UPDATE: Short-Term Plans: A Closer Look

For some time now, I've been railing against Donald Trump's executive order pushing for the expansion of both "Short Term, Limited Duration" plans as well as "Association Plans". I've scornfully referred to his EO with the hashtag #ShortAssPlans.

Something which has gotten lost in the shuffle, however, is that I don't think short-term plans should necessarily be scrapped altogether, at least until we're able to achieve a comprehensive, universal coverage system in the future. Under our current patchwork heatlhcare system, I do think they serve a purpose for certain people in certain circumstances. I just think they need to be strongly regulated and limited in scope, partly to prevent siphoning off healthy people from the individual market risk pool...but partly to prevent people from being hit with financial catastrophe in the event of unexpected high medical expenses.

The problem is that Trump's executive order--which would effectively open the floodgates for them to be mutated into year-round plans, completely destroying one of the major points of the ACA in the first place.

Here's what I had to say about short-term plans back in June 2016 when the Obama Administration first made the announcement that they were putting the screws on these plans in the first place:

Seriously, though, this is important. I was surprised to learn that carriers aren't already required to let enrollees know that short-term policies don't qualify as ACA-compliant coverage; I kind of assumed that was already baked in, but apparently not.

As for the "no renewal" rule, I'm guessing, as Herman notes, that that rule is gonna cause temper tantrums among certain insurance carriers.

It makes sense to me. The whole point of the ACA's individual mandate is to try and ensure that people are enrolled year round with fully compliant coverage. Whether you agree with that goal or not, letting people keep renewing what is presumably substandard, short-term policies over and over again kind of defeats the point.

...Sales of short-term health insurance are up sharply since the health law’s major provisions took effect in 2014, according to insurance agencies. New sales figures show the temporary policies, traditionally sold to consumers who are trying to fill coverage gaps for a few months, have continued their surge recently—even though people who buy them face mounting financial penalties because the coverage doesn’t meet the ACA’s standards.

...Ms. Herman’s new policy, like many short-term plans, doesn’t cover pre-existing conditions, a limitation no longer allowed in full health coverage. Ms. Herman’s plan also caps total benefits at $1 million, another feature prohibited in ACA plans. It doesn’t cover most prescription drugs. To get the plan, Ms. Herman had to qualify as healthy by answering a questionnaire. ACA plans are sold to every consumer regardless of health status.

“This is exactly the kind of coverage the ACA was designed to get rid of,” said Larry Levitt, a senior vice president at the Kaiser Family Foundation. Consumer advocates say they fear buyers don’t understand the short-term policies’ limits, or the risk of penalties that can hit $695 or more for adults in 2016. Some lower-income consumers also may not realize they qualify for federal subsidies that can sharply reduce the cost of ACA plans.

A spokesman for the Department of Health and Human Services said that under federal law, short-term plans aren’t considered individual health insurance, and thus aren’t subject to the ACA’s rules. Some short-term plans can last nearly a year, after which a policyholder must reapply.

This last point seems to be the key change being announced today; instead of defining "short term" as being up to 11 months (which allows someone to either skip 1 month per year or enroll in an ACA-compliant policy for 1 month and then switch to a short-term plan for the rest of the year), "STPs" can now only run up to 3 months per year.

The wording of the press release is a little unclear about how the "no renewals" provision would work--I'm not sure if this means that carriers can only provide a STP to the same person for 3 months of the year, or if the enrollee is allowed to switch from one STP to another every 3 months, or what.

As for why they're doing this, in addition to the reasons noted above, there's also the (hoped for) positive impact this change will hopefully have on the ACA-compliant risk pool...since cutting people off of STPs should push a lot of them onto ACA-compliant plans. Since these are presumably a healthy lot, that should help with the risk pool.

With that in mind, here are two recent reports about short-term plans. The first is from eHealth Insurance, one of the largest sellers of short-term plans in the country:

eHealth's position is that ACA-compliant health insurance is the best choice when people can afford it. We're finding, unfortunately, that increasing numbers of unsubsidized folks can't – a fact I know you’re well aware of.

