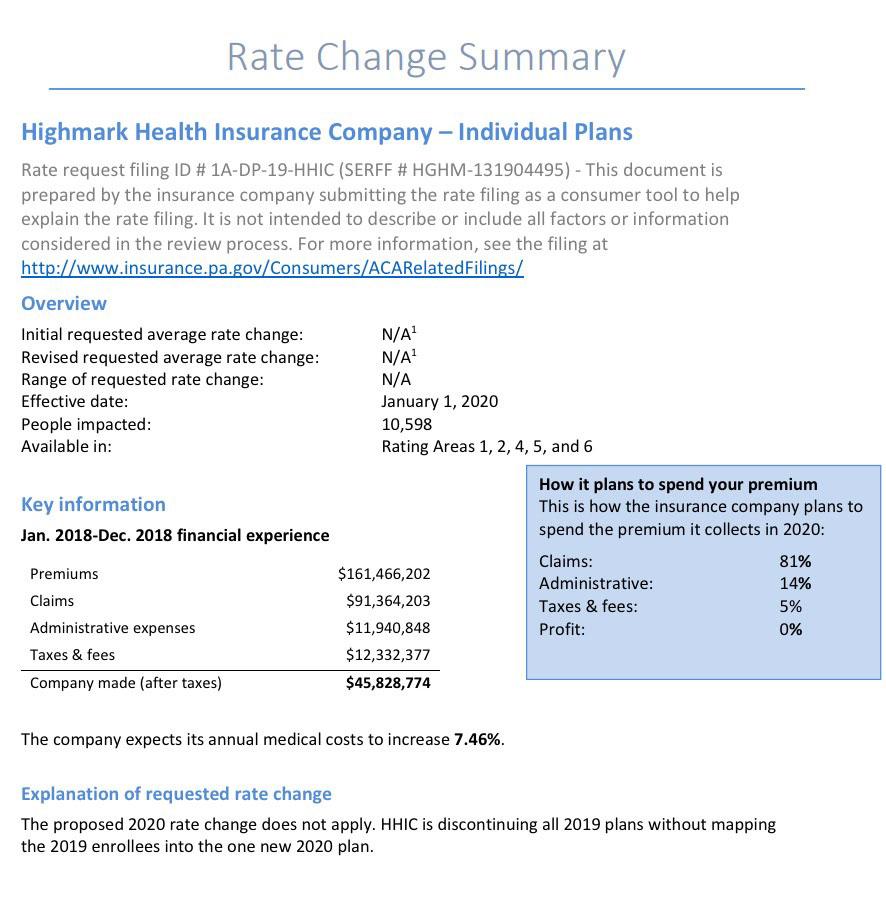

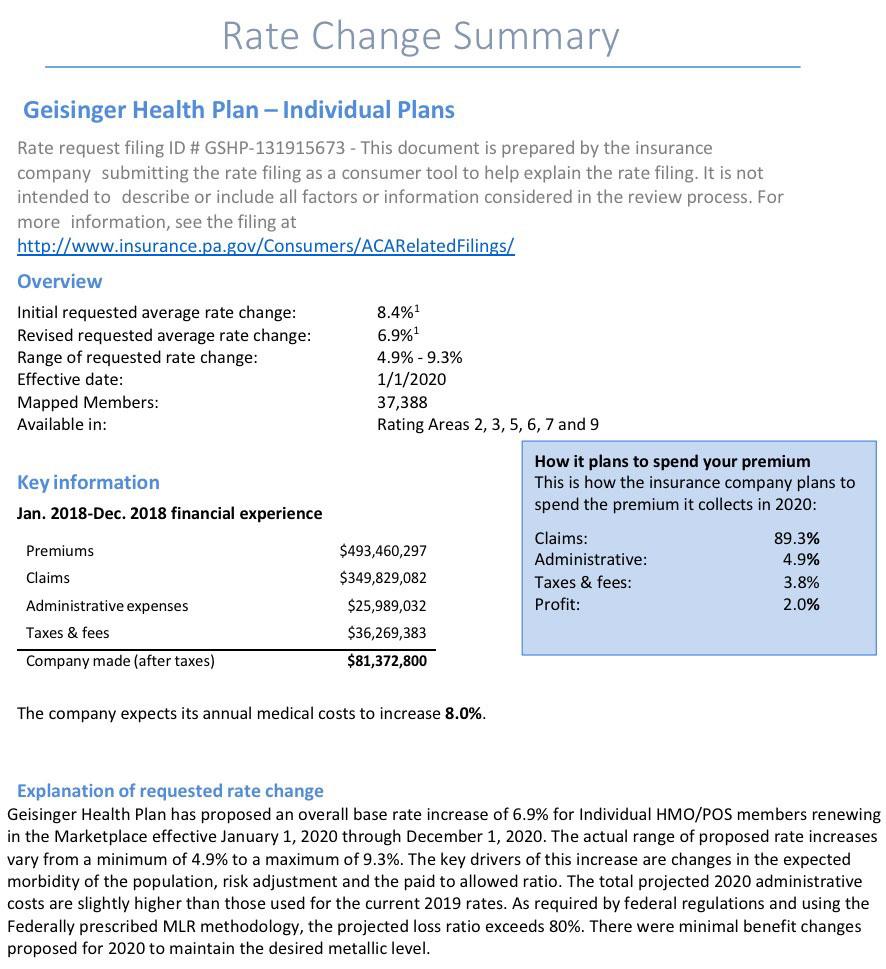

