California: CoveredCA projects 9-13% rate hikes in 2019 w/5-8 points due to mandate repeal alone

OK, this doesn't technically count as an official 2019 Rate Hike analysis since none of it comes from actual carrier rate filings, but Covered California, the largest state-based ACA exchange, just released their proposed 2018-2019 annual budget, and it includes detailed projections regarding expected premium increases and enrollment impact over the next few years due specifically to the GOP's repeal of the ACA's Individual Mandate. Oddly, while they mention short-term plan expansion as another potential threat to enrollment/premiums, they do so passingly, and they don't mention association plans at all:

Since 2014, nearly 5 million people have enrolled in Medi-Cal due to the Affordable Care Act expansion, and more than 3.5 million have been insured for some period of time through Covered California. Together, the gains cut the rate of the uninsured in California from 17 percent in 2013 to a historic low of 6.8 percent as of June 2017.

Covered California’s current enrollment remains steady, with 1.4 million actively enrolled members as of March 2018, which represents a modest increase of 47,000, or 3.4 percent, over March 2017. More than 423,000 new consumers enrolled in Covered California during the most recent open-enrollment period, which also represents a 3 percent increase over the previous period.

This is actually interesting and unexpected: In California, at least, effectuated ACA exchange enrollment retention has improved year over year (CoveredCA had 1.52 million people select Qualified Health Plans (QHPs) during Open Enrollment this year, so that's a 92% retention rate as of March. For comparison, nationally, this is usually more like 87%.

Covered California’s gains are driven by policies that put patients first, along with the recognition that health insurance needs to be sold. Covered California focuses on being sure consumers have good products that mean they will get care if they need it, and that requires significant investments in marketing and outreach. Covered California’s robust outreach helped it address the uncertainty caused by repeated attempts to “repeal and replace” the Affordable Care Act, the cancellation of direct cost-sharing reduction reimbursements to carriers, confusion surrounding a shortened open enrollment period in the federally facilitated marketplace and significant cuts to federal marketing and outreach.

The challenges facing the individual market will extend into FY 2018-19 with the removal of the individual mandate penalty and the possible expansion of short-term, limited-duration insurance plans. Numerous studies indicate that these moves will hurt consumers in the individual market, including in California, by damaging the health of the consumer pool, which will lead to higher premiums — particularly for unsubsidized consumers.

Since this is a budget proposal, there's a ton of info about revenue and where they plan on putting their money, of course, but they then go into actual premium and enrollment projections, relying on expert analysis from PricewaterhouseCoopers (PwC):

To derive the forecast, Covered California drew on a broad range of resources to project the “most likely” multi-year enrollment figures in the context of upper and lower boundary extremes. Recognized health insurance experts from PricewaterhouseCoopers (PwC) were consulted to conduct background research and provide observations about the potential impact of the loss of the mandate penalty, as well as other factors that could affect Covered California enrollment and premiums. PwC was also consulted to project potential changes in California’s health insurance market generally. In addition to their own expertise, PwC’s recommendations are informed by analyses of other prominent experts, such as the UCLA Center for Health Policy Research and the UC Berkeley Center for Labor Research and Education. The resulting forecasts upon which this budget is based also reflect Covered California management’s consideration of a variety of estimates and the insights of external and internal experts on health insurance enrollment in the individual market in California. Because Covered California’s plan assessments are based on both enrollment and gross premiums, the impact on both variables was projected.

The most significant federal policy action taken that will affect California in 2019 is the elimination of the penalty for failure to satisfy the individual shared responsibility provision of the Affordable Care Act. The penalty was designed to provide an incentive for people to enroll who may not otherwise purchase health insurance. By sustaining the number of people in the individual risk pool with low or minimal health care costs, average medical costs and thus premiums would be lower than would otherwise be the case.

Based on PwC observations, five notable analyses from highly regarded sources informed the FY 2018-19 enrollment and revenue outlook. The estimated loss of enrollment in individual health plans due to the removal of the mandate penalty ranges from 7 to 26 percent, as illustrated in Figure 1. Each analysis is unique and there is diversity as to the method used (survey or microsimulation), the geographic scope (national or California), the enrollment estimate granularity (on- or off-exchange, or the entire individual market) and the time required for the impact to play out. The PwC report also summarizes expert predictions of the impact of the penalty on premiums, which ranged from it causing increases of 5 to 10 percent.

