Massachusetts: FYI, here's how their mandate penalty compares to the just-repealed ACA penalty

As I just noted earlier this afternoon, Massachusetts is NOT expecting the repeal of the ACA's individual mandate to impact their 2019 individual market enrollment or premiums for a simple reason: The Bay State never formally repealed their own, pre-ACA mandate penalty. They basically mothballed it once the ACA's version went into effect, and are simply dusting it off for 2019 and beyond now that the federal mandate has been formally repealed.

However, the two mandate penalties don't work quite the same way. For the federal mandate, unless you qualify for an exemption (and there's a whole bunch of those), the penalty for not having ACA-compliant healthcare coverage is (or has been up until now) as follows:

- $695.00 per adult / $347.50 per child, with a maximum of $2,085 per household, or

- 2.5% of your household income, with a maximum of whatever the national average price is for a Bronze plan sold via the ACA marketplace...

- ...whichever is greater.

This is also exactly how both New Jersey and the District of Columbia's reinstated individual mandate penalties are supposed to work.

For my own family (two adults in our 40's, one child under 18), this would mean our penalty would be:

- At $40,000/year, we'd have to pay $1,737.50 ($695 x 2 + $347.50), since 2.5% of our income would only be $1,000.

- At $60,000/year, we'd have to pay $1,737.50 ($695 x 2 + $347.50), since 2.5% of our income would only be $1,500.

- At $80,000/year, we'd have to pay $2,000.00, since that's greater than $1,737.50.

- At $100,000/year, we'd have to pay $2,500.00

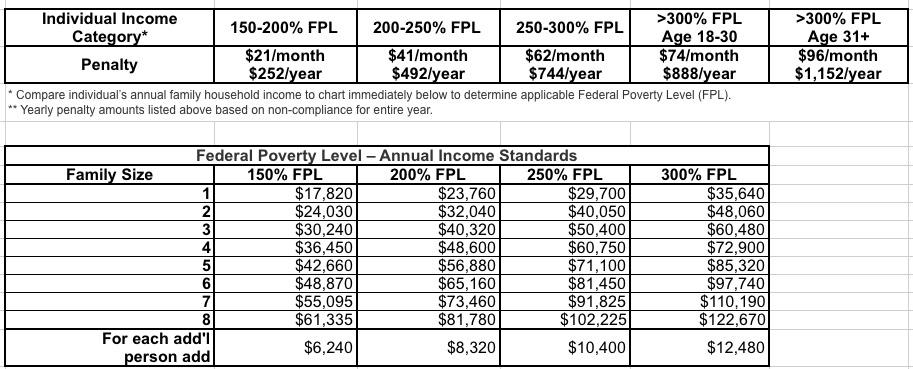

For Massachusetts, however, it's a little different. There's a bunch of details at the link, but here's what it boils down to:

If I understand how this works, if we lived in Massachusetts, my own family would have to pay:

- If we earn $40,000/year (just under 200% FPL), we'd have to pay $756 total (3x $252)

- If we earn $60,000/year (just under 300% FPL), we'd have to pay $2,232 (3x $744)

- If we earn $80,000/year (over 400% FPL), we'd have to pay $3,192 ($888 + $2,304)

- If we earn $100,000/year, we'd also have to pay $3,192.

At first glance it appears that the federal mandate is harsher on low-income folks and more lenient on higher-income people, but keep in mind that there are other variants which could mitigate that. I assume there are some other differences as well in terms of exemptions and so forth, but this seems to be the biggest distinction.