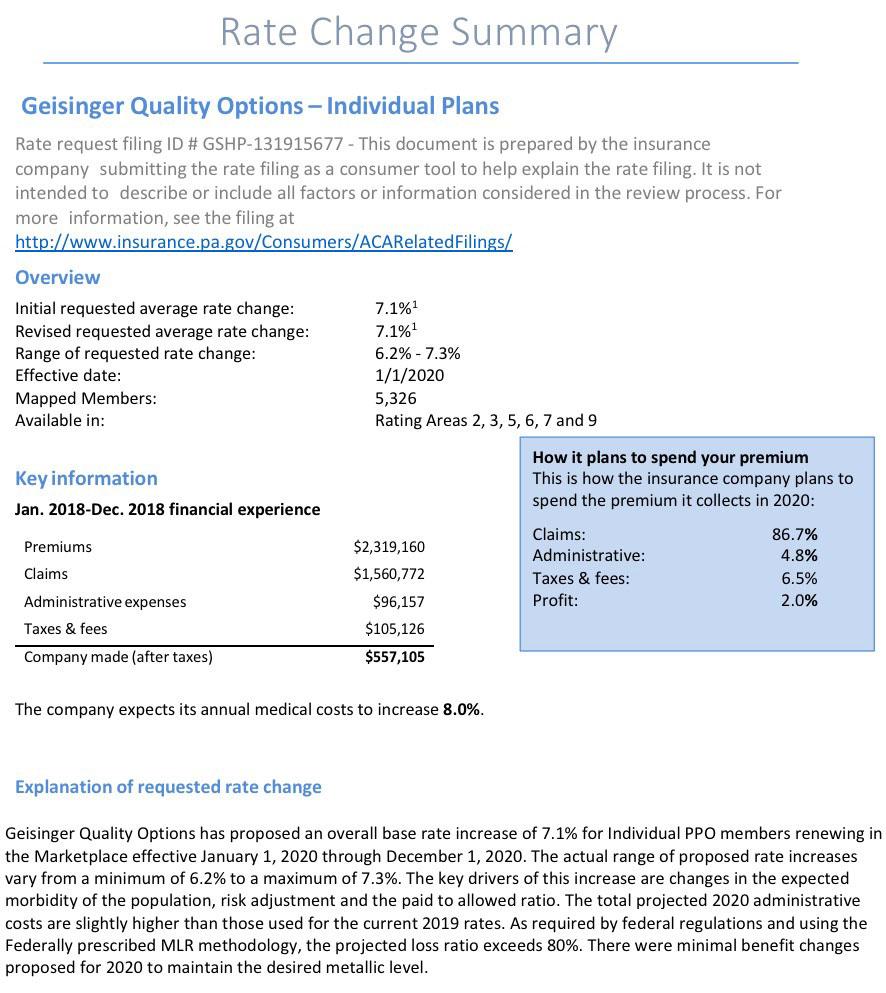

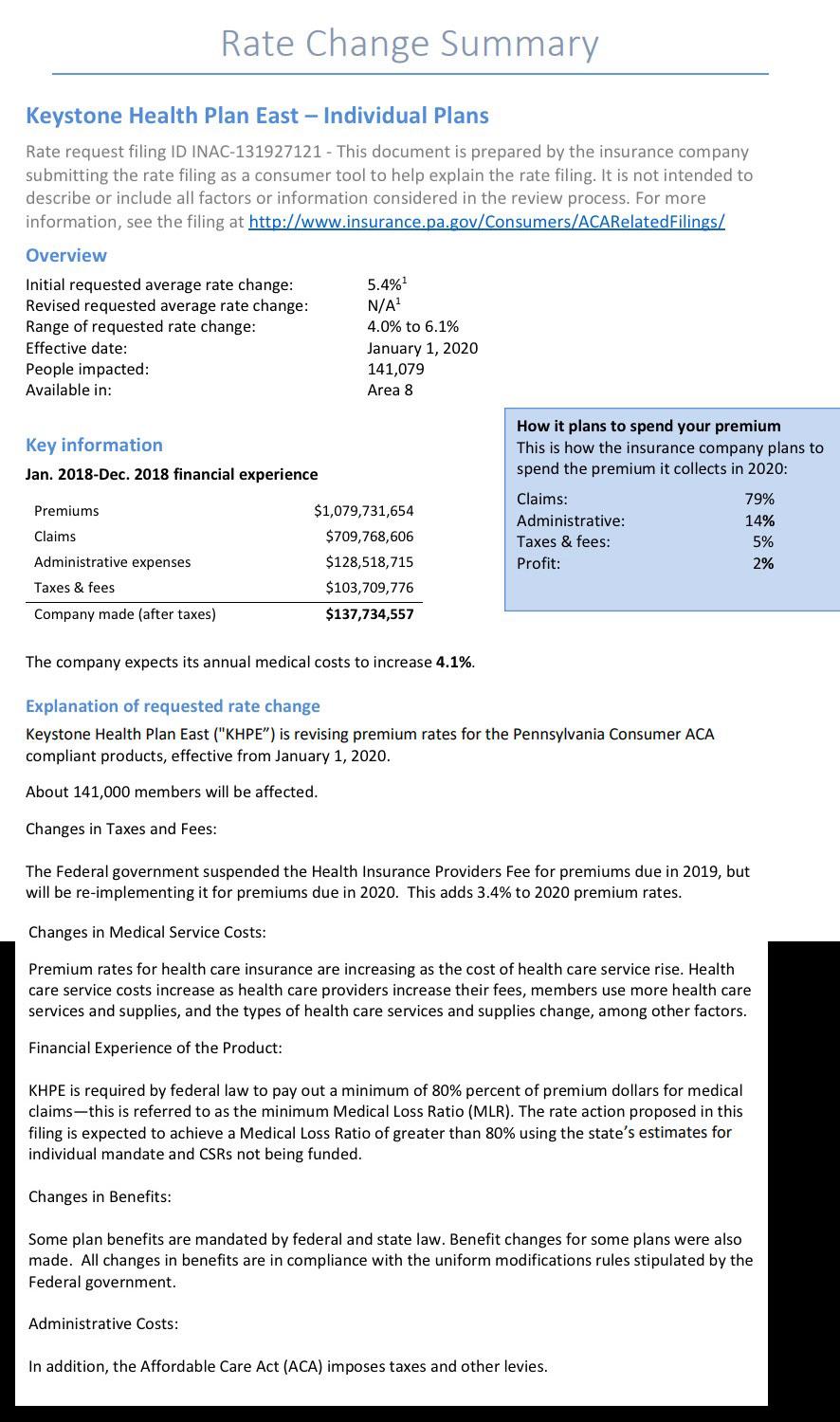

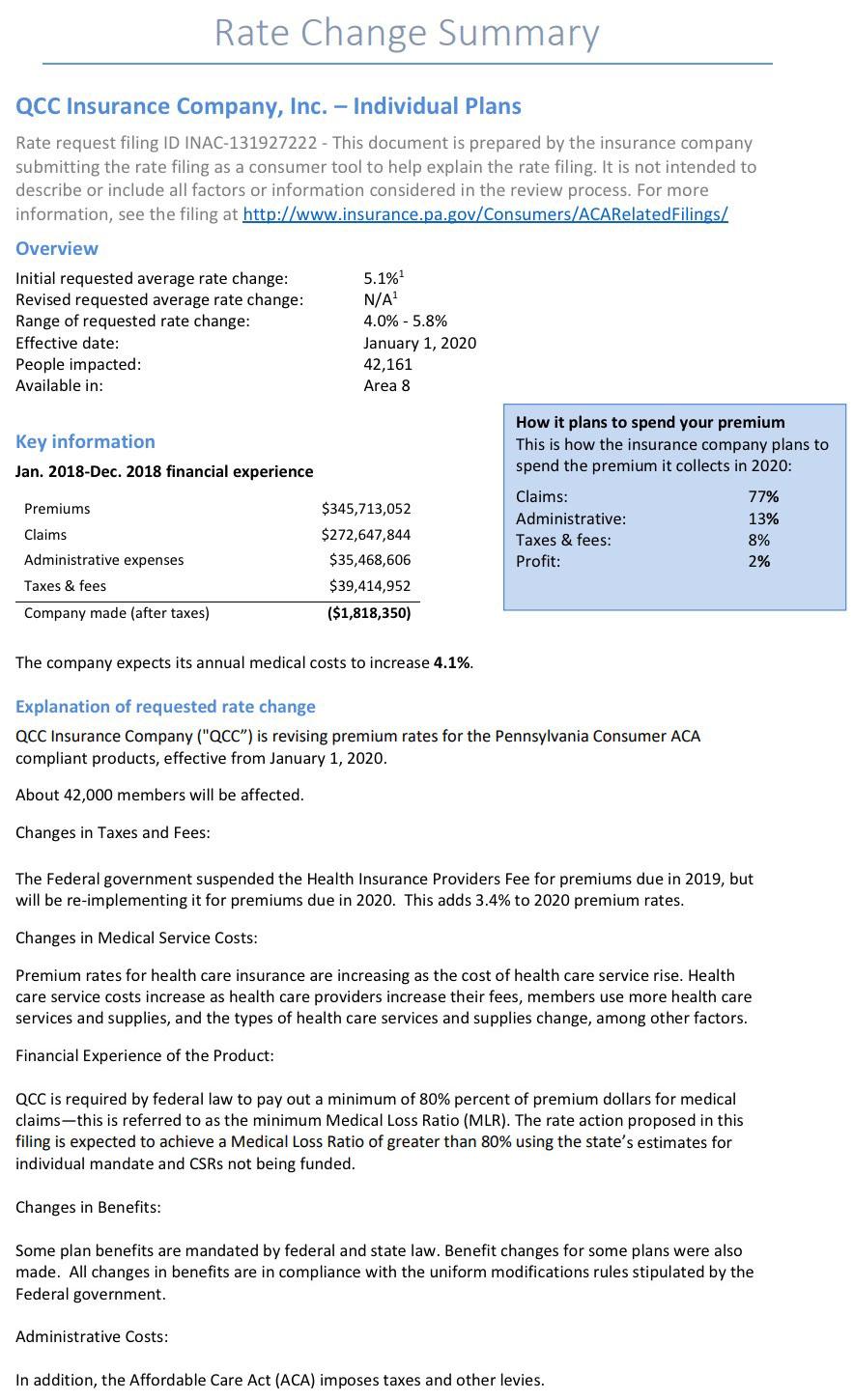

