Washington State: ~4,500 QHP selections in first 8 days (53% higher than last year)

UPDATE: To clarify, just like with Covered California's "6,000 on day one" notice, Washington State's 4,550 new enrollees in 8 days don't include renewals/re-enrollments of current enrollees. Last year WA had 10,265 QHP selections total in the first 5 days and 21,665 in the first 12, so assuming a similar number of renewals each year, their total 8-day tally this year is likely around 13,000 + 4,550 = 17,500)

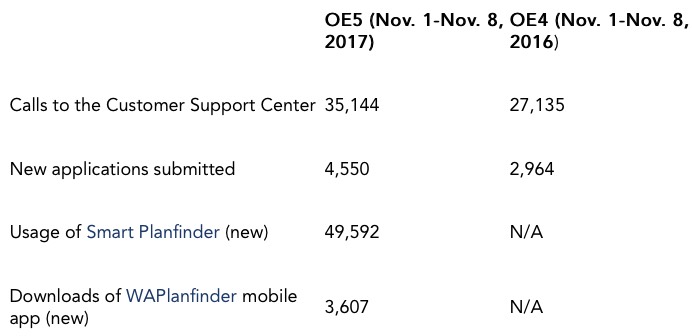

Washington Healthplanfinder Traffic, New Enrollment Surges In First Week

State’s online health insurance marketplace saw a 24 percent rise in site visits, more than 50 percent increase in new enrollees

The Washington Health Benefit Exchange is reporting today that more than 320,000 visitors have reviewed their coverage options at Washington Healthplanfinder since the start of open enrollment on Nov. 1. This traffic over the first week represents a 24 percent increase in visitation to the state’s health insurance marketplace over the same period last year.

Additional data that shows an increase in consumer interest includes:

“We are very pleased to see this level of interest so early in open enrollment,” said Pam MacEwan, CEO of the Washington Health Benefit Exchange. “As with every new plan year, people need to review their health insurance options, and Washington Healthplanfinder is the most trusted place for Washingtonians to shop for and compare available plans. Many of our customers will qualify for tax credits that can lower the cost of coverage.”

Most consumers who qualify for tax credits are finding that more financial help is available to further discount their 2018 health coverage. The price of the second-lowest-cost silver plan offered through Washington Healthplanfinder is used to calculate these tax credits. Because the price of those plans has increased, the amount of tax credits available to eligible customers has increasing as well. That increase in tax credits for qualifying customers is evident in 37 out of 39 counties in Washington state.

“Most customers have a unique opportunity to receive additional tax credits that may cause their 2018 premium costs to be less expensive,” added MacEwan. “We urge all customers to use Washington Healthplanfinder to determine their tax credit eligibility, and to leverage those tax credits to find plans that are the best fit for themselves and their family.”

Premium amounts and tax credits both vary based on the household member’s age, total number of people covered, county residence, and annual household income. Those households with income under 400 percent of the federal poverty level qualify for assistance on a sliding scale. This year, the ceiling for a family of four to be eligible to receive tax credits is $98,400.

For customers who do not qualify for federal subsidies, it is essential that they research their options and shop for the coverage that meets their needs and budget. The new Smart Planfinder, a decision-support tool available on Washington Healthplanfinder, can help customers evaluate their choices. Smart Planfinder allows customers to take key personal health cost drivers – your preferred doctor or facility, how often you or your family members go to them, and how frequently you fill or refill prescriptions – and identify what plan in what medal level will provide the best coverage options.

Additional help for those shopping is available in-person through the Exchange’s network of trained navigators and brokers. Residents can locate a navigator or broker in their area by using the all-new WAPlanfinder mobile app, clicking the “Customer Support” link on www.wahealthplanfinder.org, or visiting one of the 13 enrollment centers located throughout the state.