This is a reasonable take, and a perfect example of the Catch-22 of risk pools: A large part of the reason for the ACA-compliant risk pool being so expensive is because so many healthy people refuse to enroll in them...but the risk pool being so expensive is exactly what's causing many of them to refuse to enroll in them. This is precisely what the individual mandate was supposed to help keep a lid on...and it being repealed has removed a large part of the incentive for healthy people to do so, thus exacerbating the problem.

The same is true of expanding short-term and association plans (along with "health sharing ministries", but that's a separate discussion). The more STPs are expanded, the more likely people are to enroll in them, which in turn makes the ACA-compliant risk pool even worse, which in turn leads more people to drop out of it and so on...which is the whole point of Trump's EO in the first place (he wasn't able to "blow it up" as he said he wanted to, so instead he's trying to bleed it dry).

Given the policy discussions underway about short-term coverage and how the Trump administration's new rule may impact the market, we sought to offer some insight by analyzing the costs and benefits covered under short-term policies, the impact of the 2017 rule limiting coverage to no more than 90 days, and results from a survey of nearly 1,000 short-term policyholders. It sheds some light on how people use these policies and why they buy them. There are a few somewhat surprising findings, including a slight rise in the number of older people buying short-term plans in the past year.

There's a whole mess of interesting stuff in the eHealth survey, but I'll stick to their summary...and while this is obviously coming from a profit-based company which has a pretty clear financial stake in selling STPs, I figured I've bashed them enough that it seems reasonable to give them their say on the subject:

Short-term plans comprise a segment of the individual health insurance market that has recently become the subject of policy debates and heightened public interest. A rule established by the Obama administration that limited the length of these policies to 90 days may now be reversed, allowing short-term plans to remain in effect for periods of less than 12 months, as they had been prior to 2017. The impact such a reversal may have on the stability of insurance markets under the Affordable Care Act (ACA), and on the cost of major medical insurance plans, is a matter of speculation and sharp disagreement.

Often missing from these debates is the important role short-term plans play in providing a legitimate coverage option for individuals and families facing gaps in their major medical health insurance coverage, and increasingly, for those unable to afford ACA-compliant plans or who have limited coverage options in their area. Without broader legislative action or market changes aimed at lowering the cost of major medical coverage, restrictions on the availability of short-term policies may simply leave large numbers of consumers uninsured.

eHealth’s report aims to shed some light on today’s short-term health insurance market. It examines the cost of short-term plans (something eHealth has covered for several years) but also explores the impact of the 90- day rule, consumer sentiments about short-term coverage, changes in policyholder demographics, benefits covered under short-term plans, and the utilization of bene ts for policyholders receiving medical care.

Findings are based on data collected from individuals and families selecting short-term plans at eHealth.com, a voluntary survey of consumers purchasing short-term insurance through eHealth, and data provided by short-term insurance carriers with whom eHealth has a contractual relationship. Highlights of eHealth’s analysis include the following:

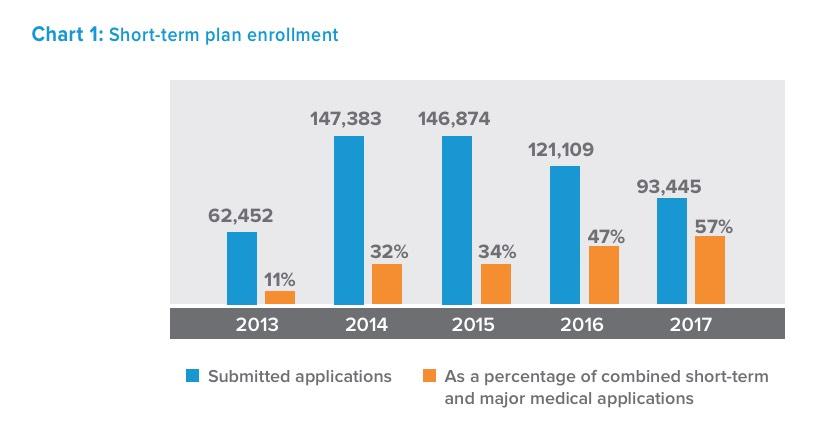

- Demand for short-term plans remains strong despite the 90-day rule. Short-term applications accounted for 57 percent of all combined short-term and major medical plan applications received by eHealth in 2017, up from 47 percent in 2016.

- Short-term policyholders want longer coverage periods. Nearly 70 percent of eHealth customers with short-term policies responding to a voluntary survey said they would have purchased a policy that lasted longer than 90 days if it were available to them.

- Without access to short-term plans, most policyholders said they would be uninsured. Fifty-one percent of survey respondents said they would have been uninsured during their coverage period without the short-term policy they purchased through eHealth.

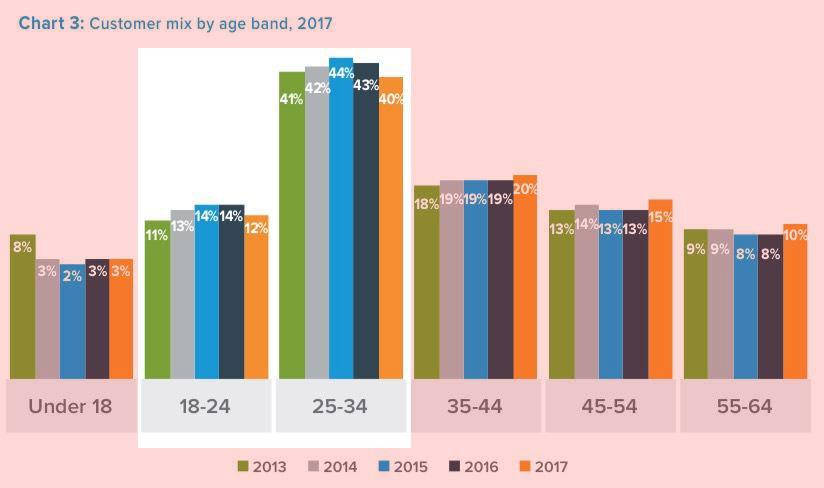

- Short-term plans are becoming more popular among older consumers. The average age of consumers buying short-term coverage at eHealth increased from 34 in 2016 to 36 in 2017; since 2015, the share of people between the ages of 45 and 64 buying short-term plans has increased from 21 percent to 25 percent.

- Nearly three-in-ten short-term policyholders use their coverage. Twenty-eight percent of eHealth survey respondents said they used their short-term coverage for medical care, most commonly for a sick visit to the doctor’s office.

- Short-term health insurance was immune to premium inflation in 2017. The average premium for individual short-term coverage in 2017 was unchanged from 2016 ($110 per month) and decreased by 3 percent for families during the same period (from $276 to $267 per month), a stark contrast to the premium inflation seen among major medical plans.

All of these certainly paint STPs in a more flattering light...until you realize that this is, once again, a closed loop situation. Of course demand will remain strong as unsubsidized ACA-compliant premiums/deductibles increase. Of course that in turn means they're going to want them to be in place for longer periods of time. And since older people are screwed by the lack of financial subsidies even more than younger people (up to 3x more, to be precise!), of course they're going to increasingly turn to them.

Finally, of course STPs are gonna be "immune to premium inflation"...because when you're allowed to pick and choose your enrollees based on their medical condition, it's easy to keep prices low.

eHealth also provides some interesting data on the enrollment trend for STPs over the years. Obviously these numbers are only for their company and don't reflect the entire STP market, but the trend should be fairly representative: In 2013 (the last year before all new major medical policies had to be ACA-compliant), eHealth had around 62,000 people apply for STPs out of around 568,000 total applications (11%). That means eHealth had ~500,000 people enroll in pre-ACA policies in 2013.

It's important to keep in mind that "applications" doesn't necessarily translate into actual enrollees--that's an important distinction in a business where the company can turn down people for their medical history. Remember that starting in 2014, major medical policies had to accept everyone regardless of their medical history...but STPs could continue to discriminate.

Having said that, look what happened starting in 2014: STP applications shot up by more than 135% to 147,000, while ACA-compliant apps stood at around 313,000. This held at about the same level in 2015. Interestingly, STP applications already started dropping (by 18%) in 2016--before the Obama Administration's 3-month restriction kicked in, which was interesting. Last year, with the 3-month cut-off in place, it plummeted even futher, by another 23% to around 93,000. However, it's worth noting that this made up 57% of their total enrollments...meaning eHealth only enrolled about 71,000 people in ACA-compliant policies last year.

Put another way: Since the ACA-compliant plan requirement kicked off in 2014, eHealth has seen their sales of major medical policies drop by 77% and sales of STPs drop by 37%. They stand to gain financially if either STPs are opened up or if ACA policies are made more affordable for more people. Needless to say, I strongly prefer Option B.

UPDATE: Curiouser and curiouser. According to this report from the National Association of Insurance Commissioners (NAIC), in 2016 only 161,000 people were enrolled in Short-Term Plans nationally (see page 13). That suggests that eHealth Insurance held a whopping 75% of the Short-Term Plan market that year, and presumably a similar ratio since then. Huh. That's a bit surprising, Even if 161K is a bit low that's still a lot lower than the ~1 million or so I've been assuming.

What I find more useful are the "Consumer Attitudes about Short-Term Health Insurance":

- Temporary coverage needs and affordability drive interest in short-term policies: When asked to identify the primary factor that had influenced the purchase of a short-term plan, 61 percent of respondents said they only needed coverage for a limited period, while 27 percent chose a short-term policy because it was more affordable than other options.

- Half said they would be uninsured without access to short-term policies: 51 percent of respondents said that without their short-term health insurance plan they would have been uninsured; another 22 percent said they don’t know what they would have done without access to short-term plans; only 12 percent said they would have purchased ACA-compliant coverage instead.

This is interesting. 12% is presented as a low number, and it is, but it's not an insigificant one either--I don't know how many people are actually enrolled in STPs, but assuming it's, say, 2 million people nationally, that means a good 240,000 would shift to ACA-compliant policies if STPs were eliminated altogether. Obviously this data is subjective; many people say they'd do X if Y wasn't available as an option. The actual number could be higher or lower...and the 51% who say they'd go completely uninsured otherwise could change their tune as well.

- One quarter chose short-term policies because they missed open enrollment: 26 percent of respondents said they purchased short-term coverage, in part, because they had missed open enrollment under the Affordable Care Act.

...and now that the individual mandate is no longer a factor, there's even less reason for these folks to bother making the Open Enrollment Period, once again making the problem worse.

- A majority consider ACA coverage first: More than half of respondents (52 percent) said they considered purchasing an ACA-compliant health insurance plan before turning to short-term coverage. About half (49 percent) believed they would not have qualified for government subsidies under the ACA.

This is a big part of the problem. While many of these people no doubt wouldn't qualify for ACA subsidies, I'd be willing to bet that a large portion of them are simply mistaken about this. According to the Kaiser Family Foundation, fully 28% of those defined as "uninsured" in the U.S. (which includes those on STPs, I believe) are eligible for ACA tax credits but either don't know it or in some cases may still find the policies to be too expensive even with financial aid).

- Three-quarters were happy with their coverage: Three-quarters (76 percent) of respondents reported being happy with their short-term coverage, while more than half (58 percent) said their plan covers the medical services they value most. Only 28 percent of respondents said they used their short-term plan when receiving medical care; 78 percent of those who accessed medical services reported being happy with their coverage.

...and I'm sure most of them are happy most of the time...because most of the time most people don't require expensive medical treatments. Once you do run into an expense which isn't covered, however, suddenly your attitude changes very quickly. This is the essential conundrum of health insurance (or any other type of insurance, for that matter).

So who takes up these plans? Well, not surprisingly, it's mostly the exact same "Young/Invincible" types who are needed to make/keep the ACA exchange risk pool stable:

Yup, depending on the year, between 50 - 60% of eHealth's STP enrollees are between 18-34 years old...which means they're siphoning off precisely the age demographic needed to stabilize the ACA exchanges. Imagine how much worse this problem will become when you remove the 3-month restriction and the individual mandate.

In terms of the actual cost. According to eHealth, their STPs cost an average of around $110/month per person, which has stayed steady for several years. The average deductible has hovered around the $4,000 - $5,000 mark the past few years, which surprised me--that's actually around the same as the average ACA-compliant deductible, which averages around $5,800/person for Bronze plans and $4,000/person for Silver plans this year according to HealthPocket.

In other words, any cost savings for STPs come from the premiums being less expensive, NOT the deductibles.

OK, so now that you've removed deductibles from the equation, what's the downside to the premiums being around 80% lower than ACA plans? Well, there's two big ones:

- They don't have to cover you at all if they don't want to; and

- They don't cover nearly as many expenses or nearly as much of the ones they do.

Here's some interesting stats on just how good or lousy STPs actually are in terms of coverage:

Short-term health insurance provides protection against medical expenses for a limited period. Benefits covered do not meet the “minimum essential health benefits” standards of the Affordable Care Act, and applicants may be declined based on their medical history. Even so, a majority (58 percent) of survey respondents said the short-term plan they bought at eHealth provided them with the bene ts they valued most.

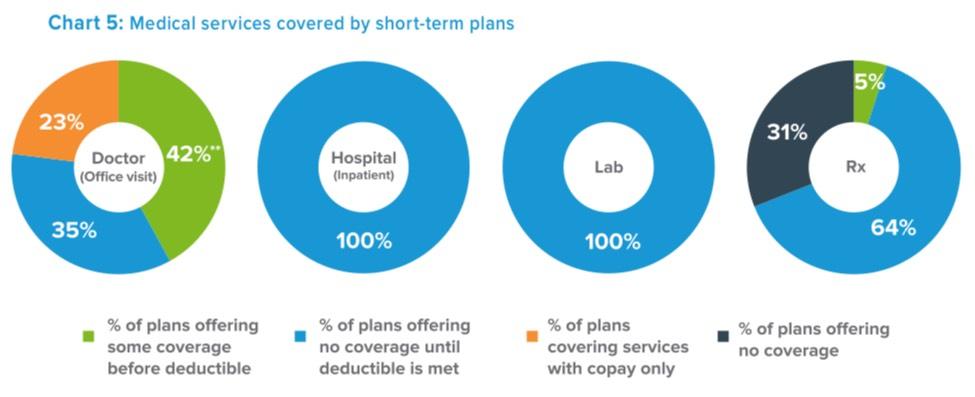

To provide a snapshot of short-term coverage, eHealth conducted an analysis of the benefit packages of more than 1,000 plans* covered by four major short-term health insurance companies, representing a significant proportion of the overall market. All plans reviewed provide some coverage for doctor’s office visits, inpatient hospital care, and laboratory work. Sixty-nine percent of the plans reviewed cover some prescription drug coverage (Chart 5).

Many plans (42 percent) provide some coverage for a sick visit to a physician’s office before policyholders meet their deductible. Approximately one-third (35 percent) offer no coverage for doctor’s office visits until the full deductible is met. Somewhat fewer than one quarter (23 percent) cover doctor’s office visits with a copay only.

All plans provide coverage for inpatient hospital and laboratory services, but only after the plan deductible is met. Approximately two-thirds (64 percent) of plans offer coverage for prescription drugs only after the medical deductible (or a separate prescription drug deductible) is met; 31 percent offer no coverage for prescription drugs, but many of these policies cover prescription drug discount cards in combination with the short-term policy. In some cases, prescription drugs are only covered on an inpatient basis.

There's an awful lot of "some", "partial" and "only after" caveats sprinkled thorughout these paragraphs. Those types of caveats, disclaimers and omissions aren't the type of thing anyone's in a mood to deal with when they suffer a stroke, fall off a ladder or contract botulism.

The problem, again, is that there's no way of predicting what sort of medical/healthcare services you're going to need in the future. Perfect physical shape? Awesome...until you get hit by a car. Never sick a day in your life? Great...until you're diagnosed with cancer anyway. Suddenly you're screwed.

To reiterate: I'm not saying "Short Term, Limited Duration" plans are necessarily evil, I'm just saying that they should remain "Short Term" and of "Limited Duration". Three months per year seems quite reasonable to me.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.