TIME FOR A REFRESHER ON THE INDIVIDUAL MANDATE AND PRE-EXISTING CONDITIONS.

It's time once again to talk about stools. Not step stools, but the Three-Legged Stool.

I posted this video explainer about the Affordable Care Act's "Three-Legged Stool" works last winter. The first 9 minutes or so covers why it exists, how it's supposed to work, how well it's actually working, the most obvious problems with it and the basics of how to fix them. The second half goes into the details of the half-dozen different awful repeal/replace bills that Congressional Republicans tried to push through throughout 2017.

Below is a condensed transcript version of the first half of the slideshow.

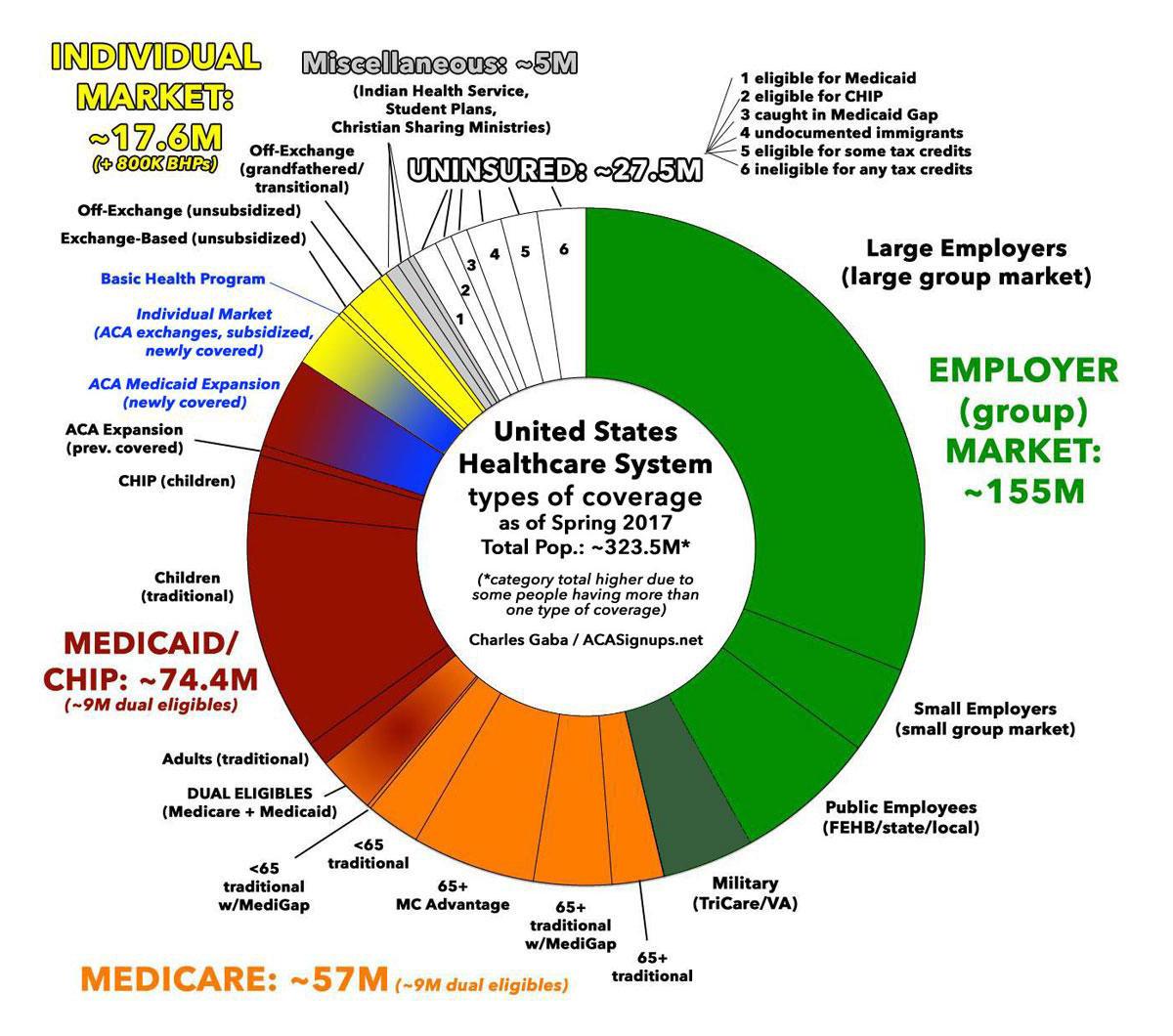

First of all, who is in the Individual Market? Well, what you're looking at right now is something a friend of mine dubbed The Psychedelic Donut. It's actually a depiction of the healthcare coverage, by type, of the entire U.S. Population...all 320 million or so of us.

