Kansas: APPROVED 2019 #ACA rate hikes: 5.3% increase, but WOULD likely have DROPPED ~4.3% w/out #ACASabotage

I analysed Kansas' 2019 ACA indy market rate changes back in August. The three carriers were requesting an average increase of around 6.1% (this may be slightly off since I had to estimate the market share for two of the three). State insurance regulators left Blue Cross Blue Shield and Ambetter's rate requests as is, but cut Medica's down by more than half, from a 10.7% increase to just 4.3%:

Premium Rates for Individual and Small Group Markets Individual plan premium rates may vary by age, rating area, family composition and tobacco usage. For example, a person living in Manhattan, KS (rating area 3) may pay a different rate than someone living in Pittsburg, KS (rating area 7) based on the claims data by rating area. A map of the counties included in each rating area is provided on the next page. Kansas is an effective rate review state, which means the actuarial review is conducted by the Kansas Insurance Department. KHIIS (Kansas Health Insurance Information System) claims data is utilized during the rate review process to verify the claims experience submitted by the companies. The following table provides details regarding the average requested rate revisions for companies writing individual policies in Kansas. Rate increases will be partially offset for individuals receiving a premium tax credit.

- Company Name / Average Filed Increase / On Marketplace /Off Marketplace

- Blue Cross and Blue Shield of Kansas, Inc. / 8.28% / Yes / Yes

- Medica Insurance Company / 4.3% / Yes / Yes

- Ambetter from Sunflower Health Plan / 2.68% / Yes / Yes

As a result, Kansas carriers have been approved for roughly a 5.3% average increase...which would likely have been closer to a 4.3% decrease if it weren't for the individual mandate being repealed and both short-term and association health plans being allowed to flood the market:

Unsubsidized Kansas residents are paying an average of $623/month this year, so that's roughly $60/month more which they'll have to pay next year due to #ACASabotage...or around $718 more for the full year.

The KS DOI Issue Brief also includes lots of additional noteworthy information about the Kansas ACA market this year...here's some of the items which caught my eye:

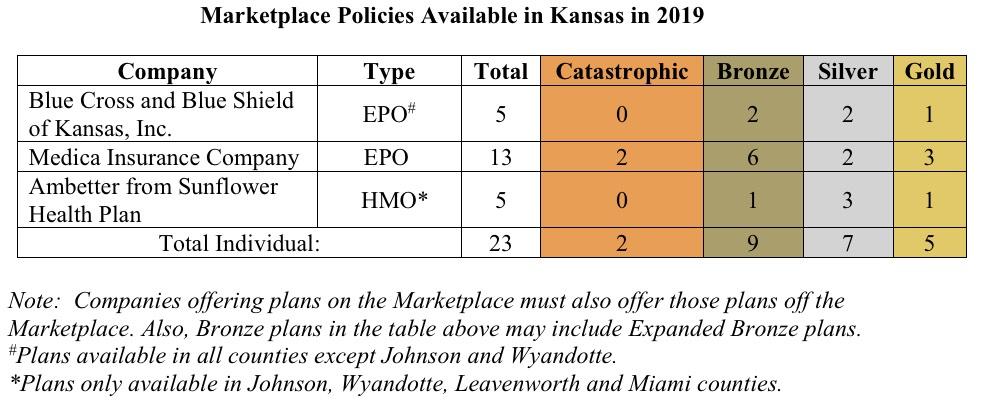

Policy Options for Individuals and Families In 2019 consumers shopping on the FFM in Kansas will have the opportunity to purchase individual policies offered by three health insurance companies depending on where they live. The companies include Blue Cross and Blue Shield of Kansas (103 counties); Medica Insurance Company (105 counties); and Ambetter from Sunflower Health Plan (4 Counties). There are 23 individual policies available on the Marketplace.

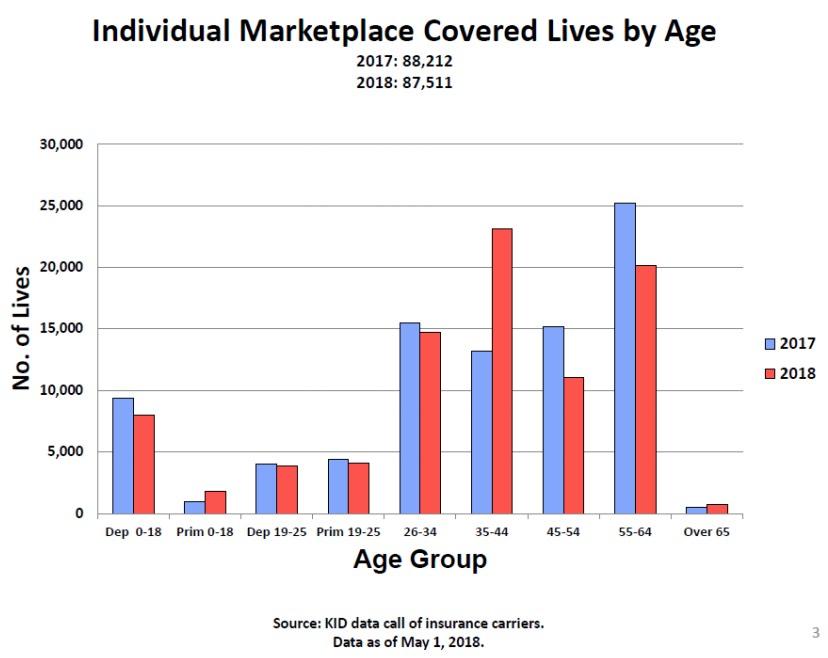

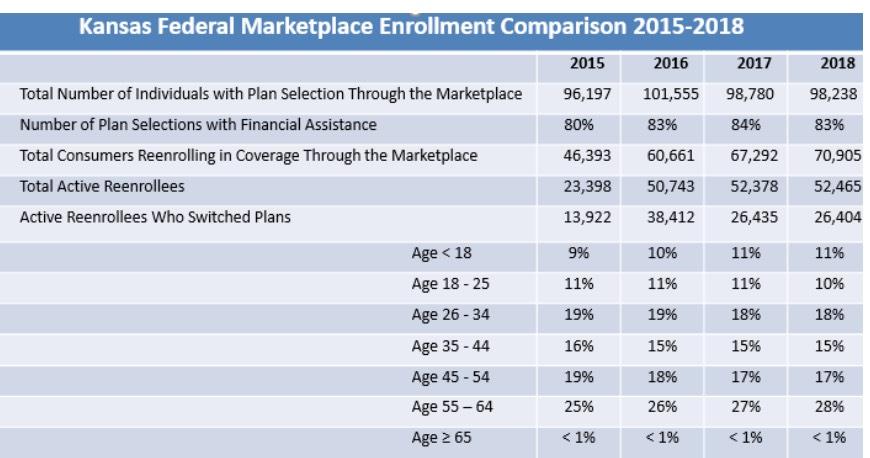

The change in age breakout of the exchange-based market year over year is particularly confusing. The bar graph shows the 35-44 bracket jumping from around 16% to 26% while the 45-54 and 55-64 groups drop accordingly...but the table beneath it shows barely any movement between age groups at all. Granted, the graph is as of May 1st and thus includes net attrition from January - April, while the table only includes the raw number of people who selected QHPs through December 15th 2017, but that still seems like a pretty odd discrepancy. Not sure what to do with that.