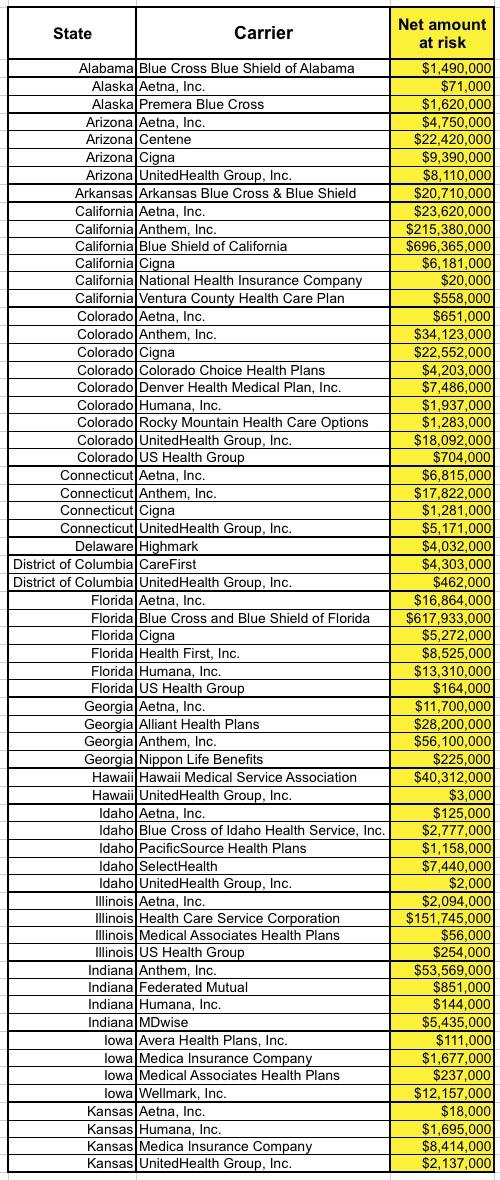

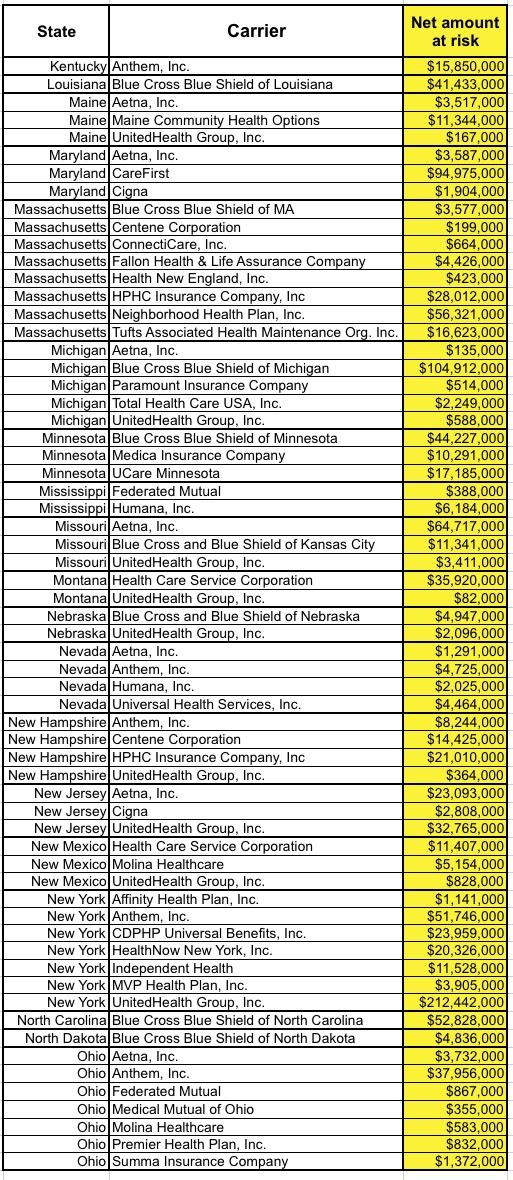

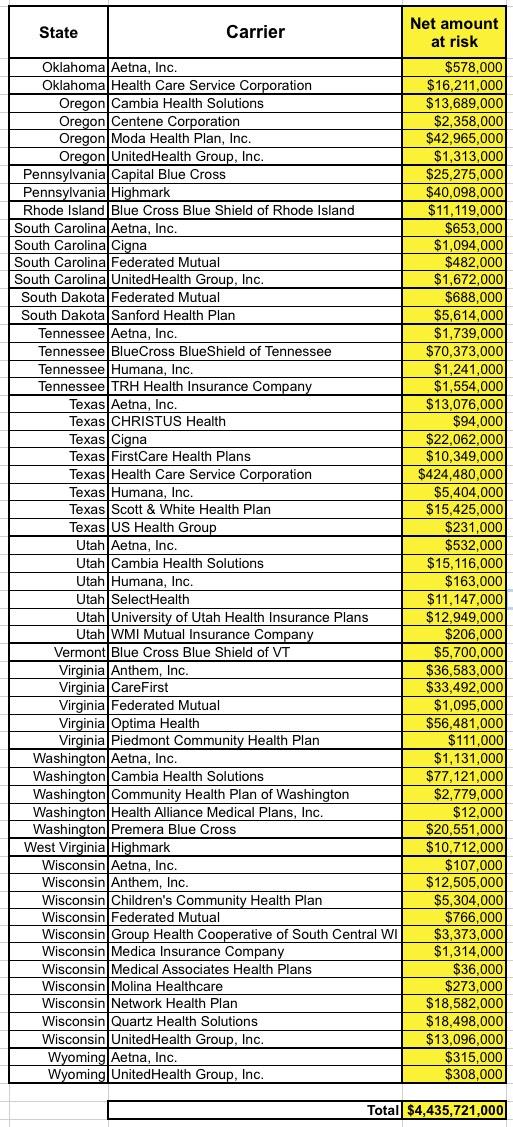

Risk Adjustment Freeze: Summary listing of the carriers owed money, by state

This morning, CMS released the 2017 Risk Adjustment Summary Report for the Individual, Catastrophic and Small Group markets. As I noted at the time, the total amount of money we're talking about being shifted around here is around $10.4 billion, with around $7.5 billion in the individual market, $2.9 billion in the small group market and just $42 million in the catastrophic market.

However...this isn't actually a matter of insurance carriers being owed $10.4 billion. Because of how Risk Adjustment (RA) works, it's actually half as much as that--around $5.2 billion is owed by some carriers to other carriers.

However, it's actually trickier yet; here's why. If you look closely at the state-by-state carrier breakout tables, you'll notice that there's quite a few carriers which have multiple listings within the same state. In Mississippi, for instance, there are 4 different listings for UnitedHealth Group, Inc., each of which officially owes over $100,000 towards the RA pool...around $500,000 total. There are several reasons why the same insurance carrier might have more than one listing:

- Some carriers have separate subsidiary companies for their HMO or PPO divisions

- Some may operate under different names for their Individual and Small Group market divisions

- Some carriers continue to operate smaller subsidiaries which they recently bought out under the pre-buyout name

- Some carriers operate under different names in different parts of the state for marketing/branding purposes

- Other reasons (?)

Personally, I can't stand this, as it makes my job much more difficult and confusing (especially when it comes to my annual Rate Hike project); I'd much prefer it if insurance carriers stuck with one name. But, whatever; it is what it is.

However, here's the thing: Take a look at my home state of Michigan and you'll notice something:

- Blue Cross Blue Shield of Michigan (HIOS ID 15560): Total Receivable: $133,410,637

- Blue Cross Blue Shield of Michigan (HIOS ID 98185): Total Payable: ($28,497,693)

The first one is BCBSM's PPO division. The second one is BCBSM's HMO division (branded as Blue Care Network).