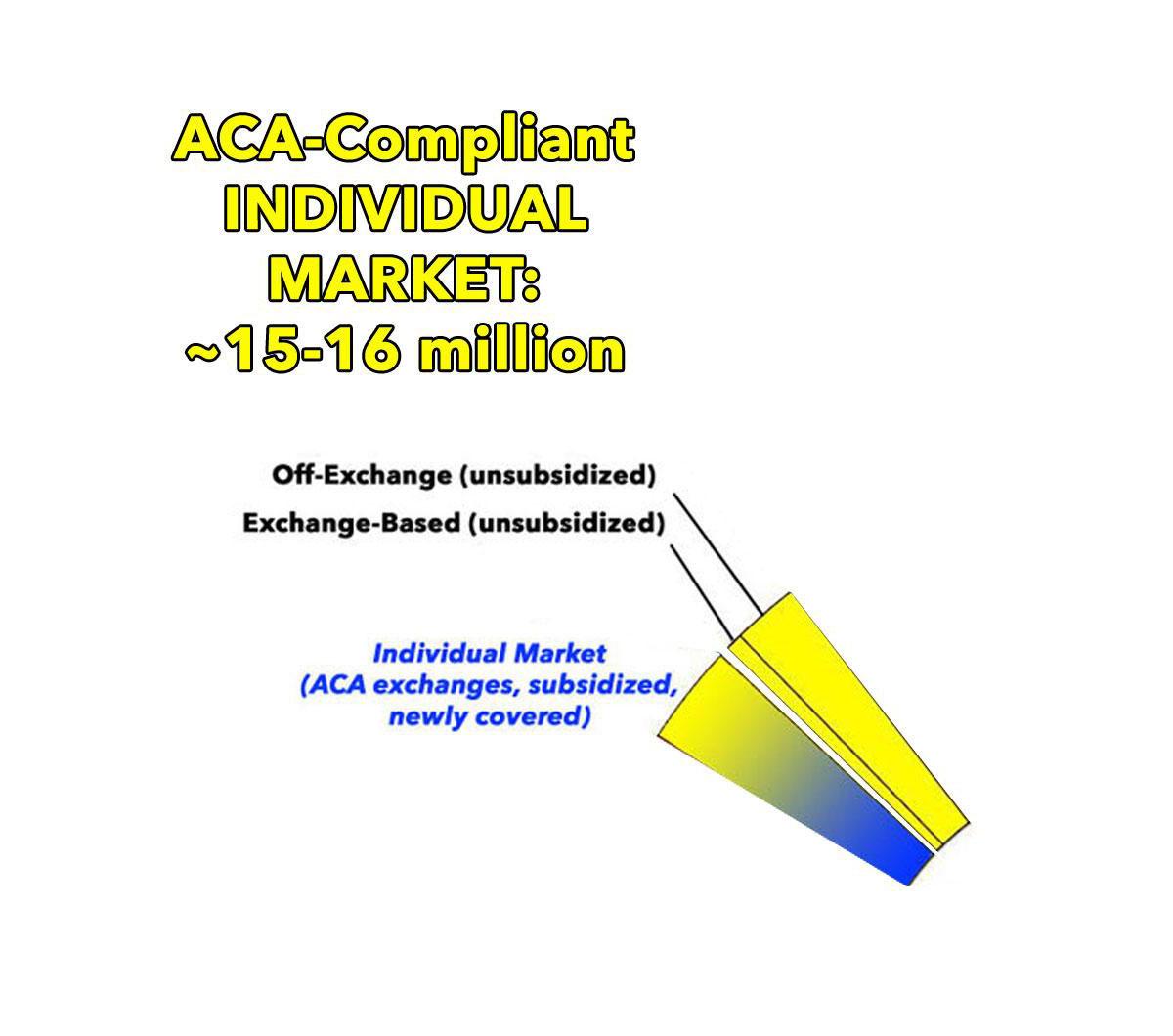

The Three-Legged Stool is about the Individual Market: People who buy private health insurance policies for themselves and their families, either through the ACA exchanges like HealthCare.Gov or directly from an insurance carrier. A couple million are enrolled in grandfathered or transitional policies from before ACA regulations went into effect, and about 800,000 in New York and Minnesota are enrolled in something called the Basic Health Program, but most of them, around 15 million--are in ACA-compliant policies, either ON or OFF the ACA exchanges.

Before the ACA, the Individual Healthcare market was pretty much the Wild West in terms of insurance regulations. Some states had more oversight than others, but for the most part, insurance companies could deny coverage to anyone they wanted based on “pre-existing conditions”, or they might let them buy a policy but charge them insanely higher premiums for it. They might cover stuff like mental illnesses, prescriptions drugs, maternity care and so on…or they might not. They might cover a huge chunk of your expenses…or hardly anything at all. Basically, it was all over the place, with confusing paperwork, “gotcha” fine print, hidden charges and so on. Some policies were pretty comprehensive, but many pretty much sucked and barely covered anything.

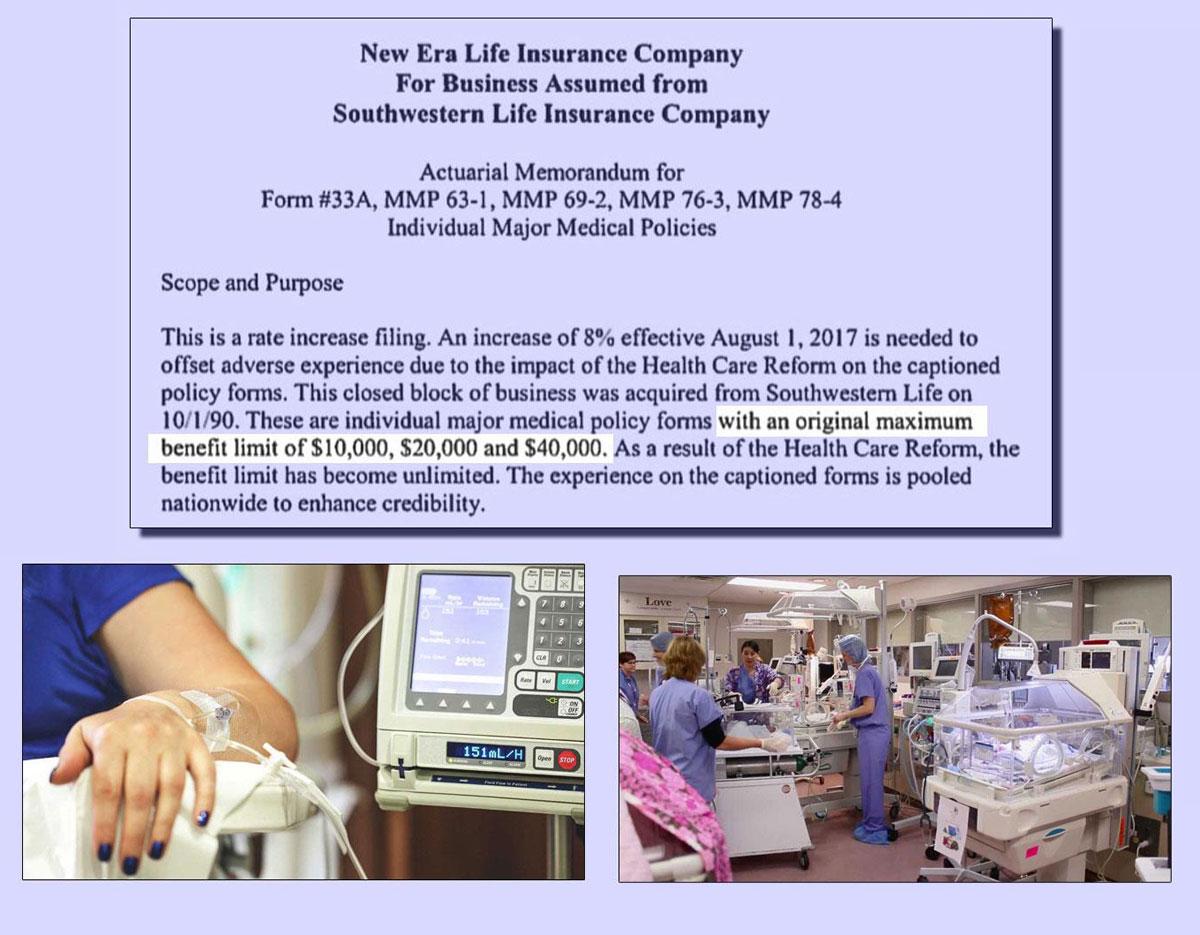

Also, lots of policies had annual or lifetime limits on maximum claims, often in the range of a few million dollars. This may sound like a lot of money, and it is, but if you're undergoing chemotherapy or have a premature baby in the neonatal unit, you can eat up your lifetime limit in a matter of months.

Overall, sure, individual market policies were relatively inexpensive…but that's because they could cherry pick their customers and put heavy restrictions on benefits. When an insurance company only covers people who they're pretty sure won't cost much to cover, of course it's easy to keep prices low! As a result, millions of people found themselves literally uninsurable at any price, and millions more found out the hard way, at the worst possible time, that their supposedly decent “health insurance policy” was anything but that.

