Virginia: (relatively) Good News! Avg. preliminary rate hike "only" 13.4% after all!

A couple of days ago, I posted that Virginia has become the first state out of the gate with their preliminary 2019 premium rate requests for ACA individual policies. However, I made sure to emphasize that these are preliminary requests only; carriers often resubmit their rate change requests more than once over the course of the summer/fall, and even that may not match whatever the final, approved rate changes are by the state insurance commissioner.

In addition, I generally try to make it understood that there's alotof room for error here--the weighted averages are based on the number of current enrollees, but of course that number can change from month to month as people drop policies or sign up during the off-season (via Special Enrollment Periods). Even then, the rate filing paperwork is often vague or confusing about just how many enrollees they actually have in these plans. Sometimes wonks are reduced to taking the number of "member months" and dividing by 12 to get a rough idea of how many people are enrolled in any given month. Sometimes the only number of enrollees available are from last year, which could bear zero resemblence to how many are currently enrolled. Sometimes the only number available is how many people the carrier expects to enroll in their policies next year. And so on.

And then...there's situations like what Hannah Recht, Louise Norris, Dave Anderson and I just stumbled upon in Virginia.

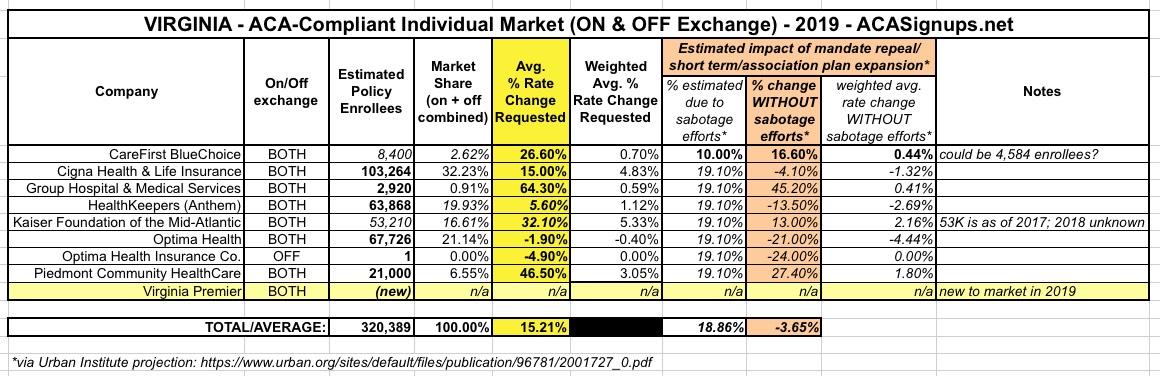

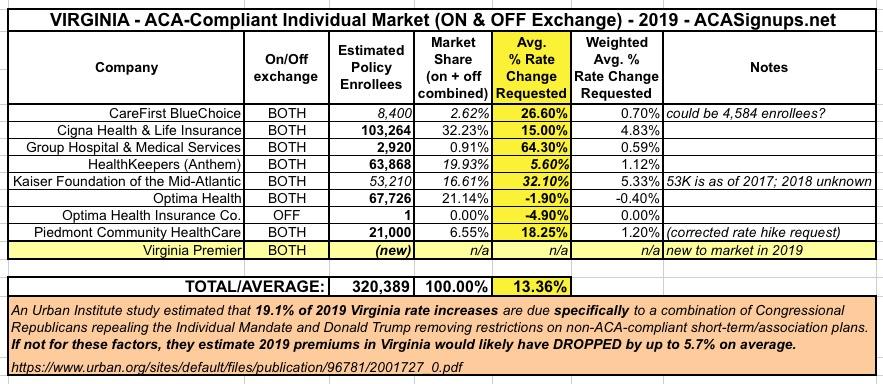

Here's what I thought the preliminary VA landscape looked like for next year's ACA individual market:

Notice there's already a couple of notes: The CareFirst number is 8,400, but it might be only 4,584 based on a different number listed in the rate filings. No biggie, since both numbers are so small it's barely a rounding error state-wide (it means the difference between the average being 15.1% or 15.2%). In addition, the Kaiser enrollee number, 53,210, was as of 2017. As I noted, I have no clue how many people enrolled in Kaiser plans this year...if it's still around 53,000, it deosn't impact things, but if it's significantly higher or lower, it makes a big difference.

And then there's this, via a private Twitter exchange between Norris, Anderson and myself, sparked by a heads up from Recht:

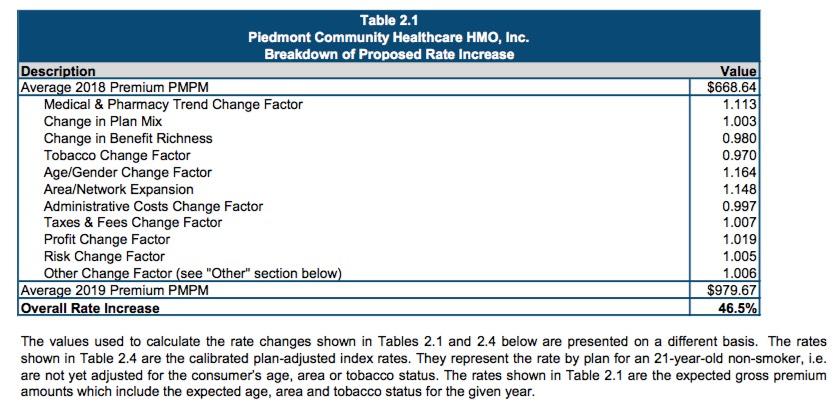

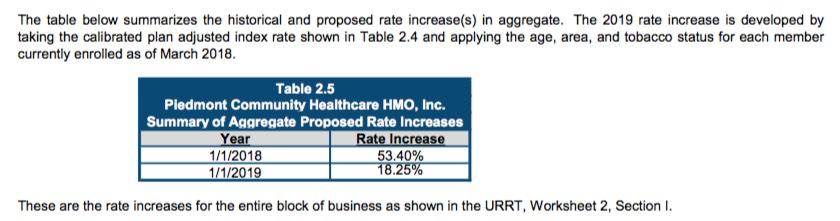

- Piedmont's filing in Virginia has a quirk...The SERFF tracking number is PDHP-131463453 Table 2.1 of the actuarial memo shows a 46.5% rate hike, but Table 2.5 shows 18.25%. They both seem to be adjusted for age, tobacco, and area, but obviously I'm missing something....

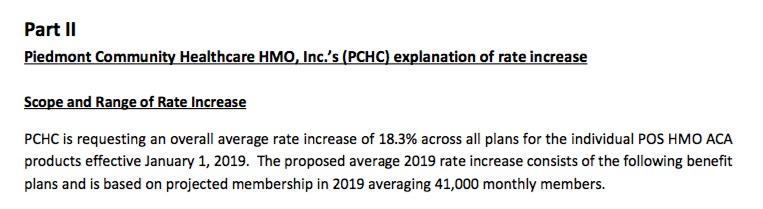

- The Rate Justification form also says 18.3%...They project 41,000 members in 2019, which I presume means they expect to double enrollment from 21,000?

"The table below summarizes the historical and proposed rate increase(s) in aggregate. The 2019 rate increase is developed by taking the calibrated plan adjusted index rate shown in Table 2.4 and applying the age, area, and tobacco status for each member currently enrolled as of March 2018."

They are applying the 18.25% against their current membership...they are assuming that the new areas that they are going into will have a much more expensive membership (Table 2.1) age/gender change factor...and "area/network expansion"...since those plans are new plans that don't apply to current membership, it makes sense how the average projected premium will increase by 46% but current members will see an 18.%

Here's what's going on: Virginia actually has 12 separate geographic rating areas. That means that while the same policy has to be priced the same for everyone of the same age within each rating area, the price of that same policycanvary if you live in a different rating area. Remember, age (within a 3:1 range) and location (rating area) are the only pricing variances allowed under the ACA (with one exception: Smokers can still be charged 50% more for a policy; it's the only health status factor still allowed).

In this case, in 2018 Piedmont is only offering policies in some of VA's rating areas. In 2019 they plan on expanding into some new areas of Virginia...and apparently they're expecting those new areas to have considerably worse risk pools, so intend on pricing their policies quite a bit higher in those regions.

So, let's suppose they have 21,000 current enrollees paying an average of, say, $668/month, and they plan on increasing the average premium by 18.25% to $791/month for their current enrollees.

What Piedmont appears to be saying is that they expect to add perhaps 20,000 more enrollees in these new areas...but that they're gonna have to charge those folks a good $1,181/month on average in 2019.

How do I know this?

- $790x 51.2% = $404

- $1,180x 48.8%= $576

- $404+ $576 = $980/month

However,the entire second half of this projection is speculative. Will 20,000 new enrollees sign up for Piedmont plans? Who knows. The only numbers I have to work with are the current enrollees, which is also true of every other carrier in every state.

Therefore, I have to go with the 18.25% average rate increase being requested for the 21,000 current enrollees.

As I added in our conversation:

I have to assume 100% of all current enrollees renew their same policy....Obviously that never happens even when the same policy is offered, but there's no way for me to speculate about how people will shift around.

If a policy has 1,000 people enrolled at $500/mo and the cost of that policy for those 1,000 people increases to $550, I have to assume a 10% increase.

In addition, I've made some changes to the part of the table which utilizes the report released by the Urban Institute in February which estimates the average premium hike impact, on a state-by-state basis, of the latest sabotage factors by Congressional Republicans (eliminating the individual mandate) and Donald Trump (his executive order opening up the floodgates on short-term and association plans, aka #ShortAssPlans). After discussing their projections with Linda J. Blumberg of the Urban Institute (one of the co-authors of the report), I've changed the "19.1%" from applying to each and every insurance carrier to being a state-wide estimate, since the impact of it will vary widely from carrier to carrier.

She did agree, however, thatthe odds are indeed pretty good that average premiums would be flat or even drop by several percent in at least some states...and Virginia appears to be a perfect example.

When I revise the table in this fashion, here's what it looks like:

As you can see, dropping Piedmont's average rate increase from 46.5% to 18.3% causes the statewide average to drop from 15.2% to 13.4%.