The PPO division is owed $133.4 million...but the HMO division owes about $28.5 million. This means that BCBSM as a whole is actually owed a net total of around $105 million. In a way, it amounts to money shifting from one bank account to another within the same company, although in practice it's more complicated than that--it's not like Blue Care Network cuts a check for $28.5 million to itself. The money is sent to the federal government, where it's merged with the rest of the $5.2 billion, and then doled back out again to the various carriers...which happens to also include $133.4 million to Blue Care Network's sister division.

There's a lot of examples of this. And yes, I went ahead and went thorugh all 610 carrier listings and combined the various multiple entries for the same carrier to get this: A full listing of the net 2017 funds which carriers are at risk of losing (or at least of being frozen for awhile). I didn't bother with the other side of the coin, since those carriers aren't any worse off than they otherwise would be (at least in theory). All told, out of 610 listings, 184 carriers are actually owed money (fewer, really, if you only count national carriers once...Aetna, Inc. has listings in 25 states even after you combine the in-state divisions, for instance.

Also worth noting: Once you account for cases like BCBSM/Blue Care Network above where the same carrier is supposed to come out ahead in one division but behind in the other, the net amount actually owed to these carriers drops further, from $5.2 billion to $4.4 billion. Still a ton of money to be sure. I should also note that I've rounded all of the total net dollar amounts off to the nearest $1,000 to make it a bit easier to read.

While I'm at it, both the largest "Winners" and "Losers" (again, with the understanding that both of these statuses are likely temporary) are, as you might expect, out of California:

- Kaiser Permanente of California owes a whopping $567 million into the kitty, while

- Blue Shield of California is owed a jaw-dropping $696 million.

One other thing: Of the 184 total carriers, 50 of them are owed less than $1 million. That doesn't necessarily mean it isn't a problem, of course; even half a million dollars or so could be pretty important to a very small carrier. I just thought it was worth noting.