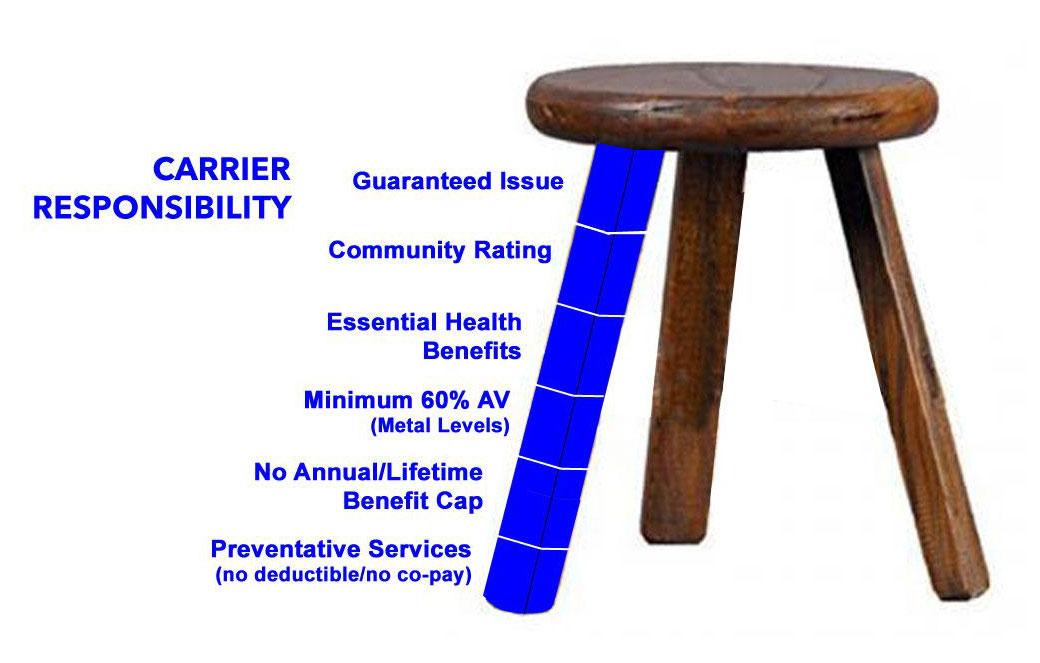

The ACA hoped to fix most of these problems while also getting as many people covered as possible. So the first thing the ACA did was require that anyone is allowed to buy any given healthcare policy; no more discrimination against people with pre-existing conditions. This is called GUARANTEED ISSUE.

Related to this, the carriers could no longer discriminate against anyone based on their medical condition or gender by charging more for the same policy; this is known as COMMUNITY RATING. The only price variations allowed are age (a 3:1 range…down from 5 or 6:1), where they live…and whether they smoke or not; that's the only behavioral surcharge that's still allowed.

The ACA also requires that every qualified healthcare plan cover 10 Essential Health Benefits, including hospitalization, surgery, mental health services, prescription drugs and so forth…in other words, the type of stuff you'd expect something called a “healthcare policy” to actually cover.

ACA-compliant policies also have to cover at least 60% of the cost of those benefits. There's 4 “metal levels” available (Bronze, Silver, Gold or Platinum), covering on average around 60%, 70%, 80% or 90% of your expenses. This is the "ACTUARIAL VALUE" of a policy.

In addition, the ACA stripped away those annual or lifetime limits on claims...not just on the individual market, but for employer-provided coverage as well. Stack all of these up and you get a one-legged stool.

Several states, such asy Washington and New York--had tried doing something like this in the past; they both required Guaranteed Issue, and New York added Community Rating to their regulations. Unfortunately, this ended up being unstable. The one-legged stool tipped over, for a simple reason: ADVERSE SELECTION.

If anyone can sign up for coverage whenever they want to, and there's no negative consequence for not doing so, healthy people have a tendency to not bother signing up as long as they stay healthy…but then to do so the moment they're diagnosed with a serious ailment or they're seriously injured.

This is like waiting until after you get into a car crash before signing up for auto insurance, or only signing up for homeowner's insurance after your house catches on fire. That's why 48 states legally require auto insurance (in the other two, you'll either have your license and registration suspended if you can't afford to pay for damages or have to pay a $500 penalty for not having it...basically the same as the ACA's Individual Mandate. And of course it's next to impossible to get a mortgage without homeowners' insurance.

Anyway, without such a requirement, most of those enrolled will end up being those more expensive to treat, which leads to higher premiums, which leads to more people who aren't terribly sick to drop coverage, which leads to higher premiums and so on. This is known as the DEATH SPIRAL.

So, to avoid this from happening, when Mitt Romney, then the Republican Governor of Massachusetts, signed RomneyCare into law, the individual market was set up as a THREE-legged stool…and the Affordable Care Act used this politically conservative model as well.