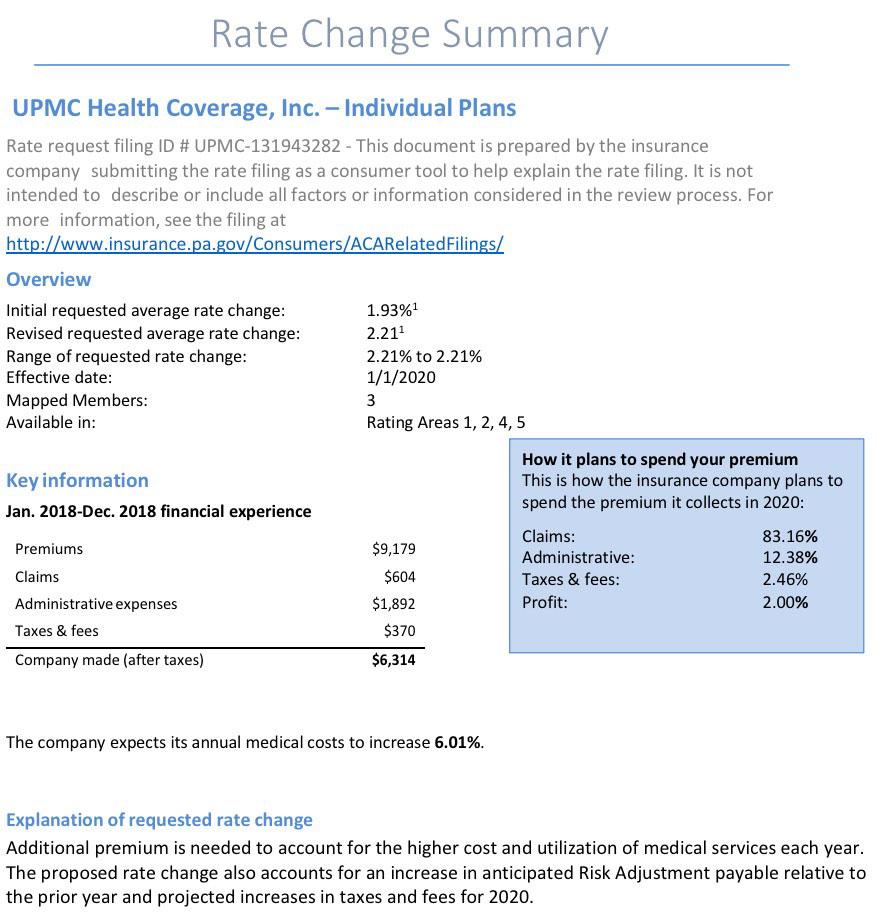

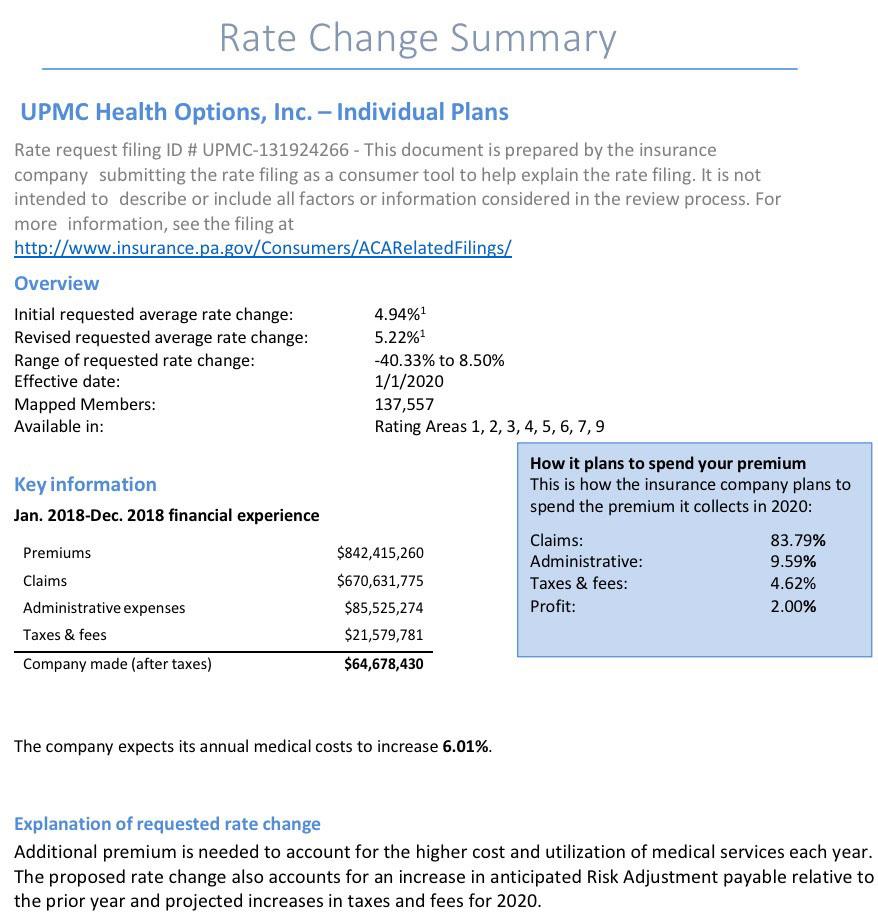