Covered California Forecast Premium Assumptions

Covered California also used these analyses and guidance to inform its projection of the impact of the elimination of the mandate on premiums.

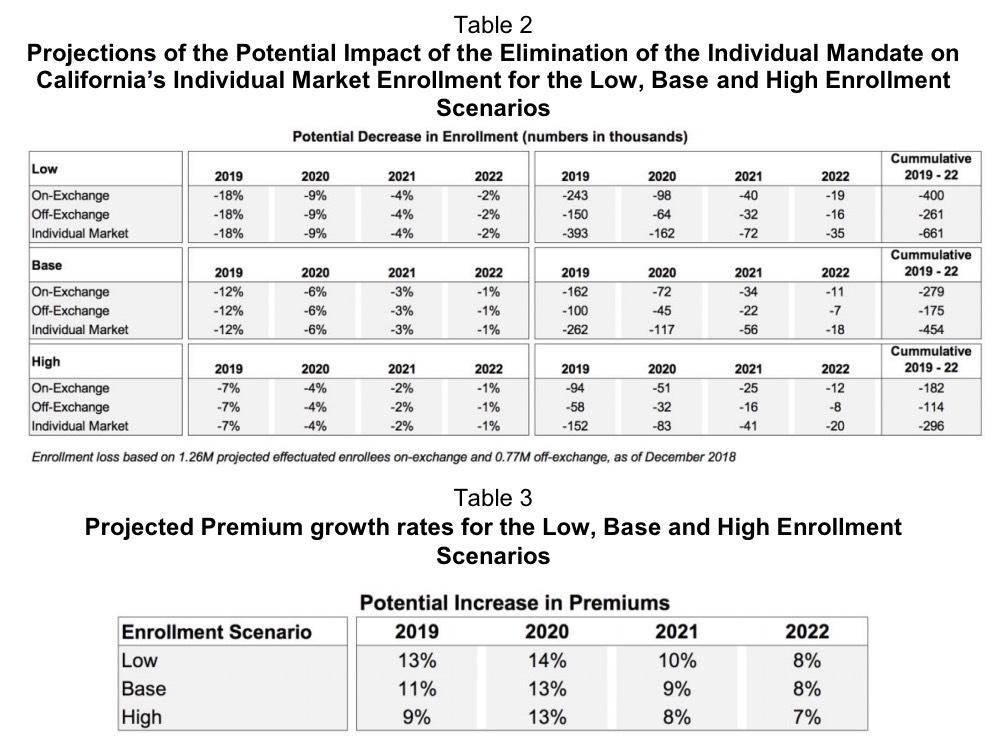

In the Base enrollment scenario, the elimination of the mandate in conjunction with the increase in medical cost trend in 2019, and subsequent reinstatement of the health insurance provider fee in 2020, the overall premium growth rates are assumed to be 11 percent in 2019, 13 percent in 2020 and 9 percent in 2021. The elimination of the mandate is projected to drive premium growth of 6 percent in 2019, 4 percent in 2020, and then 2 and 1 percent in 2021 and 2022, respectively.

In the high enrollment scenario, a range of factors is assumed to result in overall premium growth rates of 9 percent in 2019, 13 percent in 2020 and 8 percent in 2021. The elimination of the mandate is projected to drive premium growth of 5 percent in 2019, 3 percent in 2020, followed by 1 and 0 percent in 2021 and 2022, respectively.

In the low enrollment scenario, various factors are assumed to lead to overall premium growth rates of 13 percent in 2019, 14 percent in 2020 and 10 percent in 2021. The elimination of the mandate is projected to drive premium growth of 8 percent in 2019, 5 percent in 2020, and then 3 and 1 percent in 2021 and 2022, respectively. The impact of the elimination of the mandate on enrollment and premiums is summarized in Table 2.

I'm not going to include these projections in my official 2019 Rate Hike Project; that will have to wait until the carriers themselves release at least their requested rate hikes, but this at least gives a bit of guidance going forward. Remember, California holds a good 13-14% of the total individual market population, so it has a heavy impact on the national averages.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.