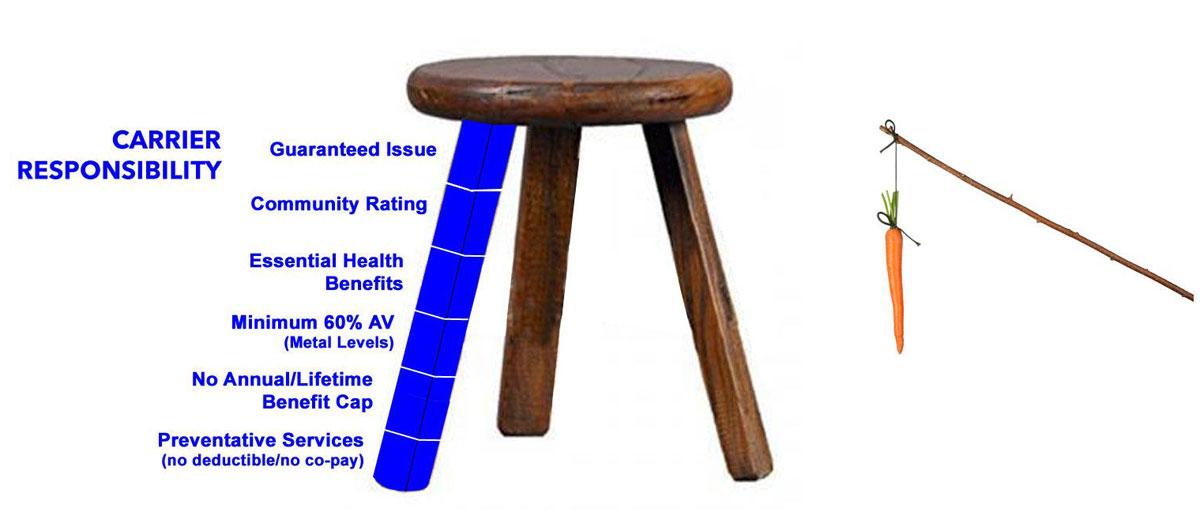

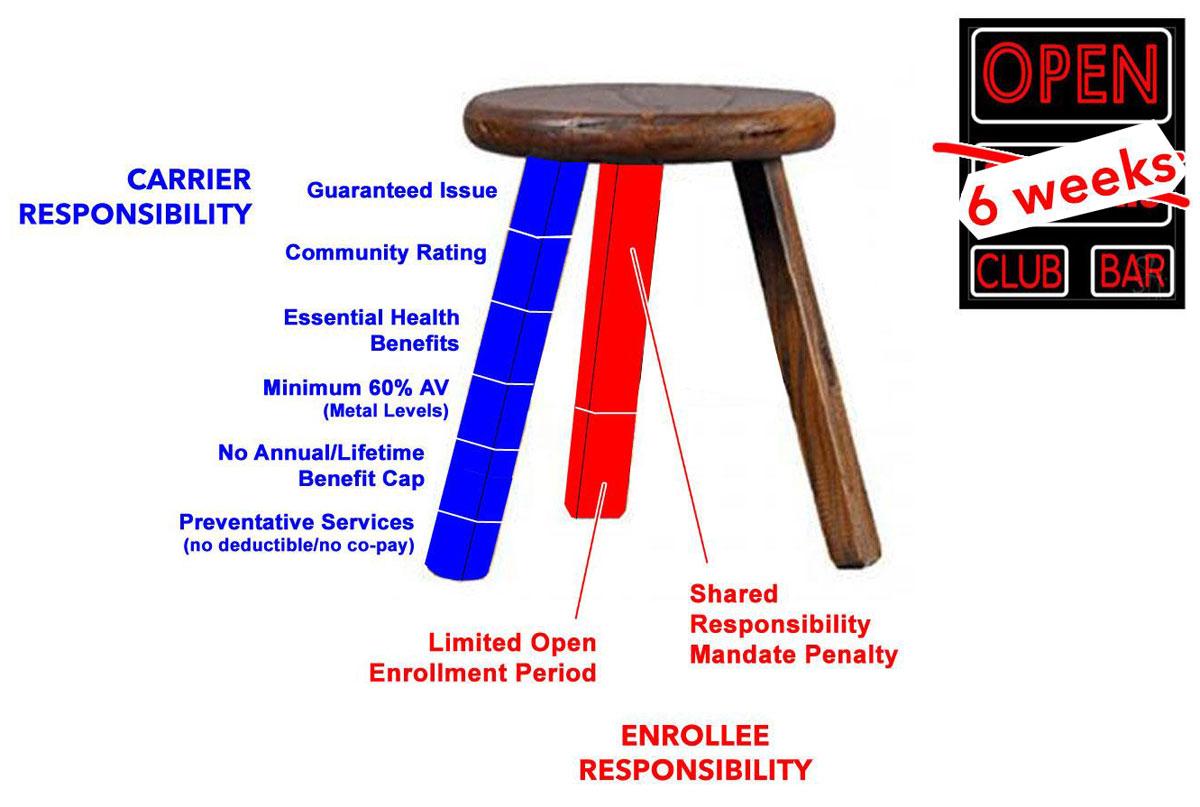

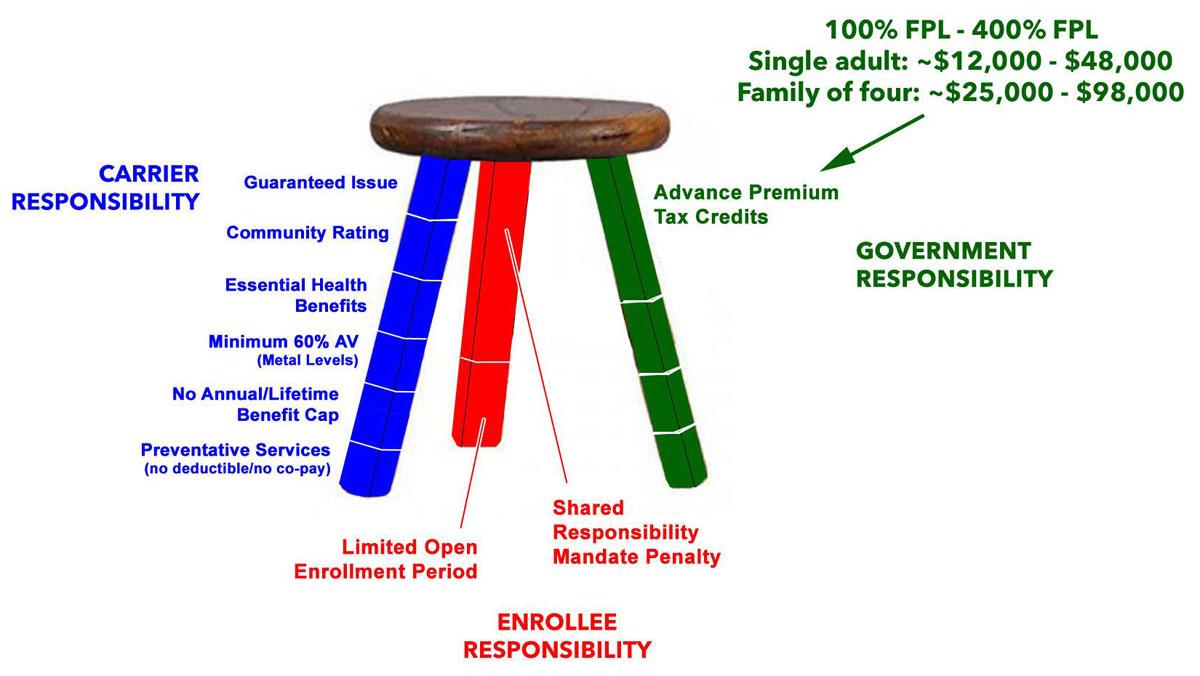

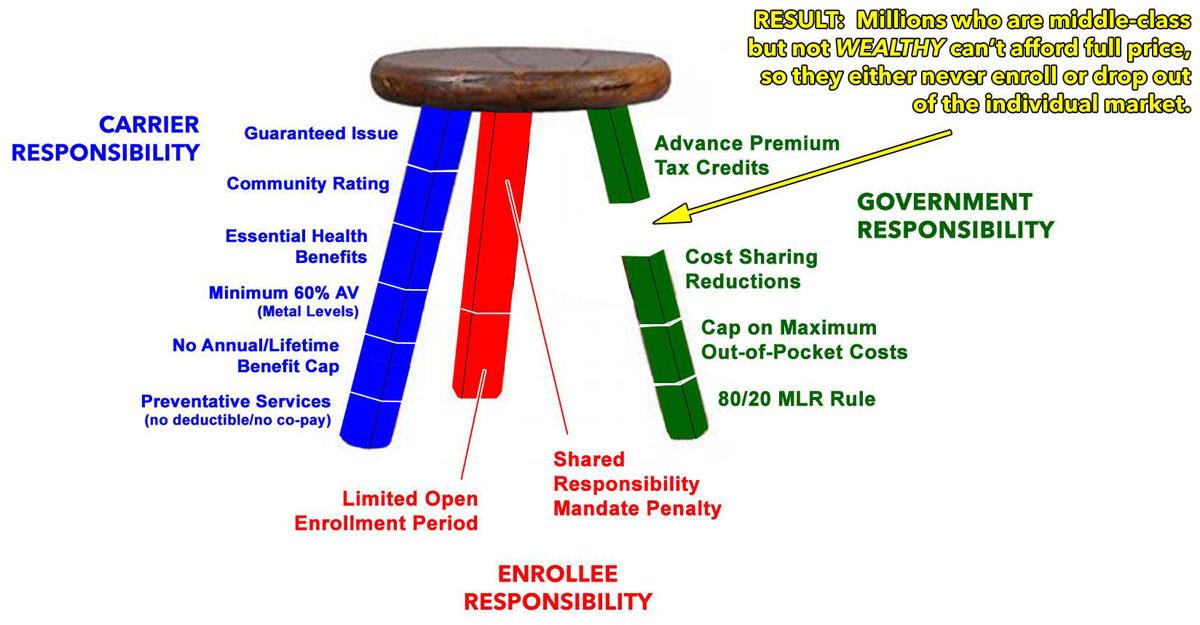

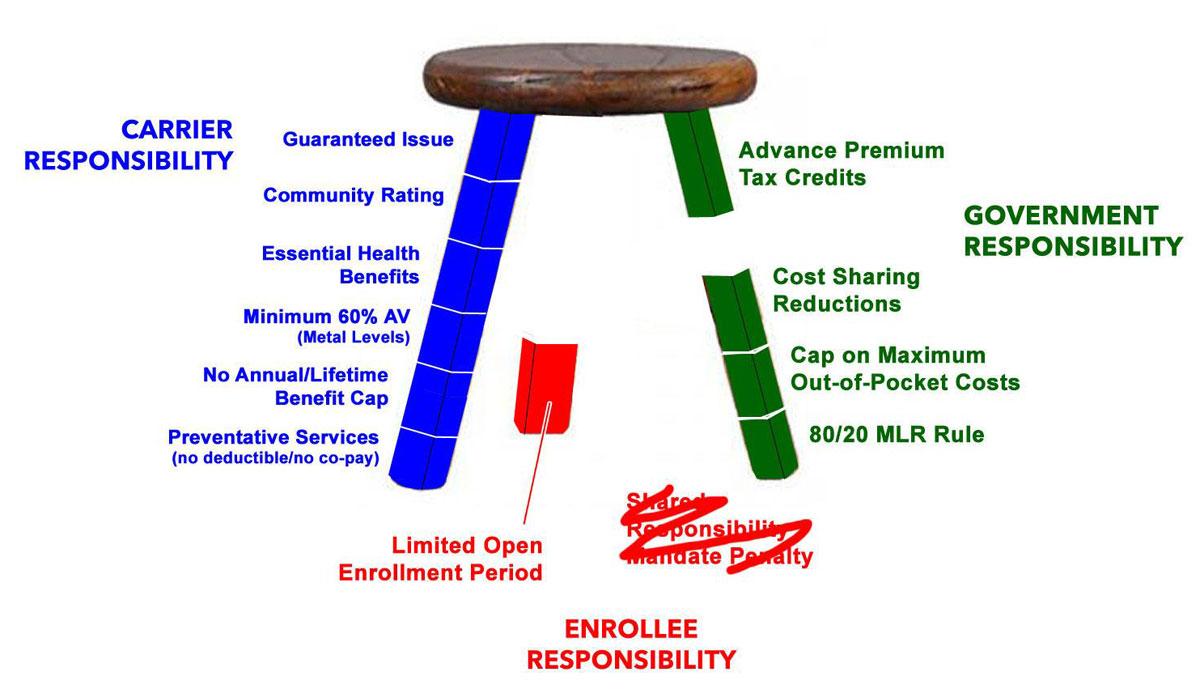

The first leg, which I'll label in BLUE, covers the INSURANCE CARRIER responsibilities…Guaranteed Issue, Community Rating, Essential Health Benefits, Minimum Actuarial Value, and No Annual or Lifetime Caps. Oh, and while they were at it, they threw in a long list of FREE Preventative Services, including stuff like annual physicals, mammograms, blood screenings and so on.

The other two legs are the positive and negative incentives for people to enroll, or the carrot and the stick.

The stick, in RED, are the ENROLLEE responsibilities, which consists of actually signing up (or having to pay a financial penalty), doing so within a limited period of time each year (to prevent gaming the system), and of course actually paying their premiums. The limited Open Enrollment period has been 3 months for the past few years, but was cut in half to just six weeks for 2018 and beyond.

