Delaware: PRELIMINARY 2020 ACA Exchange Premium Rate Changes: 5.8% decrease; could drop 25% w/reinsurance

This Just In from the Delaware Insurance Dept...

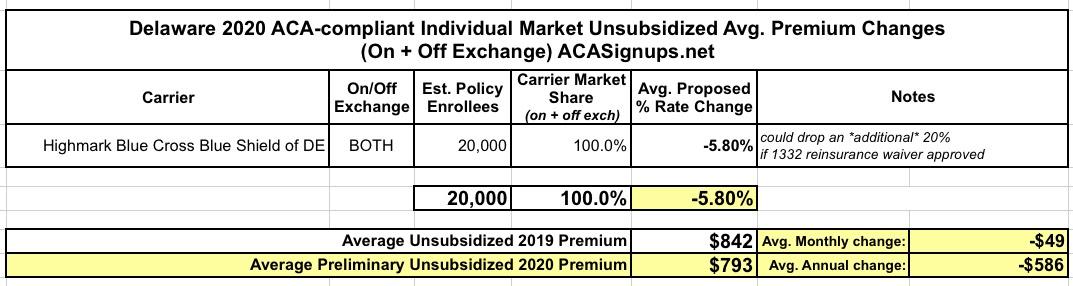

Dover, DE -- Highmark Blue Cross Blue Shield of Delaware (Highmark BCBS) has submitted its required annual rate filing to the Delaware Department of Insurance. After years of substantial increases, Delaware’s Marketplace has stabilized and premiums have decreased. Highmark BCBS, the only insurer continuing to offer insurance coverage in Delaware’s individual market, has proposed a 5.8% decrease for 2020. The proposed 2020 rate decrease will affect over 20,000 Delawareans.

The decrease comes after last year’s 3% rate increase and the Department’s decision to silver load. By applying the rate increase to silver level plans only, a practice known as ‘silver-loading,’ Delaware’s Marketplace received more federal subsidies, helping to assist in stabilizing the market and lowering premiums.

Commissioner Trinidad Navarro stated, “The silver loading strategy is something my staff and I gave careful consideration to last year, in anticipation that it would result in rate stabilization or possibly a decrease. While I am happy that we will see a decrease in the proposed rate, health insurance remains unaffordable for many Delawareans who do not qualify for premium subsidies. We are committed to reviewing the proposed rate decrease with the same careful analysis that we would give any rate proposal, whether it be an increase or decrease. I expect to announce the approved rate later this summer.”

It is important to note, that the proposed rate decrease is unrelated to Delaware’s intended submission of a 1332 Waiver to establish a reinsurance program. If the application process is successful, the actuarial consultant’s projections are correct, and the State of Delaware secures adequate funding, the waiver program may decrease rates by an additional 20%.

I can't find the actual SERFF filing yet, nor is there any info about Delaware's small group market, but seeing how Highmark is the only carrier on the state's individual market, it's pretty simple: 20,000 enrollees, 5.8% drop. Delware's individual market has the 5th highest average premiums in the nation, so that 5.8% reduction translates into nearly $50/month per unsubsidized enrollee, or $11.7 million in premium savings for the year statewide.

I wrote about Delaware's in-process 1332 Reinsurance waiver a few weeks ago. It'll cost $40 million in reinsurance funding in order to reduce premiums by another 20%. Presumably around $30 million will come from reduced federal tax credits while the state will have to come up with around $10 million.