California Final Tally: 1.51M QHPs; even year over year, but mandate repeal hurt NEW enrollment

This Just In from Covered California...

Covered California Plan Selections Remain Steady at 1.5 Million, but a Significant Drop in New Consumers Signals Need to Restore Penalty

- Covered California finishes open enrollment with 1.5 million plan selections, which is virtually identical to 2018’s total, despite federal changes.

- A key reason for the steady enrollment is that more people entered the renewal process for 2019 coverage after a strong enrollment period for 2018.

- The federal removal of the individual mandate penalty appears to have had a substantial impact, leading to a decrease of 23.7 percent in new enrollment.

SACRAMENTO, Calif. — Covered California announced that more than 1.5 million consumers selected a health plan for 2019 coverage during the most recent open-enrollment period, a figure in line with last year’s total. There was a 7.5 percent increase in the number of existing consumers renewing their coverage and a 23.7 percent drop in the number of new consumers signing up for 2019.

“Covered California’s overall enrollment has held steady, but recent actions at the federal level appear to be causing large drops in enrollment that will lead to more uninsured and higher premiums for all Californians,” said Covered California Executive Director Peter V. Lee. “The federal removal of the individual mandate penalty appears to have had a substantial impact on the number of new consumers signing up for coverage.”

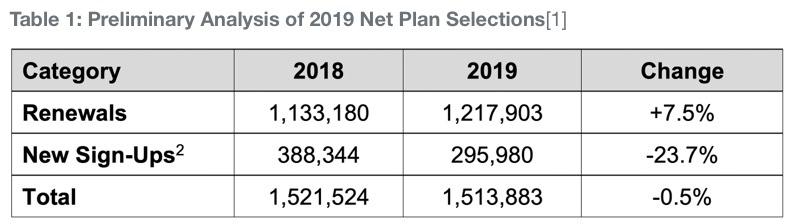

The total number of net plan selections for 2019 is 1,513,883, which reflects 1,217,903 consumers having their coverage renewed and 295,980 consumers who newly signed up for coverage during open enrollment (see Table 1: Preliminary Analysis of 2019 Net Plan Selections). Overall, there is a difference of 7,641 fewer plan selections compared to 2018, a decrease of 0.5 percent.

“While we end open enrollment in line with the number of plan selections we saw at this time last year, it is too early to draw any conclusions,” Lee said. “We have seen the impact that federal decisions have had on new enrollment, and we do not yet know how that will play out for renewing consumers down the road.

In addition to the impact of the penalty, Covered California conducted analysis and has released an issue brief, “Covered California 2019 Open Enrollment: Early Observations and Analysis,” that examines its open enrollment plan-selection demographic compared to last year. Covered California found larger differences in the share of Bronze consumers, unsubsidized consumers and those populations in which English is not the preferred spoken language. However, other demographics do not appear to be a factor.

“With the reduction being relatively evenly spread across demographics, the primary driver of the loss of new enrollees appears to be removal of the individual mandate penalty,” Lee said.

In August, Covered California shared analysis from national experts that projected that the removal of the penalty could lead to a reduction in enrollment ranging from 7 to 26 percent across the entire individual market. As part of its budgeting process, Covered California projected that the federal removal of the individual mandate penalty would reduce effectuated enrollment at the end of fiscal year 2018 to 2019 by between 7 and 18 percent, with the midpoint estimate of 12 percent. When combined with other factors, this would result in approximately 162,000 fewer consumers insured at the end of June 2019.

“The drop in new enrollment affirms the leadership Gov. Gavin Newsom has taken to propose an individual mandate and enhanced subsidies aimed at making coverage more affordable for Californians,” Lee said.

In addition to the federal removal of the mandate penalty, other potential factors affecting new enrollment could include the continued challenges of affordability and Covered California’s previous success in signing up healthy consumers.

“California has done tremendous work in building one of the healthiest consumer pools in the country,” Lee said. “One impact of successfully enrolling so many healthy Californians in previous years is that there may be fewer people newly eligible in California to enroll in this period — meaning that those who can sign up are more susceptible to being influenced by the federal removal of the penalty.”

While plan selections in Covered California have remained steady over the past four years, the number of consumers in federally facilitated marketplace (FFM) states newly enrolling continues to drop, from 9.6 million in 2016 to 8.4 million in 2019.

In addition, during the past three years that the current federal administration has made policy decisions to dramatically cut back on promoting enrollment, one result has been a substantial decrease in the number of new enrollees signing up for coverage: declining 49 percent from 4 million in 2016 to 2.1 million in 2019. (See Figure 1: Comparing Total Net Plan Selections in Covered California and the FFM.)

Figure 1: Comparing Total Net Plan Selections in Covered California and the FFM, in millions

“When the federal government pulled back on marketing and cut their enrollment period in half, they shut the door on hundreds of thousands of Americans,” Lee said. “The data shows that going into 2019, almost 1.5 million Americans who could have enrolled through FFM states were already priced out of coverage or opted not to enroll.”

Among the other major findings of the Covered California issue brief are:

- Covered California’s drop in new enrollment is higher than the average 15.8 percent drop of the 39 states served by the federally facilitated marketplace this year. The difference is likely explained by the fact that the FFM states have already experienced sharp decreases in new enrollment in each of the past four years, putting their decrease on top of an already diminished pool of healthy consumers opting out of coverage. California has maintained strong new enrollment in each of the prior four years, leaving it more susceptible to drops in new enrollment due to the loss of the penalty and other factors.

- In addition to the impact of the penalty on Covered California’s new enrollment, early analysis also indicates that affordability remains a key obstacle for many, especially those who do not receive subsidies.

- The analysis also found that enrollment by other demographics, including age and income level for those receiving subsidies, did not appear to be substantially different.

While open enrollment is over, consumers can still sign up for health care coverage if they experience a life-changing event, such as losing their health insurance, getting married, having a child or moving. More information on special-enrollment rules.

Eligible consumers who are interested in signing up can visit Covered California’s website where they can get help enrolling, explore their options and find out if they qualify for financial help by using the Shop and Compare Tool.

There's also one other interesting thing which caught my eye...the footnotes:

[1] The number of net plan selections, whether through renewal or open enrollment, reflects any cancellations made by a consumer during the three-month sign-up period.

[2] During the previous two years, Covered California reported both gross and net plan selections made during open enrollment. This year Covered California is focusing on net plan selections, which are the numbers submitted to the federal government. Covered California saw 423,484 gross plan selections for 2018 and 325,458 for 2019. These numbers allow for consistent comparisons dating back to 2014. Both figures show that the reduction in new enrollment is between 23 and 24 percent.

This goes a long way towards explaining/cleaning up the discrepancies I've seen in CA in past years, where the reported number was sometimes tens of thousands of enrollees different from the "official" CMS report. A few other state-based exchanges have had similar issues in the past, but CoveredCA is by far the largest state-based exchange so their discrepancies jump out the most. Glad to see that nipped in the bud.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.