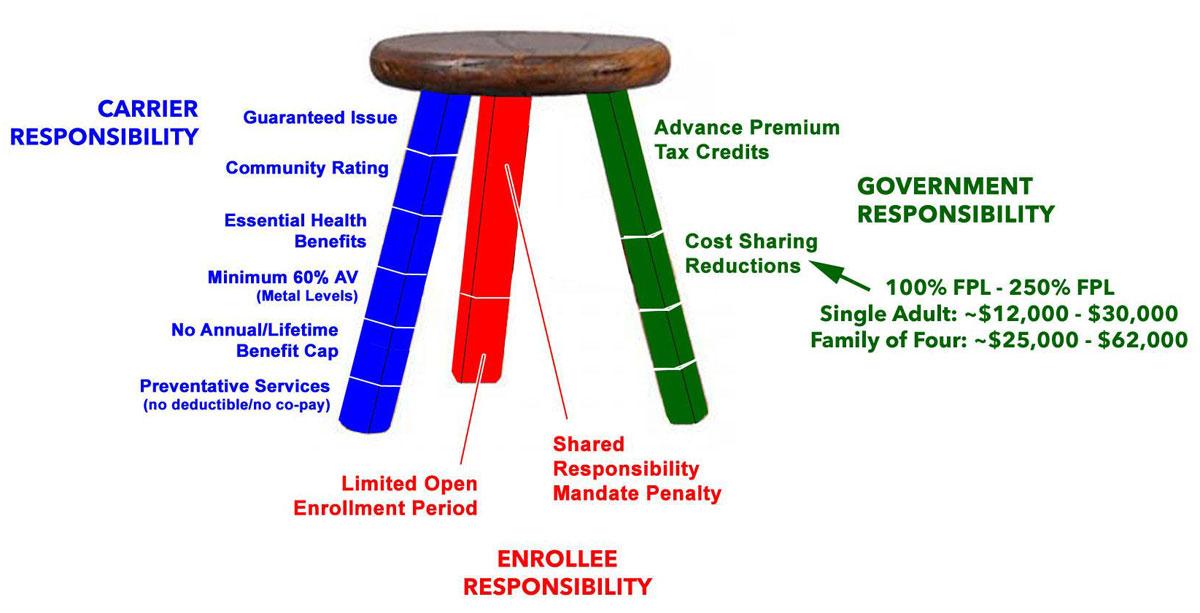

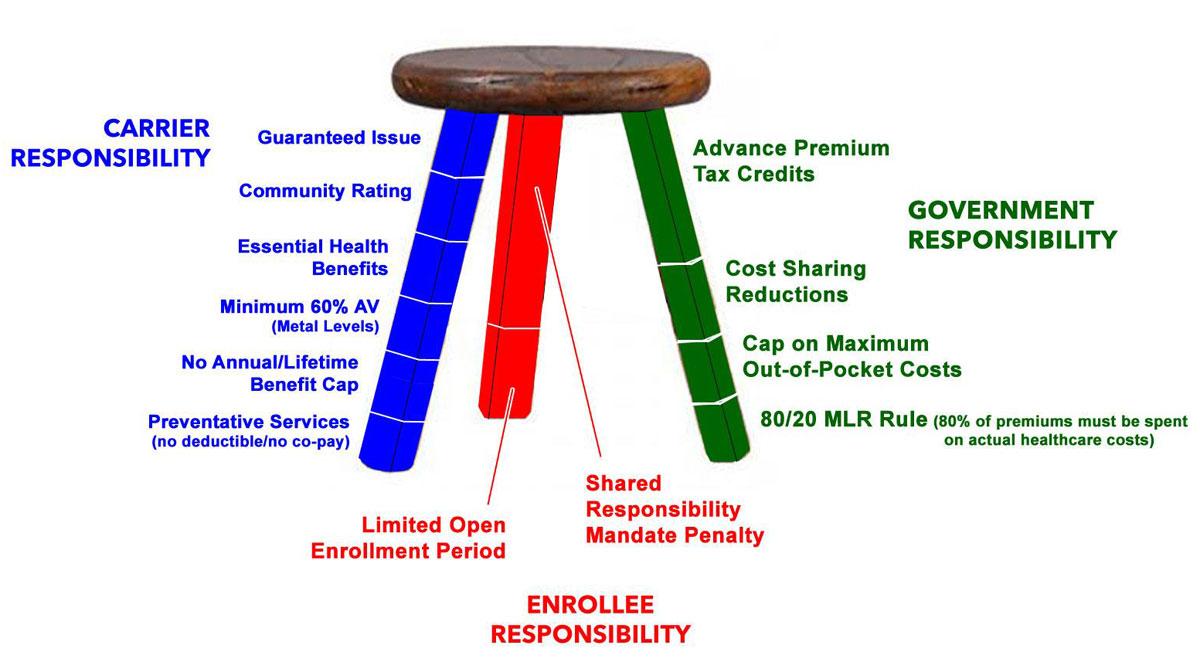

The carrot, in GREEN, is the Government Responsibilities, which mainly includes providing a level playing field, financial assistance for those who require it, and financial protection to prevent people from going bankrupt in an extreme situation. The level playing field is the ACA exchanges, where the carriers have to present their policies side by side with all the details clearly laid out.

The financial assistance comes in the form of Advance Premium Tax Credits for people earning between 100-400% of the Poverty Line...

Cost Sharing Reduction assistance (for helping with deductibles and co-pays) for those earning 100-250% FPL; a cap on their maximum out-of-pocket expenses (beyond which the insurance company has to cover additional costs)...

and a requirement that at least 80% of the premium payments have to be used by the insurance carrier for actual healthcare expenses. This was to try and help prevent price gouging or using premium payments to pay for junkets to Tahiti or marble staircases in the corporate offices and such, and was called the 80/20 Medical Loss Ratio, or the MLR rule.

OK, so that's what the 3-Legged Stool was ideally supposed to look like:

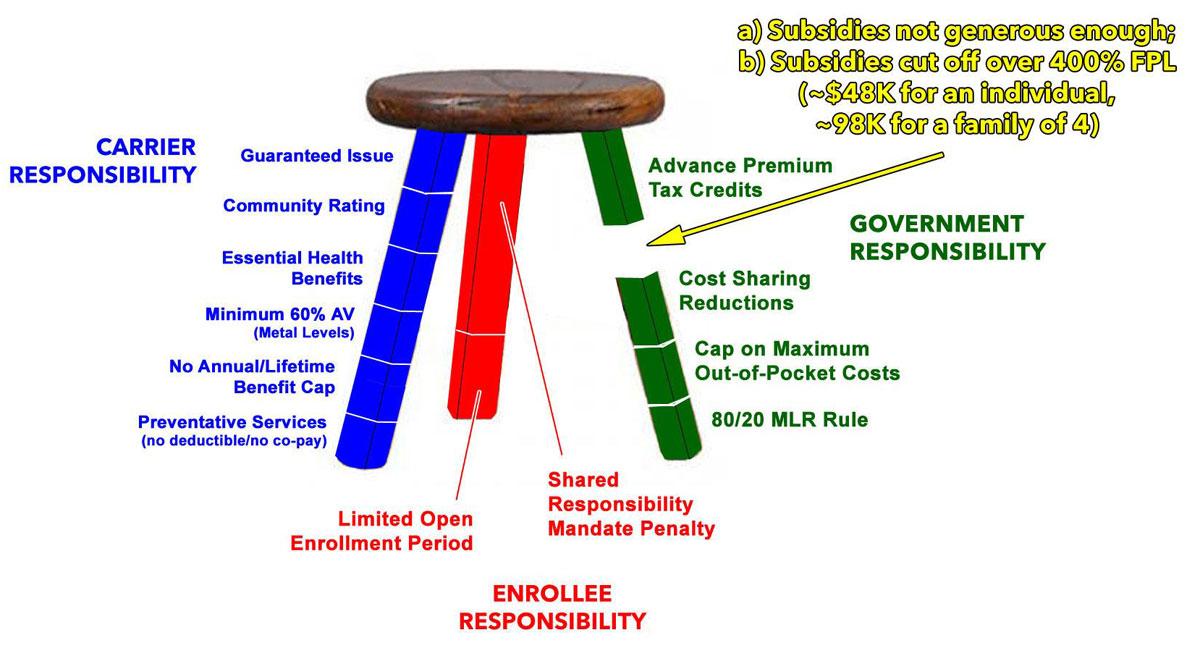

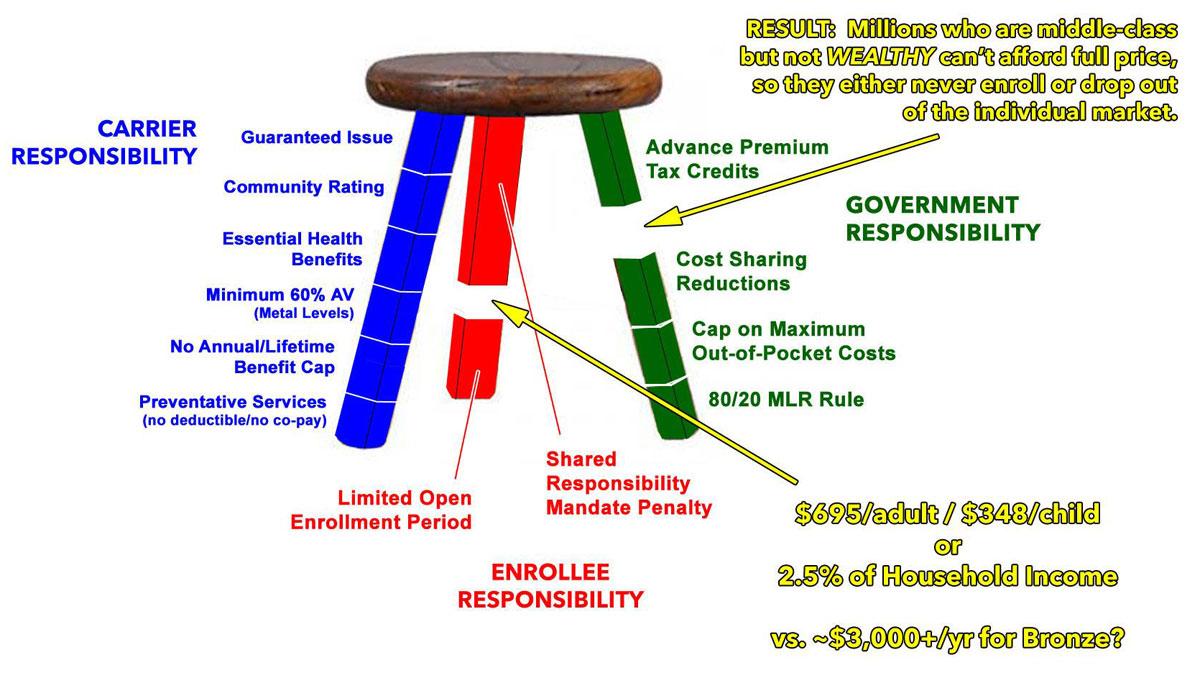

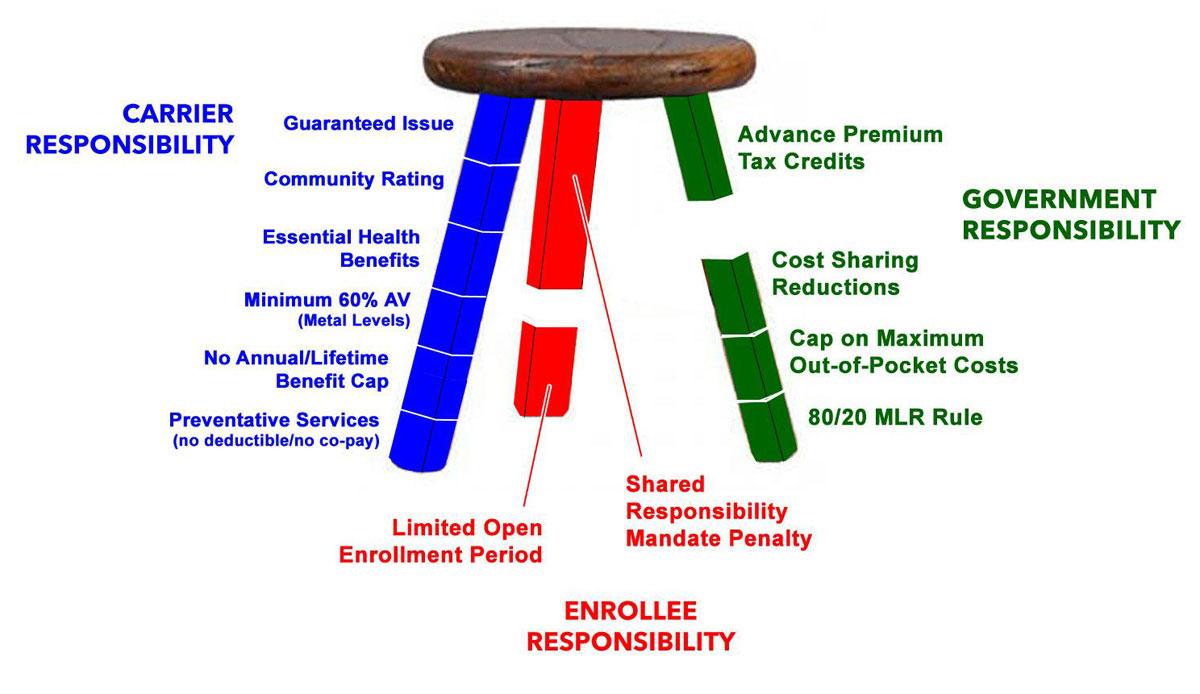

Unfortunately, in practice, it hasn't quite worked out that way. There are several problems with it, the biggest two of which are pretty obvious:

First, the formula for the Advance Premium Tax Credits, or APTC, turned out to simply not to be generous enough. That 400% FPL income cap--around $48,000 for a single adult or $98,000 for a family of four-means that anyone earning even one dollar over the cap goes from potentially thousands of dollars of assistance to nothing at all, instantly.

This is called the Subsidy Cliff, and it means that millions of middle-class people earn too much for financial assistance but too little to be able to afford to pay full price. As a result, many of them have either avoided enrolling at all or were enrolled but later dropped their coverage as rates increase, choosing to pay the mandate penalty instead.

That brings me to the second problem: While it has had some effect in spurring people to enroll, the individual mandate penalty is, to put it bluntly, too small to be fully effective. The penalty is $695 per adult or $348 per child or 2.5% of the household income, whichever is larger…but the lowest-cost plans available costs considerably more than that for many people. If faced with the option of paying, say, $3,000 for an insurance policy or the $700 penalty, many see paying the penalty as “saving” $2,300, betting that they'll be healthy enough not to ever need the coverage over the next 12 months.

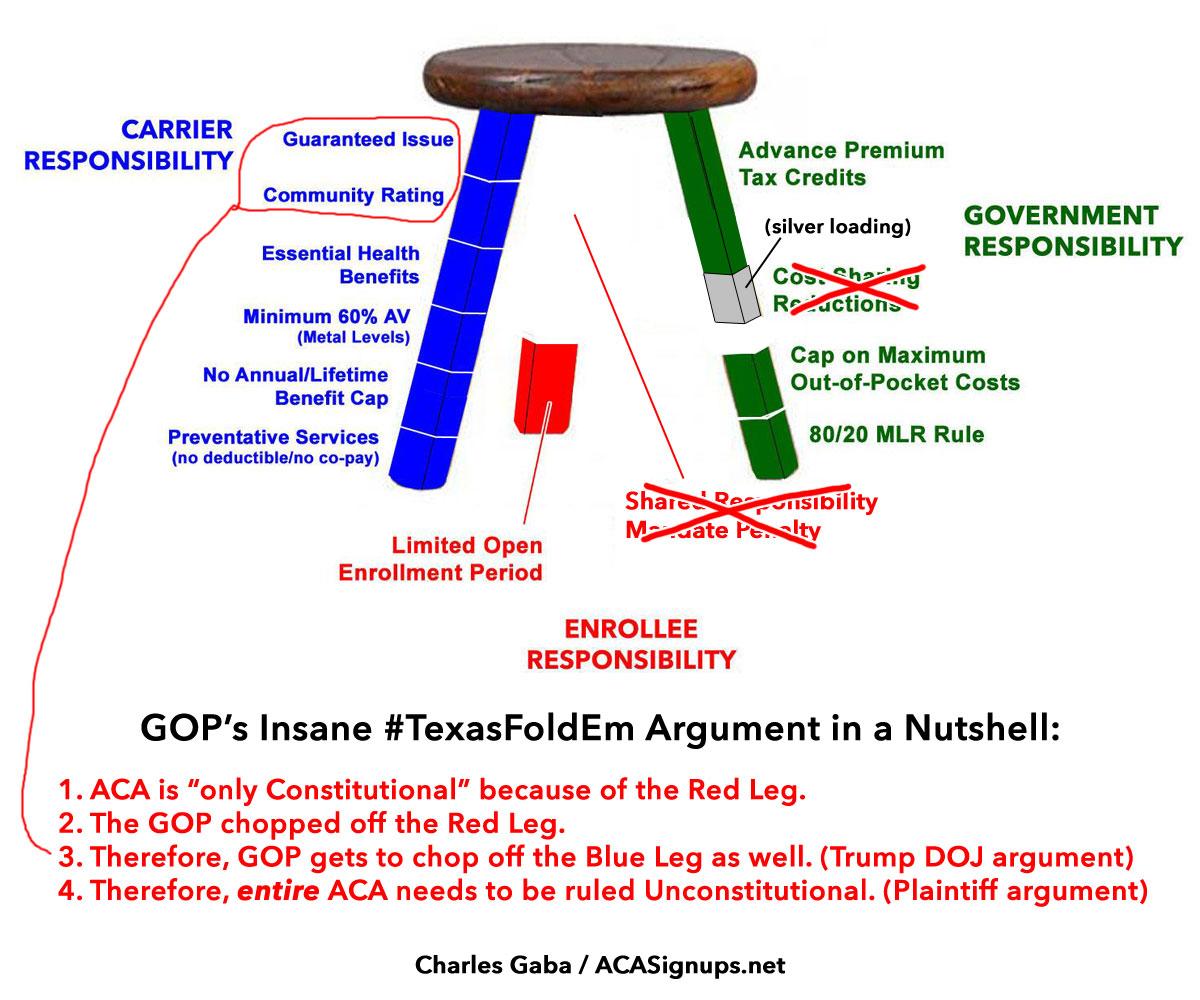

Combined, these two problems mean that the Three Legged Stool actually ended up looking like this:

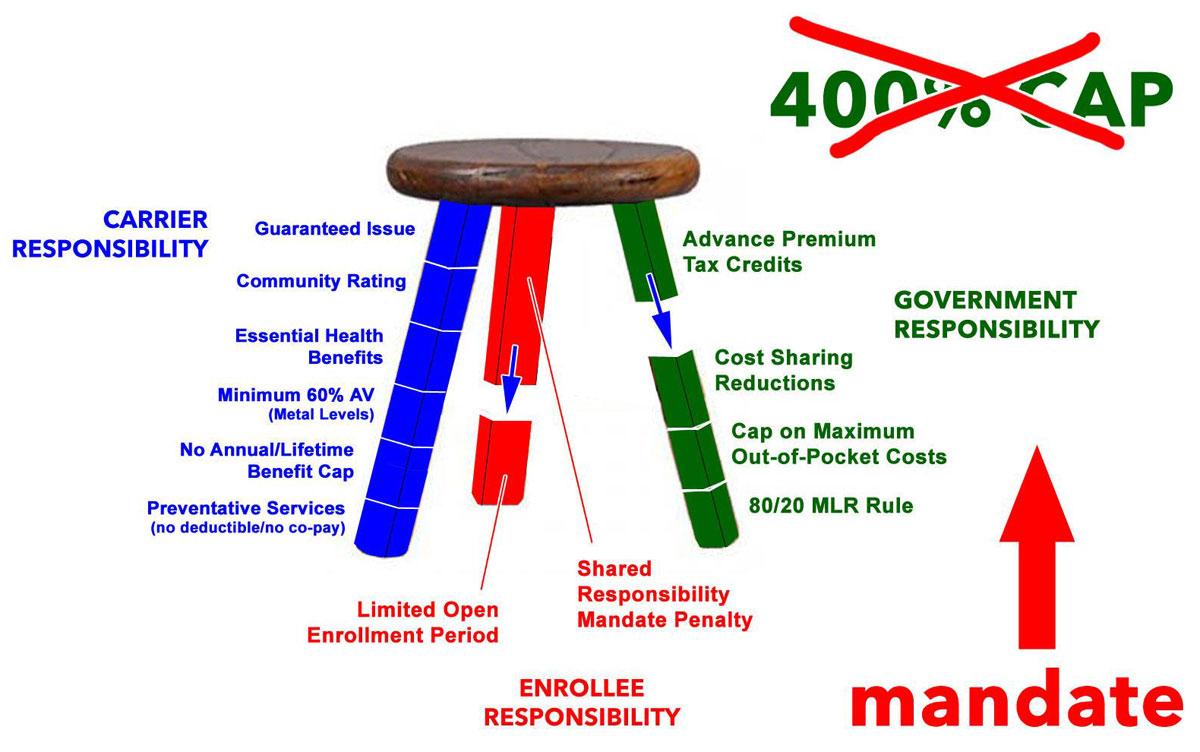

The solution to both of these problems is pretty obvious…in theory: Raise or remove the 400% APTC cap, and increase the mandate penalty. Do both of these and millions more people would sign up, which would reduce the uninsured rate even further while improving the risk pool, which in turn should stabilize the individual market and help lower premiums across the board. Now, let's be honest: Raising the mandate penalty is next to impossible politically, but at the very least it shouldn't have been ELIMINATED.

Unfortunately, eliminating it is exactly what Congressional Republicans just did last December.

The irony is that both of the supposedly “serious” ACA replacement plans they tried to shove through last year included a replacement for the individual mandate even as they pulverized the rest of the 3-legged stool and avoided addressing the actual problems at hand.

In short, the lawsuit currently at the center of the latest crisis revolves around the most insane legal argument in the world:

- 1. The ACA is “only Constitutional” because of the Red Leg.

- 2. Republicans chopped off the Red Leg.

- 3. Therefore, Republicans get to chop off the Blue Leg as well.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.