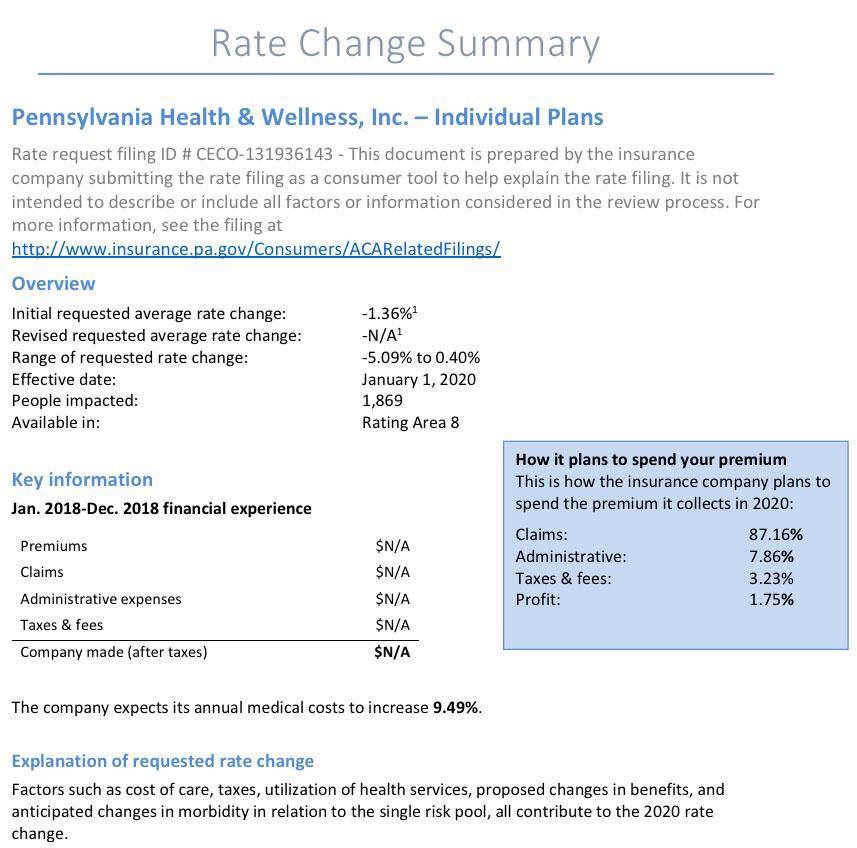

Statewide, Pennsylvania's unsubsidized ACA individual market enrollees are looking at around a 4.6% average increase next year, meaning their premiums will likely go up around $30/month on average. Meanwhile, Small Group market rates are expected to go up around 9.6%: