Hawaii: Case study in the Silver Switcharoo...but what's up with Kaiser's Bronze plans?

Over at the Obamacare: What's Next? Facebook group, John Bruder raised an odd premium situation he ran across in Hawaii.

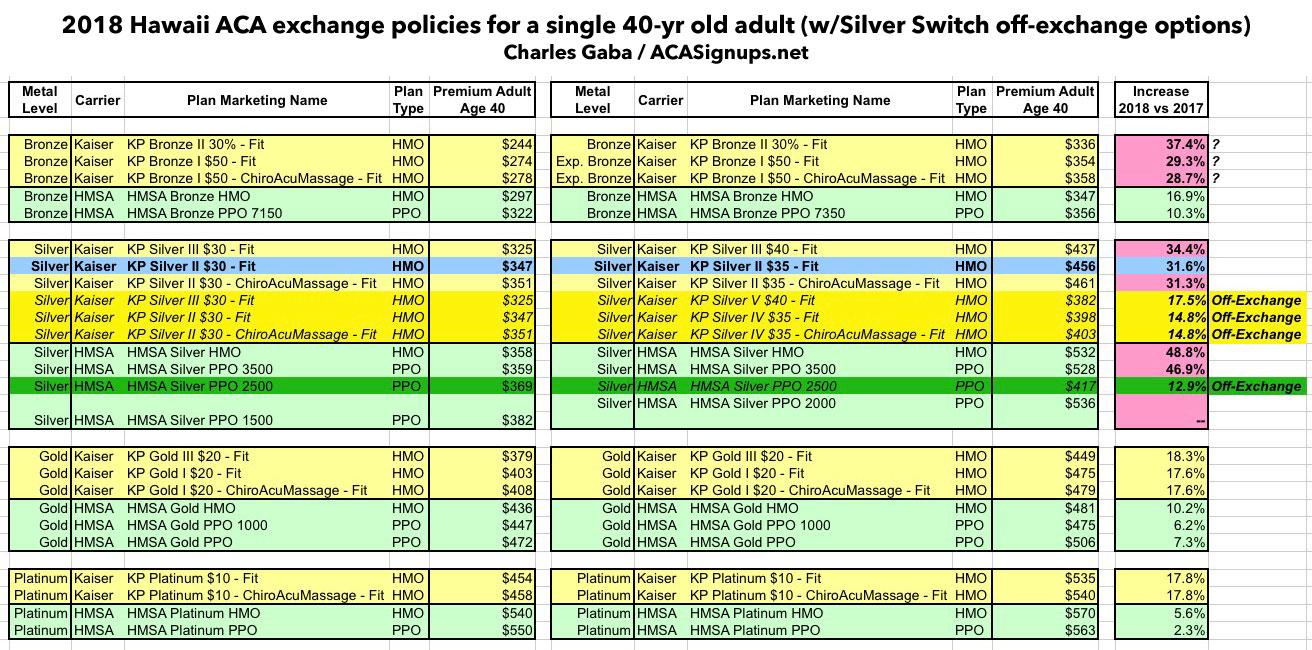

According to our CSR Load Load spreadsheet, Hawaii is supposed to be one of the 20-odd states using the full "Silver Switcharoo" strategy. It also has a single Rating Area, and only has two carriers (Kaiser and HMSA) participating in the individual market (on or off-exchange) anyway, making it a pretty easy state to run a full apples-to-apples year over year comparison.

Kaiser is offering a total of 11 plans on the ACA exchange (3 Bronze, 3 Silver, 3 Gold and 2 Platinum), while HMSA lists 10 (2 Bronze, 3 Silver, 3 Gold and 2 Platinum). I couldn't run a perfect comparison to 2017 since each carrier changed a couple of their offerings, but it's pretty darned close.

As you can see below, HMSA is following the Silver Switcharoo model to a T: Their on-exchange Silver plans are through the roof (up 47-48%) while their off-exchange Silver, as well as all Bronze, Gold and Platinum plans are only increasing anywhere from 2.3 - 16.9%. This means that subsidized enrollees get beefed-up tax credits while unsubsidized enrollees at least have the option of limiting their rate hikes to 12.9% if they want to hold onto Silver (as opposed to a 47% increase).

However, there's something odd going on with Kaiser. Their Silver, Gold and Platinum pricing seems to be a perfect Switcharoo model as well...but what's up with their Bronze plans? Not only did they jack up their Bronze plans as much as they did Silver, but on a strict percentage basis, they actually raised their entry-level Bronze plan more than Silver.

In practice, this doesn't mean much...subsidized enrollees can still get a hell of a deal on Gold plans from either Kaiser or HMSA; notice that one of the Gold plans ($449) costs less than the benchmark Silver ($456), while the other 5 from both carriers are only $19 - $50 more per month. Meanwhile, unsubsidized enrollees have the off-exchange Silver plans, which cost around $50/mo less (Kaiser) or ~$110/month less (HMSA) than their on-exchange equivalents.

Still, those high-increase Bronze plans from Kaiser are strange indeed. Every other carrier is either spreading the CSR load evenly or loading it onto Silver only (on/off or on- only), but Kaiser seems to be loading it onto on-exchange Silver and both on & off-exchange Bronze for some reason. Huh.

UPDATE: OK, several people have already suggested that the Bronze thing might have something to do with how the ACA's "Risk Adjustment" stabilization program/formula works. That gets a bit out of my league, however, so I'll leave it there. In the meantime, subsidized Hawaii residents should do fine, and unsubsidized Silver enrollees should strongly consider looking off-exchange this go around...but only if they're sure they won't qualify for tax credits: