Update: Utah approved rate hikes: ~20% w/CSRs paid, 40% without

Protect Our Care is a healthcare advocacy coalition created last December to help fight back against the GOP's attempts to repeal, sabotage and otherwise undermine the Affordable Care Act. This morning they released a report which compiled the approved 2018 individual market rate increases across over two dozen states.

Needless to say, they found that the vast majority of the state insurance regulators and/or carriers themselves are pinning a large chunk (and in some cases, nearly all) of the rate hikes for next year specifically on Trump administration sabotage efforts...primarily uncertainty over CSR payment reimbursements and, to a lesser extent, uncertainty over enforcement of the individual mandate penalty.

Anyone who follows this site knows that this is hardly shocking news; I've been laser-focused on this issue for the past five months or so. I've already compiled and broken out the average rate increases for 22 of the 28 states covered by the Protect Our Care report. The average increases in my spreadsheets differ from some of the numbers in the POC report because I also include the off-exchange ACA-compliant market (which isn't always included in the sources cited by POC's report), and because I make sure to weight the averages by relative carrier enrollment share of the market. For these reasons, the Protect Our Care report normally wouldn't have caught my eye, though obviously it's a good thing for the sabotage issue to get more exposure.

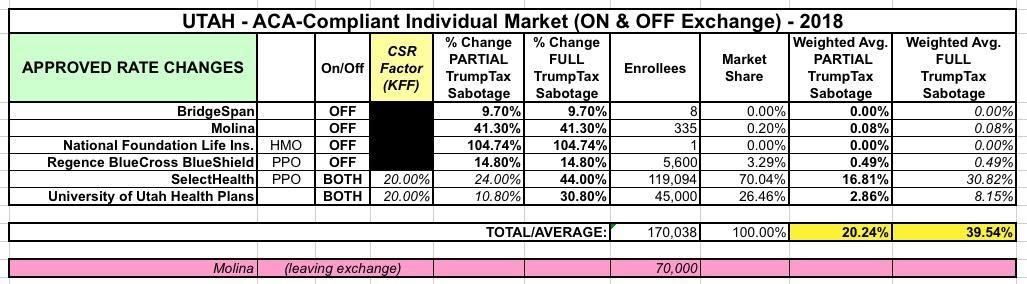

However, POC has also tracked down the approved rate increases for six additional states which I hadn't yet compiled...which makes this exciting to a healthcare data nerd like myself! They've helped me fill in the blanks for Illinois, Indiana, Nevada, Ohio, South Dakota and Utah. So without further ado, here's Utah:

The state of Utah has a handy "Insurance Transparency" website which even lets you download the raw data for every policy sold next year. Unfortunately, it doesn't appear to actually state the average rate increases for all plans. However, according to this Deseret News article linked to by POC:

SALT LAKE CITY — Insurance rates on the individual federal health care exchange in Utah are expected to increase by 39 percent in 2018, according to data released Thursday by the Utah Insurance Department.

The insurance rate increase can be explained by the expanding cost of health care itself, as well as carriers' uncertainty over whether the Trump administration will continue to put money into what are called cost-sharing reduction payments, said Steve Gooch, spokesman for the Utah Insurance Department.

"Just the general increase in medical trends that we've seen over the past decade — as the cost of services increase, premiums increase," Gooch said. "There's (also) an increase due to the uncertainty over whether the (cost-sharing payments) will be funded. So that causes some uncertainty in the risk profile, so that's kind of built into those (new) rates."

...Citing an analysis from the American Academy of Actuaries, Stevenson said that 20 percentage points of the increase in insurance rates can be directly tied to uncertainty surrounding whether the federal government will come through with cost-sharing reduction payments.

"It is important to note that over half of this rate increase is due to the continued political games that lawmakers are playing in Washington, D.C., instead of sitting down to work together to stabilize the marketplace and protect Utah families,” he said.

Because of uncertainty over those federal payments, the Utah Insurance Department instructed carriers to prepare 2018 rates for a scenario in which those payments come and a scenario in which they don't, Westover said.

"There's an approximately 30 percent difference in those two rates," he said, and the ones published Thursday assume that no cost-sharing payments will be received next year.

"The (Utah Insurance Department) ... asked us to file assuming the cost-sharing subsidies are not funded going forward," Westover added.

The first quote states the overall difference as 20 points. The second one says it's 30 points. 30% seems pretty excessive to me, so I'm going to err on the side of acution and assume that the 30 point figure applies to Silver plans only...but if spread across all metal levels it would drop to around 20 points. This would give the following: 20.2% if CSRs are paid, 39.5% if they aren't:

UPDATE: OK, according to this article in the Salt Lake Tribune, it looks like Utah is definitely limiting the additional CSR load to Silver plans, though I'm not sure whether they're going full Silver Switcharoo or all Silver plans:

With the increase, monthly premiums in Salt Lake County on the individual market would be as high as $450 for the average nonsmoking 21-year-old and as low as about $171. The average bump across the assortment of plans available would be about 33.6 percent, with what are known as Silver plans seeing the highest rise, Stevenson said.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.